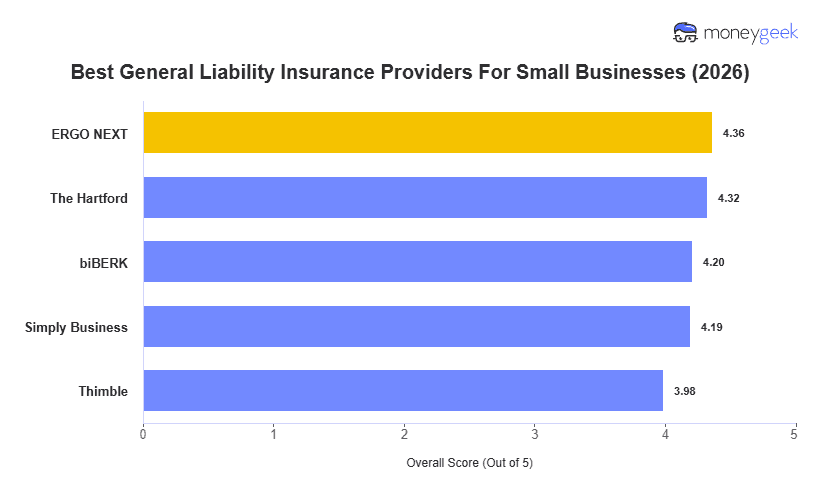

While there is no single best general liability insurance option for every small business, many companies can find strong coverage with the following companies:

- ERGO NEXT: Best Overall, Best For Hands-on and Complex Businesses

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best For Lower-risk Service Businesses

- Simply Business: Best For Coverage Selection

- Thimble: Best For Gig and Event-based Workers

These insurers balance affordability, customer experience and coverage options well. Here's why each made our top five and where they stand out.