Nationwide earns our top rating for restaurant business insurance with a MoneyGeek score of 4.8 out of 5. The company combines competitive rates with quality customer service, making it ideal for restaurant owners seeking affordable coverage without sacrificing support. The Hartford and Coverdash also offer strong options for restaurateurs comparing policies.

Best Restaurant Business Insurance

Nationwide, The Hartford and Coverdash offer the best cheap business insurance for restaurants, with rates starting at $59 monthly.

Get matched to the best business insurance provider for restaurant business owners.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Restaurants need different types of business insurance for employee and customer protection, like workers' comp, general liability, liquor liability and commercial property.

Nationwide is the best business insurance provider for restaurants with a 4.8 MoneyGeek score and offering competitive rates with quality customer service.

Nationwide provides the cheapest business insurance at $92 monthly, with workers' comp coverage starting at $70 monthly for restaurant owners.

Best Business Insurance for Restaurants

| Nationwide | 4.80 | $92 |

| The Hartford | 4.68 | $102 |

| Coverdash | 4.60 | $98 |

| ERGO NEXT | 4.41 | $141 |

| Simply Business | 4.40 | $126 |

| Chubb | 4.30 | $155 |

| Progressive Commercial | 4.30 | $127 |

| Thimble | 4.20 | $136 |

| Hiscox | 4.20 | $137 |

| biBERK | 4.20 | $161 |

Note: We based all scores on a restaurant business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Restaurant Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for restaurateurs, check out the following resources:

1. Nationwide: Best and Cheapest Overall for Restaurant Businesses

Lowest rates for general liability and BOP coverage

A+ financial strength rating from AM Best

Customer service ranked third nationally

Specialized restaurant expertise

Digital experience lags behind competitors

Enrollment often requires speaking with an agent

Professional liability and workers' comp costs rank ninth

For restaurant owners and restaurateurs, Nationwide offers the most competitive rates for general liability and business owner's policy insurance, starting at $92 per month, while earning our second-highest customer service ranking. It has an A+ (Superior) rating from AM Best.

Nationwide insures over half a million food service businesses and understands restaurant-specific risks. Its Gold and Platinum endorsements cover food contamination, equipment breakdown, utility service loss and accounts receivable.

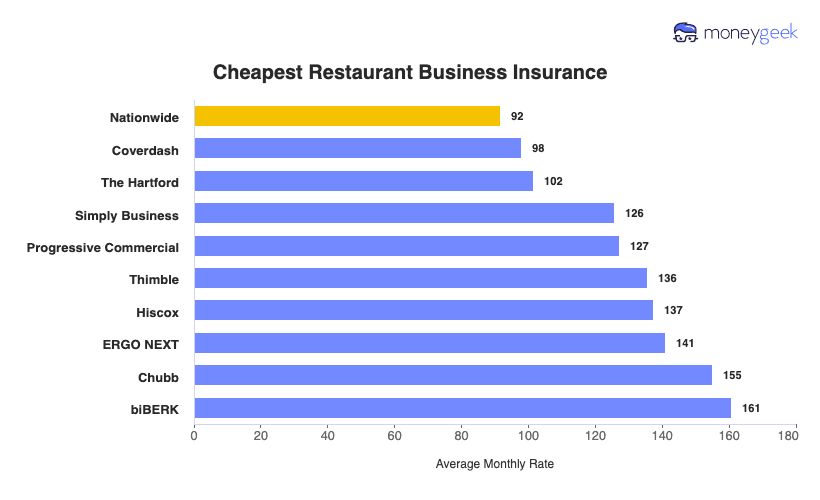

Cheapest Business Insurance for Restaurant Business Owners

Nationwide offers the cheapest restaurant business insurance at $92 monthly ($1,098 annually) and leads in general liability and business owner's policy coverage. Restaurant owners seeking workers' compensation should compare rates from ERGO NEXT, The Hartford and Thimble, while The Hartford offers the most affordable professional liability coverage.

| Nationwide | $92 | $1,098 |

| Coverdash | $98 | $1,174 |

| The Hartford | $102 | $1,218 |

| Simply Business | $126 | $1,510 |

| Progressive Commercial | $127 | $1,526 |

| Thimble | $136 | $1,627 |

| Hiscox | $137 | $1,647 |

| ERGO NEXT | $141 | $1,691 |

| Chubb | $155 | $1,860 |

| biBERK | $161 | $1,928 |

Cheapest General Liability Insurance for Restaurants

Nationwide offers the cheapest general liability insurance for restaurant owners at $83 monthly ($994 annually), saving restaurateurs $63 monthly compared to the industry average of $146. This coverage protects your restaurant business against customer slip-and-falls, foodborne illness claims and property damage while keeping costs 43% below average.

| Nationwide | $83 | $994 |

| Coverdash | $99 | $1,192 |

| The Hartford | $114 | $1,365 |

| Simply Business | $142 | $1,709 |

| Progressive Commercial | $145 | $1,745 |

Cheapest Workers' Comp Insurance for Restaurants

ERGO NEXT provides the cheapest workers' comp insurance for restaurateurs at $59 monthly ($712 annually). Restaurant owners save $4 monthly compared to the $63 industry average. The Hartford, Thimble, Progressive Commercial and Simply Business offer competitive alternatives for restaurant businesses requiring coverage for kitchen staff injuries and workplace accidents.

| ERGO NEXT | $59 | $712 |

| The Hartford | $60 | $718 |

| Thimble | $61 | $729 |

| Progressive Commercial | $61 | $736 |

| Simply Business | $61 | $737 |

Cheapest Professional Liability Insurance for Restaurants

The Hartford leads professional liability coverage for restaurant businesses at $73 monthly ($870 annually). Its rate sits 11% below the $82 industry average, helping restaurateurs protect against foodborne illness lawsuits and customer injury claims without overpaying. ERGO NEXT, Progressive Commercial and Simply Business are the best alternatives if you're looking for the most affordable professional liability insurance provider.

| The Hartford | $73 | $870 |

| ERGO NEXT | $76 | $910 |

| Progressive Commercial | $78 | $935 |

| Simply Business | $81 | $967 |

| Thimble | $81 | $969 |

Cheapest BOP Insurance for Restaurants

At $124 monthly ($1,489 annually), Nationwide delivers 42% savings on the cheapest Business Owners' Policy for restaurants compared to the $214 industry average. This bundled coverage protects your restaurant business with general liability, property insurance and business interruption for $1,077 less annually. Coverdash and The Hartford rank as cost-effective alternatives for restaurateurs.

| Nationwide | $124 | $1,489 |

| Coverdash | $144 | $1,731 |

| The Hartford | $156 | $1,876 |

| Simply Business | $214 | $2,563 |

| Progressive Commercial | $219 | $2,625 |

What Does Restaurant Business Insurance Cost?

Expect to pay these rates for the restaurant business insurance cost of essential coverage:

- General Liability: $146 on average per month, ranging from $126 to $172, depending on the state

- Workers' Comp: $63 on average per month, ranging from $55 to $73, depending on the state

- Professional Liability (E&O): $82 on average per month, ranging from $71 to $95, depending on the state

- BOP Insurance: $214 on average per month, ranging from $183 to $249, depending on the state

| BOP | $214 | $2,566 |

| General Liability | $146 | $1,753 |

| Professional Liability (E&O) | $82 | $980 |

| Workers' Comp | $63 | $760 |

What Type of Insurance Is Best for a Restaurant Business?

Workers' compensation and general liability coverage are foundational financial protection. Your restaurant's insurance needs expand depending on your operations. For example, liquor liability becomes essential if you serve alcohol, while commercial auto covers delivery vehicles and equipment breakdown protects expensive kitchen systems.

- Workers' Compensation Insurance: Required in almost every state for restaurants with employees, workers' comp covers medical bills and lost wages when kitchen staff suffer burns from fryers, cooks cut themselves during prep work or servers slip on wet floors. Coverage provides two-thirds of lost wages plus full medical expenses per your state's requirements.

- General Liability Insurance: Protects your restaurant when customers slip on spilled drinks, suffer food poisoning from undercooked meals or claim advertising injury. Most commercial leases require $1 million per occurrence and $2 million aggregate limits before you open your doors, covering legal fees, medical bills and settlements from third-party claims.

- Liquor Liability Insurance: Essential if you serve alcohol, protecting against claims when intoxicated patrons cause accidents after leaving your establishment. Dram shop laws in most states hold you legally responsible. Standard coverage starts at $1 million per occurrence for bars, wine-focused restaurants and dining establishments with liquor licenses.

- Commercial Property Insurance: Covers repair costs when kitchen fires damage industrial ovens, burst pipes flood your dining room or theft impacts equipment. Protection extends to your building, kitchen equipment ($40,000 to $200,000), furniture and inventory. Pair with business interruption coverage to replace lost income during repairs.

- Equipment Breakdown Coverage: Pays for repairs when walk-in refrigerators fail, HVAC systems malfunction or electrical components short out. When your commercial refrigerator dies overnight, this coverage replaces the unit and reimburses spoiled inventory. Typical limits range from $25,000 to $100,000 per occurrence, preventing losses standard property policies exclude.

- Commercial Auto Insurance: Required by most states for business-owned vehicles, covering accidents involving delivery vans, catering trucks or company cars. Essential when transporting food to events or making deliveries. State minimum liability limits start at $25,000 per person, though $500,000 to $1 million provides better protection for restaurant operations.

- Cyber Liability Insurance: Protects restaurants handling credit card data from breaches and cyberattacks targeting point-of-sale systems. Coverage pays for customer notification, credit monitoring, legal fees and regulatory fines when hackers compromise payment information. Limits start at $1 million for data breach response and liability coverage.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Restaurant

Getting business insurance for your restaurant requires comparing quotes, understanding coverage needs and choosing providers that protect your dining establishment affordably.

- 1Decide on Coverage Needs Before Buying

Think about what keeps you up at night: customers breaking teeth on olive pits, walk-in coolers dying during busy weekends or slip-and-falls in your dining room.

- 2Research Costs

Understanding costs for your restaurant type, employee count and annual revenue helps you recognize fair pricing and negotiate better rates.

- 3Look Into Company Reputations and Coverage Options

Read reviews from restaurant owners who've filed real claims. Check if they offer restaurant essentials, such as equipment breakdown, spoilage coverage, and liquor liability, before requesting quotes.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers using independent agents, online platforms and direct calls. Contacting insurers directly may reveal discounts for fire suppression systems or employee safety training programs.

- 5Reassess Annually

Your restaurant changes constantly. Adding a patio, launching delivery, upgrading to commercial-grade equipment or hiring more kitchen staff all affect your coverage needs and rates.

Best Insurance for Restaurant Business: Bottom Line

Nationwide offers the best restaurant business insurance with competitive rates starting at $92 monthly and a 4.8 MoneyGeek score. Restaurant owners should secure workers' compensation, general liability, liquor liability and property coverage to protect against kitchen fires, customer slip-and-falls and equipment breakdowns. Compare quotes from several providers to find the right protection for your dining establishment.

Restaurant Business Insurance: FAQ

We answer frequently asked questions about restaurant business insurance:

Who offers the best restaurant business insurance overall?

Nationwide leads restaurant business insurance with a MoneyGeek score of 4.8 out of 5. The Hartford follows closely at 4.68, delivering excellent value through top-tier customer service and comprehensive coverage options.

Who has the cheapest business insurance for restaurant owners?

Here are the cheapest business insurance companies for restaurants by coverage type:

- Cheapest general liability insurance: Nationwide at $83 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $59 monthly

- Cheapest professional liability insurance: The Hartford at $73 monthly

- Cheapest BOP insurance: Nationwide at $124 monthly

What business insurance is required for restaurants?

Restaurant businesses must carry workers' compensation insurance for employees and commercial auto insurance for company vehicles, with specific requirements varying by state. General liability coverage, though not legally mandated, is essential for securing commercial leases and client contracts.

How much does restaurant business insurance cost?

Restaurant business insurance costs by coverage type are as follows:

- General Liability: $146/mo

- Workers' Comp: $63/mo

- Professional Liability: $82/mo

- BOP Insurance: $214/mo

How We Chose the Best Restaurant Business Insurance

We selected the best business insurer for restaurants based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Nationwide. "Company Ratings." Accessed February 7, 2026.