GEICO has the cheapest car insurance for most 24-year-old drivers, while USAA offers the most affordable premiums for veterans, military members and their families. We rank the top insurance companies based on affordability for 24-year-old drivers based on coverage, gender and vehicle.

Cheapest Car Insurance for 24-Year-Olds

GEICO, Auto-Owners, Travelers, State Farm and Progressive offer the cheapest car insurance for 24-year-olds, with the lowest monthly rates at $80.

Find out if you're overpaying for car insurance below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

GEICO has the lowest monthly rates for most drivers at $80 for minimum and $175 for full coverage.

For military members and their families, USAA is the cheapest at $55 per month for minimum coverage and $119 for full coverage.

The average monthly cost of car insurance for 24-year-old drivers is $78 for minimum coverage and $167 for full coverage.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Cheapest Car Insurance Companies for 24-year-Olds

Cheapest Minimum Coverage Car Insurance for 24-Year-Olds

Among national providers, GEICO offers the most affordable minimum liability car insurance for 24-year-old drivers. Although USAA has the lowest rate, $656 per year, it's only available to military families.

| USAA | $55 | $656 |

| GEICO | $80 | $959 |

| Auto-Owners | $97 | $1,161 |

| Travelers | $102 | $1,222 |

| State Farm | $104 | $1,253 |

| Progressive | $131 | $1,571 |

| Allstate | $136 | $1,632 |

| Nationwide | $145 | $1,740 |

| Farmers | $160 | $1,915 |

| AIG | $162 | $1,943 |

Rates are for drivers with clean driving records and good credit, insuring a 2012 Toyota Camry with minimum coverage.

Read More:

Cheapest Full Coverage Car Insurance for 24-Year-Olds

GEICO offers the cheapest full coverage car insurance for 24-year-old drivers, with average rates of $2,099 annually. USAA offers a cheaper alternative for military members and their families at $1,429 annually.

| USAA | $119 | $1,429 |

| GEICO | $175 | $2,099 |

| Travelers | $203 | $2,433 |

| Auto-Owners | $205 | $2,460 |

| State Farm | $220 | $2,641 |

| Progressive | $259 | $3,113 |

| Allstate | $270 | $3,234 |

| Nationwide | $280 | $3,358 |

| Farmers | $319 | $3,826 |

| AIG | $487 | $5,839 |

Rates are for drivers with clean driving records and good credit, insuring a 2012 Toyota Camry with full coverage.

Cheapest Car Insurance for 24-Year-Olds by State

Monthly rates for 24-year-olds range from $26 to $188, depending on your state. The table below shows the cheapest insurers for this age group in each state.

| Alabama | AIG | $53 | $187 |

| Arkansas | Farm Bureau | $65 | $151 |

| California | GEICO | $78 | $170 |

| Colorado | American National | $64 | $162 |

| Connecticut | GEICO | $120 | $263 |

| Delaware | GEICO | $153 | $294 |

| District of Columbia | Chubb | $68 | $263 |

| Hawaii | GEICO | $26 | $70 |

| Idaho | State Farm | $42 | $125 |

| Indiana | Indiana Farmers Insurance | $65 | $126 |

| Louisiana | Safeway Insurance | $188 | $320 |

| Maryland | State Farm | $138 | $267 |

| Michigan | GEICO | $69 | $125 |

| Nebraska | Farmers Mutual Ins Co of NE | $38 | $110 |

| Nevada | Country Financial | $121 | $202 |

| New Hampshire | MMG Insurance | $90 | $137 |

| New Jersey | GEICO | $98 | $216 |

| North Dakota | North Star Insurance | $50 | $126 |

| Ohio | GEICO | $63 | $118 |

| Oklahoma | American Farmers & Ranchers | $58 | $149 |

| Oregon | Country Financial | $63 | $130 |

| Pennsylvania | Travelers | $64 | $141 |

| Rhode Island | State Farm | $98 | $200 |

| South Carolina | Farm Bureau | $81 | $137 |

| South Dakota | Farmers Mutual Ins Co of NE | $27 | $92 |

| Tennessee | Travelers | $89 | $195 |

| Texas | GEICO | $96 | $204 |

| Vermont | Co-operative Insurance | $33 | $102 |

| Virginia | Farm Bureau | $67 | $123 |

| Washington | American Family | $109 | $188 |

| Wyoming | American National | $41 | $131 |

Cheapest Car Insurance for 24-Year-Olds by Gender

Due to an increased risk of accidents, 24-year-old male drivers are likely to pay higher insurance rates than their female counterparts. We highlight the most affordable insurance options available for both men and women in this age group.

California, Hawaii, Massachusetts, Michigan, North Carolina and Pennsylvania have state laws or regulations that prohibit or restrict insurers from using gender as a rating factor, so male and female drivers generally receive the same rates for the same risk profile.

Cheapest Car Insurance for 24-Year-Old Female Drivers

For 24-year-old female drivers, American National P&C stands out as the most budget-friendly car insurance provider nationwide, with an average rate of $660 for minimum coverage. Concord Group has the cheapest rate at $1,263 for full coverage policies.

Female drivers benefit from lower premiums than men.

| American National P&C | $55 | $660 |

| Concord Group | $59 | $707 |

| GEICO | $82 | $987 |

| Auto-Owners | $98 | $1,179 |

| State Farm | $101 | $1,207 |

| Travelers | $102 | $1,219 |

| Country Financial | $107 | $1,287 |

| AAA | $112 | $1,344 |

| American Family | $128 | $1,541 |

| Progressive | $132 | $1,590 |

Rates are for female drivers with clean driving records and good credit, insuring a 2012 Toyota Camry.

Cheapest Car Insurance for 24-Year-Old Male Drivers

American National P&C offers 24-year-old male drivers the lowest annual rate of $664. Concord Group offers the cheapest full coverage policy option at $1,386 per year.

Male drivers often face higher premiums than females because of their higher likelihood of accidents.

| American National P&C | $55 | $664 |

| Concord Group | $65 | $779 |

| GEICO | $78 | $932 |

| Auto-Owners | $95 | $1,142 |

| Travelers | $102 | $1,225 |

| State Farm | $108 | $1,300 |

| Country Financial | $110 | $1,322 |

| AAA | $118 | $1,420 |

| American Family | $129 | $1,547 |

| Progressive | $129 | $1,553 |

Rates are for male drivers with clean driving records and good credit, insuring a 2012 Toyota Camry.

Cheapest Cars to Insure for 24-Year-Olds

Adding a safe vehicle to your policy keeps insurance costs low for 24-year-old drivers. The table shows the most affordable models by vehicle type for this age group, including the cheapest cars to insure.

| Subaru Forester | Compact SUV | GEICO | $1,279 |

| Subaru Outback | Sedan | Nationwide | $1,368 |

| Toyota Tacoma | Pickup Truck | GEICO | $1,405 |

| Audi Q5 | Luxury SUV | GEICO | $1,413 |

| Honda Passport | SUV | GEICO | $1,486 |

| Toyota Corolla | Compact | GEICO | $1,507 |

| Ford Mustang Mach E | Sports Car | GEICO | $1,538 |

| Honda Odyssey | Minivan | State Farm | $1,560 |

| Tesla Model Y | Luxury Electric | GEICO | $1,564 |

| Nissan LEAF | Electric | GEICO | $1,566 |

| BMW 1 Series | Luxury Compact | GEICO | $1,611 |

| Porsche Taycan | Luxury Sports Car | GEICO | $1,626 |

| Mercedes GLA 250 | Luxury Compact SUV | GEICO | $1,713 |

| BMW 3 Series | Luxury Sedan | State Farm | $1,955 |

Rates are for drivers with clean driving records and good credit.

Cheap Car Insurance for 24-Year-Olds: Buying Guide

Car insurance rates vary between locations and companies. Comparing quotes from multiple providers prevents costly mistakes and helps you find budget-friendly coverage with adequate financial protection.

How Much Is Car Insurance for a 24-Year-Old?

The average cost of car insurance for 24-year-olds costs $940 for minimum coverage and $2,002 for full coverage on average. These estimates assume good credit and clean driving records. Your quote depends on your specific driving profile.

Average Car Insurance Cost for 24-Year-Olds by Coverage

The table below shows average car insurance costs for 24-year-old drivers by coverage level.

| Minimum Coverage | $78 | $940 |

| Full Coverage | $167 | $2,002 |

Average Cost of Car Insurance for 24-Year-Olds by State

Average car insurance costs for 24-year-old drivers differ by state. Price differences are shaped by factors like crime levels, climate and population density. Review average state rates and estimate costs in your region using the table below.

| Alabama | $136 | $1,634 |

| Alaska | $99 | $1,185 |

| Arizona | $162 | $1,947 |

| Arkansas | $138 | $1,657 |

| California | $113 | $1,353 |

| Colorado | $166 | $1,994 |

| Connecticut | $231 | $2,768 |

| Delaware | $257 | $3,078 |

| District of Columbia | $234 | $2,806 |

| Florida | $188 | $2,261 |

| Georgia | $219 | $2,625 |

| Hawaii | $36 | $437 |

| Idaho | $94 | $1,129 |

| Illinois | $135 | $1,626 |

| Indiana | $105 | $1,265 |

| Iowa | $87 | $1,045 |

| Kansas | $113 | $1,355 |

| Kentucky | $186 | $2,231 |

| Louisiana | $244 | $2,927 |

| Maine | $101 | $1,212 |

| Maryland | $228 | $2,731 |

| Massachusetts | $106 | $1,271 |

| Michigan | $136 | $1,632 |

| Minnesota | $101 | $1,212 |

| Mississippi | $155 | $1,854 |

| Missouri | $182 | $2,184 |

| Montana | $123 | $1,481 |

| Nebraska | $117 | $1,398 |

| Nevada | $197 | $2,362 |

| New Hampshire | $125 | $1,494 |

| New Jersey | $231 | $2,771 |

| New Mexico | $130 | $1,562 |

| New York | $114 | $1,374 |

| North Carolina | $101 | $1,216 |

| North Dakota | $111 | $1,328 |

| Ohio | $112 | $1,347 |

| Oklahoma | $147 | $1,766 |

| Oregon | $145 | $1,737 |

| Pennsylvania | $105 | $1,256 |

| Rhode Island | $212 | $2,550 |

| South Carolina | $151 | $1,811 |

| South Dakota | $89 | $1,066 |

| Tennessee | $124 | $1,484 |

| Texas | $159 | $1,903 |

| Utah | $174 | $2,085 |

| Vermont | $84 | $1,011 |

| Virginia | $143 | $1,710 |

| Washington | $128 | $1,539 |

| West Virginia | $148 | $1,778 |

| Wisconsin | $109 | $1,306 |

| Wyoming | $58 | $692 |

Obtaining quotes from multiple insurance companies is a good idea to see which comes out as the best and cheapest for your specific profile. You also want to ensure the company has optional coverages that are good for a teen driver or any driver to have on their policy. They include roadside assistance and rental car coverage.

— Mark Friedlander, Director, Corporate Communications, Insurance Information Institute

Why Car Insurance Is Expensive for 24-Year-Olds

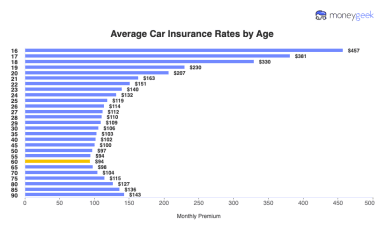

Car insurance for 24-year-olds costs more than coverage for older drivers, though premiums drop from teenage rates. Drivers aged 16 to 19, considered high-risk drivers, have more accidents and violations, with fatal crashes nearly three times as common compared to older drivers.

Speeding, distracted driving, nighttime driving and not wearing seat belts contribute to higher rates. These risks decrease as drivers gain experience.

When Does Car Insurance Get Cheaper?

Being 24 means you're one year away from major insurance savings. Most insurers drop rates when you turn 25, marking a milestone in car insurance pricing based on decades of data showing drivers become statistically safer after this age. The steepest price drops happen between ages 24 and 26, with rates decreasing gradually as you gain more driving experience.

You can increase savings before turning 25 by maintaining a clean driving record, improving your credit score and completing a defensive driving course. Some insurers review policies every six months, so you'll see benefits from these improvements quickly.

How to Get Cheap Car Insurance for 24-Year-Olds

Twenty-four-year-olds pay higher car insurance rates than older age groups. You and your family can reduce these costs with these strategies:

- 1Stay on a parent's policy

Staying on a parent's insurance policy lowers costs for 24-year-olds through the parent's coverage history and multi-car insurance discounts.

- 2Shop around as much as possible

Comparing quotes from multiple auto insurance providers reduces costs.

- 3Find discounts you qualify for

Twenty-four-year-olds qualify for several common car insurance discounts: good student discounts and reduced rates for completing driver education courses.

- 4Choose a safe, older car

Budget-friendly cars with high safety ratings reduce insurance premiums.

- 5Adjust your coverage amount

If you can afford to replace your car out of pocket, choose a liability-only auto insurance policy.

- 6Maintain good credit

Many insurers use credit scores when setting premiums.

Most insurers allow unmarried adult children to remain on family policies as long as they live in the same household. However, some companies extend this to college students living away from home.

Family policies cover all household members under one umbrella, often resulting in multi-car and multi-driver discounts that reduce overall costs. You'll need your own policy when you get married, buy a home or move to a different state permanently.

Car Insurance Discounts for 24-Year-Olds

Twenty-four-year-olds may qualify for multiple car insurance discounts that can stack together for substantial savings. Many drivers save 20 to 30% or more by layering multiple discounts together.

Maintain a 3.0 GPA or higher to qualify for savings of 10-25%. Many insurers extend this discount through age 25 for full-time students.

Your college or university may have partnerships with insurers offering ongoing savings to graduates. Check with your alma mater's alumni association for available programs.

Engineers, teachers, nurses and other professionals often qualify for group rates through their associations. Even recent graduates can access these discounts through professional memberships.

Complete an approved defensive driving course to reduce your premium, often by 5-15%. Many courses are available online and can be completed in a few hours.

Safe driving programs that monitor your habits can reduce premiums by up to 40%. These programs track factors like speed, braking and the time of day you drive.

Combine your auto with homeowners insurance or other policies to save on both coverages. The combined savings often exceed individual policy discounts.

You may be eligible for discounts by adding multiple cars to the same policy.

Maintaining a clean driving record over time can help lower car insurance rates.

Many insurers offer discounts for drivers who drive fewer miles annually.

Choosing electronic statements and payments can lower your total costs.

Cheapest Auto Insurance for 24-Year-Olds: Bottom Line

GEICO, Auto-Owners, Travelers, State Farm and Progressive offer competitive rates, but the best deal depends on your specific profile and discount eligibility.

Car Insurance for 24-Year-Olds: FAQ

Why is car insurance expensive for 24-year-old drivers?

Car insurance can be costly for 24-year-old drivers because they are still perceived as inexperienced and high-risk.

Is car insurance more expensive for 24-year-old males?

Yes, car insurance tends to cost more for 24-year-old males.

Can I get my own policy while living with my parents?

Yes, you can purchase your own car insurance policy while living with your parents.

How does getting married affect my rates?

Getting married lowers your insurance rates because insurers view married drivers as less likely to file claims.

What happens if I move to a different state?

You must update your car insurance when you move to a different state.

How often should I shop for new coverage?

Shop for new car insurance at least once per year, ideally when your policy renews. Your circumstances change frequently at 24; you might improve your credit score, move or qualify for new discounts.

Can I be removed from my parents' policy?

You can be removed from your parent's car insurance policy, but the process depends on your insurer's requirements. You'll need proof of your own coverage before being removed. Some insurers require written consent from the policyholder (your parents). Once removed, you can't easily be added back.

Best Car Insurance Rates for 24-Year-Olds: Our Methodology

We designed our research to help 24-year-olds find the balance between affordable premiums and solid financial protection.

Our Research Approach

We collected 4,284 price estimates from 100 different ZIP codes across all 50 states, focusing on six major auto insurance providers that offer competitive rates for younger drivers. Our data comes from each state's insurance department and Quadrant Information Services, which ensures accuracy across different markets and regulations.

Why This Approach Works for 24-Year-Olds

We built our analysis around practical considerations for people in their mid-twenties instead of using generic profiles. We factored in state-by-state variations because your location affects rates, and we focused on companies that compete for younger drivers rather than those that cater to families or seniors.

Sample Driver Profile

Our baseline 24-year-old driver profile includes:

- Toyota Camry LE

- Clean driving record (no accidents or violations)

- 12,000 miles annually

This profile reflects someone who's moved beyond the highest-risk teenage years but has yet to reach the lower-rate thresholds that come with age and experience.

Coverage Levels We Analyzed

Minimum Coverage: We used each state's required liability limits to find the cheapest legal coverage. While tempting for budget-conscious 24-year-olds, minimum coverage leaves you vulnerable to financial losses.

Full Coverage: We analyzed policies with 100/300/100 liability limits and $1,000 deductibles for comprehensive and collision coverage. This means:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $100,000 property damage liability per accident

These limits provide financial protection without the premium increase of maximum coverage.

Learn more about MoneyGeek's car insurance methodology.

Cheap Auto Insurance for 24-Year-Olds: Related Articles

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Centers for Disease Control and Prevention. "Teen Drivers and Passengers: Get the Facts." Accessed December 24, 2024.