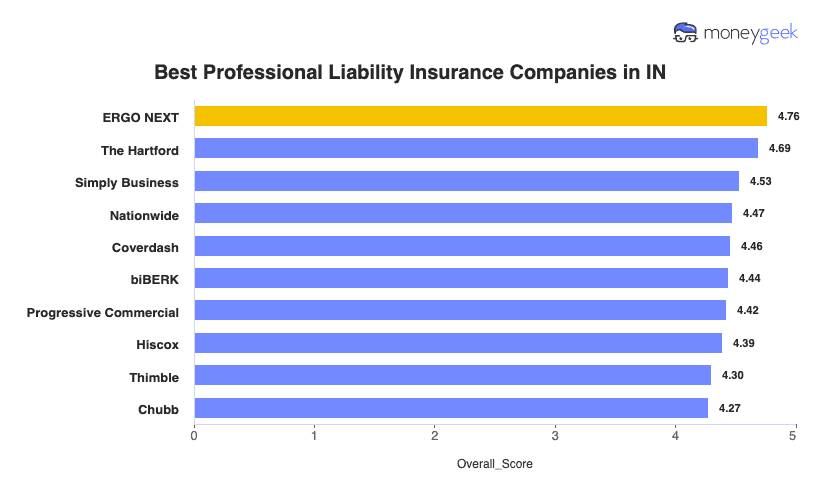

ERGO NEXT earns the top spot for professional liability insurance in Indiana with its competitive rates, highly rated customer service and easy-to-use digital platform. The Hartford ranks as the cheapest professional indemnity insurer in Indiana at $69 monthly ($7 below the state average). Simply Business, Nationwide and Coverdash also provide excellent options for businesses seeking the top errors and omissions insurance in the state.

Best Professional Liability Insurance in Indiana

Get IN professional liability insurance quotes starting at $25 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in IN for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Indiana, while The Hartford offers the most affordable coverage starting at $69 monthly (Read More).

Professional liability insurance costs in Indiana average $76 monthly ($906 annually), placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects Indiana businesses from financial losses due to professional mistakes, missed deadlines and claims of inadequate work performance (Read More).

Indiana doesn't mandate professional liability coverage for most businesses, though health care providers, attorneys and other licensed professionals need this protection (Read More).

Indiana business owners should request small business insurance quotes from multiple providers to compare coverage limits, deductibles and premium costs for their specific industry (Read More).

Best Professional Liability Insurance Companies in Indiana

| ERGO NEXT | 4.76 | $70 |

| The Hartford | 4.69 | $69 |

| Simply Business | 4.53 | $74 |

| Nationwide | 4.47 | $80 |

| Coverdash | 4.46 | $76 |

| biBERK | 4.44 | $78 |

| Progressive Commercial | 4.42 | $73 |

| Hiscox | 4.39 | $75 |

| Thimble | 4.30 | $73 |

| Chubb | 4.27 | $87 |

How Did We Determine the Best Professional Liability Insurance in Indiana?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in Indiana, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in IN

Ranks first for customer service and digital experience

Get coverage in 10 minutes with instant certificates

Offers Indiana businesses competitive professional liability rates

Backed by Munich Re's A+ Superior financial rating

Personalized coverage options for over 1,300 business types

Claims processing ranks fourth nationally among competitors

Stability score ranks lower than other providers

Limited to businesses under 20 employees

Indiana small business owners choose ERGO NEXT for its top-ranked digital platform and affordable rates at $70 monthly ($841 annually). An Indianapolis IT consultant can purchase tailored professional liability coverage in 10 minutes and generate instant certificates without calling an agent. The insurer's mobile app, which has 4.9 out of 5 stars on Apple Store, provides 24/7 policy management and COI downloads. ERGO NEXT's acquisition by Munich Re brings A+ Superior financial backing while maintaining the streamlined digital tools Fort Wayne freelancers and Evansville consultants prefer.

2. The Hartford: Cheapest Professional Liability Insurance in IN

Lowest professional liability rates in Indiana among top insurers

Best claims handling process nationwide among surveyed customers

Backed by A+ Superior financial strength from AM Best

Over 200 years of insurance experience and industry expertise

Digital experience ranks tenth nationally among competing providers

Agent-based model may require more time than competitors

The Hartford offers Indiana's cheapest professional liability insurance at $69 monthly ($832 annually), saving businesses $75 annually compared to the state average. Indianapolis consultants and Fort Wayne accountants get affordable coverage backed by A+ Superior financial strength and industry-leading claims handling.

The insurer's 200+ years of experience provides specialized E&O coverage across 50+ professional classes. Evansville businesses receive strong agent support and personalized service, though digital-focused owners should note the platform ranks tenth for online experience.

3. Simply Business: Best Professional Liability Insurance Coverage Options in IN

Ranks first for coverage options

Third-best digital experience for online quote comparisons

Backed by Travelers' A++ Superior financial strength rating

Broker model secures coverage for hard-to-insure businesses

Ranks eighth for claims processing

Ranks seventh for customer satisfaction

Simply Business ranks as Indiana's best professional liability coverage option through its broker network connecting businesses with 16+ specialized carriers. Indianapolis tech startups and Fort Wayne consultants get tailored policies unavailable from direct insurers at $74 monthly ($893 annually).

The platform's third-ranked digital experience lets Bloomington freelancers compare multiple E&O quotes in 10 minutes without agent calls. South Bend businesses with unique risks or prior coverage denials secure specialized protection through Simply Business's extensive carrier partnerships.

Average Cost of Professional Liability Insurance in Indiana

Professional liability insurance costs in Indiana vary by industry. Home-based businesses pay the least, around $36 per month, while mortgage brokers pay the highest, approximately $161 per month. The filtering tool below shows specific costs for your business type.

| Accountants | $142 | $1,699 |

| Ad Agency | $95 | $1,136 |

| Auto Repair | $80 | $959 |

| Automotive | $72 | $868 |

| Bakery | $51 | $613 |

| Barber | $42 | $504 |

| Beauty Salon | $49 | $588 |

| Bounce House | $57 | $682 |

| Candle | $41 | $489 |

| Cannabis | $118 | $1,421 |

| Catering | $77 | $922 |

| Cleaning | $53 | $639 |

| Coffee Shop | $59 | $712 |

| Computer Programming | $105 | $1,254 |

| Computer Repair | $61 | $734 |

| Construction | $74 | $889 |

| Consulting | $104 | $1,250 |

| Contractor | $62 | $747 |

| Courier | $48 | $580 |

| DJ | $45 | $539 |

| Daycare | $106 | $1,269 |

| Dental | $82 | $981 |

| Dog Grooming | $53 | $636 |

| Drone | $105 | $1,260 |

| Ecommerce | $59 | $714 |

| Electrical | $62 | $746 |

| Engineering | $99 | $1,186 |

| Excavation | $66 | $788 |

| Florist | $37 | $448 |

| Food | $108 | $1,294 |

| Food Truck | $58 | $697 |

| Funeral Home | $79 | $950 |

| Gardening | $39 | $469 |

| HVAC | $81 | $974 |

| Handyman | $52 | $627 |

| Home-based business | $36 | $435 |

| Hospitality | $71 | $851 |

| Janitorial | $48 | $580 |

| Jewelry | $59 | $712 |

| Junk Removal | $66 | $788 |

| Lawn/Landscaping | $50 | $602 |

| Lawyers | $139 | $1,669 |

| Manufacturing | $58 | $695 |

| Marine | $85 | $1,021 |

| Massage | $105 | $1,262 |

| Mortgage Broker | $161 | $1,935 |

| Moving | $79 | $943 |

| Nonprofit | $50 | $598 |

| Painting | $61 | $733 |

| Party Rental | $54 | $649 |

| Personal Training | $67 | $809 |

| Pest Control | $92 | $1,103 |

| Pet | $45 | $537 |

| Pharmacy | $56 | $673 |

| Photography | $62 | $739 |

| Physical Therapy | $92 | $1,104 |

| Plumbing | $87 | $1,043 |

| Pressure Washing | $57 | $682 |

| Real Estate | $122 | $1,466 |

| Restaurant | $79 | $950 |

| Retail | $54 | $646 |

| Roofing | $96 | $1,146 |

| Security | $98 | $1,179 |

| Snack Bars | $47 | $558 |

| Software | $94 | $1,127 |

| Spa/Wellness | $105 | $1,261 |

| Speech Therapist | $96 | $1,151 |

| Startup | $70 | $844 |

| Tech/IT | $96 | $1,148 |

| Transportation | $91 | $1,092 |

| Travel | $94 | $1,123 |

| Tree Service | $75 | $897 |

| Trucking | $107 | $1,287 |

| Tutoring | $60 | $719 |

| Veterinary | $113 | $1,355 |

| Wedding Planning | $74 | $889 |

| Welding | $74 | $890 |

| Wholesale | $59 | $712 |

| Window Cleaning | $62 | $739 |

How Did We Determine These Indiana Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Indiana Professional Liability Insurance Cover?

Professional liability insurance in Indiana protects your business when clients claim you made mistakes or failed to deliver promised services. Professional liability insurance covers the costs of these claims and any legal fees you face defending yourself. This coverage goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (used mainly in health care and law)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Indiana?

Most Indiana businesses aren't required to carry professional liability insurance. Standard coverage is $1 million per occurrence and $2 million aggregate annually, meeting contract requirements. Health care providers participating in Indiana's Patient Compensation Fund must maintain $500,000 per occurrence and $1.5 million aggregate. Contract obligations drive coverage needs more than state mandates.

Who Needs Professional Liability Insurance in Indiana?

If you provide professional services through client contracts or handle work where professional negligence claims could arise, you need professional liability insurance in Indiana. Five industries carry particularly high errors and omissions exposure.

Indiana's position as the orthopedics capital of the world makes medical malpractice insurance essential for health care providers across the state. The Medical Licensing Board of Indiana oversees physician licensing, and most health care providers must carry professional liability coverage to meet hospital privileges and Patient Compensation Fund requirements.

As the state with the highest manufacturing employment share nationally at 16.9%, Indiana's engineering professionals encounter substantial liability exposure from design errors and project delays. Engineers working in automotive, pharmaceutical manufacturing or industrial sectors need professional liability insurance to protect against costly claims arising from technical mistakes or failed specifications.

Indiana's emerging role as the "Silicon Heartland" with major semiconductor and data center investments creates significant liability exposure for IT consultants and software developers. Tech E&O insurance protects technology professionals from claims related to system failures, data breaches or missed project deadlines in Indianapolis's growing tech sector.

The Indiana Board of Accountancy regulates certified public accountants and public accountants, who encounter professional liability claims from tax errors, audit mistakes or financial misstatements. Accountants' professional liability insurance covers legal defense costs and settlements when clients allege financial harm from accounting services.

Indiana's pharmaceutical industry, anchored by Eli Lilly's record-breaking manufacturing investments, requires consultants to carry professional liability insurance for regulatory compliance work and clinical trial support. Life sciences professionals advising on FDA submissions, quality control or manufacturing processes need coverage against claims alleging regulatory violations or product development errors.

How to Get the Best Professional Liability Insurance in Indiana

Our step-by-step guide helps Indiana businesses navigate how to get business insurance that matches professional liability needs and budget. Follow these six steps to secure appropriate coverage.

- 1Assess your professional liability insurance coverage needs

Understand Indiana's contract-driven coverage requirements before shopping for policies, as state and university contracts typically mandate $1 million minimum professional liability limits. Health care providers should evaluate whether participating in Indiana's Patient Compensation Fund (requiring $500,000 per occurrence and $1.5 million aggregate) meets their practice needs in cities like Indianapolis or Evansville.

- 2Work with a local agent

Find an agent familiar with Indiana's dominant industries, like manufacturing (16.9% of state employment), life sciences and emerging semiconductor sector, since each carries distinct professional liability exposures. Indiana Professional Licensing Agency regulations affect 480,210 licensed professionals statewide, and knowledgeable agents understand how business insurance costs vary between a Fort Wayne manufacturing engineer and a Bloomington pharmaceutical consultant.

- 3Get quotes and compare coverage details

Compare quotes from insurers experienced with Indiana's unique requirements, including Patient Compensation Fund participation for health care providers and state contract standards. A Carmel tech consultant pursuing state IT contracts should find affordable business insurance that meets Indiana's $700,000 per occurrence and $5 million aggregate cyber liability requirements, not just basic E&O coverage.

- 4Research the best providers

Verify insurers understand Indiana-specific coverage needs beyond standard policies, such as Patient Compensation Fund excess coverage structures and Indiana University's $1 million professional liability requirements for design and consulting work. Check whether potential insurers maintain strong AM Best ratings and can demonstrate experience writing professional liability for Indiana's manufacturing, pharmaceutical and orthopedic medical device sectors.

- 5Consider bundling discounts

Indiana businesses supporting state contracts often need both professional liability and cyber insurance, making bundling valuable beyond just cost savings. A South Bend engineering firm serving University of Notre Dame contracts saves 15% by bundling professional liability with general liability, while an Indianapolis IT consultant bundles E&O with cyber coverage to meet the state's $700,000/$5 million cyber liability requirements, securing both types of business insurance at reduced premiums.

- 6Don't let your coverage lapse

Indiana's manufacturing and pharmaceutical consultants working on multi-year projects face particular tail coverage risks since professional liability claims can emerge years after project completion. An Elkhart RV manufacturing consultant switching carriers should purchase tail coverage (extended reporting coverage) to protect against claims from previous design work, while Fort Wayne health care providers leaving the Patient Compensation Fund must secure tail coverage to maintain protection for past patient care.

Get Indiana Professional Liability Insurance Quotes

MoneyGeek matches Indiana professionals with top professional liability insurers for your industry. Use our tool below to identify the best coverage options and receive personalized quotes that fit your business needs and budget.

Get Matched to the Best IN Professional Liability Insurer for You

Select your industry and state to get a customized IN professional liability insurer match and get tailored quotes.

Indiana Professional Liability: Bottom Line

Choosing professional liability insurance in Indiana depends on understanding your business risks and working with the right provider. ERGO NEXT tops our rankings, but your industry, client contracts and budget guide your final decision. Assess your coverage needs first, then compare options from local agents who understand Indiana's Patient Compensation Fund requirements and state contract standards to secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.