Travelers offers the cheapest full coverage car insurance in Kentucky at $94 per month or $1,123 a year, which is about 31% below the state average. Auto-Owners is a close second at $107 monthly or $1,285 yearly, costing $162 more than Travelers each year. GEICO follows at $109 per month, Shelter Insurance is $115, and State Farm rounds out the top five at $124. Explore the best car insurance in Kentucky for additional carrier comparisons.

Cheapest Car Insurance in Kentucky

Travelers leads Kentucky with cheapest full coverage at $1,123 yearly and most affordable state minimum at $560 annually.

Find low-cost Kentucky car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: Travelers, $94

Liability only: Travelers, $47

Teens: Travelers, $157

Young adults: Travelers, $62

Seniors: Travelers, $62

DUI: State Farm, $54

SR-22: Travelers, $78

Non-owner: State Farm, $65

Bad credit: Grange, $63

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Kentucky ZIP codes for various driver profiles, including those with clean records, those with violations, and different age groups. Rates are based on averages for a 40-year-old driver with good credit and a clean record, unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Kentucky

| Travelers | $94 | $1,123 | 31% |

| Auto Owners | $107 | $1,285 | 21% |

| Geico | $109 | $1,306 | 20% |

| Shelter Insurance | $115 | $1,374 | 16% |

| State Farm | $124 | $1,487 | 9% |

Cheapest Minimum Coverage Car Insurance in Kentucky

Travelers has the lowest liability-only rates at $47 per month or $560 a year, which is about 40% below the state average.

GEICO follows at $48 monthly. Shelter Insurance and State Farm are both $51 for the same coverage.

Drivers working within a limited budget may want to compare minimum coverage options alongside cheapest car insurance for drivers with low income in Kentucky.

| Travelers | $47 | $560 | 40% |

| Geico | $48 | $580 | 38% |

| Shelter Insurance | $51 | $607 | 35% |

| State Farm | $51 | $616 | 34% |

| Farm Bureau | $52 | $625 | 33% |

Cheapest Car Insurance in Kentucky by City

Auto-Owners offers competitive minimum coverage rates. Prices vary from $37 per month in Owensboro to $52 in both Georgetown and Louisville. You can also save by looking for the best home and auto insurance bundles in Kentucky

| Ashland | Travelers | $40 | $82 | 30% |

| Bowling Green | Travelers | $43 | $84 | 27% |

| Covington | Nationwide | $39 | $62 | 34% |

| Elizabethtown | Travelers | $40 | $82 | 30% |

| Erlanger | Nationwide | $42 | $66 | 28% |

| Florence | Nationwide | $42 | $66 | 27% |

| Frankfort | Travelers | $40 | $81 | 23% |

| Georgetown | Travelers | $52 | $95 | 37% |

| Henderson | Travelers | $39 | $79 | 29% |

| Hopkinsville | Travelers | $40 | $80 | 28% |

| Independence | Travelers | $38 | $78 | 23% |

| Jeffersontown | State Farm | $36 | $87 | 32% |

| Lexington | State Farm | $41 | $96 | 23% |

| Louisville | State Farm | $52 | $124 | 30% |

| Mount Washington | State Farm | $41 | $97 | 28% |

| Nicholasville | Nationwide | $49 | $77 | 20% |

| Owensboro | Travelers | $37 | $76 | 21% |

| Paducah | Auto Owners | $49 | $89 | 18% |

| Radcliff | Travelers | $40 | $81 | 33% |

| Richmond | Travelers | $41 | $83 | 21% |

Cheapest Car Insurance in Kentucky for Teens and Young Adults

Young drivers in Kentucky get the lowest rates from Auto-Owners, which charges $257 per month for 16-year-olds. Travelers offers the best price for 25-year-olds at $62 monthly and also leads for 17-year-olds at $197, 18-year-olds at $157 and 19- and 20-year-olds at $125 and $106 per month.

The $195 monthly gap between ages 16 and 25 shows how age shapes pricing for teen car insurance and young adults in Kentucky. Drivers comparing cheapest car insurance for college students can look at these providers to find options that match their budget.

Note: Teens under 18 are not allowed to buy their own policy and need a parent or guardian to cosign.

Cheapest Car Insurance for Seniors in Kentucky

Senior drivers in Kentucky can find low-cost coverage with Cincinnati Insurance, which offers $67 per month for 65-year-olds. Travelers provides the best rate for 70-year-olds at $62 monthly and also leads for 80-year-olds at $78 for minimum limits.

The small $11 difference from age 65 to age 80 shows how pricing stays steady for experienced drivers. These companies offer rates 31% to 40% below the state average, giving long-time safe drivers lower premiums. Learn more about cheapest car insurance for seniors or senior citizen discounts across carriers.

| 65 | Cincinnati Insurance | $67 | $76 | 31% |

| 70 | Travelers | $62 | $108 | 40% |

| 80 | Travelers | $78 | $138 | 40% |

Cheapest DUI Insurance in Kentucky

Kentucky drivers with a DUI can get the lowest minimum coverage from State Farm at $54 per month. Shelter Insurance is next at $66. For full coverage, State Farm is the cheapest at $127 monthly, with Shelter Insurance at $142.

There is a sizable gap between providers for high-risk drivers in Kentucky when comparing the cheapest car insurance for high-risk drivers. You can explore the cheapest car insurance after a DUI across providers to find better rates.

| State Farm | $54 | $127 | 52% |

| Shelter Insurance | $66 | $142 | 44% |

| Travelers | $69 | $146 | 42% |

| Progressive | $98 | $161 | 30% |

| Grange Insurance | $158 | $213 | 0% |

Cheapest SR-22 Insurance in Kentucky

For Kentucky drivers who need SR-22 filing, Travelers offers the lowest minimum coverage at $78 per month, with State Farm close behind at $80. Auto-Owners is $95 monthly, Shelter Insurance charges $97, and GEICO also comes in at $95. For full coverage SR-22 rates, Travelers leads again at $142 per month, followed by Auto-Owners at $168 and State Farm at $188.

The SR-22 certificate itself costs $15 to $50 and is filed by your insurer with Kentucky’s Department of Motor Vehicles. Most drivers must keep an SR-22 for about three years after a serious violation, and maintaining continuous coverage is required during that period. Explore cheapest SR-22 insurance options across carriers to compare rates.

| Travelers | $78 | $142 | 41% |

| Auto-Owners Insurance Co | $95 | $168 | 29% |

| State Farm | $80 | $188 | 28% |

| Shelter | $97 | $189 | 23% |

| GEICO | $95 | $196 | 21% |

Cheapest Non-Owner Car Insurance in Kentucky

State Farm offers the cheapest non-owner car insurance in Kentucky at $65 per month, about 26% below the state average. Auto-Owners follows at $76 monthly, while Travelers costs $88 for this type of coverage. Non-owner policies are usually cheaper than standard auto insurance because they provide liability protection only and don’t insure a specific vehicle.

Non-owner insurance can help with license reinstatement, SR-22 needs or frequent rental car use. The $23 difference between the lowest and highest rates adds up to $276 a year. Compare cheapest non-owner car insurance or non-owner SR-22 insurance rates nationally to find the best fit.

| State Farm | $65 | 26% |

| Auto-Owners Insurance Co | $76 | 19% |

| Travelers | $88 | 6% |

Cheapest Car Insurance After an Accident in Kentucky

If you’ve had an at-fault accident in Kentucky, State Farm offers the cheapest minimum coverage at $59 per month. Travelers is next at $64 monthly.

A rate increase of 20% to 40% is common after an at-fault accident.

| State Farm | $59 | $135 | 38% |

| Travelers | $64 | $135 | 36% |

| Shelter Insurance | $66 | $142 | 33% |

| Auto Owners | $82 | $145 | 27% |

| Geico | $75 | $166 | 23% |

Cheapest Car Insurance With a Speeding Ticket

For Kentucky drivers with a speeding ticket, Shelter Insurance offers the most affordable minimum coverage at $51 per month or $607 a year. Farm Bureau follows at $52 monthly. Defensive driving or traffic school may help reduce future violations.

| Shelter Insurance | $51 | $115 | 36% |

| Farm Bureau | $52 | $138 | 26% |

| Geico | $53 | $120 | 33% |

| State Farm | $54 | $127 | 30% |

| Travelers | $60 | $128 | 27% |

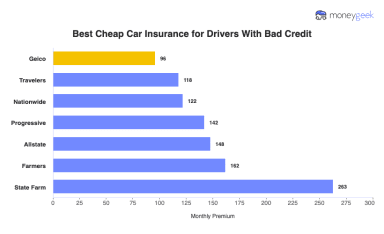

Cheapest Bad Credit Car Insurance in Kentucky

Grange offers the lowest minimum coverage for Kentucky drivers with poor credit at $63 per month or $752 a year. GEICO follows at $71 monthly, Farm Bureau comes in at $75, Shelter Insurance charges $79, and Nationwide is $106 for minimum limits.

For full coverage, Grange stays in the lead at $96 per month, giving drivers a $77 monthly or $924 yearly savings compared to GEICO at $173. Kentucky allows insurers to use credit history in their pricing, which raises costs for drivers with poor credit. A higher credit score can lower premiums by hundreds each year.

| Grange Insurance | $63 | $96 | 52% |

| Geico | $71 | $173 | 27% |

| Farm Bureau | $75 | $203 | 16% |

| Shelter Insurance | $79 | $200 | 16% |

| Nationwide | $106 | $193 | 10% |

How to Get the Cheapest Car Insurance in Kentucky

Your driving record, age, location and credit history all influence car insurance costs in Kentucky. Travelers offers competitive rates with full coverage averaging $94 monthly and minimum coverage starting at $47 monthly. You can save hundreds each year by comparing insurers and taking advantage of available discounts.

- 1Shop Multiple Carriers

Request quotes from three to five insurers. Use MoneyGeek's car insurance calculator to get estimates. Learn more about how to compare car insurance effectively.

- 2Maximize Available Discounts

Pairing your home and auto insurance with one carrier cuts costs 5% to 25%, while multiple vehicles saves 10% to 25%. Seniors benefit from defensive driving certifications, students with B averages or higher qualify for good student discounts. Maximize all available car insurance discounts.

- 3Adjust Coverage Options

Consider how much car insurance you need when balancing affordability and protection.

- 4Meet Kentucky Requirements

Kentucky's legal state minimum requirements are set at 25/50/25, covering $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage.

Average vehicle repairs will likely cost $4,500, and total loss replacements will be more, above $20,000. Understand what happens if you drive without insurance in Kentucky.

- 5Shop After Life Changes

Kentucky's city-to-city rate variations mean moving from Louisville to Owensboro might save you on insurance. Major life transitions can qualify you for improved rates or coverage.

Cheap Car Insurance in Kentucky: FAQ

Our experts answer the most common questions to help you understand your options for affordable car insurance in Kentucky.

How much does car insurance cost in Kentucky?

Kentucky car insurance ranges from $800 to $1,500 annually for minimum coverage, depending on your driving record, location, and chosen insurer. Rural areas generally see lower rates than cities like Louisville or Lexington.

Your specific cost depends on factors like age, coverage limits, and claims history. For detailed Kentucky car insurance costs, compare quotes from multiple insurers to find affordable coverage that meets your needs.

Should you buy the cheapest car insurance in Kentucky?

The cheapest car insurance isn't always your best bet. Make sure the policy offers enough financial protection for major accidents. Comparing rates and choosing an affordable option with solid coverage gives you better protection overall.

Is state minimum coverage enough in Kentucky?

Kentucky requires all drivers to carry auto insurance to legally drive. The state uses an at-fault system, which means the driver responsible for the accident must pay for resulting injuries and property damage.

State minimum coverage includes personal injury protection, property damage liability and uninsured motorist coverage. Meeting these minimums keeps you legal, but choosing higher limits offers better financial protection if you’re involved in a serious crash.

Is Kentucky a no-fault state?

Kentucky is not a no-fault state. Kentucky follows an at-fault system where the driver responsible for causing an accident must pay for resulting damages and injuries. Drivers must carry liability insurance to cover harm they cause to others and injured parties can file lawsuits against at-fault drivers to recover compensation.

Does Kentucky allow gender-based insurance pricing?

Kentucky permits insurers to factor gender into car insurance rate calculations, which usually results in higher premiums for young male drivers compared to young female drivers with similar profiles. Still, some Kentucky insurers voluntarily choose not to use gender as a rating factor.

Note: Insurance regulations change over time. Check with your insurer about current gender rating practices, since some companies avoid using gender in their pricing even when state law allows it.

Most Affordable Car Insurance in Kentucky: Related Articles

How We Found the Most Affordable Car Insurance in Kentucky

Kentucky's car insurance market presents unique challenges because rates vary between Louisville's urban environment and rural areas, and the state's required personal injury protection (PIP) coverage affects premiums differently than liability-only states. Kentucky's specific minimum liability requirements and geographic rating factors add complexity when comparing insurers. Our research cuts through this to identify which companies offer the lowest rates across Kentucky's diverse markets.

We collected auto insurance data from the Kentucky Department of Insurance and Quadrant Information Services, analyzing quotes from 12 major insurers and reviewing more than 200 million rate comparisons across every residential ZIP code in Kentucky. This comprehensive coverage ensures our data reflects what you'll actually pay based on your specific location, whether you're in Louisville, Lexington, or rural counties.

Our baseline rates use a 40-year-old driver with good credit and a clean driving record. This profile represents Kentucky drivers without violations or poor credit that increase premiums. You'll see base rates here that provide accurate comparisons between insurers, though your personal quote will adjust based on your specific driving history, credit, and location.

We analyzed two coverage scenarios: Minimum coverage meets Kentucky's required liability limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage (25/50/25). This satisfies legal requirements but often falls short covering costs in serious accidents, especially given Kentucky's PIP requirements.

Full coverage provides liability limits of $100,000/$300,000/$100,000 plus comprehensive and collision coverage with a $1,000 deductible. You're covered for damage you cause to others and repairs to your own vehicle, providing stronger financial protection when accidents occur.

Kentucky rates vary substantially from one city to another. Drivers living just a

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.