The Hartford leads our rankings for wholesale business insurance with a MoneyGeek score of 4.73 out of 5 and annual costs of $563. It earned perfect scores across affordability, customer service, coverage availability, making it our top choice for wholesale companies. Compare quotes from Coverdash, biBERK and ERGO NEXT since each brings unique strengths to wholesale distributors.

Best Wholesale Business Insurance

The Hartford, Coverdash and biBerk offer the best cheap business insurance for wholesale companies, with rates starting at $34 monthly.

Get personalized quotes for the best business insurance for wholesale distributors.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Wholesale distributors need several coverage types: workers' compensation for employee injuries, commercial auto for delivery vehicles, general liability for client accidents and property insurance protecting inventory.

The Hartford offers the best business insurance for wholesalers, with a MoneyGeek score of 4.73 out of 5 and top scores across all categories.

Coverdash provides the cheapest business insurance for wholesale companies at $46 monthly, with general liability coverage starting at just $34 per month for distribution operations.

Best Business Insurance for Wholesale Distributors

| The Hartford | 4.73 | $47 |

| Coverdash | 4.70 | $46 |

| biBERK | 4.50 | $53 |

| ERGO NEXT | 4.43 | $56 |

| Nationwide | 4.40 | $57 |

| Simply Business | 4.40 | $55 |

| Progressive Commercial | 4.40 | $51 |

| Hiscox | 4.30 | $54 |

| Chubb | 4.30 | $62 |

| Thimble | 4.30 | $53 |

Note: We based all scores on a wholesale business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Wholesale Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your wholesale business, check out the following resources:

1. The Hartford: Best Overall for Wholesale Distributors

Lowest rates for wholesale distributors at $563 annually

Perfect scores in customer service and claims processing

A+ financial stability rating guarantees reliable claim payments

Over 200 years serving businesses with proven claims expertise

Digital experience ranks 10th among small business insurers

Not available in Alaska or Hawaii for wholesalers

Fewer coverage add-ons than competing business insurance providers

The Hartford offers specialized coverage for wholesale companies, including property in transit insurance that protects inventory during shipment and XactPAY for pay-as-you-go workers' compensation based on actual monthly payroll, which is valuable for wholesale operations with seasonal staffing needs.

2. Coverdash: Cheapest Overall for Wholesale Distributors

Cheapest BOP and general liability rates for wholesale distributors

Digital experience ranks fourth among business insurance providers

Compares quotes from 30-plus carriers for competitive wholesale rates

Instant certificate of insurance generation through online customer dashboard

Customer service and claims processing ranks last

Higher rates for professional liability and workers' comp compared to competitors

Coverdash's digital platform makes policy management straightforward for wholesale operations.

Despite having strong digital tools. Its broker model works best for budget-focused wholesale distributors comfortable managing policies online and working directly with carriers during claims.

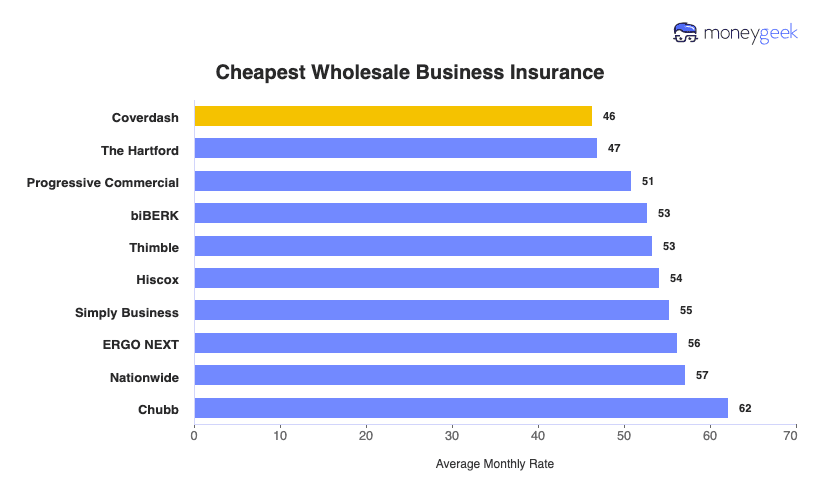

Cheapest Business Insurance for Wholesale Distributors

Coverdash leads in affordability for wholesale business insurance at $556 annually, offering the cheapest general liability and BOP coverage among companies we studied. The Hartford provides the lowest professional liability rates at $664 per year, while ERGO NEXT offers the most affordable workers' comp at $227 annually.

| Coverdash | $46 | $556 |

| The Hartford | $47 | $562 |

| Progressive Commercial | $51 | $611 |

| biBERK | $53 | $634 |

| Thimble | $53 | $640 |

| Hiscox | $54 | $649 |

| Simply Business | $55 | $664 |

| ERGO NEXT | $56 | $675 |

| Nationwide | $57 | $686 |

| Chubb | $62 | $746 |

Cheapest General Liability Insurance for Wholesale Distributors

Coverdash offers the cheapest general liability insurance for wholesale distributors at $406 annually ($34 monthly), saving wholesale companies $132 per year compared to the $538 industry average. The Hartford ranks second at $472 annually, while Progressive Commercial offers third-lowest rates at $503 per year for wholesale operations.

| Coverdash | $34 | $406 |

| The Hartford | $39 | $472 |

| Progressive Commercial | $42 | $503 |

| Thimble | $45 | $537 |

| biBERK | $46 | $551 |

Cheapest Workers' Comp Insurance for Wholesale Distributors

Wholesale distributors pay $454 annually ($38 monthly) for the cheapest workers' compensation coverage through ERGO NEXT. The Hartford and Thimble follow next, with rates of $455 and $462, respectively.

| ERGO NEXT | $38 | $454 |

| The Hartford | $38 | $455 |

| Thimble | $38 | $462 |

| Progressive Commercial | $39 | $466 |

| Simply Business | $39 | $466 |

Cheapest Professional Liability Insurance for Wholesale Distributors

The Hartford offers the most affordable professional liability insurance for wholesale companies at $664 annually ($55 monthly), saving you $75 compared to the $739 industry average. ERGO NEXT ranks second at $688 per year, followed by Progressive Commercial at $703 annually. Wholesale distributors choosing The Hartford save 10% on professional liability coverage.

| The Hartford | $55 | $664 |

| ERGO NEXT | $57 | $688 |

| Progressive Commercial | $59 | $703 |

| Thimble | $59 | $713 |

| Simply Business | $61 | $733 |

Cheapest BOP Insurance for Wholesale Distributors

Coverdash charges wholesale businesses just $589 annually ($49 monthly) for the cheapest Business Owners' Policy coverage, $205 below the $794 industry average. The 26% savings makes Coverdash the top choice for wholesale operations needing combined general liability and property protection. The Hartford ranks second at $650 per year, while biBERK offers third-lowest rates at $717 annually.

| Coverdash | $49 | $589 |

| The Hartford | $54 | $650 |

| biBERK | $60 | $717 |

| Progressive Commercial | $63 | $760 |

| Hiscox | $69 | $828 |

What Does Wholesale Business Insurance Cost?

In general, wholesale business insurance costs are the following for the four most popular coverage types:

- General Liability: $45 on average per month, ranging from $39 to $52, depending on the state

- Workers' Comp: $40 on average per month, ranging from $34 to $46, depending on the state

- Professional Liability (E&O): $62 on average per month, ranging from $54 to $72, depending on the state

- BOP Insurance: $66 on average per month, ranging from $57 to $78, depending on the state

| BOP | $66 | $794 |

| Professional Liability (E&O) | $62 | $739 |

| General Liability | $45 | $538 |

| Workers' Comp | $40 | $482 |

What Type of Insurance Is Best for a Wholesale and Distribution Business?

The coverage types wholesalers need start with workers' compensation if you employ anyone and commercial auto insurance for your delivery vehicles. Your wholesale business also needs financial protection against the specific risks you face daily: injuries in your warehouse, damage to inventory worth thousands and liability claims from the products you distribute.

- Workers' Compensation Insurance: Most states require workers' comp for wholesale businesses that have employees. Your warehouse team faces real risks every shift. Back injuries from loading 50-pound boxes onto pallets, crushed fingers from forklift accidents, hernias from repetitive heavy lifting. When your receiving clerk falls off a loading dock or a picker gets struck by falling inventory, it pays their medical bills and replaces lost wages during recovery.

- Commercial Auto Insurance: Most states require this coverage for business-owned vehicles. Whether you're delivering electronics to retailers or transporting perishable goods across town, your drivers are on the road constantly. When your delivery driver rear-ends another vehicle during rush hour or causes a multi-car accident on the highway, you're looking at vehicle repairs, medical expenses and legal fees. Standard limits of $500,000 to $1 million protect your wholesale business from these costs.

- General Liability Insurance: A retail buyer slips on your oil-stained warehouse floor during a product inspection, or your forklift operator accidentally damages a client's delivery truck while loading. Most wholesalers choose policies with $1 million per-occurrence limits and $2 million aggregate limits. Beyond covering lawsuits, many retailers won't sign distribution contracts without proof of this coverage. It's essential for landing and keeping accounts.

- Commercial Property Insurance: A late-night electrical fire destroys your entire inventory of imported goods, or a burst pipe floods your warehouse over the weekend and ruins $200,000 worth of stock. It protects your building, refrigeration units, conveyor systems, shelving and inventory from fires, storms, theft and water damage. It's the financial lifeline that keeps your wholesale operation running after disasters wipe out your facility.

- Product Liability Insurance: A batch of imported tools has defective wiring that starts a house fire, or mislabeled food products trigger severe allergic reactions. Wholesalers can be held liable when products injure customers or cause property damage. This matters especially if you import directly from overseas manufacturers, repackage bulk items into smaller quantities, or put your brand name on products. All these activities increase your liability exposure in the supply chain.

- Inland Marine Insurance: Covers items in transit and stored off-site, as opposed to property insurance which only covers items at your business location. Your $50,000 shipment of electronics gets stolen from an overnight delivery truck, or products worth $30,000 are destroyed when your cargo van crashes during transport. Standard property insurance stops protecting goods the moment they leave your warehouse. This coverage bridges that gap.

- Cyber Liability Insurance: Recommended for any business that stores credit card numbers or other sensitive data. Hackers breach your system and steal payment information from 500 retail accounts, or ransomware locks you out of your inventory management system during peak season. Beyond the immediate crisis, you're facing mandatory breach notifications, credit monitoring costs for affected clients, forensic investigations and potential lawsuits. These expenses can exceed $100,000 for a single incident.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Wholesale Company

Getting business insurance for your wholesale operation involves comparing quotes from multiple carriers and securing coverage that matches your specific distribution risks at competitive rates.

- 1Decide on Coverage Needs Before Buying

Identify your warehouse's biggest exposures: a worker crushed by falling pallets, your delivery truck totaling someone's car or imported products causing injuries. Connect with other wholesale distributors who've filed claims to learn which coverage gaps cost them thousands out of pocket.

- 2Research Costs

Compare what wholesalers in your sector pay. Food distributors face different premiums than electronics wholesalers due to spoilage and theft risks. A wholesale company moving $2 million in annual inventory pays differently than one handling $10 million, so benchmark against similar operations.

- 3Look Into Company Reputations and Coverage Options

Read reviews from wholesalers about real claim experiences: warehouse fires that destroyed inventory, product recalls, delivery accidents. Check if insurers paid promptly and understood distribution-specific issues. Choose carriers with proven experience handling wholesale operations rather than generic small business policies.

- 4Compare Multiple Quotes Through Different Means

Get quotes from independent agents familiar with wholesale distribution, specialty insurers and online platforms. Rates vary widely based on what you distribute (beauty products versus industrial chemicals) and whether you import directly, making personalized quotes essential for accurate pricing.

- 5Reassess Annually

Your peak inventory jumped from $300,000 to $500,000, you bought three more delivery vans or started importing from overseas suppliers. Each change affects your risk profile and premiums, so annual reviews catch coverage shortfalls before a major claim exposes you.

Best Small Business Insurance for Wholesale Business: Bottom Line

Your wholesale operation needs protection against the risks you face daily, from employee injuries in the warehouse to delivery vehicle accidents and damage to thousands in inventory. The Hartford earned our top rating with a MoneyGeek score of 4.73 out of 5, excelling across affordability, coverage and customer service. If you're watching costs closely, Coverdash offers general liability at $34 monthly and complete coverage starting at $46.

Insurance for Wholesale Business: FAQ

Common questions about wholesale business insurance:

Who offers the best wholesale business insurance overall?

The Hartford offers the best overall business insurance for wholesale firms, with a MoneyGeek score of 4.73 out of 5. Coverdash ranks second with excellent value and comprehensive protection.

Who has the cheapest business insurance for wholesale firms?

Here are the cheapest business insurance companies for wholesale businesses by coverage type:

- Cheapest general liability insurance: Coverdash at $34 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $38 monthly

- Cheapest professional liability insurance: The Hartford at $55 monthly

- Cheapest BOP insurance: Coverdash at $49 monthly

What business insurance is required for wholesale organizations?

Wholesale businesses must carry workers' compensation insurance with employees and commercial auto insurance for company vehicles, though requirements differ by state. General liability coverage, while not legally mandated, is essential for client contracts and leases.

How much does wholesale business insurance cost?

Wholesale business insurance costs by coverage type are as follows:

- General Liability: $45/mo

- Workers' Comp: $40/mo

- Professional Liability: $62/mo

- BOP Insurance: $66/mo

How We Chose the Best Wholesale Business Insurance

We selected the best business insurer for wholesale companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.