ERGO NEXT tops MoneyGeek's rankings as the best professional liability insurance in Delaware with competitive rates, excellent customer service and a streamlined digital experience. The provider also offers the cheapest professional indemnity coverage in Delaware at $75 monthly, saving businesses $8 compared to the state average. The Hartford follows as a strong traditional insurer with specialized E&O policies for tech, legal and medical professionals. Simply Business and Progressive round out our top recommendations for errors and omissions insurance in Delaware.

Best Professional Liability Insurance in Delaware

Get DE professional liability insurance quotes starting at $26 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in DE for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides both the best professional liability insurance and most affordable coverage in Delaware at $75 monthly (Read More).

Professional liability insurance costs in Delaware average $83 monthly ($1,001 annually), placing it among the cheaper states nationwide (Read More).

Professional liability insurance protects Delaware businesses from financial losses due to professional mistakes, errors and unmet service commitments (Read More).

Delaware doesn't mandate professional liability insurance for most businesses, though health care providers and certain licensed professionals must carry coverage (Read More).

Delaware business owners should request small business insurance quotes from multiple providers to secure optimal coverage at competitive rates (Read More).

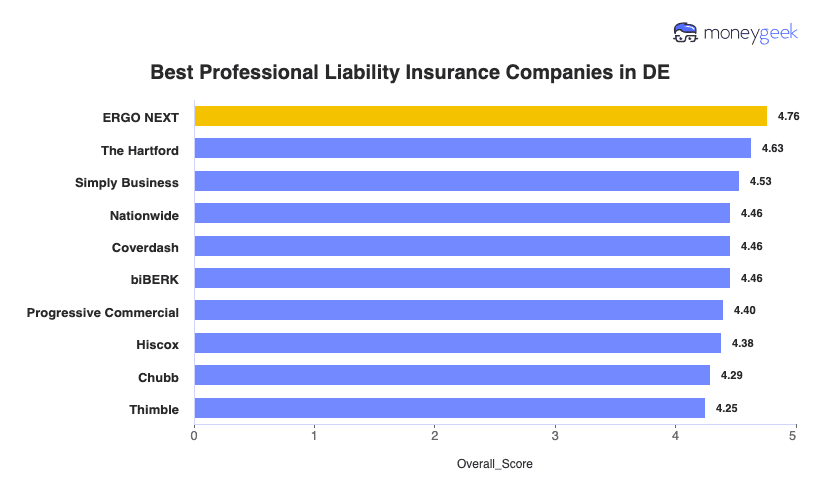

Best Professional Liability Insurance Companies in Delaware

| ERGO NEXT | 4.76 | $75 |

| The Hartford | 4.63 | $77 |

| Simply Business | 4.53 | $82 |

| Nationwide | 4.46 | $88 |

| Coverdash | 4.46 | $84 |

| biBERK | 4.46 | $85 |

| Progressive Commercial | 4.40 | $82 |

| Hiscox | 4.38 | $83 |

| Chubb | 4.29 | $95 |

| Thimble | 4.25 | $83 |

How Did We Determine the Best Professional Liability Insurance in Delaware?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability coverage is just one piece of protecting your Delaware business. Explore these additional state-specific insurance guides:

1. ERGO NEXT: Best Professional Liability Insurance in DE

Lowest professional liability rates in Delaware

Ranks first nationally for digital experience and customer service

Get coverage in 10 minutes with instant certificates of insurance

A+ Superior AM Best rating backed by Munich Re

Founded in 2016 with less industry tenure than traditional insurers

Claims process ranks fourth nationally, with some customers noting delays

ERGO NEXT earns best overall for professional liability insurance in Delaware with the state's lowest rates, top-ranked customer service and a streamlined digital experience. Business owners pay $75 monthly for E&O coverage, saving $8 compared to the $83 state average. Wilmington consultants and Dover contractors can get quotes, bind coverage and download certificates in under 10 minutes. The insurer's A+ Superior AM Best rating, earned after its 2025 Munich Re acquisition, provides added financial stability for Delaware small businesses.

2. Simply Business: Best Professional Liability Insurance Coverage Option in DE

Ranks first nationally for coverage options across 16+ carriers

Compare multiple E&O quotes in 10 minutes online

Backed by Travelers' A++ Superior AM Best rating

Broker model finds coverage for hard-to-insure businesses

Claims process ranks eighth nationally, indicating slower resolution

Customer service ranks seventh with room for improvement

Higher rates than top competitors

Simply Business earns best for coverage options in Delaware by connecting business owners with specialized E&O policies from more than 16 carriers. The broker model lets Wilmington consultants and Newark contractors compare multiple professional liability quotes in 10 minutes instead of calling individual insurers. Delaware businesses pay $82 monthly, slightly below the $83 state average. Travelers' A++ Superior AM Best rating backs the platform, giving small business owners confidence in claims-paying ability even for hard-to-place risks.

Average Cost of Professional Liability Insurance in Delaware

Professional liability insurance costs in Delaware vary by industry. Florists pay the lowest rates at around $40 per month, while mortgage brokers pay the highest at approximately $179 per month. The filtering tool below shows specific rates for your industry type.

| Accountants | $155 | $1,863 |

| Ad Agency | $104 | $1,251 |

| Auto Repair | $90 | $1,075 |

| Automotive | $82 | $983 |

| Bakery | $57 | $680 |

| Barber | $45 | $544 |

| Beauty Salon | $53 | $634 |

| Bounce House | $63 | $761 |

| Candle | $45 | $542 |

| Cannabis | $130 | $1,565 |

| Catering | $85 | $1,018 |

| Cleaning | $58 | $698 |

| Coffee Shop | $66 | $791 |

| Computer Programming | $113 | $1,360 |

| Computer Repair | $67 | $804 |

| Construction | $83 | $999 |

| Consulting | $116 | $1,396 |

| Contractor | $67 | $806 |

| Courier | $53 | $638 |

| DJ | $50 | $594 |

| Daycare | $116 | $1,397 |

| Dental | $90 | $1,080 |

| Dog Grooming | $60 | $718 |

| Drone | $113 | $1,356 |

| Ecommerce | $66 | $787 |

| Electrical | $69 | $823 |

| Engineering | $109 | $1,313 |

| Excavation | $73 | $872 |

| Florist | $40 | $476 |

| Food | $120 | $1,443 |

| Food Truck | $65 | $780 |

| Funeral Home | $87 | $1,045 |

| Gardening | $43 | $521 |

| HVAC | $88 | $1,055 |

| Handyman | $58 | $695 |

| Home-based business | $40 | $481 |

| Hospitality | $79 | $942 |

| Janitorial | $53 | $632 |

| Jewelry | $65 | $777 |

| Junk Removal | $72 | $863 |

| Lawn/Landscaping | $56 | $669 |

| Lawyers | $158 | $1,893 |

| Manufacturing | $65 | $776 |

| Marine | $96 | $1,153 |

| Massage | $113 | $1,353 |

| Mortgage Broker | $179 | $2,144 |

| Moving | $88 | $1,058 |

| Nonprofit | $54 | $643 |

| Painting | $68 | $816 |

| Party Rental | $60 | $717 |

| Personal Training | $77 | $924 |

| Pest Control | $101 | $1,215 |

| Pet | $49 | $589 |

| Pharmacy | $61 | $731 |

| Photography | $68 | $819 |

| Physical Therapy | $103 | $1,240 |

| Plumbing | $96 | $1,150 |

| Pressure Washing | $62 | $745 |

| Real Estate | $134 | $1,605 |

| Restaurant | $89 | $1,067 |

| Retail | $59 | $709 |

| Roofing | $104 | $1,249 |

| Security | $107 | $1,284 |

| Snack Bars | $51 | $614 |

| Software | $103 | $1,239 |

| Spa/Wellness | $117 | $1,409 |

| Speech Therapist | $106 | $1,267 |

| Startup | $76 | $914 |

| Tech/IT | $106 | $1,277 |

| Transportation | $103 | $1,237 |

| Travel | $103 | $1,237 |

| Tree Service | $82 | $981 |

| Trucking | $119 | $1,434 |

| Tutoring | $65 | $781 |

| Veterinary | $126 | $1,508 |

| Wedding Planning | $82 | $979 |

| Welding | $82 | $984 |

| Wholesale | $65 | $784 |

| Window Cleaning | $66 | $796 |

How Did We Determine These Delaware Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Delaware Professional Liability Insurance Cover?

Delaware professional liability insurance protects your business when clients claim you made mistakes or failed to deliver promised services. This coverage handles both the financial damages you might owe and the legal costs to defend yourself. The insurance industry uses several different names for this same protection:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Delaware?

Delaware doesn't require most businesses to carry professional liability insurance by state law. Physicians aren't mandated to have malpractice coverage either, though hospitals and health care facilities require $1 million per occurrence and $3 million aggregate for admitting privileges. For general business contracts, most clients expect $1 million per occurrence and $2 million aggregate coverage. Wilmington consultants and Dover contractors working with larger corporations often need these limits to secure project work in Delaware.

Who Needs Professional Liability Insurance in Delaware?

Delaware businesses providing professional services or contract-based work should consider professional liability insurance. The following industries face particular exposure to negligence claims and client disputes.

Delaware ranks as a national hub for banking and financial services, with major credit card operations headquartered in Wilmington. Consultants and financial advisors working with these institutions need coverage to protect against claims of poor advice or missed investment targets.

More than 60% of Fortune 500 companies incorporate in Delaware, creating substantial demand for corporate attorneys. The state doesn't mandate malpractice insurance, but attorneys must annually certify their coverage status to the Delaware Supreme Court.

ChristianaCare and other Delaware health care systems require physicians to carry malpractice insurance for hospital privileges. Standard limits of $1 million per occurrence and $3 million aggregate apply for most medical professionals in the state.

Delaware's growing fintech sector attracts software developers and IT consultants serving Wilmington's financial institutions. These professionals need specialized tech E&O insurance to cover claims related to data breaches, software failures or system errors.

Sussex County's coastal resort market and New Castle County's commercial development create strong demand for real estate services. Agents and brokers benefit from errors and omissions insurance for real estate to cover transaction disputes, disclosure failures or contract errors.

How to Get the Best Professional Liability Insurance in Delaware

Our step-by-step guide walks you through getting business insurance that matches your professional liability needs and budget in Delaware.

- 1Assess your professional liability coverage needs

Understand your business risks and any client requirements you must meet. A Wilmington financial consultant serving credit card companies needs different coverage than a Rehoboth Beach wedding planner working with seasonal tourism clients.

- 2Work with a local agent

Choose an agent who knows Delaware's business landscape and how business insurance costs vary across industries and counties. An experienced agent can explain whether your Newark tech startup needs different coverage than similar consulting firms in Dover's government sector.

- 3Get quotes and compare coverage details

Request quotes from at least three insurers, comparing both affordable business insurance rates and policy terms like exclusions and deductibles. A New Castle County IT consultant should examine coverage differences, not just premium costs, when evaluating $1 million liability policies.

- 4Research the best providers

Research insurers beyond price alone for your Delaware business. Verify AM Best ratings and review feedback from other professionals in your field, particularly those familiar with the state's corporate law and financial services industries.

- 5Consider bundling discounts

Delaware insurers often offer better premiums when you combine professional liability with other business insurance coverage types like general liability or business owner policies. A Sussex County accounting firm saves 10% to 15% by bundling its professional and general liability coverage.

- 6Maintain continuous coverage

Professional liability policies protect you only from lawsuits filed while your policy is active, even if the work happened years ago. A Dover consultant switching carriers should confirm the new policy covers prior acts or purchase tail coverage (extended reporting coverage that protects against claims filed after a policy ends) from the old insurer.

Get Delaware Professional Liability Insurance Quotes

MoneyGeek matches you with top professional liability insurers in Delaware for your specific industry. Use our tool below to find your best company match and get quotes for your business.

Get Matched to the Best DE Professional Liability Insurer for You

Select your industry and state to get a customized DE professional liability insurer match and get tailored quotes.

Delaware Professional Liability: Bottom Line

Choosing the right professional liability insurance in Delaware comes down to your business risks and budget. ERGO NEXT earns our top rating, but your industry, client contracts and coverage needs should guide your decision. Assess your exposure first, then work with a local agent to compare options and secure financial protection that fits your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.