Here are fast answers to frequently asked questions about cleaning business insurance:

Best Cleaning Business Insurance

Get the best cleaning business insurance to cover costs from damage and injuries on the job from ERGO NEXT, The Hartford and Thimble (from $46 per month).

Get matched to your best cleaning business insurer and get a COI in minutes.

Updated: February 9, 2026

Advertising & Editorial Disclosure

Cleaning Business Insurance: Fast Answers

Who offers the best cleaning business insurance overall?

ERGO NEXT is the best overall business insurance option for cleaning companies, earning a MoneyGeek score of 4.61 out of 5. The Hartford follows closely with a score of 4.60, delivering excellent affordability, customer service and comprehensive coverage options.

Who has the cheapest business insurance for cleaning firms?

Here are the cheapest commercial insurance companies for cleaning businesses by coverage type and their yearly rates:

- General Liability: Thimble at $1,006

- Workers' Comp: ERGO NEXT at $548

- Professional Liability: The Hartford at $585

- Business Owner's Policy (BOP) Insurance: The Hartford at $1,698

What is cleaning business insurance and what does it cover?

Cleaning business insurance is a specialized business insurance policy that protects cleaning companies from financial losses due to accidents, injuries, property damage and lawsuits during cleaning operations. Cleaning professionals need this coverage because they work in clients' properties, handle chemicals and use equipment that can cause injuries or damage.

What business insurance is needed for cleaning companies?

Most cleaning businesses need general liability insurance to cover property damage and injuries, and workers' compensation insurance if they have employees (required by law in most states). Commercial auto insurance is also required if using vehicles for business purposes.

What is the best type of business insurance coverage for cleaners?

General liability insurance is the most important coverage for cleaning firms because clients often require proof of it before hiring you, and it financially protects against the most common risks in the industry. It covers property damage, bodily injuries and legal fees.

How much does cleaning business insurance cost?

Monthly cleaning business insurance costs average $106 for the four most popular coverages. This pricing varies widely based on business size and location, coverage type and cleaning services you provide.

Learn more about cleaner business insurance costs for your industry with our resources below:

How can I lower cleaning business insurance costs?

The following methods lower the commercial insurance costs of cleaning businesses:

- Pay annually instead of monthly.

- Choose a higher deductible.

- Bundle policies with the same company.

- Implement safety programs and training for proper chemical handling.

- Screen and background check potential employees to avoid professional liability risksm

- Document all commercial operations, before and after.

- Specialize your services to avoid higher premiums due to a more general business classification.

- Join industry associations for discounts.

- Use green or non-toxic cleaning products to avoid potential liability claims.

Get Matched to the Best Cleaning Business Insurer

Select your industry and state to get a customized insurance quote for your cleaning business.

Best Business Insurance Providers for Cleaning Companies

ERGO NEXT is our top pick for cleaning businesses due to its unique coverage matching services, highly rated digital experience and low pricing. Consider other providers, including The Hartford, Thimble, Simply Business and Nationwide.

| ERGO NEXT | 4.61 | $89 |

| The Hartford | 4.60 | $85 |

| Thimble | 4.50 | $62 |

| Simply Business | 4.50 | $93 |

| Nationwide | 4.50 | $106 |

| Coverdash | 4.40 | $110 |

| Progressive Commercial | 4.30 | $114 |

| Chubb | 4.30 | $131 |

| biBERK | 4.30 | $130 |

| Hiscox | 4.10 | $154 |

How We Decided the Best Cleaning Insurance Companies

*We scored all companies based on a cleaning business with two employees across professional liability, general liability, workers' comp and BOP policies for affordability, customer service and coverage options specific to the industry. Learn more in our business insurance methodology.

To find the right coverage for your cleaning business, check these resources:

Best Cleaning Business Insurance Providers by Specific Industry

The Hartford is the best small business insurance provider at the more specific cleaning industry level, offering strong coverage for junk removal, pressure washing and window cleaning services. If you run a commercial janitorial business, ERGO NEXT is the better option.

| Janitorial | ERGO NEXT | $93 |

| Junk Removal | The Hartford | $125 |

| Pressure Washing | The Hartford | $561 |

| Window Cleaning | The Hartford | $140 |

Best Cleaning Business Insurer Reviews

Here are in-depth reviews of our best cleaning business insurance picks and how they fit your company.

1. ERGO NEXT: Best Overall Business Insurer for Cleaners

Best customer service experience ratings from customers

Great coverage selection and matching experience

Very affordable overall for cleaners

Lower financial stability ratings

Less affordable for cleaning general liability insurance

For cleaning businesses, ERGO NEXT provides the best commercial insurance experience with the highest-rated digital experience among the top 10 largest business insurers in our customer survey. Its coverage matching software recommends coverage types and limit amounts tailored to your company's details. It also has the most affordable workers' comp policies for cleaners and ranks within the top three most affordable providers for general liability, professional liability and BOP insurance.

2. The Hartford: Best Cleaning BOP and Professional Liability Insurance

Lowest professional liability insurance rates

Extensive experience with over 200 years in the industry

Highest financial stability ratings

Less affordable for workers' comp policies

Backed by over 200 years of experience, The Hartford earns our second-best spot for cleaning business insurance. The Hartford offers the industry's most affordable professional liability and business owner’s (BOP) insurance policies, with an average monthly rate of $49 and $142, respectively.

The Hartford offers tailored options for house cleaning services, office and janitorial cleaning, maid services, carpet cleaners and commercial cleaning operations. You can trust its service since our customer survey found that businesses ranked first for agent service and claims process.

3. Thimble: Cheapest Insurance for Cleaner Businesses

Lowest rates overall

Good financial stability ratings

Most flexible coverage terms

Lowest customer service rating in our study

Online or app-only customer support with no phone representatives

Fewer coverage options than other insurers

Thimble offers the lowest rates for small businesses in the cleaning industry. It also offers the lowest rates for general liability insurance, saving you $18 per month compared with the next cheapest provider. It's great if you want only temporary coverage while on a job, since you can get policies for as little as an hour.

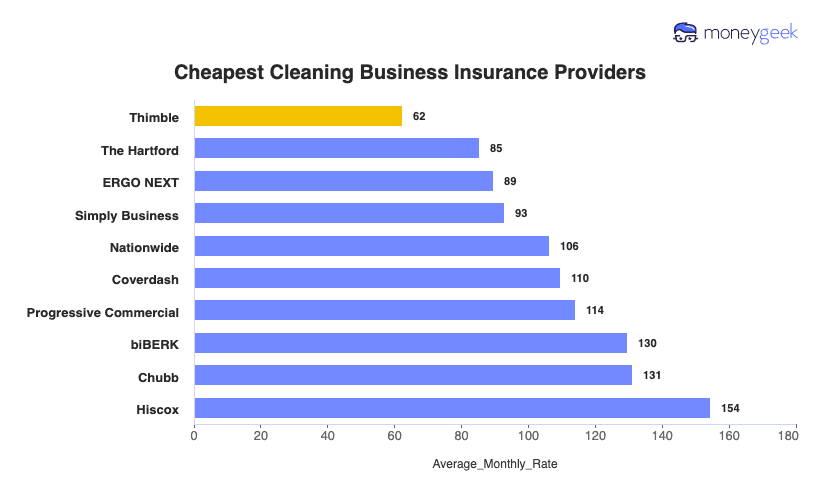

Cheapest Business Insurance Providers for Cleaning Firms

Thimble is the cheapest business insurance provider for cleaners, averaging $62 per month or $750 per year. Here are the cheapest insurance companies for cleaning businesses by coverage type:

- Cheapest for General Liability: Thimble at $84 per month or $1,006 per year

- Cheapest for Workers' Comp: ERGO NEXT at $46 per month or $548 per year

- Cheapest for Professional Liability: The Hartford at $49 per month or $585 per year

- Cheapest for BOP Insurance: The Hartford at $142 per month or $1,698 per year

| Thimble | $62 | $750 |

| The Hartford | $85 | $1,024 |

| ERGO NEXT | $89 | $1,074 |

| Simply Business | $93 | $1,114 |

| Nationwide | $106 | $1,274 |

| Coverdash | $110 | $1,316 |

| Progressive Commercial | $114 | $1,370 |

| biBERK | $130 | $1,556 |

| Chubb | $131 | $1,573 |

| Hiscox | $154 | $1,852 |

Cheapest Business Insurance for Cleaners by Specific Industry

The cheapest provider varies by cleaning specialty. The Hartford is the most affordable for window cleaners and junk removal companies. For those in the commercial janitorial business, Coverdash is the most affordable provider at $108 per month and pressure washing firms can find the lowest rates with Thimble at an average of $312 per month.

| Janitorial | Coverdash | $108 | $1,301 |

| Junk Removal | The Hartford | $125 | $1,494 |

| Pressure Washing | Thimble | $312 | $3,747 |

| Window Cleaning | The Hartford | $140 | $1,679 |

What Type of Insurance Is Best for a Cleaning Company?

A business owner's policy (BOP) works best for most cleaning companies. It bundles general liability and tools and equipment insurance to cover customer property damage, injuries and equipment losses. Property damage from accidents and slip-and-fall injuries is common in this industry and often costs tens of thousands of dollars in expenses and legal fees.

Most cleaning businesses need more than just BOP insurance to satisfy cleaning insurance requirements and prevent bankruptcy. Here's what business insurance coverage you'll likely need:

How to Get the Best Cheap Business Insurance for Your Cleaning Company

Follow these steps to get the best and cheapest business insurance for your cleaning company.

- 1Decide on Cleaning Coverage Needs Before Buying

Consider common claims risks specific to cleaning firms, including slip-and-fall accidents, client property damage, chemical burns or injuries, water damage, lost or stolen client property and employee injuries from lifting or repetitive motion. Talk with other cleaning business owners about their experiences and consult with insurance agents for a second opinion on your needs.

Ask yourself and agents questions specific to your business, like the following, to understand coverage needs:

- Does my general liability policy cover damage to a client's valuables (e.g., jewelry, electronics, artwork, antiques)?

- Are my cleaners covered while they drive between jobs? (Ask about "auto liability" or "hired and non-owned auto" coverage for employees using personal vehicles)

- Does my policy cover theft claims if a client accuses my staff of stealing?

- If I hire subcontractors, should I name them or have them carry their own liability insurance?

- Am I covered for chemical damage (discoloration, staining, fumes) caused by cleaning products?

- Does my policy include key coverage if client keys are lost or stolen?

- Is there coverage for employee dishonesty and background check requirements?

- What happens if my equipment (vacuums, buffers, carpet cleaners) damages a client's property?

- 2Research Cleaning Company Insurance Costs

Know what you should expect to pay before you start shopping. Look up typical business insurance costs for cleaning companies of your size (residential vs. commercial, number of employees, annual revenue). Research which companies offer the lowest rates for your specific cleaner company type. This homework gives you negotiating power and helps you spot a good deal when you see one.

- 3Look Into Company Reputations and Coverage Options Specific To Cleaners

Check what real customers say about each insurer, especially regarding cleaning firms. Read reviews on sites like Trustpilot and Google, or browse Reddit threads where cleaning business owners share their claims experience.

Ask the following to identify whether a company is right for your cleaning business:

- How quickly do they process claims for property damage?

- Do they have experience with cleaning-specific claims (broken items, chemical damage)?

- Are there complaints about denied claims for common cleaning incidents?

Before comparing quotes, check each company's coverage options to match your needs. Look for these cleaning-specific options:

- Blanket additional insured endorsement so you can add clients without filing individual certificates

- Employee theft and dishonesty coverage

- Tools and equipment coverage for vacuums, buffers and pressure washers

- Pollution liability if you spill chemicals or dispose of them improperly

- Cyber liability coverage when you store client payment details or access codes

- 4Compare Multiple Quotes Through Different Means

Get business insurance quotes from at least three companies specializing in cleaning businesses and use different methods to get the best deal. Go to the following types of providers for the best deal:

- Independent insurance agents who work with multiple carriers and understand cleaning industry risks

- Online comparison tools like Insureon, CoverWallet or Hiscox for quick quotes

- Direct carrier websites such as The Hartford, Nationwide or Progressive Commercial

- Industry associations like ISSA (International Sanitary Supply Association) or ARCSI (Association of Residential Cleaning Services International) may offer group rates

Independent agents can find prices not listed on company websites. Comparison tools work well for speed. Calling insurers directly often gets you better discounts or custom packages.

- 5Take Advantage of Business Insurance Discounts

Ask about discounts when you get quotes. Cleaning businesses can save money through GPS fleet tracking, written safety programs, OSHA compliance training and employee janitorial bonds. Bundling and paying annually and stacking these discounts can save you up to 40%.

- 6Reassess Your Cleaning Insurance Coverage Annually

Your cleaning business situation will change, affecting your rates and coverage needs. Growing your client base, adding services like carpet or window cleaning or purchasing specialized equipment may require different protection levels. Schedule an annual insurance review before your renewal date.

Best Insurance for Cleaning Business: Bottom Line

ERGO NEXT is the best insurer for cleaning business insurance, while Thimble offers the cheapest option overall. Also, gather quotes from The Hartford, Simply Business and Nationwide. For the best deal, talk with agents and other cleaning business owners, research costs and companies and compare multiple quotes.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 25, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 25, 2026.

- Trustpilot. "Thimble." Accessed February 25, 2026.