ERGO NEXT and The Hartford tie for best small business insurance in Montana with top customer service, competitive rates and strong coverage options. ERGO NEXT ranks first in customer service and second in coverage. The Hartford ranks first in affordability and second in customer service. Simply Business offers the widest coverage selection and rounds out our top three.

Best Small Business Insurance in Montana

Get quotes from the best business insurance providers in Montana including The Hartford, ERGO NEXT and Simply Business with rates starting at $6/mo.

Get matched to the best Montana commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT and The Hartford tie for best small business insurance in Montana, both with top customer service and comprehensive coverage.

The Hartford offers the cheapest small business insurance in Montana at $83 monthly ($998 annually).

Compare small business insurance coverage options by assessing risks, gathering quotes and bundling policies for discounts.

Get Matched to the Best Small Business Insurance Providers in Montana

Select your industry and state to get a customized quote for your Montana business.

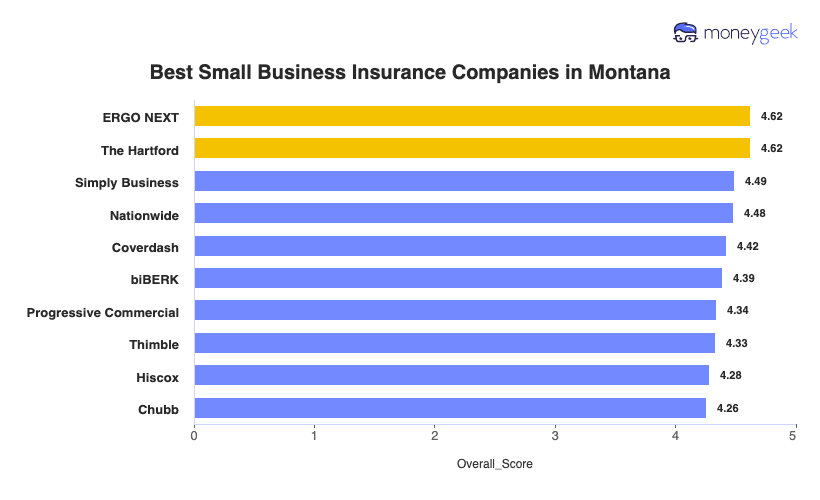

Best Small Business Insurance Companies in Montana

| ERGO NEXT | 4.62 | $100 | 1 | 2 |

| The Hartford | 4.62 | $83 | 2 | 3 |

| Simply Business | 4.49 | $97 | 5 | 1 |

| Nationwide | 4.48 | $101 | 2 | 4 |

| Coverdash | 4.42 | $100 | 6 | 2 |

| biBERK | 4.39 | $104 | 2 | 5 |

| Progressive Commercial | 4.34 | $98 | 7 | 5 |

| Thimble | 4.33 | $93 | 8 | 5 |

| Hiscox | 4.28 | $107 | 4 | 6 |

| Chubb | 4.26 | $117 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Find the best or cheapest small business insurance in Montana for different coverage types in these resources:

Best Montana Business Insurance

Average Monthly Cost of General Liability Insurance

$103This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$59This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first among the providers MoneyGeek researched

Provides excellent customer service

Provides quotes and coverage in under 10 minutes

A- AM Best rating

consHigher average cost than other providers

No physical offices

ERGO NEXT ranks first in Montana with $100 monthly costs ($1,195 annually) and reliable claim-paying ability (A- AM Best rating). The provider delivers instant quotes and same-day coverage through its digital platform, excelling in professional liability and workers' compensation pricing. It's best for Montana businesses who value fast setup and app-based service, even if paying more for business owner's policies.

ERGO NEXT averages $100 monthly ($1,195 annually), ranking fifth for overall affordability in Montana. You'll find the state's lowest rates for workers' compensation ($69 monthly vs. $73 average) and second-lowest for professional liability ($73 monthly vs. $77 average). Business owner's policies run $154 monthly, above Montana's $146 average, so contractors and retail businesses may want to compare BOP rates with other providers.

ERGO NEXT leads nationally for digital experience, letting you generate certificates instantly through its mobile app. The platform excels at fast quotes and self-service but lags behind competitors in claims speed and phone support. Montana owners who prefer app-based management will appreciate the convenience despite challenges reaching help when issues arise.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT protects Montana contractors' tools and equipment from job site theft through add-on coverage for cleaning and trades businesses. You can add cyber breach protection (from $4 monthly) or hired and non-owned auto coverage for employees using personal vehicles. Coverage options match Montana's trades and professional services businesses, with limits up to $4 million when contracts require higher protection.

Cheapest Montana Business Insurance

Average Monthly Cost of General Liability Insurance

$72This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$62This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Offers the lowest rates for most coverage types

Excellent claims process and customer satisfaction

A+ AM Best rating

More than 200 years of insurance industry experience

consRanks last for digital experience

Unavailable in Hawaii and Alaska

The Hartford ties for first in Montana with the state's lowest rates at $83 monthly ($998 annually) and reliable claim-paying ability (A+ AM Best rating) backed by over 200 years of experience. The company delivers fast claim resolutions across business owner's policies, general liability and professional liability. It's best for Montana businesses who prioritize low rates and proven claim handling over cutting-edge digital tools.

The Hartford offers Montana's lowest rates at $83 monthly ($998 annually), ranking first for overall affordability. You'll save significantly on business owner's policies ($112 monthly vs. $146 state average), general liability ($81 vs. $103 average) and professional liability ($70 vs. $77 average). Workers' compensation runs $69 monthly (competitive but second-cheapest), so businesses with larger payrolls may want to compare workers' comp rates across providers.

The Hartford resolves claims faster than competitors with knowledgeable phone support. The company excels at agent relationships and phone assistance but offers limited mobile app features and basic online policy management (ranks 10th digitally). Montana business owners who value responsive claim handling over self-service tools will appreciate The Hartford's traditional approach.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford's business owner's policies automatically include employment practices liability with wage and hour defense, protecting Montana's seasonal tourism businesses from employee lawsuits. Add equipment breakdown coverage for contractor machinery, liquor liability for bars and restaurants, and data breach protection. Coverage accommodates Montana's trades, tourism and professional services businesses with limits up to $2 million when contracts require higher protection than standard $1 million.

Best Commercial Coverage Options in Montana

Average Monthly Cost of General Liability Insurance

$82This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$61This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

Above-average digital experience rating

consLower customer service ranking than other carriers

Ranks third to last in claims processing

Simply Business ranks second in Montana at $97 monthly ($1,163 annually), offering the state's widest coverage selection through 20+ carrier partnerships including Travelers (A++ rated). The digital marketplace delivers instant quotes in under 10 minutes, letting you compare specialized policies simultaneously. It's best for Montana businesses who want diverse carrier options and need specialized coverage beyond standard policies.

Simply Business averages $97 monthly ($1,163 annually), ranking fourth for overall affordability in Montana. You'll find competitive rates on general liability ($95 monthly, below Montana's $103 average) and business owner's policies ($145 monthly, near Montana's $146 average). Workers' compensation and professional liability rank mid-pack at sixth and fifth respectively, so businesses prioritizing these coverages may want to compare quotes across multiple carriers

Simply Business lets you compare quotes from 20+ carriers through one streamlined platform. The multi-carrier model excels at fast shopping but claims take longer to resolve since you work directly with your carrier, not Simply Business. Montana business owners seeking diverse coverage options will appreciate the marketplace convenience despite slower claims compared to direct insurers.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business connects you with 20+ carriers (including Travelers, CNA and Hiscox), accessing specialized coverage direct insurers don't offer. Add inland marine protecting contractor tools from job site theft, cyber insurance for businesses handling payment data, and professional liability shielding consultants from lawsuit costs. The marketplace matches Montana's trades, tourism and professional services businesses with carriers serving your industry.

How to Get the Best Cheap Small Business Insurance in Montana

Montana has the most small business employees in the U.S., and most owners deal with wildfires and strict workers' comp thresholds. Getting small business insurance that fits these scenarios means more than shopping for low rates.

- 1

Know what Montana requires versus what your business actually needs

Montana requires workers' comp from your first employee and 25/50/20 liability for work vehicles. Meeting these requirements won't help when your Bozeman landlord demands a general liability certificate or your Billings client refuses to sign without errors and omissions coverage. You'll need coverage the state doesn't require but your contracts depend on.

- 2

Cover Montana-specific risks that standard policies miss

Montana's 2024 wildfires burned 387,966 acres across western counties, forcing business closures even without direct damage. Standard business owner's policies provide minimal business interruption protection during Missoula evacuations. Contractors need inland marine coverage protecting tools and equipment from job site theft—a gap costing Montana businesses $15,000 to $25,000 on average.

- 3

Get quotes from Montana's top small business insurers

ERGO NEXT, The Hartford and Simply Business rank as the best small business insurance options across Montana's industries. If standard carriers turn you down due to claims history, Montana State Fund provides workers' comp as the backup option for coverage. The fund operates as both a competitive carrier and the insurer of last resort, ensuring all Montana employers can obtain required workers' comp.

- 4

Don't pick your provider based on the cheapest premium

Saving $25 monthly sounds good until Montana wildfires close your Missoula restaurant and you're waiting weeks for an adjuster while losing revenue. The 2024 fire season separated insurers who respond fast from those who leave you hanging. Ask how many adjusters each carrier maintains in Montana and typical claim resolution times before choosing the lowest price because both matter when something goes wrong.

- 5

Stack bundling and payment timing to reduce your insurance costs

Bundle general liability with property coverage into a business owner's policy to reduce what you pay across multiple policies. Pay your annual premium upfront instead of monthly to skip billing fees, which matter for Montana's seasonal tourism and hospitality businesses managing cash flow between May and September peak seasons. Claim-free discounts and safety program credits stack with these strategies to lower your business insurance costs.

- 6

Reassess coverage when your Montana business changes or expands

Opening a second location in Bozeman versus Great Falls means different insurance costs due to regional rate variations. Landing bigger contracts requiring $2 million general liability limits means increasing your coverage before you're underinsured. Add cyber liability protection if you're handling customer payment data as you grow.

Best Business Liability Insurance Montana: Bottom Line

ERGO NEXT and The Hartford tie for Montana's best small business insurance with top customer service and comprehensive coverage. The Hartford also ranks as the cheapest option at $83 monthly. Compare quotes from both providers, assess your Montana business risks like wildfire exposure and workers' comp from your first employee, then bundle coverage to cut costs. Choose based on whether you prioritize The Hartford's low rates or ERGO NEXT's digital tools.

Business Insurance Montana: FAQ

Small business owners in Montana often have questions about choosing the right business insurance. We answer the most common concerns below:

What business insurance do I need for my Montana business?

Montana requires workers' comp from your first employee and 25/50/20 commercial auto liability for work vehicles. Beyond legal requirements, get general liability when landlords or clients demand certificates before signing contracts. Compare quotes from ERGO NEXT, The Hartford and Simply Business to match coverage to your specific risks.

How much is small business insurance per month in Montana?

Coverage costs for your Montana business depend on your industry, claims history and employee count, but these are the monthly and annual averages by coverage type:

- General liability insurance: $103 monthly or $1,237 annually

- Workers' compensation insurance: $73 monthly or $878 annually

- Professional liability (E&O) insurance: $77 monthly or $926 annually

- Business owner's policy (BOP): $146 monthly or $1,758 annually

General liability vs. a BOP: which one do I need?

General liability covers customer injuries and property damage required by Montana landlords and clients. A BOP bundles general liability with commercial property. Choose general liability if you work from home with no business property, or get a BOP if you lease space or own equipment.

Do I need workers' comp in Montana if I have 1 employee (or seasonal/part-time help)?

Yes, Montana requires workers' comp from your first employee, including part-time and seasonal workers. Independent contractors need either their own coverage or an exemption certificate from Montana's Department of Labor. Contact Montana State Fund if standard carriers decline coverage due to claims history.

What do clients usually require? COI, additional insured and coverage limits?

Montana clients require certificates showing $1 million general liability per occurrence and $2 million aggregate, plus additional insured status. Professional services contracts often demand matching errors and omissions coverage. Request certificates from your insurer within 24 hours and verify additional insured endorsements appear on your policy before starting work.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Montana Department of Labor & Industry. "39-71-401. Employments covered and exemptions -- elections -- notice, MCA." Accessed February 7, 2026.

- Montana Department of Justice. "61-6-103. Motor vehicle liability policy minimum limits -- other requirements, MCA." Accessed February 7, 2026.

- Montana Governor's Office. "Governor Gianforte Praises DNRC for 2024 Fire Season Response." Accessed February 7, 2026.

- Montana State Fund. "Who is Covered." Accessed February 7, 2026.

- U.S. Small Business Administration Office of Advocacy. "2024 Small Business Profile: Montana." Accessed February 7, 2026.