ERGO NEXT leads Kentucky's small business insurance with the highest customer service ranking, strong coverage options and competitive rates. The Hartford and Simply Business offer solid alternatives for Kentucky business owners seeking affordable protection.

Best Small Business Insurance in Kentucky

Kentucky's top business insurance options include ERGO NEXT, The Hartford and Simply Business with coverage starting at $68 annually.

Get matched to the best Kentucky commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers the best small business insurance in Kentucky with top customer service and strong coverage options.

The Hartford offers the cheapest small business insurance in Kentucky at $83 monthly ($996 annually).

Compare quotes across small business insurance coverage types to match your risks and budget.

Get Matched to the Best Small Business Insurance Providers in Kentucky

Select your industry and state to get a customized quote for your Kentucky business.

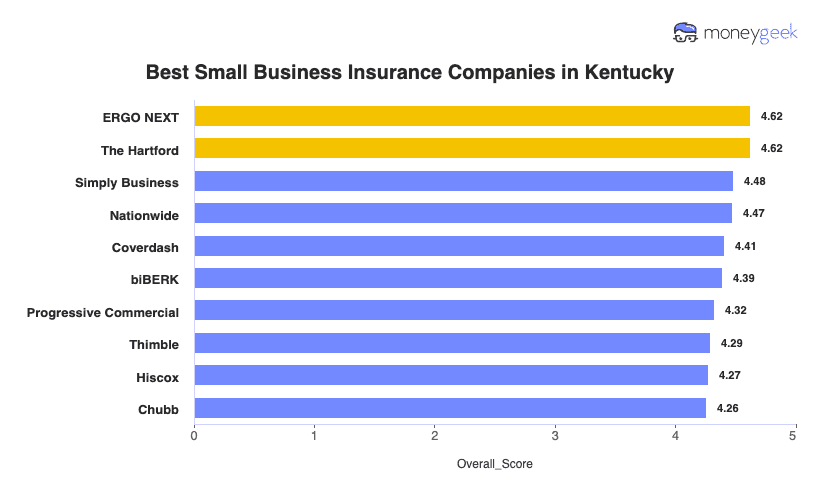

Best Small Business Insurance Companies in Kentucky

| ERGO NEXT | 4.62 | $84 | 1 | 2 |

| The Hartford | 4.62 | $83 | 2 | 3 |

| Simply Business | 4.48 | $90 | 5 | 1 |

| Nationwide | 4.47 | $95 | 2 | 4 |

| Coverdash | 4.41 | $94 | 6 | 2 |

| biBERK | 4.39 | $97 | 2 | 5 |

| Progressive Commercial | 4.32 | $92 | 7 | 5 |

| Thimble | 4.29 | $88 | 8 | 5 |

| Hiscox | 4.27 | $101 | 4 | 6 |

| Chubb | 4.26 | $110 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Discover the best or cheapest business insurer in Kentucky for your desired coverage type in our resources below:

Best Kentucky Business Insurance

Average Monthly Cost of General Liability Insurance

$82This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$64This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first in Kentucky for customer service with highly responsive support team

Offers extensive coverage options for various business types and sizes

Digital-first approach enables quick policy quotes and easy claims processing

consMobile app functionality lags behind some competitors

Limited physical office locations for in-person support

You'll get answers fast when problems arise with ERGO NEXT's first-ranked Kentucky customer service, plus instant online quotes that let you purchase coverage today instead of waiting days. ERGO NEXT ties for first place statewide at $84 monthly but ranks fourth nationally for claim processing. It works best for Kentucky businesses needing quick setup and reliable support between claims.

ERGO NEXT saves Kentucky businesses money on essential coverage, charging the lowest rates statewide for general liability at $82 monthly ($14 below average) and workers' compensation at $64 monthly ($5 below average). You'll pay slightly more for BOP at $124 monthly but less for professional liability at $68 monthly. At $84 monthly overall, ERGO NEXT fits tight small business budgets.

When you need help, ERGO NEXT's first-ranked customer service gets you answers quickly, and its digital experience score means you'll generate certificates instantly without phone calls or paperwork delays. Claims take longer to resolve than competitors though, ranking fourth nationally. You'll love the daily support but may get frustrated waiting for claim payments.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT handles all your coverage needs with one provider through seven policy types protecting you from customer injuries, employee claims and professional mistakes, eliminating the hassle of managing multiple insurers. Standard $1 million aggregate limits meet most Kentucky lease and contract requirements. Whether you run a Louisville food truck or Lexington consulting firm, you'll manage everything online.

Cheapest Kentucky Business Insurance

Average Monthly Cost of General Liability Insurance

$84This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Kentucky's most affordable business insurance

A+ (Superior) AM Best financial strength rating

Top-ranked claims process and customer service

More than 200 years in business

consWeak digital tools (ranks 10th nationally)

Not available in Alaska or Hawaii

The Hartford offers Kentucky's lowest rates at $83 monthly ($996 annually) for small businesses. When your employee gets injured on the job or a customer sues over a slip-and-fall, you'll reach experienced claim handlers by phone who resolve cases without delays. Its A+ financial rating and 215-year history mean large claims get paid reliably.

The Hartford costs $83 monthly ($996 annually) for Kentucky small businesses, beating state averages across most coverage types. You'll save $155 annually on general liability and $80 on professional liability. Business owner's policies cost $20 more monthly than Kentucky's cheapest option but remain below most competitors.

The Hartford ranks first nationally for claims processing and customer service. Kentucky business owners reach experienced claim handlers by phone who move cases forward quickly when disputes arise. Digital tools rank 10th, with limited mobile app features and challenges managing policies online. Best suited for business owners who prefer talking to knowledgeable representatives over self-service platforms.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford includes up to $25,000 of employment practices liability insurance (EPLI) in its business owner's policy at no extra cost, protecting Kentucky businesses from wrongful termination and discrimination claims without separate coverage. You can bundle professional liability and cyber breach protection into your business owner's policy, simplifying coverage for consultants and service businesses. Coverage scales from $300,000 for lower-risk operations to $2 million for contractors and trades needing higher protection.

Best Commercial Coverage Options in Kentucky

Average Monthly Cost of General Liability Insurance

$84This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first in Kentucky for coverage options, offering extensive policy customization

Places second overall among Kentucky business insurance providers

Provides an easy-to-use online marketplace to compare multiple insurance quotes

consLower customer service ranking than other carriers

Ranks third to last in claims processing

At $90 monthly, Simply Business's online marketplace lets you compare multiple quotes in one place and customize policies across 65+ industries without calling each insurer separately. It ranks second overall in Kentucky but customer service lags behind competitors. Simply Business works best for Kentucky businesses that prioritize coverage choices over phone support.

At $90 monthly ($1,082 annually), Simply Business fits mid-range budgets with the best value in general liability at $89 monthly, saving you $7 compared to Kentucky's average. BOP runs near the state average at $134 monthly, while workers' compensation costs slightly more at $66 monthly. You'll save most on essential liability coverage but pay a bit extra for workers' comp.

Simply Business's marketplace platform earns praise for easy quote comparisons, but you'll encounter extended hold times and phone support challenges that drop it to seventh nationally for overall customer experience. Claims processing ranks eighth, meaning slower resolutions when you file. You'll love shopping for coverage but may struggle getting help when problems arise.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business shields Kentucky restaurants from wrongful termination lawsuits, protects contractors from data breaches and covers 65+ other industries with specialized policies tailored to your specific risks. You'll find both essential coverage like general liability and workers' compensation plus niche protection options. Some specialized coverages have limited availability in certain Kentucky regions.

How to Get the Best Cheap Small Business Insurance in Kentucky

Getting business insurance for your Kentucky small business means knowing what landlords require versus what protects you from actual risks. These steps help you find coverage that handles what can go wrong.

- 1

Understand what Kentucky requires vs what protects your business

Kentucky law requires workers' compensation from your first hire and commercial auto at 25/50/25 minimums if you drive for work. Both are non-negotiable. General liability isn't legally required, but landlords demand $1 million before handing over keys and clients won't sign contracts without your certificate of insurance (COI). Legal requirement or not, you need it.

- 2

Identify risks specific to your Kentucky industry

Louisville restaurants lose entire walk-ins when tornado season knocks out power for days and spoilage coverage protects that inventory loss. Contractors hauling tools between Lexington jobsites get equipment stolen from trucks so get inland marine, which covers gear outside your shop. Bourbon distillers need fire coverage for aging warehouses stacked with flammable barrels.

- 3

Compare standard carriers and Kentucky specialty programs

Start with ERGO NEXT, The Hartford and Simply Business, since all three offer online quotes in minutes. If you do roofing, run a bar near Ohio River flood zones or have past claims, standard carriers may decline you. Surplus carriers step in but charge more for the same coverage.

- 4

Prioritize claims service over lowest premiums

Call each insurer's claims line at 2 p.m. on a weekday and time your wait. When tornadoes knock out businesses across your county, you compete with hundreds of other owners for help. ERGO NEXT lets you file claims through its app instantly, while The Hartford assigns adjusters who've handled Kentucky tornado damage.

- 5

Maximize savings through bundling and Kentucky discounts

Bundle general liability with commercial property in a business owner's policy (BOP) to pay 20% to 30% less than buying separately. Pay annually instead of monthly to avoid installment fees adding hundreds yearly. After 12 months with no claims, ask about renewal discounts.

- 6

Reassess coverage after major business changes

If your new lease requires $2 million but you have $1 million, you're not compliant. Equipment purchases need updated limits. Hiring a second employee adjusts your workers' comp premium immediately. The 2021 Mayfield tornado exposed how underfunded business interruption coverage forces closures. Review your business insurance costs after major changes.

Best Business Liability Insurance Kentucky: Bottom Line

ERGO NEXT, The Hartford and Simply Business lead Kentucky's small business insurance market, but the right provider depends on your industry risks and how many employees you have. Compare each company's claims handling, stack available discounts and choose coverage that protects your business within budget.

Best Small Business Insurance Kentucky: FAQ

Small business owners in the Bluegrass State often have questions about finding the right business insurance. We answer the most common concerns below:

Is business insurance required in Kentucky?

Workers' compensation is required from your first hire. There no exceptions, even for part-timers. Commercial auto needs 25/50/25 minimums for business driving. General liability isn't legally required, but landlords and clients won't work with you without it.

What insurance do I need for my small business in Kentucky?

Get general liability first since landlords require $1 million before handing over keys. Add workers' compensation when hiring your first employee. Restaurants need spoilage coverage for tornado-related power outages; contractors need inland marine for stolen tools.

How much does small business insurance cost in Kentucky?

How much coverage costs for your Kentucky business depend on your industry, but these are the monthly and annual averages by coverage type:

- General liability insurance: $96 monthly or $1,151 annually

- Workers' compensation insurance: $69 monthly or $825 annually

- Professional liability (E&O) insurance: $73 monthly or $870 annually

- Business Owner's Policy (BOP): $137 monthly or $1,639 annually

My landlord/client wants proof. How do I get a COI and what should it include?

Request a certificate of insurance (COI) from your insurer (ERGO NEXT emails them instantly through its app). Your COI shows coverage types, $1 million liability limit and names your landlord as certificate holder. Most landlords and clients require this before signing contracts.

Who are the best small business insurance companies in Kentucky, and how do I compare them?

ERGO NEXT and The Hartford tie for first. While ERGO NEXT leads customer service with instant claims, The Hartford costs least at $83 monthly. Simply Business ranks second with the most coverage options.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.