Teen insurance rates drop significantly as drivers age, and the cheapest companies shift at each age. For 16-year-olds, Amica Mutual offers the lowest rates at $5,148 annually, resulting in a savings of $1,039 compared to the national average. By 19, GEICO becomes the most affordable at $2,810 per year—a 28% savings over typical teen rates.

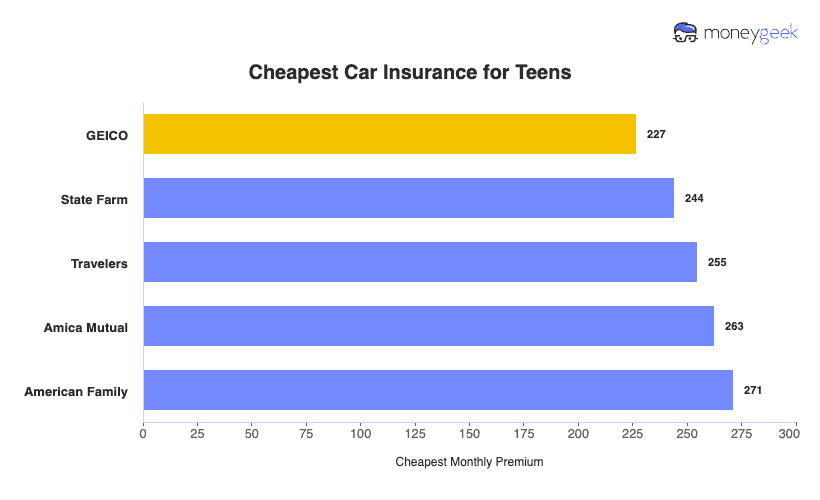

Cheapest rates by age: