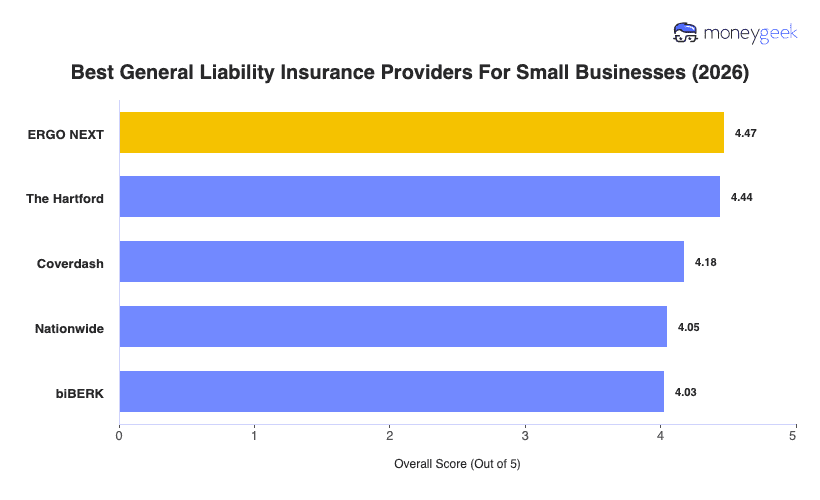

No single company has the best small business insurance for everyone, but the following five companies offer the strongest combination of workers' comp affordability, service quality, and policy features:

- ERGO NEXT: Best overall, Best for hands-on industries

- The Hartford: Best for Professional Services

- Coverdash: Best for Personal Service and Fitness Businesses

- Nationwide: Best for Agricultural Businesses

- biBERK: Best for Recreation and Sports Businesses

Keep in mind that these providers should only serve as starting points in your workers' compensation insurance search. Below you can compare these top insurers and why they made it into the top 5.