Most major insurers use credit scores to set rates, but a few specialized companies operate differently. Here's the complete list of insurers that skip credit checks or minimize their impact.

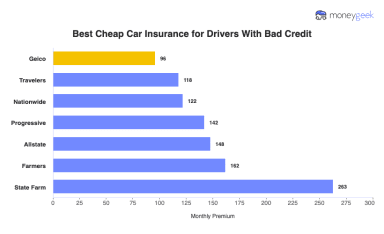

While few insurers skip credit checks entirely, you can still find affordable car insurance with poor credit.