ERGO NEXT earned the top spot for barber business insurance with perfect scores in coverage and affordability. We also recommend comparing quotes from our other top picks, including The Hartford, Simply Business, Nationwide and Coverdash.

Best Barber Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for barber companies with rates starting at $14 monthly.

Get matched to the best barber shop insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Barber businesses need several types of business insurance coverage including general liability, workers' compensation, professional liability, commercial property and business interruption insurance.

ERGO NEXT is both the best business insurer and the cheapest insurance company for barber shops and barbers in our study.

Comparing plenty of business insurance quotes, deciding coverage needs before you buy and researching costs and discounts specific to barbers will help you find the best option for your business.

Best Business Insurance for Barber Companies

| ERGO NEXT | 4.82 | $27 |

| The Hartford | 4.73 | $31 |

| Simply Business | 4.70 | $31 |

| Nationwide | 4.70 | $33 |

| Coverdash | 4.50 | $40 |

| Thimble | 4.50 | $49 |

| Chubb | 4.50 | $43 |

| Progressive Commercial | 4.40 | $37 |

| Hiscox | 4.40 | $40 |

| biBERK | 4.20 | $62 |

*We based all scores on a barber business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Barber Shop Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your business, check out the following resources:

1. ERGO NEXT: Best Overall for Barber Shops

Best digital customer experience

Cheapest rates overall for barbers

Fastest quotes process with under 10-minutes required

Most likely to be recommended to other businesses

Less experience in the industry

Some products are not offered directly by ERGO NEXT

ERGO NEXT offers tailored coverage packages designed for you throughout the quoting process, including coverage types and amounts recommendations.

The company lets you easily get a policy and instant proof of insurance documents from its digital platform.

2. The Hartford: Best Professional Liability Insurance for Barbers

Lowest professional liability insurance rates

Over 200+ years of experience in the industry

Second most affordable provider overall

Earned the best claims process and agent service spot in our customer survey

Ranked lowest for digital experience by customers

Does not insure Alaska and Hawaii businesses

The Hartford has a tailored customer service team for barber companies; it offers a customizable coverage plan specific to hair service professionals.

The insurer has an A+ rating from A.M. Best for financial strength and the top ratings from customers for their claims and agent service. The Hartford offers a reasonable price for one of the most needed coverages in the industry.

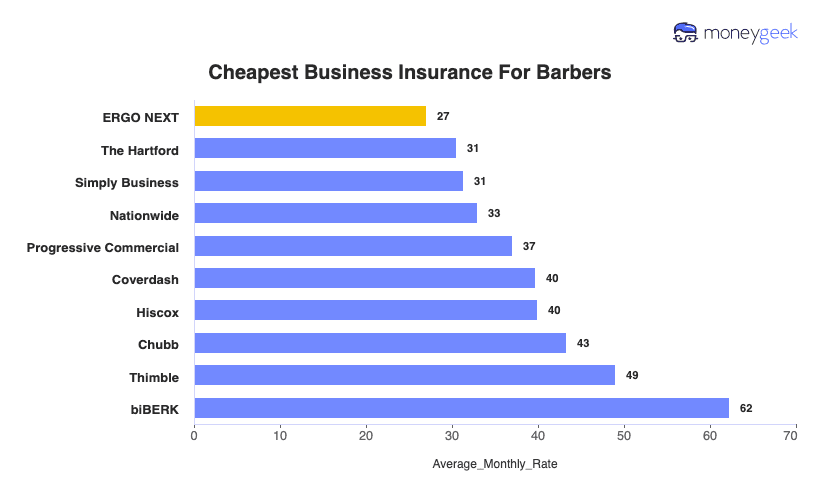

Cheapest Business Insurance for Barber Shops

According to our research, ERGO NEXT is the most affordable business insurance option overall for barber shops at $27 per month, offering the best rates across general liability, workers' compensation, and business owner's policy coverage.

Barbers who need professional liability insurance would be better served by exploring The Hartford, which provides more competitive pricing for this specific coverage type.

| ERGO NEXT | $27 | $324 |

| The Hartford | $31 | $366 |

| Simply Business | $31 | $376 |

| Nationwide | $33 | $396 |

| Progressive Commercial | $37 | $445 |

| Coverdash | $40 | $477 |

| Hiscox | $40 | $479 |

| Chubb | $43 | $519 |

| Thimble | $49 | $588 |

| biBERK | $62 | $747 |

What Does Barber Business Insurance Cost?

In general, barber business insurance costs are the following for the four most popular coverage types:

- General Liability Cost: $45 on average per month, ranging from $39 to $54, depending on the state

- Workers Comp Cost: $14 on average per month, ranging from $12 to $16, depending on the state

- Professional Liability (E&O Cost): $43 on average per month, ranging from $37 to $50, depending on the state

- BOP Insurance Cost: $54 on average per month, ranging from $47 to $62, depending on the state

| BOP | $54 | $645 |

| General Liability | $45 | $537 |

| Professional Liability (E&O) | $43 | $513 |

| Workers Comp | $14 | $169 |

What Type of Insurance Do I Need for a Barber Shop?

When evaluating insurance options for barber businesses, general liability and tools and equipment coverage stand out as essential non-mandatory policies which can be bundled in a bop policy. To meet state regulations and typical contract obligations, most shops will also need workers' compensation, professional liability, commercial property (property leases/financing), and commercial auto insurance if vehicles are part of operations.

Here's why each coverage type matters and what policy limits work for most barber shops:

- General liability insurance: Third-party bodily injury and property damage claims are covered under this policy, which shields barber businesses from scenarios including client slips and falls, injuries sustained during haircuts or shaves, and harm to personal items like clothing or accessories. Policy limits of $1 to $2 million per occurrence with $2 to $3 million aggregate coverage are what we suggest.

- Workers' comp insurance: If you employ staff at your barber business, state law mandates this coverage. Medical expenses and wage replacement get handled through this insurance when employees experience work-related harm—think chemical burns from styling products, injuries from wet floor accidents, lacerations from razors and scissors, or musculoskeletal problems from standing for long periods and performing repetitive tasks.

- Professional liability insurance: When clients allege substandard service or claim negligence led to damages, this protection steps in to cover associated costs. Bad haircuts, uneven fades, shaving nicks, product allergies, and hair dye mishaps are typical situations where this coverage applies. To meet most client contracts and ensure adequate protection, barber shops should carry $1 to $2 million per claim with a $2 to $3 million aggregate limit.

- Tools and equipment: Clippers, trimmers, shears, scissors, styling irons, barber chairs, and hair care products all fall under this category when they malfunction, break, or sustain damage while you're working. Coverage between $10,000 and $15,000 is appropriate for most operations in the barbering industry.

- Commercial auto (if you use vehicles for business): For barber businesses utilizing vehicles—particularly those offering mobile services or traveling to client locations—a combined single limit of $1 million for liability plus comprehensive and collision protection meets state mandates and provides solid coverage. This policy type is critical when your business model involves house calls or mobile barbering.

- Commercial property insurance: This coverage protects your barbershop's physical assets from losses due to fire, theft, vandalism, storms, and other covered perils. Your building (if owned), equipment, product inventory, furniture, and fixtures all receive protection under this policy. If you rent your space, this insurance still covers your business property and improvements you've made to the location. Coverage amounts typically range from $100,000 to $500,000 depending on the value of your property and equipment.

- Cyber insurance: Data breaches, cyberattacks, and compromised customer information create costs that this policy addresses. When your shop maintains electronic records of credit card details, scheduling information, or client personal data, this coverage becomes a necessity. Typical policies offer $50,000 to $100,000 in protection.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Barber Company

Below we've provided a comprehensive guide to buying business insurance that is right for your company.

- 1Decide on Coverage Needs Before Buying

Think about the daily risks at your barber shop. A client slips on your wet floor and breaks their wrist. Your clippers die mid haircut. Styling chairs collapse. These real scenarios tell you what coverage you need.

Talk to other barber shop owners about which policies saved them money after claims. Meet with insurance agents who actually know small businesses, not just general commercial insurance. - 2Research Costs

Find out what barber shops your size pay for insurance before you call insurers. This stops you from overpaying when agents quote high. Industry standard pricing gives you leverage to negotiate better rates.

- 3Look Into Company Reputations and Coverage Options

Read reviews from barber shop owners specifically, since their claims match what you might file. Check Google reviews and Better Business Bureau ratings to see how insurers treat clients during claims.

Make sure the insurer offers barber shop coverage, not generic small business policies with gaps. Generic policies might exclude scissors injuries or chemical damage from hair products. - 4Compare Multiple Quotes Through Different Means

Get at least three quotes using different channels. Call independent brokers who shop multiple carriers for you. Check company websites for online rates. Use comparison platforms that show quotes side by side.

Phone calls sometimes get you promotional rates that websites don't advertise. - 5Reassess Annually

Your barber shop changes every year. You add chairs, hire stylists or start selling products. Insurance rates drop as new companies enter the market.

Compare your current policy against new quotes each year. Make sure your coverage still fits your business. This yearly check can save you hundreds without leaving you underinsured.

Best Insurance for Barber Business: Bottom Line

ERGO NEXT is the best and cheapest insurer for barber business insurance. We also recommend getting quotes from The Hartford, Simply Business and Nationwide. For the best deal, consult agents and similar businesses, research costs and companies, and compare multiple quotes.

Barber Insurance: FAQ

We answer frequently asked questions about barber shop insurance:

Who offers the best barber business insurance overall?

ERGO NEXT leads barber business insurance with a MoneyGeek score of 4.82 out of 5. The Hartford follows closely at 4.73, delivering excellent affordability, customer service and comprehensive coverage options.

Who has the cheapest business insurance for barber firms?

Here are the cheapest business insurance companies for barber businesses by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $21 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $13 monthly

- Cheapest professional liability insurance: The Hartford at $38 monthly

- Cheapest BOP insurance: ERGO NEXT at $32 monthly

What business insurance is required for barber organizations?

Barber businesses must carry workers' compensation insurance if they employ staff and commercial auto insurance for company vehicles, though requirements differ by state. General liability coverage and professional bonds are practically essential for securing commercial leases and clients.

How much does barber business insurance cost?

Barber business insurance costs per month by coverage type are as follows:

- General Liability: $45/mo

- Workers' Comp: $14/mo

- Professional Liability: $43/mo

- BOP Insurance: $54/mo

How We Chose the Best Barber Business Insurance

Barber shops need affordable coverage that actually pays claims when scissors slip or clients get injured. We focused on insurers offering policies specifically designed for barber shop risks like chemical burns from hair dye, cuts from razors and slip injuries on wet floors. Generic small business policies often exclude these salon specific hazards, so we only ranked companies that understand barber shop operations.

We scored insurers on four factors totaling 100 points. Affordability counts for 50%, customer service for 30%, coverage options for 15% and financial stability for 5%.

- Affordability (50 points): We collected quotes for four essential coverages: general liability, professional liability, property insurance and workers' compensation. Our sample barber shop has three chairs, two employed stylists and annual revenue of $150,000. Companies charging below average rates for this profile scored higher.

- Customer service (30 points): We analyzed industry satisfaction studies, customer reviews on Google and the Better Business Bureau, plus discussions on Reddit where barber shop owners share real claim experiences. We looked specifically for patterns in how insurers handle typical barber shop claims like client injuries from hot tools or allergic reactions to products.

- Coverage options (15 points): We scored insurers on payment flexibility (monthly vs annual), coverage variety (equipment breakdown, cyber liability, business interruption) and policy comprehensiveness. Companies offering barber specific endorsements for things like product liability or employee theft scored higher than those with only generic small business policies.

- Financial stability (5 points): We checked AM Best and Moody's ratings to verify each insurer can pay claims years from now. A financially weak insurer might deny your claim or go bankrupt before settling, leaving you exposed.

Throughout this article, pricing data relies on a consistent base profile that mirrors typical small businesses operating in any state:

- Business structure: three people total with two employees

- Policy limits: $1 million per occurrence and $2 million annual aggregate across all coverage types, with BOP policies adding $5,000 in business property coverage to these same liability limits

- Payroll: $150,000 annually

- Revenue: $300,000 per year

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.