ERGO NEXT leads West Virginia small business insurance with top customer service and coverage scores. The Hartford offers the lowest rates at $88 monthly. Simply Business provides the broadest coverage options for growing West Virginia businesses.

Best Small Business Insurance in West Virginia

West Virginia businesses choose ERGO NEXT, The Hartford and Simply Business for top-rated coverage starting at $76 annually.

Get matched to the best West Virginia commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers the best small business insurance in West Virginia with top scores for customer service and coverage.

he Hartford offers the cheapest small business insurance in West Virginia at $88 monthly ($1,058 annually).

Compare quotes and assess your risks to find the right small business insurance coverage for your West Virginia business.

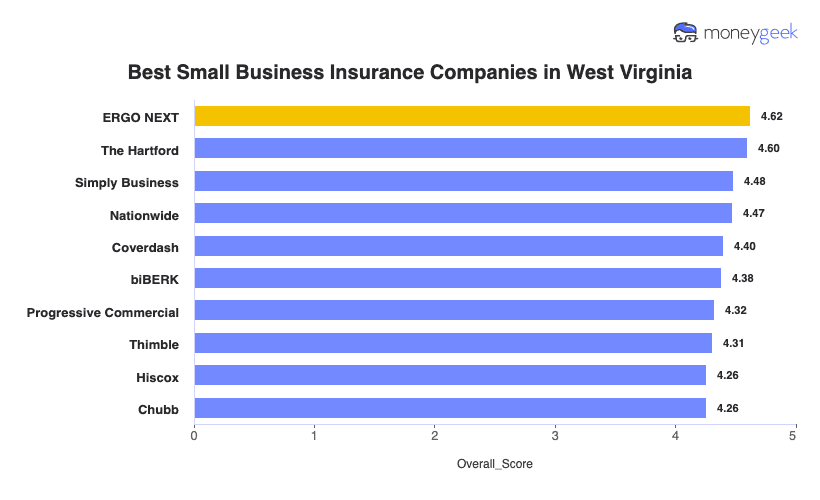

Best Small Business Insurance Companies in West Virginia

| ERGO NEXT | 4.62 | $105 | 1 | 2 |

| The Hartford | 4.60 | $88 | 2 | 3 |

| Simply Business | 4.48 | $101 | 5 | 1 |

| Nationwide | 4.47 | $107 | 2 | 4 |

| Coverdash | 4.40 | $106 | 6 | 2 |

| biBERK | 4.38 | $109 | 2 | 5 |

| Progressive Commercial | 4.32 | $104 | 7 | 5 |

| Thimble | 4.31 | $98 | 8 | 5 |

| Hiscox | 4.26 | $113 | 4 | 6 |

| Chubb | 4.26 | $123 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Compare the best or cheapest small business insurers in West Virginia for general liability, workers' comp, professional liability and other coverage types below:

Best West Virginia Business Insurance

Average Monthly Cost of General Liability Insurance

$108This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$72This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first among the providers MoneyGeek researched

Provides excellent customer service

Provides quotes and coverage in under 10 minutes

A- AM Best rating

consHigher average cost than other providers

No physical offices

ERGO NEXT ranks first in West Virginia at $105 monthly with instant COI downloads and app-based claims filing. It's best for West Virginia businesses that need to send proof of insurance to clients or landlords the same day they buy coverage.

ERGO NEXT averages $105 monthly ($1,258 annually) with the lowest workers' comp rates in West Virginia at $72 monthly, helping you stay compliant without overpaying. Professional liability ranks second at $76 monthly. General liability and BOPs cost more (ranks fifth and eighth), so compare quotes from other providers.

ERGO NEXT ranks first nationally for policy management and renewal ease, with a 4.8 rating for digital experience. This matters when you need a COI fast. Claims processing ranks fourth, so you may wait longer than other insurers when filing after an accident.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT bundles tools and equipment coverage with general liability for contractors and cleaners, protecting your gear from theft or damage on West Virginia jobsites. Add hired and non-owned auto coverage if employees drive personal vehicles for deliveries or client visits, plus cyber liability endorsements up to $250,000.

Cheapest West Virginia Business Insurance

Average Monthly Cost of General Liability Insurance

$86This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$73This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks second among the providers MoneyGeek researched

Offers the lowest rates across all coverage types

Excellent claims process and customer satisfaction

A+ AM Best rating

More than 200 years of insurance industry experience

consRanks last for digital experience

Unavailable in Hawaii and Alaska

The Hartford ranks second in West Virginia with the state's lowest rate at $88 monthly, combining affordability with first-place financial stability and second-place customer service. It's best for West Virginia businesses that need budget-friendly coverage backed by experienced claims specialists when something goes wrong.

The Hartford offers West Virginia's cheapest small business insurance at $88 monthly ($1,058 annually), ranking first for general liability, professional liability and BOPs with all three priced well below state averages. This saves you hundreds annually, while workers' comp ranks second at $73 monthly.

The Hartford ranks first nationally for overall satisfaction, claims and customer service, meaning faster claim resolutions and experienced specialists when you file. Its digital experience ranks tenth, so online policy management lags behind competitors like ERGO NEXT.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford includes equipment breakdown in BOPs at no extra charge and provides free online certificates of insurance for client and landlord requirements. You can add crime and employee theft endorsements for retail or food businesses, plus employment practices liability up to $25,000 when hiring your first employees.

Best Commercial Coverage Options in West Virginia

Average Monthly Cost of General Liability Insurance

$100This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$74This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Policy Management

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

Above-average digital experience rating

consLower customer service ranking than other carriers

Ranks third to last in claims processing

Simply Business ranks third in West Virginia at $101 monthly and leads the state for coverage breadth, letting you compare quotes from multiple insurers in one place to find your best price. It's best for West Virginia businesses shopping around to balance coverage needs with budget, especially if you want options without calling multiple agents.

Simply Business averages $101 monthly ($1,215 annually) and ranks second for general liability at $100 monthly, well below the state's $109 average. BOPs rank third at $150 monthly, saving you about $50 annually compared to the state average. Professional liability and workers' comp rank fourth and fifth.

Simply Business ranks third nationally for digital experience, making online quotes and policy comparisons easy. Customer service ranks sixth, while claims processing ranks eighth, so you may wait longer than providers like The Hartford when filing after an incident.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business offers multiple BOP endorsements including equipment breakdown for machinery failures, employee theft protection for retail and food businesses, and cyber liability for data breach costs. Add inland marine coverage if you transport tools and equipment between West Virginia jobsites, plus errors and omissions endorsements to general liability policies.

Get Matched to the Best Small Business Insurance Providers in West Virginia

Select your industry and state to get a customized quote for your West Virginia business.

How to Get the Best Cheap Small Business Insurance in West Virginia

West Virginia small business owners deal with repeated flood disasters, severe storms and strict workers' comp compliance enforcement. Getting business insurance that covers these risks takes more than shopping for the lowest premium.

- 1

Know West Virginia's legal mandates from actual business protection

West Virginia requires workers' compensation from your first employee, and prime contractors must verify subs carry it since you're liable for their gaps. You also need commercial auto liability for business vehicles, general liability when clients request certificates, and commercial property in flood-prone areas like Charleston where standard policies exclude water damage.

- 2

Address hazards unique to your West Virginia operation

Professional liability matters for Morgantown tech consultants since client contract errors can lead to lawsuits over missed deliverables. Harsh West Virginia winters cause HVAC and machinery failures in Parkersburg manufacturing facilities, making equipment breakdown coverage worth the added premium. If you're in the Eastern Panhandle handling cash or inventory, employee theft protection addresses risks that service businesses don't face.

- 3

Compare top providers rates but also consider West Virginia resources

Start with ERGO NEXT, The Hartford and Simply Business since they offer different West Virginia strengths: The Hartford has the lowest rates, ERGO NEXT leads for customer service, and Simply Business lets you compare the broadest range of coverage options. Standard carriers may decline your workers' comp if you have claims history, so NCCI administers West Virginia's assigned risk plan as a backup at higher premiums.

- 4

Don't make low premiums your only decision factor

Saving $20 monthly sounds good until West Virginia storms hit and your cheap insurer takes weeks to process claims or lacks coverage options you need. Responsive customer service matters when you need certificates issued fast for client contracts. Coverage breadth becomes important as your business grows because you'll need specialized endorsements for equipment, employees or larger projects that bare-bones policies exclude.

- 5

Stack bundling with payment timing to maximize savings

Combining general liability and commercial property into a business owner's policy cuts premiums 20% to 30%, savings that add up in West Virginia where repeated floods make property coverage expensive. Pay annually to dodge $200 to $400 in fees, and pursue safety training credits that reduce workers' comp rates on the cost of your coverage.

- 6

Reassess coverage after growth milestones and location changes

Your first employee triggers West Virginia's workers' comp requirement immediately. Adding a work vehicle means you need commercial auto since personal policies won't cover business use. Opening a second location in a different West Virginia region changes your rates and coverage needs, especially if you're moving from low-flood areas like Morgantown to high-risk zones near Charleston or Huntington.

Best Business Liability Insurance West Virginia: Bottom Line

ERGO NEXT ranks first in West Virginia for customer service and coverage options if you need fast certificate turnaround and broad protection, while The Hartford offers the state's cheapest rates at $88 monthly. Compare quotes from both based on your priorities, assess your business risks, and choose coverage that fits your West Virginia operation.

Business Insurance West Virginia: FAQ

Small business owners in West Virginia often have questions about choosing the right business insurance. We answer the most common concerns below:

I'm starting out. What insurance do I need in West Virginia?

General liability covers client accidents and property damage claims. Add workers' comp when you hire your first employee since West Virginia requires it immediately. Professional liability protects consultants from contract errors, while commercial auto covers business vehicle use.

What does West Virginia actually require, and what's just my landlord, client or general contractor's (GC) rule?

West Virginia requires workers' comp from your first employee and commercial auto for business vehicles. General liability isn't legally required but landlords demand it for leases and clients need certificates for contracts. Prime contractors must verify subs carry coverage.

About how much per month is business insurance in West Virginia, and what makes the price go up or down?

How much coverage costs for your West Virginia business depends on your industry, but these are the monthly and annual averages by coverage type:

- General liability insurance: $109 monthly or $1,303 annually

- Workers' compensation insurance: $77 monthly or $925 annually

- Professional liability (E&O) insurance: $81 monthly or $978 annually

- Business owner's policy (BOP): $155 monthly or $1,855 annually

Your rates increase with revenue, employee count, claims history and high-risk operations like roofing or excavation work.

How fast can I get a COI in West Virginia for a job or lease, and can you add additional insured?

ERGO NEXT issues certificates instantly through its app when you buy coverage. The Hartford provides free online certificates within hours. Both insurers add additional insured endorsements to general liability, protecting clients or property owners you name.

Do I need workers' comp in West Virginia if it's just me, and what happens when I hire someone or use 1099 help?

You don't need workers' comp as a sole proprietor, but buy it immediately when hiring your first W-2 employee because West Virginia requires it. Prime contractors must verify subcontractors carry their own coverage or you're liable for their gaps.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- West Virginia Division of Homeland Security and Emergency Management. "2023 State Hazard Mitigation Plan - Executive Summary." Accessed February 8, 2026.

- West Virginia Legislature. "Article 2. Liability of Employer to Pay Compensation." Accessed February 8, 2026.

- West Virginia Legislature. "Section 23-2-1d. Liability of Prime Contractor for Subcontractor's Failure to Obtain Insurance." Accessed February 8, 2026.

- West Virginia Legislature. "Section 17D-4-2. Proof of Financial Responsibility Required." Accessed February 8, 2026.