ERGO NEXT leads our Maryland business insurance analysis with excellent customer service, competitive rates and comprehensive coverage. The Hartford and Simply Business are also strong choices for business owners in the Old Line State.

Best Small Business Insurance in Maryland

Maryland's top business insurers, ERGO NEXT, The Hartford and Simply Business, offer coverage starting at just $6 monthly.

Get matched to the best Maryland commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers Maryland's best small business insurance with top customer service scores and comprehensive coverage ranking second.

The Hartford offers the cheapest small business insurance in Maryland at $80 monthly ($959 annually).

Finding the right small business insurance coverage means assessing your risks, comparing quotes and using available discounts.

Get Matched to the Best Small Business Insurance Providers in Maryland

Select your industry and state to get a customized quote for your Maryland business.

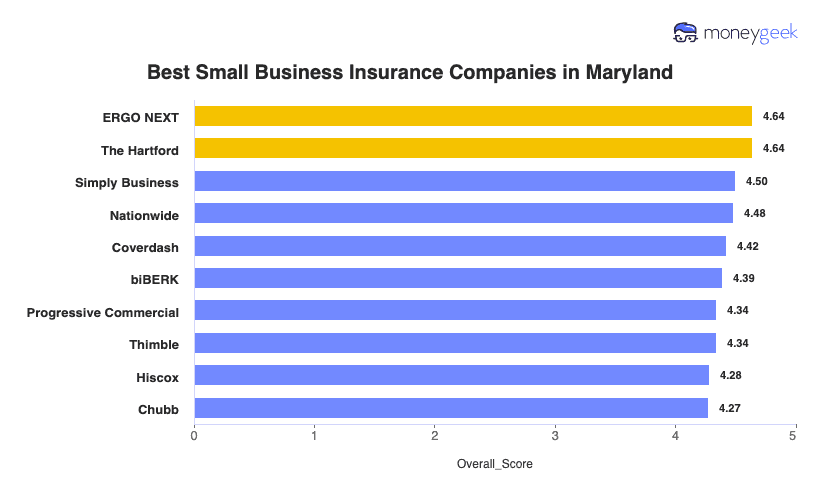

Best Small Business Insurance Companies in Maryland

| ERGO NEXT | 4.64 | $95 | 1 | 2 |

| The Hartford | 4.64 | $80 | 2 | 3 |

| Simply Business | 4.50 | $92 | 5 | 1 |

| Nationwide | 4.48 | $96 | 2 | 4 |

| Coverdash | 4.42 | $96 | 6 | 2 |

| biBERK | 4.39 | $100 | 2 | 5 |

| Progressive Commercial | 4.34 | $95 | 7 | 5 |

| Thimble | 4.34 | $89 | 8 | 5 |

| Hiscox | 4.28 | $103 | 4 | 6 |

| Chubb | 4.27 | $112 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Discover the best or cheapest business insurer in Maryland for your desired coverage type in our resources below:

Best Maryland Business Insurance

Average Monthly Cost of General Liability Insurance

$98This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first in Maryland for customer service, with excellent support and claims handling

Offers comprehensive coverage options focused on small business needs

User-friendly digital platform enables instant coverage and easy policy management

consRanks sixth for financial stability, suggesting potential long-term reliability concerns

Limited physical presence may challenge customers who prefer in-person service

ERGO NEXT ranks first in Maryland with a 4.64 MoneyGeek score, averaging $95 monthly across all coverage types. Its digital-first platform delivers instant certificates of insurance and 24/7 policy access, critical for contractors and service businesses that need certificates of insurance quickly for client contracts. ERGO NEXT works best for Maryland businesses prioritizing responsive customer service and fast online tools over in-person agent support.

ERGO NEXT averages $95 monthly ($1,140 yearly) with workers' comp rates of $66 monthly, $4 below Maryland's $70 average, reducing annual payroll costs for employers. Professional liability costs $70 monthly, keeping coverage affordable for Maryland's consulting and tech sectors while ranking second statewide. Business owner's policies run $148 monthly, $8 above the state average, so compare BOP quotes from The Hartford or Simply Business.

ERGO NEXT ranks first nationally for digital experience (4.70 score), meaning you can generate certificates instantly through its mobile app without calling an agent. Customer service scores rank fourth nationally, indicating longer wait times or fewer resolution options compared to top-ranked competitors. Claims processing also ranks fourth, suggesting some customers experience delays when filing claims so check recent Trustpilot reviews for current claim handling feedback.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT protects against customer injuries, employee accidents, professional mistakes and equipment theft across seven coverage types for over 1,300 Maryland business categories. Cyber liability and data breach protection cover technology firms and consultants handling federal contracts common near DC and Baltimore. Add-ons like liquor liability, tools coverage and employment practices liability fill gaps for restaurants serving alcohol, contractors with expensive equipment and growing employers.

Cheapest Maryland Business Insurance

Average Monthly Cost of General Liability Insurance

$78This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$67This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Maryland's most affordable business insurance rates

Fast claim approvals with responsive customer service

Strong financial stability ensures claims get paid

Deep understanding of small business risks

consMobile app can't manage all policy tasks

Agent required for some transactions

Fewer specialty coverages than competitors

The Hartford delivers Maryland's lowest business insurance costs at $80 monthly while maintaining exceptional claims support. Its A+ Superior financial rating means your claims get paid promptly, even during economic downturns. You'll work with agents instead of managing everything online, but gain expertise in COI processing and Maryland small business requirements that contractors and professional services depend on.

Maryland businesses save $192 yearly with The Hartford, paying $959 compared to the state's $1,151 average. General liability delivers the most savings at $252 annually, freeing cash for equipment or payroll. Workers' compensation costs slightly more than competitors but business owner policies rank cheapest statewide.

The Hartford resolves claims faster than competitors, ranking first nationally with expert handlers who walk you through filing and explain what coverage applies. Phone support delivers quick answers but you cannot change policies or manage certificates through the mobile app, requiring agent contact for routine updates. Agents understand Maryland licensing requirements and help contractors navigate state compliance for commercial projects.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford includes employment practices liability up to $25,000 in its business owner policy, covering wage dispute defense costs that most Maryland insurers charge separately. Professional liability protects consultants and contractors from client lawsuits over service mistakes or missed project deadlines. You can bundle data breach coverage for businesses handling customer information like restaurants or retail shops.

Best Commercial Coverage Options in Maryland

Average Monthly Cost of General Liability Insurance

$78This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$67This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first in Maryland for coverage options, offering extensive business protection plans

Provides an easy-to-use online marketplace to compare multiple insurance quotes

Specializes in customized policies for small businesses across various industries

consCustomer service ranks fifth in Maryland, suggesting room for improvement in support quality

Falls in the middle range for financial stability compared to competitors

Simply Business ranks third in Maryland with a 4.5 MoneyGeek score, operating as a digital marketplace that compares quotes from over 20 A-rated carriers. At $92 monthly across coverage types, it connects you with multiple insurers simultaneously, saving time for busy Maryland business owners who want options without calling individual agents. Simply Business works best for businesses comparing rates across carriers and prioritizing coverage breadth over single-insurer relationships.

Simply Business averages $92 monthly ($1,104 yearly) with general liability at $91 monthly. That's $8 below Maryland's $98 average, delivering savings for retail shops and service businesses. Workers' comp costs $67 monthly, running $3 below the state average and ranking third statewide. Professional liability runs $73 monthly, slightly above Maryland's $74 average, so consultants and tech firms should compare quotes from ERGO NEXT or The Hartford for E&O coverage.

Simply Business ranks third nationally for digital experience, meaning you can compare multiple carrier quotes through one streamlined platform without separate applications. Customer service ranks fifth in Maryland, indicating longer response times compared to ERGO NEXT or The Hartford when you need phone support. Claims processing scores eighth nationally, suggesting some delays when filing claims since you work through the underlying carrier, not Simply Business directly.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business ranks first in Maryland for coverage breadth, connecting you with specialized policies for contractors needing tools coverage, restaurants requiring liquor liability and tech firms handling cyber risks. Its marketplace compares general liability, professional liability and workers' compensation terms from multiple carriers. That helps you find lower deductibles, higher limits or industry-specific endorsements. Coverage options include pollution liability for Baltimore harbor operations and EPLI for growing Maryland employers.

How to Get the Best Cheap Small Business Insurance in Maryland

Maryland small business owners deal with Chesapeake Bay flooding, brutal winter storms and some of the strictest workers' comp rules in the country. Getting business insurance that covers these risks takes more than shopping for the lowest price.

- 1

Know what Maryland law requires versus what protects your business

Maryland law requires workers' compensation from your first hire, 30/60/15 liability minimums for work vehicles and $50,000 in general liability for licensed contractors. Cover what the law requires, then add what your business actually needs, like professional liability coverage, which isn't state-mandated but most clients require before they sign commercial contracts.

- 2

Address hazards unique to your Maryland operation

Chesapeake Bay flooding hit Baltimore and Annapolis with 12 and 11 high-tide flood days in 2023 and standard commercial property policies exclude flood damage entirely. Small businesses with business interruption coverage stay financially stable when winter ice storms force closures across the Baltimore-Washington corridor, covering lost revenue while you can't operate. Without these coverage types, you absorb losses that could bankrupt a small operation.

- 3

Don't skip Maryland's assigned risk option when shopping rates

Start with ERGO NEXT, The Hartford and Simply Business for standard market quotes. If carriers reject you because of high-risk operations or past claims, Chesapeake Employers' Insurance provides workers' compensation through Maryland's assigned risk pool. Expect premiums 25% to 50% higher than standard rates, but coverage beats the penalties Maryland imposes for operating uninsured (fines start at $1,000 and climb fast).

- 4

Don't make low premiums your only priority

The cheapest Maryland business insurance won't help if it takes weeks to process claims. The 2024 winter ice storms separated responsive carriers from slow ones across the Baltimore-Washington corridor. Ask providers about their Maryland adjuster count and claim resolution times, as both deliver value when you need it the most.

- 5

Stack bundling discounts with Maryland safety incentives

Bundle general liability with commercial property in a business owner's policy cuts your combined premiums 20% to 30%. Pay your full annual premium upfront instead of monthly to avoid $200 to $400 in installment fees. Maryland insurers reward claim-free years and safety training completion, and these discounts compound when you stack them together over time.

- 6

Reassess your policies after Maryland growth milestones

Maryland's one-employee workers' compensation threshold triggers mandatory coverage when you hire. Expanding from Baltimore to the Eastern Shore means different premium rates, since Montgomery County businesses pay 18% to 32% more than rural areas. Landing contracts with federal agencies often requires $2 million aggregate limits. Review your business insurance costs before growth happens, not after you're already committed and exposed.

Best Business Liability Insurance Maryland: Bottom Line

ERGO NEXT leads Maryland with top customer service and comprehensive coverage, while The Hartford offers the most affordable rates at $80 monthly. Compare quotes, assess your risks and use available discounts to find the right coverage for your business.

Business Insurance Maryland: FAQ

Small business owners in the Hawkeye State often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need for my small business in Maryland?

Maryland law requires workers' compensation from your first hire, 30/60/15 commercial auto minimums for work vehicles and $50,000 in general liability for licensed contractors. Add professional liability when clients demand proof before signing contracts, and consider business interruption coverage if winter storms or Chesapeake Bay flooding could shut down your operation.

How much does small business insurance cost in Maryland?

Coverage costs for your Maryland business depend on your industry, but these are the monthly and annual averages by coverage type:

- General liability insurance: $99 monthly or $1,185 annually

- Workers' compensation insurance: $70 monthly or $842 annually

- Professional liability (E&O) insurance: $74 monthly or $889 annually

- Business owner's policy (BOP): $140 monthly or $1,686 annually

What should I buy first: general liability, a BOP, workers' comp or professional liability?

Start with what Maryland law mandates: workers' compensation if you have employees and commercial auto if you use work vehicles. If neither applies, buy general liability first since Baltimore landlords and clients demand it before signing leases or contracts. Add a BOP when you need both general liability and property coverage together.

Who has the best small business insurance in Maryland?

ERGO NEXT leads Maryland with top customer service scores and comprehensive coverage options ranking second overall. The Hartford offers the most affordable rates at $80 monthly while maintaining strong claims service. Simply Business provides the broadest coverage selection, ranking first for policy options. Your best choice depends on whether you prioritize service, cost or coverage variety.

How do I get a COI fast, and what does "additional insured" mean?

Choose insurers like ERGO NEXT that issue certificates of insurance instantly through their online platforms, like waiting days for paperwork costs you deals. "Additional insured" extends your liability coverage to protect your client or landlord when they're named on your policy. Request this endorsement when signing contracts or leases requiring proof of insurance.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.