At an average of $1,164 per year, Travelers' full coverage auto insurance is the cheapest for leased cars among the companies MoneyGeek surveyed. Full coverage insurance is best for leased cars since most lessors require liability, comprehensive and collision coverage.

Cheapest Car Insurance for Leased Cars

Travelers hs the cheapest insurance for leased cars for most drivers at $1,164/year. Leasing companies require higher liability limits and full coverage policies.

Find out below if you're overpaying for car insurance on your leased vehicle.

Updated: February 6, 2026

Advertising & Editorial Disclosure

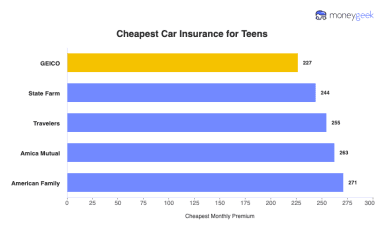

Travelers offers the lowest rates for leased cars, along with solid coverage options like accident forgiveness. GEICO is close behind, with competitive pricing and strong customer service.

Car lessors require full coverage car insurance, including liability, collision and comprehensive coverage, and may require higher liability limits than the state minimum.

You can save on leased car insurance by increasing deductibles, bundling policies, improving your driving record and credit score and applying discounts. Comparing quotes between three to five companies will help you get a cheaper rate.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

What Is the Cheapest Insurance for Leased Cars?

| Travelers | $97 | $1,164 |

| Geico | $98 | $1,179 |

| Amica | $115 | $1,381 |

| State Farm | $121 | $1,448 |

| Progressive | $125 | $1,503 |

| Nationwide | $127 | $1,526 |

| Kemper | $127 | $1,528 |

| Chubb | $140 | $1,680 |

| Farmers | $152 | $1,822 |

| UAIC | $152 | $1,829 |

| AAA | $160 | $1,916 |

| Allstate | $161 | $1,937 |

| AIG | $215 | $2,576 |

Cheapest Insurance for Leased Cars by State

Car insurance costs vary by location, so the cheapest option is different in each state. For example, GEICO is cheapest for leased cars in California and Auto Owners is cheapest in Ohio. Check the table below to see the company with the cheapest leased car insurance in your area.

| Alabama | AIG | $68 | $817 |

| Alaska | Geico | $84 | $1,005 |

| Arizona | Travelers | $86 | $1,030 |

| Arkansas | Farm Bureau | $86 | $1,032 |

| California | Geico | $90 | $1,085 |

| Colorado | American National | $74 | $891 |

| Connecticut | Geico | $76 | $910 |

| Delaware | Travelers | $74 | $887 |

| District of Columbia | Chubb | $108 | $1,300 |

| Florida | Travelers | $112 | $1,349 |

| Georgia | Auto Owners | $100 | $1,201 |

| Hawaii | Geico | $66 | $787 |

| Idaho | Geico | $53 | $632 |

| Illinois | Geico | $69 | $830 |

| Indiana | Geico | $63 | $755 |

| Iowa | Travelers | $66 | $789 |

| Kansas | Geico | $71 | $853 |

| Kentucky | Travelers | $94 | $1,132 |

| Louisiana | Geico | $158 | $1,894 |

| Maine | Travelers | $54 | $644 |

| Maryland | Geico | $84 | $1,002 |

| Massachusetts | Plymouth Rock Insurance | $67 | $804 |

| Michigan | Geico | $70 | $841 |

| Minnesota | Auto Owners | $75 | $897 |

| Mississippi | Farm Bureau | $95 | $1,140 |

| Missouri | Auto Owners | $79 | $948 |

| Montana | State Farm | $80 | $957 |

| Nebraska | Farmers Mutual Ins Co of NE | $67 | $802 |

| Nevada | Travelers | $106 | $1,268 |

| New Hampshire | MMG Insurance | $60 | $718 |

| New Jersey | NJM Insurance | $121 | $1,453 |

| New Mexico | Geico | $96 | $1,147 |

| New York | NYCM Insurance | $58 | $700 |

| North Carolina | State Farm | $56 | $671 |

| North Dakota | Geico | $56 | $677 |

| Ohio | Auto Owners | $68 | $811 |

| Oklahoma | Progressive | $89 | $1,069 |

| Oregon | Progressive | $81 | $975 |

| Pennsylvania | Travelers | $68 | $815 |

| Rhode Island | State Farm | $85 | $1,025 |

| South Carolina | American National | $64 | $764 |

| South Dakota | Progressive | $52 | $621 |

| Tennessee | Auto Owners | $77 | $923 |

| Texas | State Farm | $95 | $1,135 |

| Utah | Geico | $93 | $1,118 |

| Vermont | Co-operative Insurance | $50 | $604 |

| Virginia | Farm Bureau | $61 | $736 |

| Washington | Progressive | $99 | $1,184 |

| West Virginia | Erie Insurance | $91 | $1,096 |

| Wisconsin | Geico | $55 | $655 |

| Wyoming | American National | $63 | $753 |

Best Affordable Leased Car Insurance: Buyer's Guide

You'll need higher liability limits and full coverage to meet your lessor's requirements. Understanding these requirements and exploring different cost-saving strategies can help you find the best car insurance for your leased car without overpaying.

How to Find the Cheapest Car Insurance for Leased Cars

Leased vehicles require full coverage with higher liability limits than owned cars. You can't drop to state minimums, but these lease-specific approaches will help you find the best car insurance to lower your costs without violating your lease agreement. Learn how to get the right car insurance for your situation.

- 1Understand your lessor's exact requirements

Review your lease agreement before shopping for insurance. Most lessors require 100/300/50 liability limits, comprehensive and collision coverage with deductibles capped at $500 or $1,000, and gap insurance. Knowing these minimums prevents you from paying for higher coverage than necessary.

- 2Compare gap insurance costs carefully

Gap insurance covers the difference between your lease payoff and your car's actual cash value after a total loss. Dealerships charge $500 to $700 for gap coverage over your lease term. Your auto insurer typically charges $20 to $60 annually. Buying gap insurance through your auto policy instead of the dealership saves you $300 to $500 over a typical three-year lease.

- 3Adjust deductibles within lease limits

Most lease agreements cap deductibles at $500 or $1,000. If your lessor allows $1,000 deductibles, choosing this higher amount over $500 saves you $200 to $400 annually on premiums. Check your lease contract for the maximum allowed deductible before adjusting.

- 4Shop before signing your lease

Get insurance quotes for your specific leased vehicle before finalizing the lease. Insurance costs vary significantly by model. A Honda Civic might cost $1,200 annually to insure with full coverage, while a luxury sedan could run $2,500. Factor these costs into your total lease budget.

- 5Verify lessor-approved insurers

Some leasing companies maintain lists of approved insurance carriers or require specific financial strength ratings. Confirm your chosen insurer meets your lessor's requirements before purchasing. Switching insurers mid-lease because your lessor rejects your carrier wastes time and money.

- 6Time your coverage to match your lease start

Coordinate your insurance effective date with your lease pickup date. Starting coverage too early wastes money on premiums for a car you're not driving yet. Most insurers let you schedule coverage to begin on a specific future date.

- 7Plan for lease-end coverage adjustments

When your lease ends, you drop to lower coverage limits if you're not leasing or financing your next vehicle. Set a reminder 30 days before lease end to contact your insurer about adjusting coverage. This prevents paying for higher coverage after you return the vehicle.

What Are the Requirements for Insurance on a Leased Car?

Leased cars require full coverage insurance, including liability, collision and comprehensive. Collision protect your car if you cause an accident and comprehensive protects your car from storms, theft, or other damage. Some lessors also ask for extras like gap insurance or uninsured motorist coverage.

Required Coverage | Description |

|---|---|

Liability Coverage | Covers bodily injury liability and property damage liability. Bodily injury covers the injuries of the other driver and the other car's passengers, while property damage covers the damage to the other driver's vehicle. |

Comprehensive coverage | Pays for your car's damage from incidents other than collisions with other vehicles, such as theft, vandalism, natural disasters and fires. |

Collision coverage | Pays for damage to your car caused by an accident involving another vehicle or an object, such as a tree, fence or light pole. Collision also covers rollover accidents and pothole damage. |

Uninsured and underinsured motorist coverage | Pays for damage to your vehicle if you're in an accident with an uninsured driver or a driver without enough coverage to cover your damage and injuries. Some states require this coverage. |

Personal injury protection | Pays for your medical bills and those of your passengers if you're in an accident. Some states require this coverage. |

Gap insurance | Covers the difference between the value of a car and what you owe on it. |

Before leasing a car, get full coverage insurance in addition to your state’s minimum requirements. This protects the lessor’s investment because comprehensive and collision coverage pay for car damage. Some lessors may also require higher liability limits.

Cheapest Auto Insurance for Leased Cars: Bottom Line

Travelers offers the cheapest full coverage policy for leased car drivers at $1,164 per year, followed by GEICO at $1,179. Military members can save even more with USAA at $899.

Leased car insurance costs more than minimum coverage because most lessors require comprehensive and collision coverage along with higher liability limits. Some also mandate gap insurance to cover depreciation.

To save on insurance, compare quotes, use discounts and adjust deductibles. Use our comparison tool to find the best rate for your needs.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Cheap Car Insurance for Leased Cars: FAQ

We answer common questions to help you better understand car insurance for leased cars.

Do I need full coverage on a leased car?

Yes, you need full coverage on a leased car. Nearly all lessors require comprehensive and collision coverage in addition to liability insurance to protect their investment in the vehicle.

Can I use minimum coverage on a leased car?

No, you can't use minimum coverage on a leased car. Leasing companies require full coverage insurance because they own the vehicle and need comprehensive protection against damage, theft or total loss.

What happens if I don't have enough insurance on my leased car?

You risk violating your lease agreement if you don't have enough insurance coverage. The lessor can require you to purchase additional coverage immediately or terminate your lease early, leaving you responsible for remaining payments and penalties.

Do I need gap insurance when leasing a car?

Many lessors require gap insurance to cover the difference between what you owe on the lease and the car's actual cash value if it's stolen or totaled. Even if not required, gap insurance is recommended since leased cars depreciate quickly, especially in the first year.

What happens to my insurance when my lease ends?

You can cancel your car insurance policy when your lease ends if you're not getting another vehicle. However, if you plan to extend the lease, lease a new car, or buy the leased car, you'll need to update your policy and inform your provider about the changes.

Can I choose my own deductible on a leased car?

Your deductible choices are limited when leasing. Most lessors cap deductibles at $500 to $1,000 maximum for comprehensive and collision coverage. You can't choose deductibles higher than what your lessor allows.

Why is leased car insurance more expensive than regular car insurance?

Leased car insurance costs more because lessors require higher liability limits, mandatory comprehensive and collision coverage, lower deductible caps and often gap insurance. These requirements provide more coverage but increase your premium costs.

Is it more expensive to insure a leased car?

If you're used to paying for minimum coverage, car insurance for a leased vehicle costs more because lessors often require full coverage. However, it comes with more protection, including liability, comprehensive and collision coverage.

Best Cheap Car Insurance for Leased Cars: Our Methodology

Leasing a car means driving someone else's valuable asset, and your insurance needs differ from those of car owners. Leasing companies require specific coverage levels, and you'll face financial gaps that standard policies don't cover. We designed our research to address these challenges and help you find the right financial protection without overpaying.

Cheap Auto Insurance for Leased Cars: Related Pages

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.