Drivers looking for full coverage will find GEICO offering the lowest rate at $90 monthly ($1,085 yearly), which is 35% or $584 cheaper than the state average. Progressive follows closely at $91 monthly ($1,095 yearly), saving you 34% or $572 annually. Choosing GEICO instead of Progressive gives you an extra $12 in yearly savings.

Cheapest Car Insurance in California

GEICO leads California with the cheapest full coverage at $90 monthly ($1,085 yearly) and lowest state minimum coverage at $39 monthly ($465 yearly).

Find low-cost California car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: GEICO, $90

Liability only: GEICO, $39

Teens: Wawanesa, $150

Young adults: CSAA, $52

Seniors: GEICO, $56

DUI: GEICO, $93

SR-22: CSAA, $69

Bad credit: GEICO, $60

Why You Can Trust MoneyGeek's Methodology

We analyzed car insurance rates from major insurers across all California ZIP codes for various driver profiles, including clean records, violations and age groups. Rates show averages for a 40-year-old driver with good credit and a clean record unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in California

| Geico | $90 | $1,085 | 35% |

| Progressive | $91 | $1,095 | 34% |

| State Farm | $107 | $1,286 | 23% |

| AAA | $119 | $1,423 | 15% |

| Wawanesa Insurance | $130 | $1,561 | 6% |

Should you opt for cheaper minimum coverage or full coverage in California? Though state minimum liability car insurance is cheaper, it won't protect your car. Full coverage gives you collision coverage, protecting your car from an at-fault accident and comprehensive, which covers you from theft, weather damange or vandalism.

Cheapest Minimum Coverage Car Insurance in California

GEICO leads the market for drivers who need the cheapest liability-only rates. GEICO offers minimum coverage at $39 monthly ($465 yearly), saving you 40% or $310 annually compared to the state average. State Farm is the second-lowest at $46 monthly ($556 yearly), saving you 28% or $219 annually. Choosing GEICO saves you $91 yearly compared to State Farm.

For drivers facing higher insurance costs on a limited budget, comparing minimum coverage rates with cheapest car insurance for drivers with low income in California can help surface consistently lower-priced insurers.

| Geico | $39 | $465 | 40% |

| State Farm | $46 | $556 | 28% |

| Progressive | $48 | $579 | 25% |

| AAA | $55 | $655 | 15% |

| Farmers | $58 | $698 | 10% |

Cheapest Car Insurance in California by City

GEICO is the cheapest carrier in all of California’s 20 largest cities, saving you up to 43% or $308 annually compared to city averages. San Jose has the lowest minimum coverage at $36 monthly with GEICO, while Los Angeles costs $58 monthly. That $264 yearly difference shows how much your city can affect your rate in California.

| Anaheim | Geico | $48 | $107 | 35% |

| Bakersfield | Geico | $38 | $89 | 42% |

| Berkeley | Geico | $35 | $83 | 45% |

| Burbank | Geico | $65 | $140 | 36% |

| Chula Vista | Geico | $34 | $79 | 43% |

| Fontana | Geico | $51 | $113 | 37% |

| Fremont | Geico | $40 | $92 | 39% |

| Fresno | Geico | $38 | $90 | 38% |

| Fullerton | Geico | $49 | $107 | 38% |

| Glendale | Geico | $71 | $161 | 33% |

| Irvine | Geico | $40 | $92 | 41% |

| Long Beach | Geico | $47 | $107 | 35% |

| Los Angeles | Geico | $58 | $136 | 34% |

| Modesto | Geico | $42 | $96 | 38% |

| Oakland | Geico | $41 | $98 | 41% |

| Ontario | Geico | $51 | $114 | 34% |

| Orange | Geico | $42 | $95 | 38% |

| Oxnard | Geico | $46 | $102 | 36% |

| Palmdale | Geico | $52 | $116 | 39% |

| Pasadena | Geico | $47 | $105 | 42% |

| Riverside | Geico | $43 | $99 | 39% |

| Roseville | AAA | $44 | $98 | 40% |

| Sacramento | Geico | $41 | $95 | 41% |

| San Bernardino | Geico | $45 | $105 | 37% |

| San Diego | Geico | $37 | $87 | 40% |

| San Francisco | Geico | $38 | $88 | 45% |

| San Jose | Geico | $36 | $85 | 42% |

| San Mateo | Geico | $43 | $97 | 37% |

| Santa Ana | Geico | $44 | $102 | 41% |

| Santa Clara | AAA | $36 | $86 | 43% |

| Santa Clarita | Geico | $40 | $94 | 39% |

| Santa Rosa | Geico | $37 | $88 | 40% |

| Stockton | Geico | $42 | $98 | 38% |

| Sunnyvale | Geico | $37 | $86 | 41% |

| Temecula | Geico | $45 | $103 | 37% |

| Ventura | Geico | $53 | $109 | 35% |

Cheapest Car Insurance in California for Teens and Young Adults

For teen drivers, Wawanesa offers the lowest rates at $177 monthly for 16-year-olds, which is 36% or $1,195 below the state average. They also have the cheapest prices for 17- and 18-year-olds. At age 19, GEICO becomes the most affordable option at $111 monthly, saving you 32% or $531 each year.

Rates improve as young adults get older, and by age 25, CSAA offers $52 monthly for minimum coverage and $137 for full coverage. Teens can save more by staying on their families’ policy, maintaining a clean driving record, and qualifying for good student discounts.

Cheapest Car Insurance for Seniors in California

Senior drivers often get the best rates from GEICO. At age 70, minimum coverage runs $56 monthly and full coverage costs $121, saving you 33% or $331 to $615 a year compared to the state average.

By age 80, GEICO charges $60 for minimum coverage and $129 for full coverage, giving you 40% or $480 to $720 in yearly savings. Most seniors also qualify for extra discounts, which can lower costs even more. If you drive less, reducing your mileage estimate may help you save up to another 30% in California.

| 70 | GEICO | $56 | $121 | 33% |

| 80 | GEICO | $60 | $129 | 40% |

Cheapest DUI Insurance in California

Drivers with a DUI will find GEICO offering the lowest minimum coverage at $93 monthly, which is 40% or $744 cheaper than the state average. Progressive follows at $112 monthly, saving you 33% or $600 annually.

Choosing GEICO instead of Progressive gives you an extra $228 in yearly savings for minimum coverage. For full coverage after a DUI, GEICO remains the most affordable at $212 monthly. Going with GEICO over Progressive saves you $1,140 each year for full coverage.

| Geico | $93 | $212 | 40% |

| Progressive | $112 | $228 | 33% |

| Mercury Insurance | $115 | $240 | 30% |

| Wawanesa Insurance | $146 | $287 | 15% |

| Auto Owners | $130 | $311 | 14% |

Cheapest SR-22 Insurance in California

For drivers who need the cheapest SR-22 insurance for minimum coverage, CSAA is the most affordable at $69 monthly, saving you 41% or $575 annually compared to the state average. GEICO comes in second at $74 monthly, saving you 41% or $516 annually compared to the state average.

You'll save $60 yearly by choosing CSAA over GEICO for minimum coverage. For SR-22 full coverage, GEICO offers the best rate at $164 monthly, saving you $60 yearly versus CSAA at $169 monthly.

| GEICO | $74 | $164 | 41% |

| CSAA | $69 | $169 | 41% |

| Progressive | $104 | $199 | 25% |

| Mercury | $125 | $241 | 10% |

| Wawanesa Insurance | $140 | $251 | 4% |

Cheapest Car Insurance After an Accident in California

After an accident, GEICO offers the lowest minimum coverage rate at $69 monthly, which is 35% or $446 cheaper than the state average. Progressive follows at $82 monthly, saving you 29% or $361 compared to the average.

Choosing GEICO instead of Progressive gives you an extra $156 in yearly savings for minimum coverage.For full coverage, GEICO is still the most affordable at $152 monthly. In California, rates often rise 20% to 40% after an at-fault accident.

| Geico | $69 | $152 | 35% |

| Progressive | $82 | $159 | 29% |

| State Farm | $87 | $192 | 18% |

| AAA | $94 | $192 | 16% |

| Auto Owners | $87 | $203 | 14% |

Cheapest Car Insurance With a Speeding Ticket

GEICO offers the most affordable minimum coverage with a speeding ticket at $58 monthly ($696 yearly). For comprehensive and collision protection, GEICO remains the most affordable option, with a monthly rate of $133. Progressive is the next cheapest at $147 per month.

| Geico | $58 | $133 | 39% |

| Progressive | $74 | $147 | 29% |

| Auto Owners | $83 | $200 | 10% |

| State Farm | $84 | $185 | 14% |

| AAA | $84 | $176 | 17% |

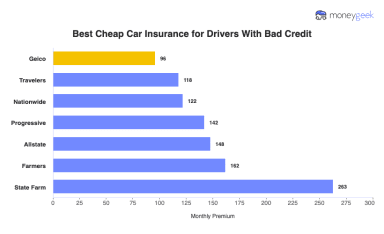

Cheapest Bad Credit Car Insurance in California

California prohibits credit-based insurance pricing, so bad credit doesn't increase your rates. GEICO is the cheapest at $60 monthly for minimum coverage, saving you 44% or $566 annually compared to the state average.

Progressive comes in second at $76 monthly, saving you 36% or $461 annually compared to the state average. You'll save $192 yearly by choosing GEICO over Progressive.

| Geico | $60 | $140 | 44% |

| Progressive | $76 | $152 | 36% |

| Allstate | $102 | $185 | 19% |

| Mercury Insurance | $103 | $215 | 11% |

How to Get the Cheapest Car Insurance in California

Your location, driving history, age and credit score directly impact car insurance costs in California. You can save hundreds of dollars annually through smart shopping and comparing insurers. Here are the strategies to use to lower your rates in California:

- 1Shop by California City, Not Just by Carrier

Compare quotes from three to five providers, including both national and regional carriers. Regional providers, such as Wawanesa, often offer lower rates in specific California metropolitan areas.

Use MoneyGeek's auto insurance calculator for a customized estimate of the cheapest car insurance based on your location and driver profile. The tool is free, requires no personal information, and we won't send you spam.

- 2Compare Regional Carriers

Wawanesa and CSAA beat national carriers in specific California metros. Always get quotes from regional providers alongside GEICO and Progressive.

- 3Maximize Discounts and bundles

Maximize your savings by bundling home and auto policies in California for 5% to 25% savings and apply multi-car discounts for 10% to 25% off. Additional discounts include, defensive driver programs that benefit seniors the most, paying in full, and qualifying for low-mileage discounts of 15% to 30%.

- 4Raise Your Deductible and Adjust Coverage

Increasing your deductible from $500 to $1,000 usually lowers your premium by about 10% to 15%. Higher deductibles reduce your monthly payments, but you’ll pay more out of pocket if you file a claim.

If you drive an older vehicle, consider lowering certain coverage types, while newer cars may benefit from higher liability limits. Review your situation and decide how much car insurance you need based on your budget and risk level.

- 5Shop After Life Changes

Most consumer in California can save money by switching carriers frequently. A good time to compare is after life changes like a move, marriage, or when adding a new teen driver.

Cheap Car Insurance in California: FAQ

Car insurance in California can feel overwhelming, so our experts put together answers to the questions drivers ask most.

How much does car insurance cost in California?

Minimum coverage in California car insurance costs usually ranges from $39 to $58 per month, based on rates from providers such as GEICO, State Farm and Progressive. Full coverage generally falls between $85 and $136 monthly, depending on your driving record, location, and chosen insurer.

Urban areas like Los Angeles and San Francisco tend to have higher prices than smaller cities, so comparing quotes helps you find a rate that fits your budget.

Should you buy the cheapest car insurance in California?

The cheapest coverage might not provide enough protection in a serious accident. It’s better to compare rates and choose an affordable option that still offers the level of coverage you need. Most drivers will benefit from full coverage to protect their car.

What is the lowest amount of coverage in California?

California requires minimum liability coverage of $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

Is California a no-fault state?

California uses an at-fault system, not a no-fault system. When an accident occurs, the driver responsible for causing it must pay for damages and injuries through their liability insurance.

Does California allow gender-based insurance pricing?

California prohibits insurers from using gender as a rating factor when setting car insurance premiums. Male and female drivers with similar driving records, coverage levels, and other characteristics pay identical rates. However, some California insurers voluntarily choose not to use gender as a rating factor.

Most Affordable Car Insurance in California: Related Articles

How We Found the Most Affordable Car Insurance in California

Our Research Approach

California's insurance landscape operates under unique constraints. The state prohibits insurers from using credit scores or gender in pricing, restrictions that shift rating emphasis to your driving record and ZIP code. Geographic location drives dramatic rate variations here, with urban drivers in Los Angeles and San Francisco often paying double what rural residents pay for identical coverage.

We gathered auto insurance data from the California Department of Insurance and Quadrant Information Services, analyzing quotes from 12 major insurers and reviewing more than 200 million rate comparisons across every residential ZIP code in California.

Sample Driver Profile

Our baseline rates use a 40-year-old driver with a clean driving record. No accidents, tickets, or coverage lapses. This profile represents typical California drivers without violations that trigger surcharges. You'll see base rates here. Your personal quote will adjust based on your specific driving history and location.

Coverage Levels We Compared

We analyzed two coverage scenarios:

Minimum coverage: California's required liability limits of $15,000 per person for bodily injury, $30,000 per accident for bodily injury and $5,000 per accident for property damage (15/30/5). This meets legal requirements but leaves you financially exposed in serious accidents.

Full coverage: Liability limits of $100,000/$300,000/$100,000 plus comprehensive and collision coverage with a $1,000 deductible. You're covered for damage you cause to others and repairs to your own vehicle.

Location Affects Your Rate

California rates swing wildly by region. Your neighbor in the next city might pay less for the same coverage. Our ZIP code analysis reveals where drivers overpay because of geography, a critical factor in a state where urban theft rates, accident frequency and repair costs create massive pricing disparities between coastal metros and inland communities.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.