Coverdash takes the top spot for coffee shop business insurance with its exceptional affordability and comprehensive coverage options. We found this provider excels most in these two areas, making it an ideal choice for coffee shop owners looking to balance cost with protection. However, we recommend comparing quotes from our other top picks, including Nationwide, The Hartford, Simply Business and biBERK.

Best Coffee Shop Business Insurance

Coverdash, Nationwide and The Hartford offer the best cheap business insurance for coffee shops and cafes starting at $44/mo.

Get personalized quotes from the best coffee shop business insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Coffee shops and cafes need commercial coverage including general liability, workers' compensation and business property insurance.

Coverdash ranks as the best cheap business insurance company for cafes because it delivers excellent affordability and comprehensive coverage protection.

To get the best business insurance for your coffee shop, consider risks specific to your industry, research average costs and compare plenty providers and options.

Best Business Insurance for Coffee Shop Companies

| Coverdash | 4.70 | $62 |

| Nationwide | 4.70 | $73 |

| The Hartford | 4.67 | $71 |

| Simply Business | 4.50 | $80 |

| biBERK | 4.40 | $87 |

| Progressive Commercial | 4.40 | $81 |

| ERGO NEXT | 4.37 | $108 |

| Thimble | 4.30 | $87 |

| Chubb | 4.30 | $99 |

| Hiscox | 4.30 | $87 |

*We based all scores on a coffee shop business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Coffee Shop Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your coffee shop business, check out the following resources:

1. Coverdash: Best Business Insurance for Coffee Shops and Cafes

Lowest rates overall, especially for general liability policies

Large coverage selection due to their aggregator model

Easy quote process for buying completely online

Loan matching program for near instant financing matches

Coverage is not offered directly, so customer service varies

Less experience in the industry (officially launched in 2023)

Average costs for their policies are 13% lower than the next most affordable provider, making them ideal if price is paramount for your coffee shop. In addition, cafe owners will be able to get instant certificates of insurance, bundle matching for coverage plans and even fast matching for loans through their partnerships.

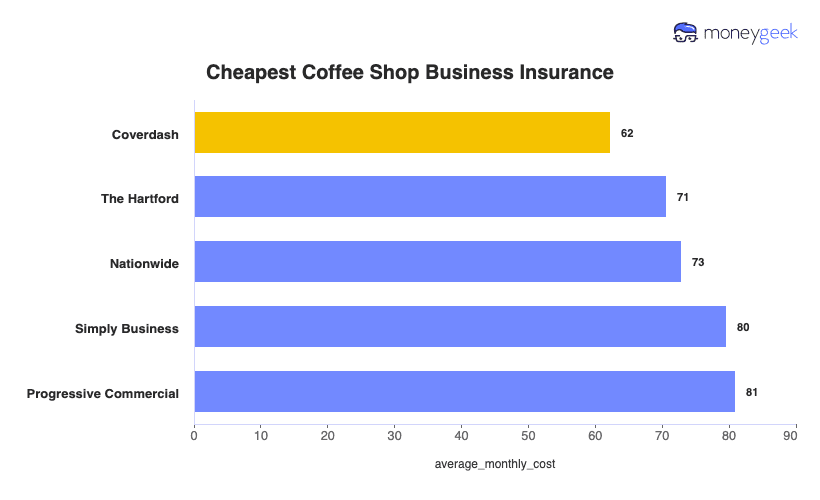

Cheapest Business Insurance for Coffee Shops

Coverdash leads the market with the most competitively priced comprehensive coffee shop insurance at $62 per month, outperforming rivals in both general liability and Business Owner's Policy (BOP) coverage. ERGO NEXT delivers superior value for cafes on workers' compensation insurance at $44 monthly, while The Hartford secures the lowest rates for professional liability protection.

| Coverdash | $62 |

| The Hartford | $71 |

| Nationwide | $73 |

| Simply Business | $80 |

| Progressive Commercial | $81 |

| Thimble | $87 |

| Hiscox | $87 |

| biBERK | $87 |

| Chubb | $99 |

| ERGO NEXT | $108 |

What Does Coffee Shop Business Insurance Cost?

In general, coffee shop business insurance costs are the following for the four most popular coverage types:

- General Liability: $90 on average per month, ranging from $78 to $105, depending on the state

- Workers' Comp: $47 on average per month, ranging from $40 to $55, depending on the state

- Professional Liability (E&O): $61 on average per month, ranging from $52 to $71, depending on the state

- BOP Insurance: $133 on average per month, ranging from $111 to $155, depending on the state

| BOP | $133 | $1,594 |

| General Liability | $90 | $1,083 |

| Professional Liability (E&O) | $61 | $732 |

| Workers' Comp | $47 | $563 |

What Type of Insurance Is Best for a Coffee Shop?

For most coffee shop businesses, the essential types of coverage are general liability and commercial property insurance, often bundled together in a Business Owner's Policy (BOP). Workers' compensation, commercial auto insurance for delivery vehicles, and liquor liability insurance for establishments serving alcohol are often legally required to satisfy state regulations and common contract requirements.

Here's why these coverages are important, and the recommended coverage amounts for each policy type for the average coffee shop business:

- General liability insurance: Covers third-party claims for bodily injury and property damage, protecting coffee shop businesses from common risks like customer slip-and-falls, burns from hot beverages, and damage to customers' personal belongings. We recommend a $1 million per occurrence or $2 million aggregate policy.

- Commercial property insurance: Helps protect your owned or rented building, tools, and equipment used to operate your business, including espresso machines, grinders, furniture, and inventory, from covered events such as fire, theft, vandalism, water damage, and weather-related incidents. Coverage amounts should be based on the replacement value of your equipment and property.

- Workers' compensation: Required by law in almost every state if your coffee shop has employees. This coverage pays medical bills and lost wages for baristas and other employees injured on the job, including burns from espresso machines, slips on wet floors, or back injuries from lifting supplies. The average cost is about $97 per month or $1,168 annually.

- Equipment breakdown coverage: Covers damages to your business equipment if there's an unexpected breakdown, protecting critical machines like espresso machines, grinders, refrigerators, and POS systems from internal failures such as motor burnout, power surges, and electrical shorts. This coverage can also include spoilage protection, reimbursing you for products that spoil due to equipment failure and the profit you would have made from selling them. This is typically included in a BOP or can be added as an endorsement.

- Liquor liability insurance (if you serve alcohol): Covers legal fees, property damage, and medical costs if alcohol is served or sold at your coffee shop to an intoxicated person who then harms others or damages property. The average cost is about $35 per month, with typical policy limits of $1 million per occurrence and $2 million aggregate. Many states have dram shop laws that hold businesses liable for damages caused by intoxicated customers.

- Commercial auto insurance (if you operate delivery vehicles): Required in most states for business-owned vehicles. This policy covers medical expenses and property damage if someone driving your coffee shop vehicle is held liable for an accident, as well as vehicle theft, vandalism, and weather damage. The average cost is about $164 per month or $2,116 annually for food and beverage businesses.

- Cyber liability insurance: If your business relies on computer systems for point-of-sale transactions or online ordering, cyber coverage protects against data breaches, ransomware attacks, and other cyber incidents. This coverage can include notification expenses and credit monitoring services for affected customers if payment details are stolen.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Coffee Shop?

Here's a step-by-step method for finding the best and cheapest business insurance for your coffee shop company.

- 1Decide on Coverage Needs Before Buying

Think about what could go wrong in your coffee shop such as customers burning themselves on hot beverages, baristas slipping on wet floors behind the counter, or expensive espresso machines breaking down. Talk with other coffee shop owners about their insurance experiences and consult with agents who specialize in food and beverage businesses for professional guidance. Understanding your specific risks, from equipment failures to customer injuries, gives you a solid foundation for making smart insurance decisions.

- 2Research Costs

Know what you should expect to pay before you start shopping for coverage. Look up typical business insurance costs for coffee shops and cafes your size to understand market rates. This research gives you negotiating power and helps you recognize a good deal when you find one.

- 3Look Into Company Reputations and Coverage Options

Check what real customers say about each insurer, especially other coffee shop and cafe owners who have filed claims for incidents like equipment damage or customer injuries. Read reviews on sites like Consumer Affairs and Trustpilot, or browse food service business owner forums where people share honest experiences.

While researching, compare each company's coverage options to make sure they match your specific needs, including protection for high-value espresso equipment, spoilage coverage for inventory, and business interruption insurance in case of temporary closures.

- 4Compare Multiple Quotes Through Different Means

Get business insurance quotes from at least three companies using different methods to find the best rates for your coffee shop. Independent agents who work with food service businesses might discover discounts that don't appear on company websites, while online tools offer quick comparisons.

Calling insurers directly sometimes unlocks additional savings or specialized coverage options for cafes, such as equipment breakdown protection or liquor liability if you serve alcohol.

- 5Reassess Annually

Your coffee shop will evolve over time, which affects both your insurance needs and available rates. Review your coverage each year using these same steps to ensure you still have the most affordable protection.

Changes like purchasing new espresso machines, adding a delivery service, expanding seating capacity, starting to serve alcohol, or hiring additional staff may require coverage adjustments to keep your business properly protected.

Best Insurance for Coffee Shop Business: Bottom Line

Coverdash is the best cheap insurer for coffee shop insurance, and we also recommend getting quotes from Nationwide, The Hartford and Simply Business, our next top picks. For the best deal, consult agents and similar businesses, research costs and companies, and compare multiple quotes.

Coffee Shop Insurance: FAQ

We answer frequently asked questions about coffee shop business insurance:

Who offers the best coffee shop business insurance overall?

Coverdash and Nationwide tie for the best overall business insurance for coffee shops, each earning a MoneyGeek score of 4.7 out of 5. The Hartford follows closely behind with a score of 4.67, offering excellent coverage and customer service.

Who has the cheapest business insurance for coffee shop firms?

Here are the cheapest business insurance companies for coffee shop businesses by coverage type:

- Cheapest general liability insurance: Coverdash at $57 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $44 monthly

- Cheapest professional liability insurance: The Hartford at $55 monthly

- Cheapest BOP insurance: Coverdash at $83 monthly

What business insurance is required for coffee shop organizations?

Coffee shop businesses must carry workers' compensation insurance if they have employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability coverage is essential for leases and client contracts.

How much does coffee shop business insurance cost?

Coffee Shop business insurance costs by coverage type are as follows:

- BOP Insurance: $133/mo

- General Liability: $90/mo

- Professional Liability: $61/mo

- Workers' Comp: $47/mo

How We Chose the Best Coffee Shop Business Insurance

We selected the best business insurer for coffee shop companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.