ERGO NEXT earned our top spot for photography business insurance with a MoneyGeek score of 4.82 out of 5. It combines competitive rates with quality customer service and comprehensive coverage options photographers need. We also recommend comparing quotes from The Hartford and Simply Business to find the best fit for your photography studio.

Best Photography Business Insurance

ERGO NEXT, The Hartford and Simply Business offer the best cheap business insurance for photography businesses, with rates starting at $13 monthly.

Discover the best business insurance provider for photographers.

Updated: February 2, 2026

Advertising & Editorial Disclosure

General liability, equipment coverage and professional liability are some of the coverage types protecting photographers from venue accidents and gear theft.

ERGO NEXT ranks as the best business insurance provider for photography studios with a 4.82 MoneyGeek score for competitive rates and quality service.

ERGO NEXT offers the cheapest business insurance for photographers at $27 monthly, with general liability coverage starting at just $13 monthly.

Best Business Insurance for Photography Services

| ERGO NEXT | 4.82 | $27 |

| The Hartford | 4.75 | $28 |

| Simply Business | 4.60 | $31 |

| Nationwide | 4.50 | $35 |

| biBERK | 4.50 | $32 |

| Progressive Commercial | 4.40 | $33 |

| Thimble | 4.30 | $42 |

| Hiscox | 4.30 | $35 |

| Chubb | 4.30 | $40 |

| Coverdash | 4.20 | $43 |

Note: We based all scores on a photography business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Photography Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for photographers, check out the following resources:

1. ERGO NEXT: Best and Cheapest Insurance Overall for Photography Businesses

Lowest rates for general liability and BOP coverage

Top digital experience with instant quotes and policy management

Unlimited free certificates of insurance delivered instantly

Coverage starts same day with 10-minute online application

Claims processing rated lower than overall customer satisfaction

Workers' comp limited to 20 employees and $5M payroll

No in-person agents for face-to-face photographer consultations

ERGO NEXT offers the best combination of affordability and digital convenience. It ranks first across three core policy types, with general liability starting at $13 monthly and business owner's policy averaging $20 monthly.

Photographers on Trustpilot consistently highlight the free certificates of insurance as a valuable resource for simplifying work with wedding venues and event clients. ERGO NEXT offers tailored equipment coverage that follows your cameras and gear wherever you shoot, plus add-ons like drone liability insurance.

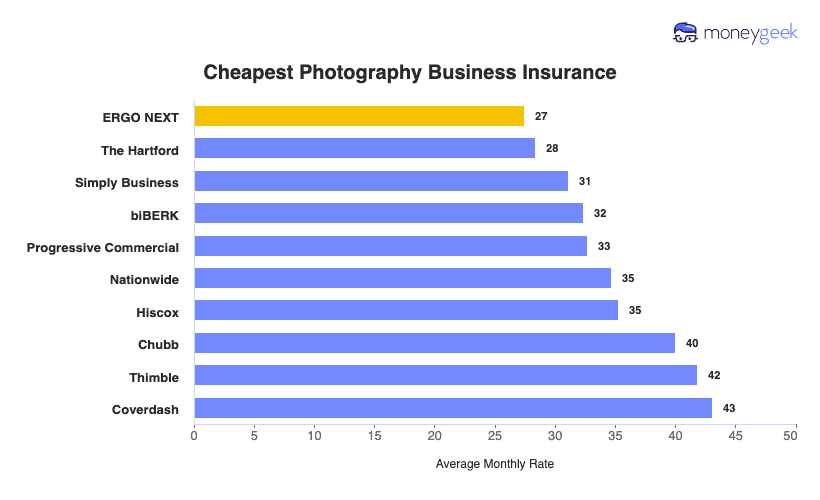

Cheapest Business Insurance for Photography Studios

ERGO NEXT offers photography business insurance at the most affordable rate of $27 monthly or $329 annually. It ranks cheapest for general liability, workers' compensation and business owner's policy coverage. For professional liability insurance, The Hartford provides more affordable rates at $57 monthly for photography studios.

| ERGO NEXT | $27 | $329 |

| The Hartford | $28 | $341 |

| Simply Business | $31 | $373 |

| biBERK | $32 | $388 |

| Progressive Commercial | $33 | $392 |

| Nationwide | $35 | $416 |

| Hiscox | $35 | $423 |

| Chubb | $40 | $480 |

| Thimble | $42 | $502 |

| Coverdash | $43 | $516 |

Cheapest General Liability Insurance for Photographers

ERGO NEXT offers the cheapest general liability insurance for photographers at just $13 monthly or $159 annually. That's $11 less than the $24 monthly industry average, saving photography studios 46% on essential liability coverage that protects your business from client injuries and property damage claims.

| ERGO NEXT | $13 | $159 |

| The Hartford | $16 | $197 |

| Simply Business | $17 | $209 |

| biBERK | $19 | $234 |

| Nationwide | $20 | $241 |

Cheapest Workers' Comp Insurance for Photographers

ERGO NEXT ranks as the most affordable workers' compensation option for photography business owners at $16 monthly or $192 annually, compared to the $17 monthly industry average. The Hartford, Thimble, Progressive Commercial and Simply Business also provide competitive rates for photographers with employees.

| ERGO NEXT | $16 | $192 |

| The Hartford | $16 | $195 |

| Thimble | $16 | $197 |

| Progressive Commercial | $16 | $197 |

| Simply Business | $17 | $199 |

Cheapest Professional Liability Insurance for Photographers

Professional photographers pay $57 monthly or $689 annually for the cheapest professional liability insurance through The Hartford, which comes in $7 below the $64 monthly industry average. ERGO NEXT follows closely at $59 monthly, giving photography studios two strong budget-friendly options for errors and omissions coverage.

| The Hartford | $57 | $689 |

| ERGO NEXT | $59 | $712 |

| Progressive Commercial | $61 | $727 |

| Thimble | $62 | $747 |

| Simply Business | $63 | $754 |

Cheapest BOP Insurance for Photographers

At $20 monthly or $243 annually, ERGO NEXT provides the most affordable BOP insurance for photography businesses, running $12 below the $32 monthly industry average. That saves photography studios $142 yearly while covering equipment, client injuries and business property damage.

| ERGO NEXT | $20 | $243 |

| The Hartford | $22 | $269 |

| biBERK | $25 | $305 |

| Simply Business | $26 | $316 |

| Nationwide | $30 | $362 |

What Does Photography Business Insurance Cost?

Photography business insurance costs depend on which coverage you need. These are the average rates for the four most popular policy types:

- General Liability: $24 on average per month, ranging from $21 to $28, depending on the state

- Workers' Comp: $17 on average per month, ranging from $15 to $20, depending on the state

- Professional Liability (E&O): $64 on average per month, ranging from $55 to $74, depending on the state

- BOP Insurance: $32 on average per month, ranging from $28 to $37, depending on the state

| Workers' Comp | $17 | $205 |

| General Liability | $24 | $292 |

| BOP | $32 | $385 |

| Professional Liability (E&O) | $64 | $765 |

What Type of Insurance Is Best for a Photography Business?

The required coverage for photographers varies by state, but workers' compensation is mandatory in most states when you hire employees, and commercial auto insurance is required for business-owned vehicles. Beyond legal requirements, general liability insurance is essential for professional photographers since wedding venues, event spaces and corporate clients routinely require proof of coverage before allowing you to work on their property.

- Workers' Compensation Insurance: Protects your photography studio when employees suffer work-related injuries like twisted ankles during outdoor shoots or back strain from loading equipment. Most states require this coverage if you have employees, with limits covering medical bills and partial lost wages.

- Commercial Auto Insurance: Covers accidents when transporting cameras and gear to wedding venues or client locations. Required in most states for business-owned vehicles, recommended limits include $1 million in liability coverage to protect against injury and property damage claims.

- General Liability Insurance: Protects photographers when clients trip over tripods at wedding receptions or lighting equipment damages venue property during shoots. Wedding venues and event spaces commonly require $1 million to $2 million in coverage before granting access, making this essential for securing bookings.

- Equipment Coverage: Covers stolen cameras from vehicle break-ins, water-damaged lenses during outdoor shoots, and broken gear from accidental drops. Professional photographers carry $5,000 to $30,000 in coverage depending on their equipment value, protecting gear anywhere you work.

- Professional Liability Insurance (Errors and Omissions): Covers photographers when memory cards fail and wedding photos are lost, equipment malfunctions prevent delivering promised shots or clients sue over missed family portraits. Coverage limits of $1 million protect against claims that your work caused financial losses.

- Business Owner's Policy (BOP): Combines general liability and commercial property insurance at a discount, covering both client injuries and studio damage from fires or burst pipes. Photography studios with physical locations benefit from bundled coverage that protects both liability risks and business property in one policy.

- Cyber Liability Insurance: Protects photography businesses when client data gets breached from hacked websites or stolen laptops containing wedding photos and personal information. Coverage limits of $25,000 to $1 million help pay for credit monitoring services, legal fees and notification costs after cyber attacks.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Photography Business

Follow our guide on how to get business insurance to protect your photography business affordably.

- 1Decide on Coverage Needs Before Buying

Talk with other photographers about their insurance experiences and consult agents to match coverage types with your actual risks.

- 2Research Costs

Know photography insurance pricing before shopping. Research the usual costs for photography studios similar to yours, then identify insurers offering competitive rates in your area.

- 3Look Into Company Reputations and Coverage Options

Read reviews from photographers who've filed claims for stolen gear or venue damage. Check Google and Better Business Bureau ratings focusing on claims processing speed and customer service quality.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers for your photography business using different methods.

- 5Reassess Annually

Review coverage annually as your photography business grows. New camera equipment, drone photography services or hired assistants change your insurance needs.

Best Insurance for Photography Business: Bottom Line

Photography business insurance protects your studio from equipment theft, client injuries and delivery failures. ERGO NEXT offers the best coverage for photographers with a 4.82 MoneyGeek score, combining competitive rates starting at $27 monthly with quality service. General liability, equipment and professional liability coverage safeguard your photography services against common risks.

Photography Business Insurance: FAQ

We answer frequently asked questions about photography business insurance:

Who offers the best photography business insurance overall?

ERGO NEXT delivers the top business insurance for photography firms, earning a MoneyGeek score of 4.82 out of 5. The Hartford follows closely behind with a score of 4.75, providing excellent value through competitive pricing and comprehensive protection.

Who has the cheapest business insurance for photographers?

Here are the cheapest business insurance companies for photographers by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $13 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $16 monthly

- Cheapest professional liability insurance: The Hartford at $57 monthly

- Cheapest BOP insurance: ERGO NEXT at $20 monthly

What business insurance is required for photography services?

Photography businesses must carry workers' compensation insurance if they employ staff and commercial auto insurance for business vehicles, with specific requirements varying by state. General liability insurance, though not legally mandated, is essential for securing commercial clients and property leases.

How much does photography business insurance cost?

Photography business insurance costs by coverage type are as follows:

- General Liability: $24/mo

- Workers' Comp: $17/mo

- Professional Liability: $64/mo

- BOP Insurance: $32/mo

How We Chose the Best Photography Business Insurance

We selected the best business insurer for photographers based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Trustpilot. "nextinsurance.com." Accessed February 7, 2026.