Iowa drivers looking for affordable full coverage find the lowest yearly rate with Travelers at $770 or $64 a month. That price is 34% below what most drivers in the state pay. Auto-Owners follows at $822 a year, just $53 more than Travelers. Progressive costs $958 annually, while GEICO charges $1,022. State Farm rounds out the top five at $1,050 a year.

Cheapest Car Insurance in Iowa

For full coverage, Travelers costs $64 monthly, while State Farm's minimum coverage runs $19 monthly in Iowa.

Find low-cost Iowa car insurance for you below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

Full coverage: Travelers, $64

Liability only: State Farm, $19

Teens: Travelers, $107

Young adults: Travelers, $39

Seniors: Progressive, $31

DUI: State Farm, $21

SR-22: Progressive, $42

Non-owner: State Farm, $40

Bad credit: IMT, $50

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Iowa ZIP codes for various driver profiles, including clean records, violations and age groups. Rates show averages for a 40-year-old driver with good credit and a clean record unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Iowa

| Travelers | $64 | $770 | 34% |

| Auto Owners | $69 | $822 | 30% |

| Progressive | $80 | $958 | 18% |

| Geico | $85 | $1,022 | 13% |

| State Farm | $87 | $1,050 | 11% |

Cheapest Minimum Coverage Car Insurance in Iowa

State Farm offers the cheapest minimum coverage at $231 a year or $19 a month, which is 44% below Iowa’s state average. Travelers charges $334 a year for the same state-required coverage. Choosing State Farm over Travelers saves $103 annually. Progressive costs $253 a year, Farm Bureau charges $316 and Auto-Owners comes in at $328 annually.

| State Farm | $19 | $231 | 44% |

| Progressive | $21 | $253 | 39% |

| Farm Bureau | $26 | $316 | 24% |

| Auto Owners | $27 | $328 | 21% |

| Travelers | $28 | $334 | 19% |

Cheapest Car Insurance in Iowa by City

Across Iowa’s major cities, Progressive and Travelers trade places as the most affordable options. Progressive leads in Ames, Burlington, Cedar Falls, Dubuque, Iowa City, Mason City, Marshalltown, Sioux City and Waterloo. Travelers offers the lowest rates in Ankeny, Bettendorf, Clinton, Davenport, Marion, Ottumwa, Urbandale and West Des Moines.

Burlington shows Progressive with the biggest price gap, offering $16 a month for minimum coverage and $63 for full coverage, both about 35% below the city average. In Cedar Rapids, GEICO provides the cheapest rates at $31 a month for minimum coverage and $81 for full coverage.

| Ames | Progressive | $18 | $68 | 29% |

| Ankeny | Travelers | $27 | $62 | 28% |

| Bettendorf | Travelers | $28 | $64 | 30% |

| Burlington | Progressive | $16 | $63 | 35% |

| Cedar Falls | Progressive | $18 | $68 | 36% |

| Cedar Rapids | Geico | $31 | $81 | 20% |

| Clinton | Travelers | $26 | $61 | 32% |

| Council Bluffs | State Farm | $19 | $89 | 31% |

| Davenport | Travelers | $32 | $70 | 29% |

| Des Moines | Geico | $29 | $75 | 28% |

| Dubuque | Progressive | $23 | $74 | 28% |

| Iowa City | Progressive | $17 | $65 | 31% |

| Marion | Travelers | $29 | $67 | 28% |

| Marshalltown | Progressive | $19 | $75 | 25% |

| Mason City | Progressive | $17 | $64 | 34% |

| Ottumwa | Travelers | $27 | $63 | 31% |

| Sioux City | Progressive | $20 | $78 | 32% |

| Urbandale | Travelers | $27 | $64 | 28% |

| Waterloo | Progressive | $19 | $74 | 32% |

| West Des Moines | Travelers | $26 | $61 | 31% |

Cheapest Car Insurance in Iowa for Teens and Young Adults

Iowa families looking for teen car insurance see the lowest 16-year-old rate from State Farm at $137 a month. Travelers takes over at age 17 with a $136 monthly rate, then drops to $107 at age 18. Costs fall quickly as drivers move into early young adults age brackets. Travelers charges 19-year-olds $84 a month and 20-year-olds $70. By age 25, the price drops to $39 monthly, creating $1,180 in yearly savings compared to 16-year-old rates.

Note: Teens under 18 can’t legally buy a policy without a parent or guardian as a cosigner. Parents either add them to an existing policy or help them qualify for lower rates through good student discounts.

Cheapest Car Insurance for Seniors in Iowa

Senior drivers in Iowa find strong pricing across several companies. West Bend Mutual charges 65-year-olds $49 a month for minimum coverage and $48 for full coverage. At age 70, Progressive offers the lowest rates at $31 monthly for minimum coverage and $79 for full coverage. By age 80, State Farm provides the best prices at $39 a month for minimum coverage and $102 for full coverage.

Rates actually drop as Iowa seniors age, with 80-year-olds paying $10 less each month than 65-year-olds. All three providers offer prices roughly 29% to 34% below the state average.

| 65 | West Bend Mutual | $49 | $48 | 34% |

| 70 | Progressive | $31 | $79 | 29% |

| 80 | State Farm | $39 | $102 | 30% |

Cheapest DUI Insurance in Iowa

State Farm provides the lowest minimum-coverage rate after a DUI at $21 a month, which is 51% below Iowa’s average. Progressive follows at $26. For full coverage, State Farm leads at $92 monthly, with Travelers close behind at $99.

Minimum coverage costs $60 monthly through GEICO and $67 through Farmers. Full coverage runs $157 with GEICO, $164 with Farmers.

| State Farm | $21 | $92 | 51% |

| Progressive | $26 | $101 | 45% |

| Travelers | $40 | $99 | 40% |

| Geico | $60 | $157 | 6% |

| Farmers | $67 | $164 | 0% |

Cheapest SR-22 Insurance in Iowa

Drivers filing an SR-22 in Iowa pay $42 monthly for minimum coverage through Progressive, $43 through State Farm. Full coverage costs $98 monthly with Travelers, about 30% below the state average.

Minimum coverage with an SR-22 runs $46 monthly through GEICO, $51 through Auto-Owners. Full coverage prices hit $113 with GEICO, $127 with Auto-Owners.

| Travelers | $47 | $98 | 30% |

| GEICO | $46 | $113 | 24% |

| Progressive | $42 | $117 | 23% |

| State Farm | $43 | $127 | 18% |

| Auto-Owners Insurance Co | $51 | $127 | 14% |

Cheapest Non-Owner Car Insurance in Iowa

Drivers in Iowa looking for non-owner coverage find the lowest rate with State Farm at $47 a month, which is 27% below the state average. This type of policy helps with license reinstatement after a suspension, SR-22 filing needs or frequent car rentals.

Non-owner policies cost less than standard auto insurance because they only include liability coverage, meaning they pay for damage you cause others but not for any specific vehicle. GEICO charges $64 a month for non-owner coverage.

| State Farm | $47 | 27% |

| GEICO | $64 | 3% |

Cheapest Car Insurance After an Accident in Iowa

If you’re dealing with an at-fault accident, State Farm offers the lowest minimum coverage at $23 a month, 34% less than the state average. For full coverage, Travelers leads at $91 monthly, while Progressive charges $115.

Premiums often rise 20% to 40% after an at-fault accident and stay higher for three to five years. Auto-Owners charges $37 a month for minimum coverage and $104 for full coverage for drivers with recent accidents.

| State Farm | $23 | $96 | 34% |

| Travelers | $38 | $91 | 28% |

| Auto Owners | $37 | $104 | 21% |

| Progressive | $32 | $115 | 18% |

Cheapest Car Insurance With a Speeding Ticket

Minimum coverage with a speeding ticket costs $21 monthly ($251 annually) through State Farm. Full coverage runs $87 monthly with Travelers, $92 with State Farm.

Full coverage after a speeding ticket costs $108 monthly through Progressive, $111 through GEICO, $131 through Farm Bureau.

| State Farm | $21 | $92 | 32% |

| Progressive | $26 | $108 | 19% |

| Farm Bureau | $31 | $131 | 2% |

| Travelers | $35 | $87 | 26% |

| Geico | $39 | $111 | 9% |

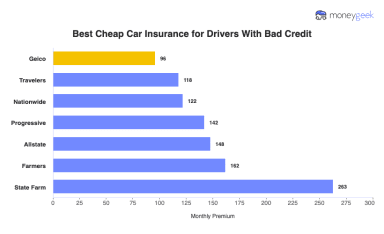

Cheapest Bad Credit Car Insurance in Iowa

IMT charges $598 a year for minimum coverage with bad credit or $50 monthly. That rate is 53% lower than Iowa’s state average. For full coverage, IMT leads at $118 monthly, saving drivers $81 each month compared to Auto-Owners at $199.

Farm Bureau charges $73 a month for minimum coverage and $225 for full coverage. GEICO costs $89 monthly for minimum coverage and $213 for full coverage, while Travelers charges $105 monthly for minimum coverage and $214 for full coverage.

| IMT Insurance | $50 | $118 | 53% |

| Farm Bureau | $73 | $225 | 17% |

| Geico | $89 | $213 | 16% |

| Auto Owners | $94 | $199 | 18% |

| Travelers | $105 | $214 | 11% |

How to Get the Cheapest Car Insurance in Iowa

Iowa drivers lower their insurance costs by comparing quotes and using available discounts. State Farm offers minimum coverage for $231 a year and Travelers has full coverage for $770 annually. Your actual rate varies based on your location, driving record, age and credit score.

- 1Compare Quotes Strategically

Iowa's metropolitan markets reward smart shopping. Farm Bureau Financial Services and Grinnell Mutual undercut national brands consistently. MoneyGeek's car insurance calculator produces personalized quotes instantly without requiring your phone number or email address.

Your location and driver profile generate three to five company comparisons in seconds. The results show exactly which car insurance companies offer Iowa drivers the lowest premiums.

- 2Maximize Discount Combinations

Home and auto policy bundling cuts premiums 5% to 25%. Iowa carriers reward loyalty at the higher end of that range. Adding multiple vehicles to one policy saves another 10% to 25%, making multi-car households eligible for compound discounts.

B-average students earn 10% to 15% reductions. Defensive driving courses provide similar savings (especially valuable for senior drivers). Annual mileage under 7,500? Low-mileage programs cut premiums 15% to 30%.

- 3Deductible and Coverage Decisions

Monthly premiums drop 10% to 15% when you raise deductibles from $500 to $1,000. That savings comes with a trade-off: you'll pay more out of pocket when accidents happen.

Financial situation and risk appetite determine how much coverage you need. Financed vehicles require comprehensive and collision through lender requirements. Owned cars qualify for liability-only coverage when premium savings outweigh the protection loss.

- 4Meet Iowa Requirements

Iowa's state minimums stop at 20/40/15 liability limits ($20,000 bodily injury per person, $40,000 per accident, $15,000 property damage). Serious accidents quickly exhaust these limits when vehicle repairs average $4,500 and total losses run past $20,000.

Asset protection improves dramatically with 100/300/100 limits. Most Iowa drivers pay just $10 to $20 more monthly for triple the bodily injury coverage, which protects savings and property from lawsuit judgments.

- 5Timing Your Insurance Shopping

Major life events unlock better rates. Marriage drops premiums 5% to 15% compared to single status (identical driving records). Relocating within Iowa produces dramatic shifts: Des Moines to Cedar Rapids saves $50 monthly.

Online insurer switches finish in 15 minutes. Digital processes handle everything from quotes to active coverage. Shop immediately after buying vehicles, moving addresses or adding household members to maximize available discounts.

- 6Consider AIPSO Coverage

Standard insurers reject high-risk drivers. Iowa's Automobile Insurance Plan Service Office (AIPSO) fills that gap by accepting applications from drivers with multiple violations, suspended licenses or DUI convictions. Premiums run higher than standard market rates but satisfy Iowa's mandatory coverage laws.

AIPSO placement length depends on your driving record. Three to five years of clean driving typically earns re-entry to the standard market at lower premiums. The assigned risk pool maintains legal driving status during your insurance profile rebuild.

Cheap Car Insurance in Iowa: FAQ

If you want to save on car insurance in Iowa, our insurance experts break down the questions drivers ask most.

How much does car insurance cost in Iowa?

Iowa car insurance costs range from around $30 monthly for minimum coverage to $85 for full coverage. Rates vary based on your location, driving record and coverage choices. Des Moines residents pay higher rates than rural drivers due to increased traffic and accident frequency.

Should you buy the cheapest car insurance in Iowa?

Buying the cheapest car insurance makes sense if you have minimal assets to protect, drive an older vehicle with low market value and maintain a strong emergency fund covering potential liability costs.

However, most drivers benefit from coverage beyond state minimums because Iowa's 20/40/15 requirements rarely cover serious accident costs. Medical bills from major accidents often exceed $20,000 and vehicle repairs often surpass property damage limits. Consider your financial situation and risk tolerance when choosing coverage levels.

Is state minimum coverage enough in Iowa?

State minimum coverage proves insufficient for most drivers. Iowa requires only $20,000 per person for bodily injury, but the average hospital stay after a car accident costs $57,000.

Property damage coverage of $15,000 falls short when the average new vehicle costs $48,000. One serious accident can leave you personally liable for tens of thousands in uncovered costs. Full coverage or higher liability limits protect your assets and provide better financial security.

Is Iowa a no-fault state?

Iowa operates under a traditional fault-based system. The at-fault driver's insurance pays for costs after an accident. You can file claims directly against the responsible party's insurer or sue for amounts exceeding policy limits.

This differs from no-fault states where each driver's insurance covers their own injuries regardless of fault. Iowa's system allows accident victims to pursue full compensation through the at-fault party's coverage.

Does Iowa allow gender-based insurance pricing?

Iowa permits insurers to use gender as a pricing factor. Young male drivers often have higher accident rates, which leads to increased premiums compared to female drivers of the same age.

This gap narrows as drivers get older, with minimal differences by age 30. Some states ban gender-based pricing, but Iowa still allows it. Your driving record and other factors usually have a greater impact on your final rate.

Note: Gender-based pricing varies by insurer and some companies no longer use gender when setting rates. State rules and underwriting practices may change, so check current guidelines with your insurer or a licensed agent.

Most Affordable Car Insurance in Iowa: Related Articles

How We Found the Most Affordable Car Insurance in Iowa

Our Research Approach

Iowa's auto insurance landscape varies a lot. Premiums differ between Cedar Rapids' urban corridors and small-town rural routes, and coverage decisions directly impact what you pay monthly versus what you're protected against. Our analysis pinpoints which companies deliver competitive pricing throughout Iowa's distinct regions.

We gathered rate data from the Iowa Department of Insurance and Quadrant Information Services, examining quotes from 12 major insurers through more than 200 million rate comparisons spanning every residential ZIP code statewide.

Driver Profile Used

Our standard rates reflect a 40-year-old policyholder with solid credit and no driving violations. This baseline captures what Iowa drivers without tickets or credit issues usually pay. Your actual premium depends on your personal driving record, credit profile and specific address.

Two Coverage Options Analyzed

We examined both coverage types:

State minimum: Iowa mandates $20,000 bodily injury per person, $40,000 bodily injury per accident and $15,000 property damage per accident (20/40/15). While legally sufficient, these limits rarely cover costs from major collisions.

Comprehensive protection: $100,000/$300,000/$100,000 liability paired with comprehensive and collision at a $1,000 deductible. This covers both your liability for others' damages and repairs to your vehicle.

Geographic Rate Variations

Iowa premiums fluctuate across cities. Drivers in neighboring communities sometimes see 40% cost differences for identical policies. Our statewide ZIP code breakdown shows where location pushes rates higher.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.