ERGO NEXT leads Massachusetts business insurance with excellent customer service, competitive rates and comprehensive coverage options. The Hartford and Simply Business provide quality coverage for Massachusetts entrepreneurs.

Best Small Business Insurance in Massachusetts

Massachusetts business owners choose ERGO NEXT, The Hartford, and Simply Business for top coverage with rates starting at $76 yearly.

Get matched to the best Massachusetts commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers Massachusetts' best small business insurance with top customer service scores and rates ranking second for affordability.

The Hartford offers the cheapest small business insurance in Massachusetts at $88 monthly ($1,054 annually).

Choosing the right small business insurance coverage means comparing quotes, assessing risks and using discounts.

Get Matched to the Best Small Business Insurance Providers in Massachusetts

Select your industry and state to get a customized quote for your Massachusetts business.

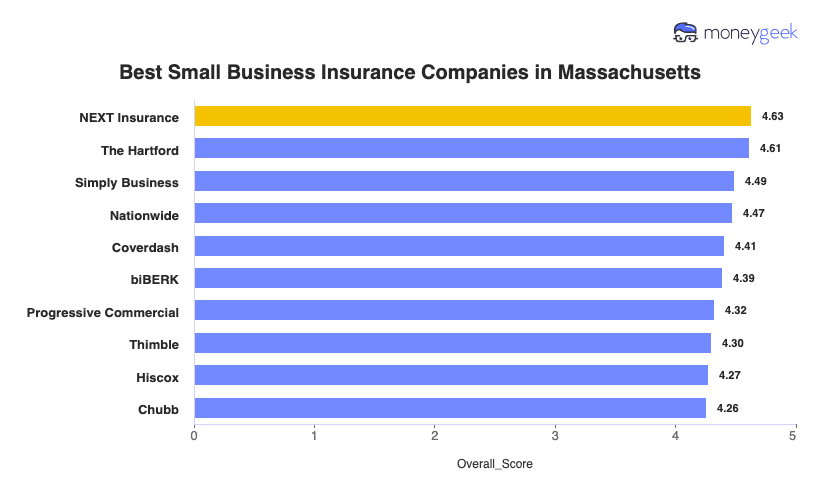

Best Small Business Insurance Companies in Massachusetts

| ERGO NEXT | 4.63 | $105 | 1 | 2 |

| The Hartford | 4.61 | $88 | 2 | 3 |

| Simply Business | 4.49 | $101 | 5 | 1 |

| Nationwide | 4.47 | $107 | 2 | 4 |

| Coverdash | 4.41 | $106 | 6 | 2 |

| biBERK | 4.39 | $109 | 2 | 5 |

| Progressive Commercial | 4.32 | $104 | 7 | 5 |

| Thimble | 4.30 | $99 | 8 | 5 |

| Hiscox | 4.27 | $113 | 4 | 6 |

| Chubb | 4.26 | $124 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Discover the best or cheapest business insurer in Massachusetts for your desired coverage type in our resources below:

Best Massachusetts Business Insurance

Average Monthly Cost of General Liability Insurance

$108This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$72This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first in Massachusetts for customer service

User-friendly digital platform enables instant coverage

Comprehensive coverage options focused on small business needs

consRanks sixth for financial stability

Limited physical presence may challenge in-person service preference

ERGO NEXT leads Massachusetts with top customer service and competitive rates. Its digital platform allows you to get instant certificates of insurance when Boston landlords require proof before lease signing or contractors need documentation before starting jobs. You'll reach live agents quickly when filing claims, not wait weeks for responses during Massachusetts winter storms that damage equipment or close your storefront.

ERGO NEXT averages $105 monthly, ranking second statewide for affordability. Workers' comp ranks first, so you keep more cash for payroll when hiring Massachusetts employees. Professional liability costs $76 monthly, saving you $71 yearly when Cambridge clients require E&O coverage. BOP costs $162 monthly (eighth statewide), so compare The Hartford's rates for your Boston storefront.

ERGO NEXT ranks first nationally for customer service, so you'll reach live agents quickly when filing claims or adjusting policies. Customer reviews praise instant COI generation and easy quotes, though some mention longer hold times during peak hours. Best for Massachusetts business owners managing policies digitally who value fast certificates when Worcester landlords or Cape Cod contractors require proof of coverage.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT protects Massachusetts contractors with tools and equipment coverage when gear gets stolen from Springfield job sites during harsh winters or damaged by frozen pipes. If employees drive personal cars across multiple municipalities for business errands, hired and non-owned auto coverage shields you from liability. Lowell restaurants add liquor liability to meet local licensing boards' insurance requirements before serving alcohol.

Cheapest Massachusetts Business Insurance

Average Monthly Cost of General Liability Insurance

$86This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$73This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Massachusetts' most affordable business insurance rates

Fast claim approvals with responsive customer service

Strong financial stability ensures claims get paid

Deep understanding of small business risks

consMobile app can't manage all policy tasks

Agent required for some transactions

Fewer specialty coverages than competitors

The Hartford saves Massachusetts businesses $216 yearly compared to the state average, crucial when Berkshires restaurants operate on thin margins or Pioneer Valley contractors pay employees during slow winter months. Its 215-year track record means your North Shore storefronts get claim checks fast when nor'easters damage inventory, not excuses when quarterly revenue depends on reopening quickly.

The Hartford's $443 yearly BOP savings cover a Metrowest manufacturer's property insurance or two months of workers' compensation premiums when cash flow tightens. General liability costs $86 monthly (first statewide), freeing up $273 yearly for South Shore retailers expanding inventory before summer tourism season. Professional liability saves Fall River consultants $80 yearly, while workers' comp at $73 stays $54 below average.

The Hartford ranks first nationally for claims processing and customer service, ensuring Worcester contractors reach live agents quickly when Massachusetts winter storms damage equipment. Business insurance reviews on Trustpilot show 5-star ratings 86% of the time, praising fast claim payments. Digital experience ranks tenth, making it a better fit for small business owners valuing agent support over managing policies from smartphones.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 Business owner's policies include $25,000 in employment practices liability insurance at no cost, protecting Cape Cod seasonal employers from wage disputes and Boston businesses from wrongful termination claims. When 1099 contractors claim misclassification under Massachusetts law, coverage pays defense costs averaging $50,000. Worcester manufacturers can bundle property coverage with liability protection.

Best Commercial Coverage Options in Massachusetts

Average Monthly Cost of General Liability Insurance

$100This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$75This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

Digital experience ranks third nationally

consCustomer service ranks fifth in the state

Claims process ranks eighth nationally

Policy management capabilities rank seventh nationally

Simply Business's 20+ carrier marketplace finds specialized coverage Boston tech startups and Cambridge biotech firms can't get from single carriers, averaging $101 monthly in Massachusetts. Quotes in 10 minutes help you meet commercial lease deadlines requiring instant certificates. Claims processing ranks eighth and customer service fifth, so Cape Cod businesses face longer resolution times for slip-and-fall settlements during peak tourist season.

Simply Business averages $101 monthly ($1,216 annually) in Massachusetts, with general liability at $100 monthly saving Boston businesses $98 yearly. Business owner's policies cost $151 monthly and rank third statewide. Cambridge consultants and Worcester manufacturers save less on professional liability and workers' comp ($21 and $30 yearly respectively) than Hartford's lower rates, so compare quotes before renewal.

Digital experience ranks third nationally, so Boston retailers get instant online quotes without scheduling agent meetings, critical when commercial landlords require certificates within 24 hours. Claims processing ranks eighth, meaning Cambridge restaurants and Worcester contractors wait longer for slip-and-fall or property damage claim resolutions. Best for Massachusetts businesses prioritizing quick buying over claims service quality.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Through business owner's policies, Simply Business protects Springfield food manufacturers from product liability claims and Cape Cod restaurants when refrigeration systems fail. Route 128 tech companies bundle cyber coverage against data breaches, while equipment breakdown covers mechanical failures in Lowell manufacturing facilities. General liability ranges from $1 million per occurrence to $2 million aggregate.

How to Get the Best Cheap Small Business Insurance in Massachusetts

Massachusetts small business owners face winter storms closing offices statewide, workers' compensation requirements from the first hire and new commercial auto minimums. Getting business insurance means preparing for these legal requirements and seasonal disruptions.

- 1

Know what Massachusetts law requires versus what protects your business

Massachusetts law requires workers' compensation from your first employee—even part-time hires, with a 16-hour weekly minimum only for domestic workers. Commercial vehicles need 25/50/30 coverage starting July 2025, the first increase in four decades. Liquor liability isn't state-mandated, but Cape Cod restaurants serving alcohol need it when intoxicated customers cause accidents, and landlords require proof before leasing bar space.

- 2

Address hazards unique to your Massachusetts operation

February 2024 winter storms brought eight to 12 inches of snow statewide, closing government offices and causing scattered power outages. Cambridge biotech labs without business interruption coverage absorbed lost revenue while refrigeration systems failed and research samples spoiled. Worcester manufacturers need commercial property insurance covering costs from power outages damaging CNC machines and inventory during severe weather.

- 3

Compare standard carriers with Massachusetts specialty programs

ERGO NEXT, The Hartford and Simply Business offer competitive Massachusetts rates, but if two carriers reject your Route 128 startup or Worcester machine shop because of high-risk operations or past claims, Massachusetts's assigned risk pool offers workers' compensation through the Workers' Compensation Rating and Inspection Bureau. Assigned risk premiums exceed standard market rates, so exhaust traditional carriers first.

- 4

Don't sacrifice claims service for the lowest premium

February 2024 winter storms closed government offices and created hazardous travel across Massachusetts, separating responsive insurers from slow ones. Boston financial consultants losing client billings or Cape Cod restaurants losing tourism revenue can't wait three weeks for business interruption checks. Ask carriers about Massachusetts adjuster counts and average claim resolution times before committing to the cheapest option.

- 5

Stack discounts and pay annually to cut costs

Bundle general liability with commercial property in a business owner's policy to reduce combined premiums and pay annually instead of monthly to avoid installment fees. Massachusetts insurers reward claim-free years and safety training completion. Cambridge biotech labs completing lab safety certifications or restaurants completing food handler training stack these discounts with bundling, reducing total insurance spend.

- 6

Reassess your policies after Massachusetts growth milestones

Massachusetts's one-employee workers' compensation threshold triggers mandatory coverage when you hire. Expanding from Baltimore to the Eastern Shore means different premium rates, since Montgomery County businesses pay 18% to 32% more than rural areas. Landing contracts with federal agencies often requires $2 million aggregate limits. Review your business insurance costs before growth happens, not after you're already committed and exposed.

Best Business Liability Insurance Massachusetts: Bottom Line

ERGO NEXT leads Massachusetts for customer service while The Hartford offers the state's lowest rates at $88 monthly. Compare quotes from both, assess your business risks and stack available discounts to find coverage that protects your operation without overpaying.

Business Insurance Massachusetts: FAQ

Small business owners in Massachusetts often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need for my small business in Massachusetts?

Massachusetts requires workers' compensation from your first hire and commercial auto at 25/50/30 minimums starting July 2025. General liability isn't state-mandated, but landlords and clients require proof before contracts. Cambridge biotech labs need equipment coverage, while Cape Cod restaurants serving alcohol should add liquor liability.

How much does small business insurance cost in Massachusetts?

Coverage costs for your Massachusetts business depend on employee count, claims history and industry risk level, but these are the monthly and annual averages by coverage type:

- General liability insurance: $109 monthly or $1,303 annually

- Workers' compensation insurance: $77 monthly or $925 annually

- Professional liability (E&O) insurance: $82 monthly or $980 annually

- Business owner's policy (BOP): $155 monthly or $1,858 annually

Do I need general liability, or should I get a Business Owner's Policy (BOP)?

Start with general liability if you're a solo consultant because it covers customer injuries at $109 monthly. BOPs bundle general liability with commercial property for $155 monthly, saving 20% to 30% for Worcester manufacturers and Boston storefronts. Get a BOP if you own equipment, inventory or lease space.

Do I need workers' comp in Massachusetts if I hire my first employee?

Yes, Massachusetts requires workers' compensation from your first employee, stricter than neighboring states. The only exception is domestic workers under 16 hours weekly. Coverage costs $77 monthly and protects you from $100 daily fines and Stop Work Orders. Get quotes from ERGO NEXT or The Hartford before your hire date.

How do I get proof of insurance (a COI) for a landlord or client in Massachusetts?

Request a certificate of insurance from your insurer online, by phone or through your agent—most issue COIs within 24 hours at no charge. The certificate lists coverage limits and names your landlord or client as "additional insured." Cambridge tech startups need COIs before signing leases or landing Mass General contracts.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Commonwealth of Massachusetts. "Healey-Driscoll Administration Issues Safety Reminders Ahead of Anticipated Winter Storm." Accessed February 7, 2026.

- Commonwealth of Massachusetts. "New Motor Vehicle Mandatory Coverage Limits." Accessed February 7, 2026.

- Commonwealth of Massachusetts. "Workers' Compensation Insurance Requirements." Accessed February 7, 2026.