GEICO offers Idaho's cheapest full coverage car insurance at $614 per year, which comes out to approximately $51 per month and is 37% cheaper than what most drivers in the state pay. State Farm follows at $647 a year, only $33 more than GEICO. American National P&C ranks third at $721 a year, followed by Auto-Owners at $779 and Grange at $815 yearly.

Cheapest Car Insurance in Idaho

Idaho drivers can get minimum coverage from State Farm for $18 monthly or full coverage from GEICO for $51 monthly.

Find low-cost Idaho car insurance for you below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

Full coverage: GEICO, $51

Liability only: State Farm, $18

Teens: American National P&C, $74

Young adults: American National P&C, $30

Seniors: American National P&C and State Farm, $26

DUI: State Farm, $19

SR-22: American National P&C, $35

Non-Owner: State Farm, $33

Bad Credit: Grange, $56

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Idaho ZIP codes for various driver profiles, including clean records, violations and age groups. Rates show averages for a 40-year-old driver with good credit and a clean record unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Idaho

| Geico | $51 | $614 | 37% |

| State Farm | $54 | $647 | 33% |

| American National | $60 | $721 | 26% |

| Auto Owners | $65 | $779 | 20% |

| Grange Insurance | $68 | $815 | 16% |

Cheapest Minimum Coverage Car Insurance in Idaho

State Farm offers Idaho's cheapest minimum coverage car insurance at $210 a year, which works out to about $18 a month and sits 52% cheaper than the state average. Farm Bureau charges $310 a year for the same required coverage, meaning choosing State Farm saves $100 a year. Grange costs $262 annually, GEICO charges $272 and American National P&C comes in at $284.

| State Farm | $18 | $210 | 52% |

| Grange Insurance | $22 | $262 | 41% |

| Geico | $23 | $272 | 38% |

| American National | $24 | $284 | 36% |

| Farm Bureau | $26 | $310 | 30% |

Cheapest Car Insurance in Idaho by City

GEICO offers the cheapest rates in many of Idaho's largest cities, including Boise, Caldwell, Idaho Falls, Meridian, Nampa and Pocatello. State Farm has the lowest prices in Lewiston, Post Falls, Rexburg and Twin Falls. American National P&C offers the best rates in Coeur d'Alene.

In Boise, GEICO charges $27 a month for minimum coverage and $54 a month for full coverage, both about 40% below the city average. Lewiston drivers benefit from State Farm's competitive pricing at $17 a month for minimum coverage and $53 a month for full coverage.

| Boise | Geico | $27 | $54 | 40% |

| Caldwell | Geico | $25 | $52 | 43% |

| Coeur d'Alene | American National | $21 | $54 | 38% |

| Idaho Falls | Geico | $24 | $53 | 39% |

| Lewiston | State Farm | $17 | $53 | 40% |

| Meridian | Geico | $27 | $53 | 40% |

| Nampa | Geico | $22 | $51 | 41% |

| Pocatello | Geico | $24 | $54 | 37% |

| Post Falls | State Farm | $18 | $55 | 39% |

| Rexburg | State Farm | $18 | $55 | 41% |

| Twin Falls | State Farm | $17 | $54 | 38% |

Cheapest Car Insurance in Idaho for Teens and Young Adults

Idaho Farm Bureau offers Idaho's cheapest full coverage car insurance for teens at $81 monthly for 16-year-olds, keeping the lowest price at age 17 at $80 a month. American National P&C becomes the most affordable option at age 18 with a $74 monthly rate and continues offering the best pricing for young adults through age 25.

American National P&C charges $63 a month for 19-year-olds, $54 a month at age 20 and $30 a month at age 25. The difference between ages 16 and 25 adds up to $612 in yearly savings. Teens under 18 need a parent or guardian to cosign a policy, so most families add teen drivers to an existing plan instead of buying separate coverage.

Note: Teen driver insurance rules vary from state to state. If you're unsure about the requirements in your area, reach out to a licensed insurance agent who can explain age limits, consent rules and the coverage levels new drivers must meet.

Cheapest Car Insurance for Seniors in Idaho

American National P&C offers Idaho's cheapest minimum coverage car insurance for seniors at age 65, charging $26 a month for minimum coverage and $27 for full coverage. State Farm offers 70-year-olds the same $26 monthly rate for minimum coverage and $60 a month for full coverage.

Idaho Farm Bureau has the best prices for 80-year-olds at $32 a month for minimum coverage and $70 a month for full coverage. Minimum coverage only goes up about $6 a month from ages 65 to 80. Across these senior age groups, all three companies offer prices that are 38% to 60% below Idaho's average.

| 65 | American National P&C | $26 | $27 | 60% |

| 70 | State Farm | $26 | $60 | 38% |

| 80 | Idaho Farm Bureau | $32 | $70 | 44% |

Cheapest DUI Insurance in Idaho

State Farm offers Idaho's cheapest minimum coverage car insurance for drivers with a DUI at $19 a month, which is 61% below Idaho's average. American National P&C follows at $36 a month.

For full coverage, State Farm also leads at $58 a month, while American National P&C costs $91 a month. Grange charges $40 a month for minimum coverage and $124 for full coverage. Travelers costs $57 a month for minimum coverage and $121 for full coverage, while Farmers charges $59 a month for minimum coverage and $122 for full coverage.

| State Farm | $19 | $58 | 61% |

| American National | $36 | $91 | 35% |

| Grange Insurance | $40 | $124 | 16% |

| Travelers | $57 | $121 | 9% |

| Farmers | $59 | $122 | 7% |

Cheapest SR-22 Insurance in Idaho

American National P&C and State Farm tie for Idaho's cheapest SR-22 insurance at $35 a month for minimum coverage. American National P&C also has the cheapest full coverage with an SR-22 at $78 a month, which is 39% below the state average.

GEICO charges $38 a month for minimum coverage and $80 a month for full coverage with an SR-22. Idaho Farm Bureau costs $45 a month for minimum coverage and $102 for full coverage, while Grange charges $46 a month for minimum coverage and $105 for full coverage.

| American National P&C | $35 | $78 | 39% |

| State Farm | $35 | $81 | 38% |

| GEICO | $38 | $80 | 36% |

| Idaho Farm Bureau | $45 | $102 | 21% |

| Grange Insurance | $46 | $105 | 19% |

Cheapest Non-Owner Car Insurance in Idaho

State Farm offers Idaho's cheapest non-owner car insurance at $33 a month, sitting 35% under the state average. This policy works well for people who need proof of insurance without owning a car.

Non-owner policies help with license reinstatement after a suspension, SR-22 requirements or frequent car rentals. These policies cost less than standard auto insurance because they only include liability coverage, which pays for damage you cause to others, not damage to a specific vehicle. Auto-Owners charges $35 a month for non-owner coverage, while GEICO costs $52 a month.

| State Farm | $33 | 35% |

| Auto-Owners Insurance Co | $35 | 32% |

| GEICO | $52 | 1% |

Cheapest Car Insurance After an Accident in Idaho

State Farm offers Idaho's cheapest minimum coverage car insurance after an at-fault accident at $21 a month, sitting 51% lower than Idaho's average. It also offers the cheapest full coverage at $62 a month. American National P&C and Farm Bureau both charge $32 a month for minimum coverage after an accident, while GEICO costs $40 a month. Grange tops out at $90 a month for full coverage. An at-fault accident can raise your premiums by 20% to 40%, and these higher rates usually stay in place for three to five years.

| State Farm | $21 | $62 | 51% |

| American National | $32 | $81 | 33% |

| Farm Bureau | $32 | $86 | 30% |

| Grange Insurance | $29 | $90 | 29% |

| Geico | $40 | $90 | 23% |

Cheapest Car Insurance With a Speeding Ticket

State Farm offers Idaho's cheapest minimum coverage car insurance for drivers with a speeding ticket at $19 a month, which comes to $228 a year and also has the lowest full coverage rate at $58 a month. GEICO follows at $61 a month for full coverage, while Farm Bureau and American National P&C both charge $69 a month. Auto-Owners ranks fifth at $67 a month for full coverage with a speeding ticket, and the difference between State Farm and Auto-Owners adds up to $108 in yearly savings.

| State Farm | $19 | $58 | 46% |

| Farm Bureau | $26 | $69 | 32% |

| American National | $27 | $69 | 32% |

| Geico | $27 | $61 | 37% |

| Auto Owners | $30 | $67 | 31% |

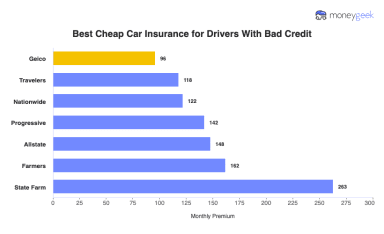

Cheapest Bad Credit Car Insurance in Idaho

Grange offers Idaho's cheapest minimum coverage car insurance for drivers with bad credit at $676 a year, or about $56 a month. For full coverage, Grange also has the lowest rate at $120 a month, giving drivers $55 in monthly savings compared to American National P&C, which charges $175. That gap adds up to $660 in yearly savings, a meaningful difference for low-income drivers.

American National P&C costs $67 a month for minimum coverage and $175 for full coverage. GEICO charges $81 a month for minimum coverage and $196 for full coverage, while Farm Bureau has minimum coverage at $88 a month and full coverage at $232.

| Grange Insurance | $56 | $120 | 51% |

| American National | $67 | $175 | 32% |

| Geico | $81 | $196 | 23% |

| Farm Bureau | $88 | $232 | 11% |

| Travelers | $101 | $216 | 12% |

How to Get the Cheapest Car Insurance in Idaho

Your location, driving record, age and credit score all influence your Idaho car insurance rates. State Farm offers the lowest minimum coverage at $210 a year, while GEICO’s full coverage averages $614 yearly. Comparing quotes and using available discounts can help you cut your yearly costs by a lot.

- 1Compare Regional and National Insurers

Regional carriers like Country Financial and Farm Bureau compete aggressively in Idaho's metropolitan markets. Compare three to five providers to find your best rate.

MoneyGeek's car insurance calculator generates customized estimates without requiring personal information. The calculator delivers instant comparisons based on your location and driver profile. No spam, no sales calls, just real numbers from multiple carriers.

- 2Capture All Available Discounts

Bundling home and auto policies cuts premiums 5% to 25%. Multi-car households save another 10% to 25% off base rates. Stack these discounts for maximum savings.

Good student discounts reward academic performance with 10% to 15% off.

Defensive driving courses deliver similar savings, particularly valuable for senior drivers. Low-mileage programs slash premiums 15% to 30% for drivers logging fewer annual miles.

- 3Balance Deductibles and Coverage

Your deductible directly affects monthly costs. Raising deductibles from $500 to $1,000 can lower premiums by about 10% to 15%, but only choose the higher amount if you can comfortably cover that out-of-pocket expense after an accident.

Decide how much coverage you need based on your financial situation and comfort with risk. Lenders require full coverage on financed vehicles, including comprehensive and collision. Once you own your car outright, switching to liability-only becomes an option if the savings justify the reduced protection.

- 4Review Coverage After Major Life Events

Marriage, moving between Idaho cities or adding vehicles creates new discount opportunities. Boise vs. Coeur d'Alene relocations can save $45 monthly. Review your policy whenever major life events occur.

Switching insurers takes about 15 minutes online. Most carriers complete the entire process digitally, from quote to coverage activation.

- 5Consider Idaho AIPSO Coverage

Idaho's Automobile Insurance Plan Service Office (AIPSO) serves drivers rejected by standard insurers. The assigned risk pool accepts applications from high-risk drivers. Premiums exceed standard market pricing but meet Idaho's mandatory coverage requirements.

Cheap Car Insurance in Idaho: FAQ

If you're searching for cheaper auto coverage in Idaho, these expert-answered questions can help you understand your options.

How much does car insurance cost in Idaho?

Idaho car insurance ranges from $30 to $70 monthly for minimum coverage and $80 to $150 for full coverage, depending on your location and driving record. Rural areas generally offer lower rates than cities like Boise, where traffic density increases accident risk.

Your specific cost depends on factors like age, coverage limits and vehicle type. Compare quotes from multiple insurers to find affordable Idaho car insurance.

Should you buy the cheapest car insurance in Idaho?

Buying the cheapest insurance isn't always smart. Affordable coverage should provide enough financial protection for serious accidents, not just meet state minimums. State Farm offers strong value in Idaho with competitive rates and reliable coverage across several driver profiles.

Is state minimum coverage enough in Idaho?

Idaho requires all drivers to carry auto insurance to legally drive. The state operates under an at-fault system, meaning the driver who causes an accident is responsible for damages. It mandates minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, plus $15,000 for property damage.

While meeting these minimums keeps you legal, many drivers choose higher limits for better financial protection against costly accidents.

Is Idaho a no-fault state?

Idaho operates as an at-fault state, not a no-fault system. When you cause an accident in Idaho, you're financially responsible for resulting injuries and property damage.

It requires drivers to carry liability insurance covering bodily injury and property damage they cause to others. Injured parties can file lawsuits against at-fault drivers to recover compensation for medical expenses, lost wages and pain and suffering.

Does Idaho allow gender-based insurance pricing?

Idaho allows insurers to use gender when calculating car insurance rates, so young men often pay higher premiums than young women with similar driving records. Still, some Idaho insurers choose not to use gender as a rating factor.

Note: Some states prohibit gender-based pricing. Check with your insurer to understand the rating factors used in your area.

Most Affordable Car Insurance in Idaho: Related Articles

How We Found the Most Affordable Car Insurance in Idaho

Our Research Approach

Idaho's car insurance market presents unique challenges. Rates vary between Boise's urban corridors and rural mountain communities, and your coverage choices matter more in a state with low minimum requirements.

Wildlife collisions, harsh winter weather and isolated roads create risks that generic coverage often misses. Our research identifies which insurers offer the lowest rates across Idaho's diverse landscape while providing the financial protection you actually need.

We collected auto insurance data from the Idaho Department of Insurance and Quadrant Information Services, analyzing quotes from 12 major insurers and reviewing more than 200 million rate comparisons across every residential ZIP code in Idaho.

Sample Driver Profile

Our baseline rates use a 40-year-old driver with good credit and a clean driving record. This profile represents typical Idaho drivers without violations or poor credit that increase premiums. You'll see base rates here. Your personal quote will adjust based on your specific driving history, credit and location.

Coverage Levels We Compared

We analyzed two coverage scenarios:

Minimum coverage: Idaho's required liability limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury and $15,000 per accident for property damage (25/50/15). This meets legal requirements but often falls short in serious accidents.

Full coverage: Liability limits of $100,000/$300,000/$100,000 plus comprehensive and collision coverage with a $1,000 deductible. You're covered for damage you cause to others and repairs to your own vehicle.

Location Affects Your Rate

Idaho rates vary by region. Drivers in Boise pay different amounts than those in Idaho Falls or Coeur d'Alene for identical coverage. Our ZIP code analysis reveals where drivers overpay because of geography alone.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 8, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 8, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 8, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 8, 2026.