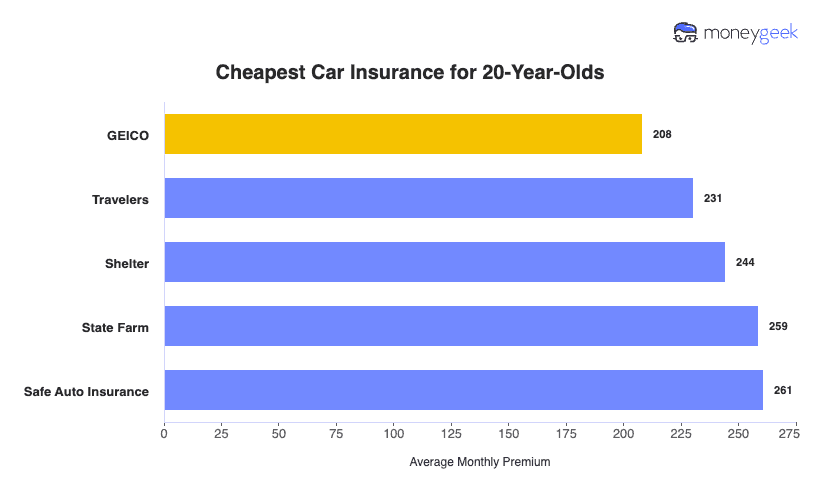

GEICO leads with the most affordable nationwide rates for 20-year-olds at $208 monthly when you're added to a family policy. That's $700 in annual savings compared to what most insurers charge. Travelers comes in second at $231 monthly, while Shelter offers another solid option at $244 monthly. All three deliver substantial savings, though availability varies by state.

Cheap Car Insurance for 20-Year-Olds

GEICO offers the cheapest car insurance for 20-year-olds nationwide at $208 monthly when added to a family policy, followed by Travelers at $231 and Shelter at $244.

Find out if you're overpaying for car insurance below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

GEICO offers the cheapest minimum coverage for 20-year-olds at $129, saving young drivers about $700 annually compared to the national average.

GEICO is the most affordable provider, offering budget-friendly full coverage to 20-year-olds for $129 monthly, which is 31% lower than the national average, resulting in an annual savings of $700 for drivers.

Shelter is the cheapest regional provider for 20-year-olds, with rates averaging 14% below the national average at $244 monthly, where coverage is available.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Best Cheap Car Insurance for 20 Year Olds

| GEICO | $208 | $2,500 | 26% |

| Travelers | $231 | $2,767 | 18% |

| Shelter | $244 | $2,932 | 14% |

| State Farm | $259 | $3,103 | 9% |

| Safe Auto Insurance | $261 | $3,129 | 8% |

Cheapest Minimum Liability Car Insurance for 20-Year-Olds

If you're looking for low-cost minimum coverage to meet state requirements, GEICO charges just $129 monthly or $1,554 annually. That's about $700 less per year than the national average for minimum coverage. Travelers and Shelter also keep costs reasonable at $154 and $157 monthly, respectively. Just remember that minimum coverage only protects others when you cause an accident, not your own vehicle.

| GEICO | $129 | $1,554 | 31% |

| Travelers | $154 | $1,843 | 18% |

| Shelter | $157 | $1,881 | 17% |

| State Farm | $170 | $2,045 | 9% |

Cheapest Full Coverage Car Insurance for 20-Year-Olds

The cheapest full coverage for 20-year-olds costs $287 monthly with GEICO, which includes comprehensive and collision coverage in addition to your liability policy. This protects your own vehicle from accidents you cause, as well as theft, vandalism, and weather damage. Travelers charges slightly more at $308 monthly, while Safe Auto Insurance offers coverage at $330 monthly.

The extra cost over minimum coverage buys you financial protection. If you total your car, full coverage pays to replace it. Without it, you will have to cover those costs yourself. Lenders won't even let you drive off the lot without full coverage on financed or leased vehicles.

| GEICO | $287 | $3,446 | 24% |

| Travelers | $308 | $3,690 | 19% |

| Safe Auto Insurance | $330 | $3,960 | 13% |

| Shelter | $332 | $3,983 | 12% |

| State Farm | $347 | $4,161 | 8% |

*Rates are for a family policy for male and female drivers with a clean driving record and good credit who drive a 2012 Toyota Camry.

Cheapest Car Insurance for 20-Year-Olds by State

Where you live makes a massive difference in what you'll pay. Hawaii drivers pay just $58 monthly with GEICO, while Florida drivers shell out $274 monthly with Travelers. That's nearly five times more just because of your ZIP code.

GEICO is the most affordable option in 28 states, making it your best bet for nationwide coverage. State Farm offers plans in 12 states, primarily in lower-cost rural areas, such as North Carolina, at $84 per month, and in Vermont at $94 per month. Progressive leads in 11 states with competitive pricing.

| Alabama | Geico | $141 | $1,687 | 31% |

| Alaska | Geico | $149 | $1,786 | 24% |

| Arizona | Travelers | $182 | $2,189 | 40% |

| Arkansas | Travelers | $147 | $1,765 | 33% |

| California | Geico | $162 | $1,944 | 29% |

| Colorado | Geico | $197 | $2,366 | 33% |

| Connecticut | Geico | $226 | $2,708 | 45% |

| Delaware | Geico | $250 | $2,999 | 41% |

| District of Columbia | Geico | $245 | $2,939 | 9% |

| Florida | Travelers | $274 | $3,285 | 44% |

| Georgia | Geico | $230 | $2,765 | 42% |

| Hawaii | Geico | $58 | $694 | 17% |

| Idaho | State Farm | $104 | $1,242 | 30% |

| Illinois | Travelers | $160 | $1,918 | 34% |

| Indiana | Travelers | $128 | $1,538 | 25% |

| Iowa | Travelers | $110 | $1,322 | 30% |

| Kansas | Travelers | $124 | $1,493 | 43% |

| Kentucky | Travelers | $155 | $1,860 | 47% |

| Louisiana | Geico | $331 | $3,968 | 33% |

| Maine | Travelers | $100 | $1,200 | 36% |

| Maryland | Travelers | $243 | $2,919 | 41% |

| Massachusetts | Geico | $177 | $2,121 | 26% |

| Michigan | Geico | $163 | $1,952 | 46% |

| Minnesota | Travelers | $158 | $1,892 | 32% |

| Mississippi | Travelers | $164 | $1,969 | 27% |

| Missouri | Travelers | $155 | $1,861 | 51% |

| Montana | State Farm | $114 | $1,371 | 43% |

| Nebraska | Geico | $129 | $1,543 | 42% |

| Nevada | Travelers | $281 | $3,372 | 36% |

| New Hampshire | Geico | $122 | $1,465 | 39% |

| New Jersey | Geico | $197 | $2,358 | 55% |

| New Mexico | Geico | $145 | $1,744 | 30% |

| New York | Geico | $278 | $3,334 | 22% |

| North Carolina | State Farm | $84 | $1,006 | 37% |

| North Dakota | Geico | $106 | $1,267 | 29% |

| Ohio | Geico | $124 | $1,483 | 32% |

| Oklahoma | Geico | $200 | $2,401 | 20% |

| Oregon | Geico | $185 | $2,221 | 28% |

| Pennsylvania | Travelers | $154 | $1,845 | 51% |

| Rhode Island | State Farm | $194 | $2,327 | 44% |

| South Carolina | Geico | $223 | $2,671 | 19% |

| South Dakota | State Farm | $153 | $1,840 | 15% |

| Tennessee | Travelers | $144 | $1,728 | 27% |

| Texas | State Farm | $210 | $2,523 | 34% |

| Utah | Geico | $201 | $2,408 | 30% |

| Vermont | State Farm | $94 | $1,128 | 37% |

| Virginia | Travelers | $124 | $1,485 | 45% |

| Washington | Travelers | $212 | $2,549 | 17% |

| West Virginia | Geico | $198 | $2,380 | 1% |

| Wisconsin | Geico | $124 | $1,485 | 36% |

| Wyoming | Geico | $104 | $1,246 | 11% |

*Rates are for a family policy for male and female drivers with a clean driving record and good credit who drive a 2012 Toyota Camry.

Cheapest Cars to Insure for 20-Year-Olds

Your car choice can save or cost you thousands annually. A 2020 MINI Cooper runs just $85 monthly for full coverage, but a BMW i8 will set you back over $540 monthly. That's $5,460 more per year for the flashy option.

Practical vehicles like the 2021 Subaru Forester at $90 monthly and the 2020 Subaru Outback at $91 monthly make them the most affordable cars to insure while offering reliability and strong safety ratings. These aren't the most exciting cars on the road, but they won't drain your bank account every month either.

| 2020 MINI Cooper | $85 | $1,015 | 55% |

| 2021 Subaru Forester | $90 | $1,075 | 52% |

| 2020 Subaru Outback | $91 | $1,090 | 52% |

| 2022 Mazda CX-5 | $94 | $1,128 | 50% |

| 2022 MINI Electric | $94 | $1,131 | 50% |

How to Get Cheap Car Insurance at 20 Years Old

Most 20-year-olds save the most money by joining a family policy, but that's just the starting point. You've got several other ways to cut costs without sacrificing the protection you actually need when you have an accident.

Shopping multiple quotes, keeping your record clean, stacking discounts, adjusting your coverage and choosing the right car can each save you hundreds or thousands annually.

- 1Compare quotes from multiple insurers

Shopping around saves real money since prices vary dramatically between companies. The Insurance Information Institute recommends getting quotes from at least three insurers, but more is better. MoneyGeek data shows that 20-year-olds can save up to 28% by comparing the lowest quotes instead of sticking with their parents' current insurer. Companies count on customer inertia, so taking 30 minutes to compare quotes can save you $500 or more annually.

Use MoneyGeek's car insurance calculator to compare quotes from the most affordable companies instantly. It's free, easy to use, and requires no personal information.

- 2Keep your driving record clean

Every ticket and accident remains on your record for three to five years, which can drive up your premiums. A single speeding ticket can increase rates by 20% to 30%, resulting in hundreds of dollars in annual costs.

An at-fault accident hits even harder, often doubling your premium. Avoid the drama by staying off your phone, following speed limits and driving defensively.

- 3Stack every discount you can find

Many insurers offer student discounts for maintaining a B average or higher, often saving 10% to 25%. Students living away at school can qualify for distant student discounts on car insurance, even if they don't own a car. Completing driver's education or defensive driving courses can lead to additional savings—programs like State Farm's Steer Clear and Allstate's teenSMART reward safe driving habits with lower rates. Be sure to ask your insurer about all available discounts, as they may not always volunteer this information.

- 4Adjust your coverage strategically

If you're driving an older car worth less than $3,000, dropping collision and comprehensive coverage might make sense. You can also increase your deductible from $500 to $1,000 to reduce premiums by 15% to 30%.

Ensure you can afford the deductible if you need to file a claim. There's no point in saving $30 monthly if a $1,000 deductible would wipe out your emergency fund.

- 5Choose a sedan over a sports car

The car you drive matters as much as your age when insurers calculate rates. A modest sedan costs hundreds less monthly to insure than a high-performance sports car. Insurance companies track which vehicles are stolen most often, which ones are the most expensive to repair, and which ones drivers crash most frequently.

A Honda Civic costs substantially less to insure than a Dodge Charger, despite both being similar in size and class. Consider insurance costs before falling in love with a car at the dealership.

Why Is Car Insurance for 20-Year-Olds Expensive?

Insurance companies classify 20-year-olds as high-risk drivers despite having a few years of experience. The numbers back this up. Young adults crash more frequently, make more claims and cost insurers more money than older drivers. Limited driving history means insurers can't predict your behavior as accurately as they can for a 40-year-old with two decades of clean driving.

Statistics show drivers under 25 cause accidents at substantially higher rates than those 25 and older. This age group also tends to speed more, text while driving more frequently and make riskier decisions behind the wheel. Insurers price these risks into premiums until around age 25, when rates typically drop significantly as you prove you're a safer bet.

Ensure you are getting the best rate for your car insurance. Compare quotes from the top insurance companies.

Cheap Insurance for 20-Year-Olds: Bottom Line

GEICO offers the most affordable car insurance for 20-year-olds nationwide at $208 per month when added to family policies, although Auto-Owners might provide a lower rate in states where it operates. Travelers and State Farm offer competitive options, supported by reliable customer service and strong financial ratings.

Your best approach is to compare quotes from all four companies, along with any regional insurers in your state, as rates can vary based on your location, driving history, and vehicle type.

Car Insurance for 20-Year-Old Drivers: FAQ

Finding affordable car insurance for 20-year-olds can be challenging due to their higher risk profile. Get insights on securing the most cost-effective policy for young drivers.

What is the cheapest car insurance for a 20-year-old?

GEICO ranks as the best insurance company for 20-year-olds, based on its combination of nationwide low rates, strong financial stability, and decent customer service. Auto-Owners scores higher on customer satisfaction but operates in fewer states. State Farm and Travelers also provide reliable coverage with competitive pricing and extensive agent networks for drivers who prefer in-person service.

What is the best insurance company for a 20-year-old?

Insurance companies charge 20-year-olds higher rates because statistical data shows young adults crash more frequently and file more claims than older drivers. Limited driving experience means insurers can't accurately predict your risk level. Rates typically drop significantly around age 25 as you build a more extended history of safe driving and prove you're a lower-risk customer.

Which states have the cheapest car insurance for 20-year-olds?

The most affordable states include:

- Hawaii: $69 monthly

- Wyoming: $105 monthly

- North Carolina: $132 monthly

- Vermont, Maine, and Iowa: all under $160 monthly

Is car insurance more expensive for 20-year-old males?

Yes, but the difference is more minor than most people think. Twenty-year-old males pay approximately $5 more per month than females for minimum coverage, or $60 more annually. The gap reflects data showing males in this age group have slightly higher accident rates. However, both genders face elevated rates due to age, so your driving record and credit score impact your premium more than gender at this stage.

What vehicles are cheapest to insure for 20-year-olds?

Compact sedans and practical SUVs tend to be the least expensive to insure. The 2020 MINI Cooper runs just $85 monthly, while the 2021 Subaru Forester costs $90 monthly and the 2020 Subaru Outback charges $91 monthly for full coverage. These vehicles combine low repair costs, strong safety ratings and lower theft rates. Avoid sports cars, luxury vehicles, and high-performance models, which can cost $400 to $500 monthly to insure.

Is minimum coverage enough for a 20 Year Old?

To financially protect a driver who causes an accident, experts recommend liability coverage of at least $100,000 per person, $300,000 per accident for bodily injury and $100,000 for property damage. They also suggest full coverage, which includes comprehensive and collision insurance, to cover the driver's vehicle in an at-fault crash or noncollision event like fire, theft or weather damage.

Optional add-ons like roadside assistance and rental car coverage can also be useful. Young drivers working with rideshare companies should add rideshare insurance.

— Mark Friedlander, Director, Corporate Communications, Insurance Information Institute

How much does car insurance cost for 20-year-olds?

Twenty-year-olds pay an average of $182 monthly ($2,183 yearly) for minimum coverage. Full coverage averages $363 monthly ($4,354 annually). The $181 monthly difference buys comprehensive and collision coverage with full coverage. Minimum coverage only protects damage you cause to others, while full coverage also protects your own vehicle from accidents, theft, and weather damage like hailstorms.

20-Year-Old Car Insurance Providers: Our Review Methodology

Why Trust MoneyGeek?

MoneyGeek's auto insurance quotes are based on research conducted with information gathered from several sources, including state insurance authorities and Quadrant Information Services. The cost of insurance varies from person to person based on several criteria. One's age, gender, driving record, credit history and the kind of coverage required may all play a role in determining premiums.

Study Overview

MoneyGeek used a sample driver profile to determine national and state averages for vehicle insurance for 20-year-old drivers. Using this information, we assist readers in selecting the best policy at the lowest price possible.

Data Sources and Depth

We collected data from each state's insurance department and Quadrant Information Services. The data consists of 4,284 price estimates from 100 different ZIP codes and six auto insurance providers.

Driver Profile

MoneyGeek calculates yearly car insurance policy estimates based on a policyholder with the following characteristics:

- Toyota Camry LE

- Clean driving record

- 12,000 miles driven every year

To determine which companies provide the most affordable policies, MoneyGeek compared rates for 20-year-old drivers across different states. We made adjustments to this profile to reflect the differences in age, location and driving behavior.

Coverage Levels and Deductibles Explained

A deductible is the money you have to pay out of your own pocket before your insurance company will pay for your claim. Most drivers would benefit from purchasing full coverage vehicle insurance, which covers both collision and comprehensive damage.

Our national insurance quotes are based on a 100/300/100 full coverage policy with a $1,000 deductible, broken down as follows:

- Bodily injury liability per person: $100,000

- Bodily injury liability per accident: $300,000

- Property damage liability per accident: $100,000

We used 50/100/50 liability limits on a full coverage policy with comprehensive and collision coverage with a $1,000 deductible for our sample driver when researching state-specific data. Liability limits of 50/100/50 stand for:

- Bodily injury liability per person: $50,000

- Bodily injury liability per accident: $100,000

- Property damage liability per accident: $50,000

Learn more about MoneyGeek's methodology.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AAA Foundation for Traffic Safety. "Rates of Motor Vehicle Crashes, Injuries and Deaths in Relation to Driver Age, United States, 2014-2015." Accessed July 10, 2025.

- Car and Driver. "Which Gender Pays More for Car Insurance?." Accessed July 10, 2025.

- Insurance Information Institute. "Automobile Financial Responsibility Laws by State." Accessed July 10, 2025.

- Insurance Information Institute. "What Determines the Price of an Auto Insurance Policy?." Accessed July 10, 2025.

- USA Today. "Back-to-school Cars: These are some of the best cars for teenage drivers." Accessed July 10, 2025.