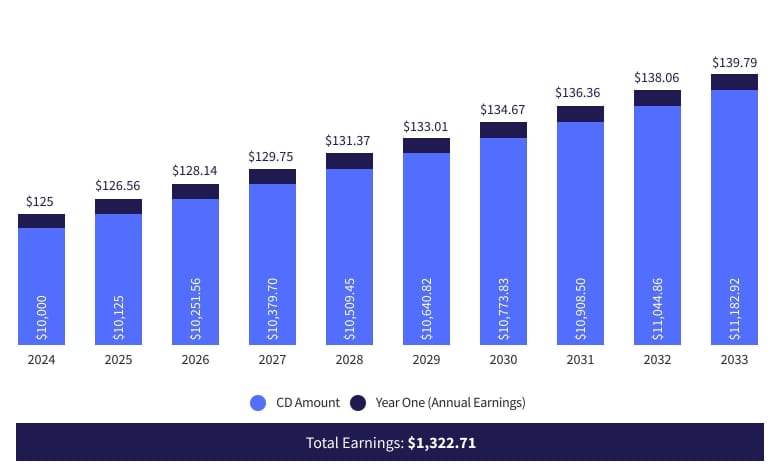

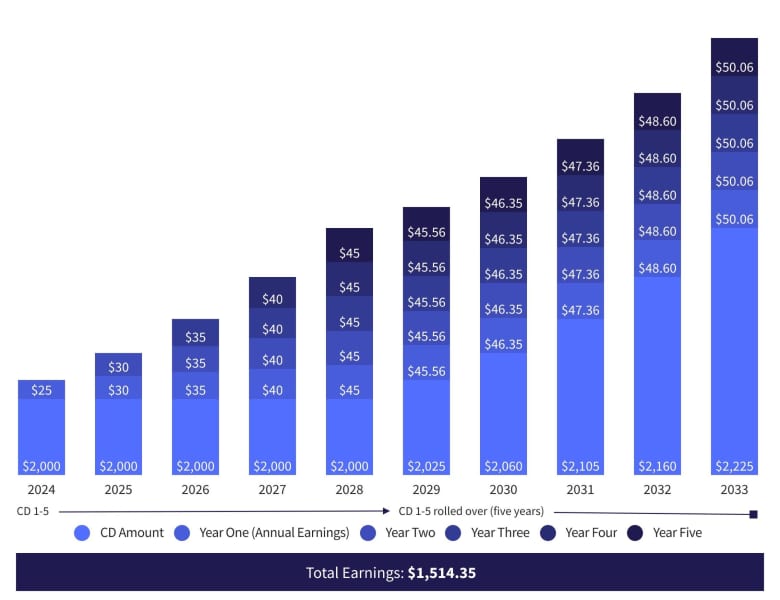

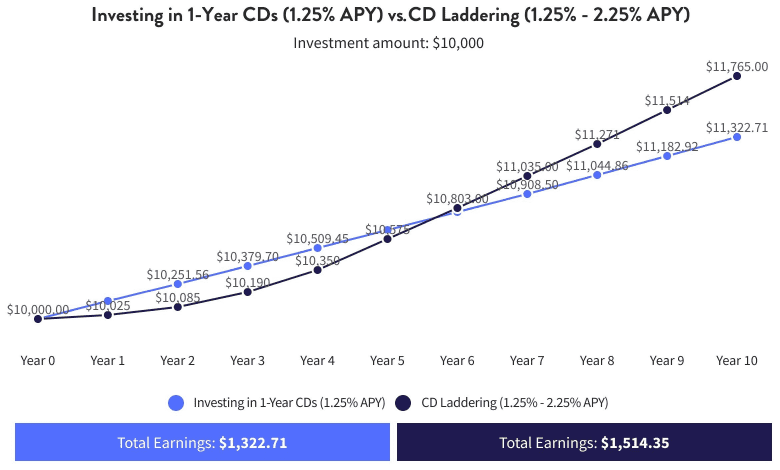

A certificate of deposit (CD) is a savings instrument that ensures growth through a guaranteed rate of return. Typically, these accounts have a higher annual percentage yield (APYs) than other options. The funds deposited in CDs remain locked throughout the CD’s term. One way of maximizing the benefits of these accounts is through CD laddering —or investing in multiple CDs with staggering maturities — which creates higher APYs on long-term CDs and ensures consistent returns through short-ter m CDs.

CD laddering could potentially help you grow your money as you navigate the current economic climate. However, proper management is a must. It’s essential to understand your CD laddering options, how CD laddering works and what steps you need to take to build an effective CD ladder.