ERGO NEXT leads Michigan small business insurance with the highest customer service score and ranks second for coverage breadth. ERGO NEXT's rates rank fourth for affordability among major providers. The Hartford and Simply Business provide strong alternatives. The Hartford offers Michigan's lowest rates, and Simply Business provides the broadest coverage options.

Best Small Business Insurance in Michigan

Michigan's top business insurers are ERGO NEXT, The Hartford and Simply Business, offering coverage starting at just $6 monthly.

Get matched to the best Michigan commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT leads Michigan's best small business insurance with first-place customer service and second-place coverage rankings.

The Hartford offers the cheapest small business insurance in Michigan at $79 monthly ($951 annually).

Compare quotes across general liability, workers' comp and BOP to find small business insurance coverage that fits your budget.

Get Matched to the Best Small Business Insurance Providers in Michigan

Select your industry and state to get a customized quote for your Michigan business.

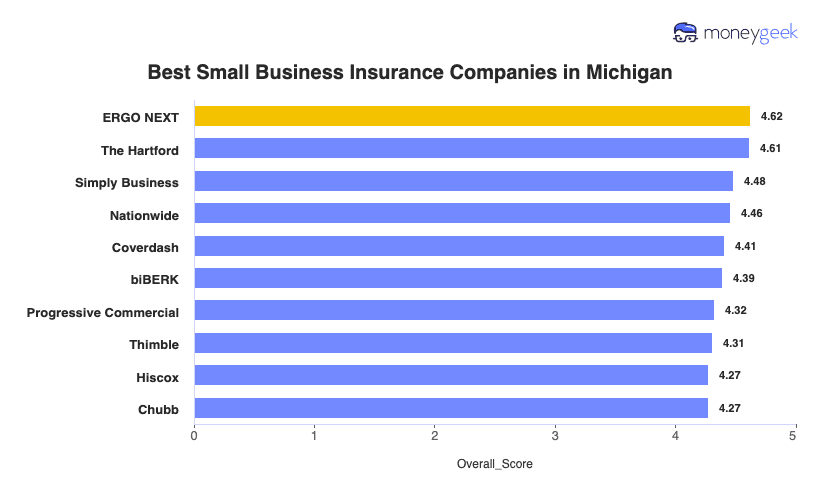

Best Small Business Insurance Companies in Michigan

| ERGO NEXT | 4.62 | $95 | 1 | 2 |

| The Hartford | 4.61 | $79 | 2 | 3 |

| Simply Business | 4.48 | $92 | 5 | 1 |

| Nationwide | 4.46 | $96 | 2 | 4 |

| Coverdash | 4.41 | $95 | 6 | 2 |

| biBERK | 4.39 | $99 | 2 | 5 |

| Progressive Commercial | 4.32 | $94 | 7 | 5 |

| Thimble | 4.31 | $89 | 8 | 5 |

| Hiscox | 4.27 | $102 | 4 | 6 |

| Chubb | 4.27 | $111 | 3 | 4 |

*These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Find the best or cheapest business insurer in Michigan for your coverage type below:

Best Michigan Business Insurance

Average Monthly Cost of General Liability Insurance

$98This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$65This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first for customer service with 24/7 digital support

Provides broad coverage options

Quick online quote process

consLower financial stability ratings

Few physical offices

ERGO NEXT ranks first in Michigan for business insurance with an overall score of 4.62 out of 5, averaging $95 monthly across four essential coverage types. ERGO NEXT ranks first nationally for digital experience with 24/7 platform access and same-day coverage. Michigan businesses that prefer instant quotes and online policy management over in-person agent meetings will find ERGO NEXT's digital-first approach matches their needs.

ERGO NEXT's $95 monthly average ($1,137 annually) beats competitors on workers' compensation and professional liability with the state's lowest and second-lowest rates. General liability costs $98 monthly (matching Michigan's average) while ERGO NEXT's business owner's policy runs $148 monthly, above the state's $140 average and ranking eighth among competitors.

ERGO NEXT leads Michigan providers with a 4.45 customer experience score, ranking first nationally for digital experience with 24/7 certificate generation through its mobile app. ERGO NEXT's claims processing score ranks fourth. You'll get faster resolutions for complex claims from competitors with stronger claims departments.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides $1 million aggregate limits that meet most contract and lease requirements, with policies covering Michigan's trade and field-based businesses including contractors, consultants and service providers. ERGO NEXT's digital platform offers instant policy customization and same-day coverage for straightforward needs. Businesses with complex coverage decisions get better guidance from providers with direct agent consultation.

Cheapest Michigan Business Insurance

Average Monthly Cost of General Liability Insurance

$77This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$65This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks first for affordability and financial stability

Ranks second for customer service

consRanks third for coverage options

Slower online quote process

The Hartford ranks second in Michigan with a 4.61 overall score. The Hartford offers the state's lowest rates at $79 monthly and holds an A+ AM Best financial stability rating. Established in 1810, The Hartford provides top-ranked claims processing and customer service. Michigan businesses who prioritize proven reliability and cost savings over cutting-edge digital tools will find The Hartford's traditional strengths match their needs.

The Hartford leads Michigan in affordability at $79 monthly ($951 annually) with the state's lowest rates across three major coverage types: business owner's policies at $107 monthly (vs. $140 state average), general liability at $77 monthly (vs. $98 average) and professional liability at $67 monthly (vs. $73 average). Workers' compensation costs $65 monthly, ranking second statewide and nearly matching Michigan's $70 average.

The Hartford ranks second nationally for customer experience and earns first place for both claims processing and customer service. You'll get faster claim resolutions and responsive support when problems arise. The Hartford's digital experience ranks tenth. Business owners who prefer managing policies primarily through mobile apps will find competitors' online tools more intuitive.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides financial protection against employee lawsuits through employment practices liability coverage and covers businesses operating across state lines with international policies. The Hartford ranks third for coverage breadth in Michigan. The Hartford's general liability, workers' compensation and business owner's policies cover the state's contractors, field service teams and professional services firms. Specialized industries should verify coverage availability before purchasing.

Best Commercial Coverage Options in Michigan

Average Monthly Cost of General Liability Insurance

$91This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$67This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Online marketplace model for easy comparison of multiple insurance quotes

Provides specialized coverage options for over 1,000 business types

consRanks fifth for customer service

Mid-range financial stability ranking

Simply Business ranks third in Michigan, operating as a digital marketplace that compares quotes from over 20 carriers to find competitive rates averaging $92 monthly. The platform matches businesses to specialized coverage from multiple insurers. Michigan businesses that want to compare options from several providers in one place rather than contacting each company separately will find Simply Business's marketplace model fits their needs.

Simply Business averages $92 monthly ($1,099 annually) with strong pricing on general liability at $91 monthly, saving you $7 compared to Michigan's $98 average (ranking second statewide). Business owner's policies cost $136 monthly (vs. $140 state average), while professional liability runs $73 monthly and workers' compensation costs $67 monthly, both closely matching state averages and ranking competitively among Michigan providers.

Simply Business ranks seventh nationally with a strong third-place digital experience for efficient online quote comparisons and straightforward policy management. Simply Business's claims processing ranks eighth. You'll get slower resolutions when working through a broker rather than directly with the carrier handling your claim.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business leads Michigan in coverage breadth, partnering with major carriers like Travelers and CNA to offer general liability, professional liability, workers' compensation and business owner's policies for over 1,000 business types. Its marketplace covers Michigan's contractors, consultants, service businesses and emerging sectors like e-commerce, giving you access to specialized coverage options that single-carrier platforms don't provide.

How to Get the Best Cheap Small Business Insurance in Michigan

Michigan's one-employee workers' disability compensation threshold, January 2024 winter storms that closed businesses and clients demanding certificates before signing contracts hit small business owners simultaneously. Business insurance covers your real financial risks, not just state requirements.

- 1

Know What Michigan Law Requires vs. What Your Contracts Demand

Michigan law mandates workers' disability compensation from your first employee and 50/100/10 commercial auto liability for work vehicles. Michigan law doesn't require general liability or professional liability, but landlords demand certificates before leasing space and clients refuse contracts without proof of coverage.

- 2

Address Risks Unique to Your Michigan Operation

Michigan's 250 miles of high-risk Great Lakes shoreline erode one foot yearly, requiring flood coverage that standard commercial property policies exclude. This coverage matters for Muskegon to Port Huron businesses. January 2024's storm dropped four to eight inches with thundersnow across Detroit Metro, closing businesses. Business interruption coverage would've covered these losses. Equipment breakdown insurance protects against losses when subzero Michigan winters cause pipe freezes and heating system failures that standard policies don't cover.

- 3

Compare Standard Carriers Against Michigan's Assigned Risk Options

ERGO NEXT, The Hartford and Simply Business offer competitive Michigan rates for standard operations. If carriers reject you due to claims history, Michigan's NCCI workers' compensation assigned risk pool provides mandatory coverage at 50% to 100% premium increases over standard markets. Exhaust traditional carriers first since assigned risk premiums stay elevated and you can't switch mid-policy once placed.

- 4

Prioritize Fast Claims Processing Over Saving $15 Monthly

January 2024's winter storm closed Michigan businesses statewide, revealing which carriers deployed adjusters within days versus weeks. Waiting three weeks for business interruption approval while losing daily revenue costs more than the monthly premium savings. Ask carriers how many Michigan-based adjusters they maintain and their typical resolution timeframe. Local presence determines whether you're paid quickly when storms close operations.

- 5

Cut Premiums Across Your Multiple Policies

Bundle general liability with commercial property in a business owner's policy to cut combined premiums 20% to 30%, and pay annually instead of monthly to avoid $150 to 200 in installment fees. Michigan's workers' comp mandate and required commercial auto coverage mean you're managing multiple policies, so stack bundling discounts with annual payment and claim-free credits to offset total costs.

- 6

Update Coverage at Business Growth Milestones

Michigan's one-employee threshold triggers mandatory workers' disability compensation from your first hire, earlier than most states. Your first work truck requires commercial auto insurance. Larger contracts demand $1 million per occurrence and $2 million aggregate limits. Review your business insurance coverage before hitting growth triggers, like adding employees, buying vehicles and landing bigger contracts, not after gaps expose you.

Best Business Liability Insurance Michigan: Bottom Line

The Hartford leads Michigan small business insurance for affordability at $79 monthly, while ERGO NEXT ranks first for customer service and second for coverage breadth. Compare quotes across general liability, workers' comp and BOP from both carriers, assess your risks and stack discounts to find coverage that protects your operation at the right price.

Business Insurance Michigan: FAQ

Small business owners in Michigan often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need for my Michigan business, and what's actually required?

Michigan law mandates workers' disability compensation from your first employee and 50/100/10 commercial auto liability for work vehicles. Landlords demand general liability certificates before leasing space, and clients require professional liability proof before contracts. Review your lease agreements and client contracts to identify which coverages you need beyond state minimums.

How much does small business insurance cost in Michigan per month?

Coverage costs for your Michigan business depend on your industry, but these are the monthly and annual averages by coverage type:

- General liability: $98 monthly ($1,176 annually)

- Workers' compensation: $70 monthly ($835 annually)

- Professional liability (E&O): $73 monthly ($880 annually)

- Business owner's policy (BOP): $140 monthly ($1,677 annually)

Should I get a BOP or just general liability?

Get a BOP if you need commercial property coverage for inventory, equipment or business property because it bundles general liability with property at 20% to 30% savings. Choose standalone general liability if you work from home with no inventory or equipment. Request quotes for both to compare actual costs.

When do I need workers' comp in Michigan if I hire my first employee (even part-time)?

Michigan requires workers' disability compensation from your first employee, including part-time workers, with no minimum hours threshold. This makes Michigan stricter than Ohio's three-employee minimum. Purchase coverage before your first hire's start date, as operating without coverage leaves you liable for employee injury costs and state penalties.

How do I get a COI fast? What coverage limits do clients/landlords usually want?

Contact your insurer or use your online portal to request a certificate of insurance (COI). Most insurers issue COIs within 24 to 48 hours. Clients and landlords demand $1 million per occurrence and $2 million aggregate for general liability, with them named as additional insured. Confirm specific requirements before requesting your certificate.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Michigan Department of Environment, Great Lakes, and Energy. "High Risk Erosion Areas: Program and Maps." Accessed February 8, 2026.

- Michigan Department of Insurance and Financial Services. "Frequently Asked Questions: Information on Purchasing Auto Insurance." Accessed February 8, 2026.

- Michigan Legislature. "Worker's Disability Compensation Act of 1969, Section 611." Accessed February 8, 2026.

- National Council on Compensation Insurance. "Michigan." Accessed February 8, 2026.

- National Weather Service Detroit/Pontiac. "January 12-13, 2024 Winter Storm." Accessed February 8, 2026.