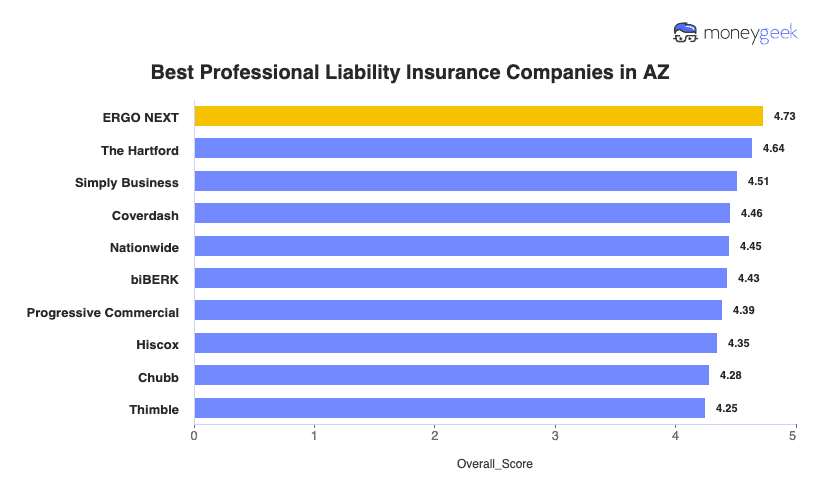

ERGO NEXT stands out as the top professional liability insurance provider in Arizona with plans averaging $66 per month, saving Arizona professionals $8 monthly compared to the state average. The insurer combines strong customer satisfaction ratings with digital tools that simplify coverage management.

The Hartford offers dependable coverage at $68 per month ($6 below average). Simply Business and Coverdash round out the top errors and omissions insurance options in Arizona, ranking among the cheapest professional indemnity insurers.