ERGO NEXT leads Mississippi small business insurance providers with top customer service, competitive rates and strong coverage options. The Hartford and Simply Business also provide reliable choices for Mississippi business owners.

Best Small Business Insurance in Mississippi

Mississippi business owners choose ERGO NEXT, The Hartford and Simply Business for reliable coverage starting at $72 annually.

Get matched to the best Mississippi commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers the best small business insurance in Mississippi with top customer service and strong coverage options.

The Hartford offers the cheapest small business insurance in Mississippi at $84 monthly ($1,013 annually).

Compare small business insurance coverage options, assess your risks and maximize discounts to find the right fit.

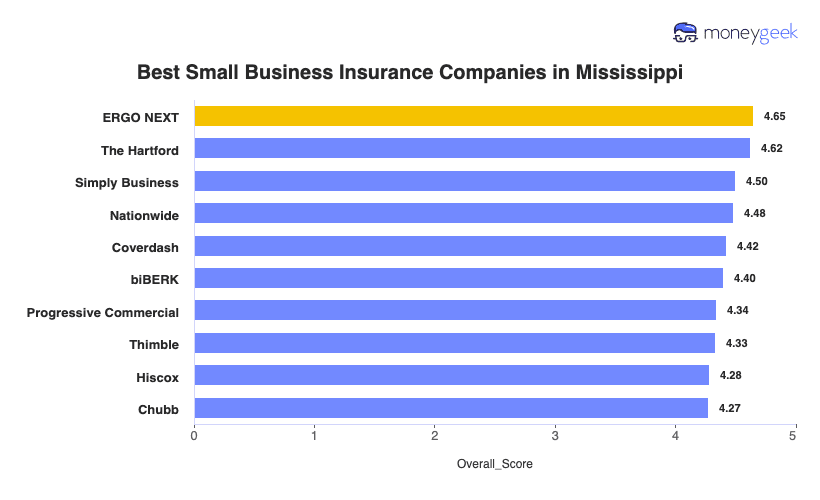

Best Small Business Insurance Companies in Mississippi

| ERGO NEXT | 4.65 | $100 | 1 | 2 |

| The Hartford | 4.62 | $84 | 2 | 3 |

| Simply Business | 4.50 | $97 | 5 | 1 |

| Nationwide | 4.48 | $102 | 2 | 4 |

| Coverdash | 4.42 | $101 | 6 | 2 |

| biBERK | 4.40 | $105 | 2 | 5 |

| Progressive Commercial | 4.34 | $100 | 7 | 5 |

| Thimble | 4.33 | $94 | 8 | 5 |

| Hiscox | 4.28 | $108 | 4 | 6 |

| Chubb | 4.27 | $119 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Find the best or cheapest small business insurer in Mississippi for your coverage type below:

Best Mississippi Business Insurance

Average Monthly Cost of General Liability Insurance

$104This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$69This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first in Mississippi for customer service, with exceptional support and claims handling

Offers comprehensive coverage options for both common and specialized business needs

Simple digital platform makes policy management and claims processing efficient

consFinancial stability ranking falls outside the top five in Mississippi

Limited physical locations may restrict in-person service options

ERGO NEXT ranks first in MoneyGeek's Mississippi study at $100 monthly, and leads the state providers in customer service. Its digital platform delivers same-day coverage and instant certificate generation, backed by an A- (Excellent) AM Best rating. ERGO NEXT is best for Mississippi businesses needing fast policy setup and 24/7 mobile access.

ERGO NEXT costs $100 monthly ($1,205 annually) and leads Mississippi in workers' comp pricing at $69 monthly. The insurer's professional liability rates rank second-best statewide at $73 monthly, beating the $78 state average. General liability costs $104 monthly (matching the state average), while BOP runs $156 monthly—compare other providers for potential bundled savings.

ERGO NEXT ranks first in Mississippi for customer experience, earning the nation's highest digital score for instant mobile policy management. Claims processing ranks fourth statewide, which is solid performance but not industry-leading. Some customers report difficulty reaching human support for complex claim questions despite strong app functionality.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT covers Mississippi contractors, consultants and food services with same-day protection against customer injuries, professional errors and employee accidents. Policies provide $1 million in liability coverage with instant certificate generation for contract requirements. Specialized industries like aviation or hazardous materials may need alternative providers, so verify eligibility online before applying.

Cheapest Mississippi Business Insurance

Average Monthly Cost of General Liability Insurance

$82This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$70This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks first in Mississippi for affordability with competitive premium rates

Over 200 years of experience providing business insurance solutions

Excellent financial stability ensures reliable claim payments

consOnline quote process can be lengthy compared to newer competitors

May not offer some specialized coverage options for unique business needs

The Hartford ranks second overall in MoneyGeek's Mississippi study while offering the state's lowest rates at $84 monthly ($1,013 annually). Founded in 1810 with an A+ AM Best financial rating, the company combines proven stability with competitive pricing. It's best for Mississippi businesses prioritizing budget-friendly coverage from a financially strong provider with over 200 years of experience.

The Hartford leads Mississippi across three coverage types: general liability at $82 monthly (vs. $104 average), professional liability at $71 monthly (vs. $78 average) and BOPs at $114 monthly (vs. $148 average). Workers' comp costs $70 monthly, ranking second-best and matching the $74 state average. You'll save significantly on most coverage types compared to competitors.

The Hartford ranks second nationally for customer service with a 4.55 score, earning first place for claims processing. That means faster resolutions when filing claims. The company's digital experience ranks last among Mississippi competitors, indicating stronger phone support than online tools. Some customers report billing issues and complex cancellation processes despite excellent claims handling.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford covers over 60 industries with employment practices liability that automatically includes wage and hour defense, valuable protection for Mississippi contractors, food services and retail businesses managing employees. Liability limits from $300,000 to $2 million let you meet most contract and lease requirements. Mississippi businesses can't purchase BOPs, and some specialized products vary by state, so confirm availability for your location.

Best Commercial Coverage Options in Mississippi

Average Monthly Cost of General Liability Insurance

$96This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$71This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Provider

4.0/5

- pros

Ranks first in Mississippi for coverage options, offering extensive policy customization

Provides an easy-to-use online marketplace to compare multiple insurance quotes

Partners with multiple A-rated insurance carriers for diverse coverage options

consCustomer service ranks fifth in the state, indicating room for improvement

Middle-tier financial stability rating may concern some business owners

Simply Business ranks third overall in MoneyGeek's Mississippi study at $97 monthly as a digital insurance marketplace partnering with over 20 top-rated carriers. The platform streamlines comparison shopping by eliminating traditional agent commissions while connecting you to multiple A-rated insurers. It's best for Mississippi businesses who want to compare coverage options from multiple providers in one place.

Simply Business costs $97 monthly ($1,170 annually) with rates varying by carrier and coverage type. General liability ranks second-best at $96 monthly (vs. $104 average), saving you $8 monthly compared to the state average. Workers' comp costs $71 monthly and professional liability runs $76 monthly because both slightly above state averages, so compare multiple carriers through the platform.

Simply Business ranks third nationally for digital experience, offering streamlined quote comparisons and policy management through one platform. Customer service scores 4.0, ranking sixth in Mississippi as its multi-carrier model means support quality varies by your chosen insurer. The platform excels at price transparency but relies on partner carriers for claims handling and ongoing service.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business partners with over 20 carriers including Travelers, Hiscox and CNA, giving Mississippi contractors, consultants and online retailers access to specialized policies single insurers can't match. The platform earned selection for Amazon's Insurance Accelerator Program, offering e-commerce businesses product liability coverage formatted for Amazon's requirements. Coverage breadth ranks first statewide, matching you with carriers that understand your specific industry.

Get Matched to the Best Small Business Insurance Providers in Mississippi

Select your industry and state to get a customized quote for your Mississippi business.

How to Get the Best Cheap Small Business Insurance in Mississippi

Mississippi businesses have unique risks: storm surges, tornado outbreaks and a more lenient threshold for workers' compensation. Getting small business insurance that covers these threats requires more than comparing premiums.

- 1

Know Mississippi's legal mandates and actual business protection needs

Mississippi law requires workers' compensation from your fifth employee and 25/50/25 commercial auto liability for work vehicles. Meeting these mandates won't protect you when Gulfport landlords demand general liability certificates before leasing retail space or Jackson clients refuse contracts without professional liability coverage. These are small coverage types your business needs but Mississippi doesn't require.

- 2

Cover risks unique to your Mississippi business

Gulf Coast casinos and Biloxi restaurants need liquor liability coverage since Mississippi holds establishments liable for patron overservice injuries. Agricultural operations lose $50,000 annually to equipment theft, requiring a tools and equipment policy to protect tractors and tools commercial property won't cover. Over 20% of flood claims occur outside high-risk zones, making flood insurance critical statewide.

- 3

Get quotes from budget leaders and Mississippi's backup option

ERGO NEXT, The Hartford and Simply Business are the top small business insurance companies in Mississippi across 79 major industries. If your claims history or high-risk classification blocks standard carriers, Mississippi participates in the NCCI assigned risk pool where you'll pay more but meet legal requirements. Get standard market quotes first since assigned risk locks you in for the full policy term.

- 4

Don't make low premiums your sole basis for choosing a provider

A Biloxi restaurant owner saved $400 annually choosing the cheapest business liability insurance, then waited 8 weeks for an adjuster after the March 2023 tornado outbreak while losing $3,000 weekly in business interruption revenue. Mississippi's 108 billion-dollar disasters since 1980 separate fast-paying insurers from slow ones. Ask providers: "How many adjusters cover Mississippi and what's your average claim resolution time?"

- 5

Trim premiums without cutting coverage that matters

Pay your annual premium upfront to save $180 to $250 in monthly billing fees, which is meaningful savings when you're already carrying Mississippi's mandatory workers' comp and commercial auto policies. Adding a second coverage type to create a business owner's policy cuts your combined cost 20% to 30%. Skip coverage you don't need: if you work from home with no clients visiting, you won't need general liability.

- 6

Reassess coverage when your Mississippi business changes or expands

Your $500,000 general liability limit worked fine until you landed a $2 million contract requiring higher limits. Expanding from Jackson to Biloxi means adding flood coverage you didn't need inland. Hiring employees triggers workers' comp at 5 employees, but you'll need employment practices liability insurance sooner if you want protection from wrongful termination claims. Review your business insurance costs when business changes, not after you're underinsured.

Best Business Liability Insurance Mississippi: Bottom Line

The Hartford offers Mississippi's cheapest small business insurance at $84 monthly, while ERGO NEXT ranks first for customer service and coverage strength. Compare Mississippi business insurance quotes from both providers plus Simply Business, assess your risks across general liability, workers' comp and business owner's policies, then maximize discounts to protect your operation at the right price.

Business Insurance Mississippi: FAQ

Small business owners in Mississippi often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need for my small business in Mississippi (and what can I skip for now)?

Mississippi law requires workers' compensation from your fifth employee and commercial auto insurance for work vehicles. Landlords demand general liability certificates before leasing space, and clients refuse contracts without professional liability coverage. Skip business interruption or inland marine coverage until you've got physical inventory or expensive equipment to protect.

How much does small business insurance cost per month in Mississippi?

Coverage costs for your Mississippi business depend on your industry, employee count and claims history, but these are the monthly and annual averages by coverage type:

- General liability insurance: $104 monthly or $1,248 annually

- Workers' compensation insurance: $74 monthly or $886 annually

- Professional liability (E&O) insurance: $78 monthly or $934 annually

- Business owner's policy (BOP): $148 monthly or $1,780 annually

What do I need to get a COI that meets my Mississippi landlord or client's requirement?

Request a certificate of insurance (COI) from your insurer showing $1 million per occurrence and $2 million aggregate general liability limits. That's the standard most Mississippi landlords and clients require. Your insurer generates COIs within 24 hours at no cost. Ask your client or landlord for their exact coverage requirements before ordering to avoid delays.

Do I need workers' comp in Mississippi if I have 5 employees (or use 1099 contractors)?

Mississippi requires workers' compensation insurance starting with your 5th employee. Independent contractors (1099 workers) don't count toward this threshold, but misclassifying employees as contractors risks penalties. If you hire your 5th W-2 employee, you'll need coverage immediately. Contact three Mississippi insurers for quotes before hitting this threshold—don't wait until you're legally required.

If I use my car or truck for work in Mississippi, do I need commercial auto? Or will my personal policy cover it?

Personal auto insurance excludes business use, so if you transport clients, deliver goods or visit job sites, you'll need commercial auto coverage. Mississippi requires 25/50/25 liability minimums for all work vehicles. Your personal insurer will deny claims for accidents during business activities. Switch to commercial auto insurance before using your vehicle for work to avoid coverage gaps.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Federal Emergency Management Agency. "Everything You Need to Know About Flood Insurance (NFIP)." Accessed February 8, 2026.

- Mississippi Insurance Department. "Auto Insurance." Accessed February 8, 2026.

- Mississippi Insurance Department. "Mississippi Workers' Compensation Claims Guide." Accessed February 8, 2026.

- National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters: State Summary - Mississippi." Accessed February 8, 2026.

- National Council on Compensation Insurance. "Voluntary Compensation Assigned Risk Pool (VCAP) FAQs." Accessed February 8, 2026.

- National Hurricane Center. "Storm Surge Overview." Accessed February 8, 2026.

- National Weather Service Jackson. "Tornadoes." Accessed February 8, 2026.