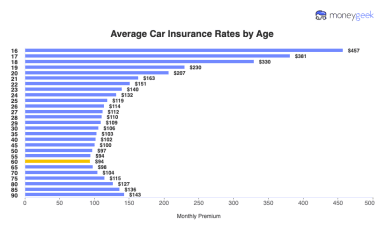

Car insurance rates generally fall as drivers gain experience and show safer driving behavior. For most people, premiums drop steadily between ages 16 and 24, with the largest decreases tied to a few key age milestones insurers use to reassess risk.

Rates tend to stabilize after the mid-20s. At that point, age matters less than your driving record, claims history, and coverage choices.