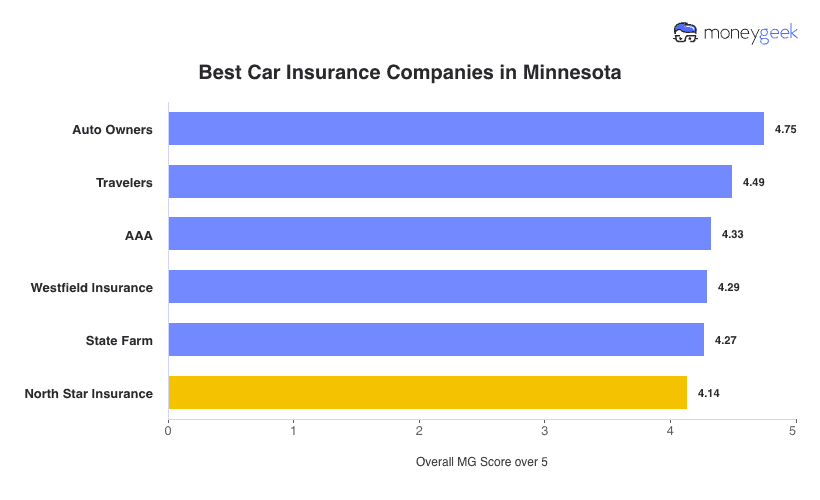

MoneyGeek evaluated all auto insurance providers in Minnesota and scored their services based on affordability (cost and discounts), customer service, and coverage options across all residential ZIP codes. All in total, these companies offer the best car insurance in Minnesota (Click on each category to learn more about the winners):

Best by Rating:

- Best Cheap Overall: Auto-Owners

- Customer Service: Auto-Owners

- Coverage Options: Travelers

Best by Driver and Coverage:

- Minimum Coverage Car Insurance: Westfield

- Full Coverage: Auto-Owners

- Seniors (65+): Auto-Owners

- Young Drivers (16 to 25): Auto-Owners

- Adults (26 to 64): Auto-Owners

- Drivers With Violations: Auto-Owners

- Those With Bad Credit: Auto-Owners

To ensure you get a good deal on Minnesota auto insurance, we also provided answers to common questions about the topic (Click to learn more).