ERGO NEXT tops our study for wedding planner business insurance with a MoneyGeek score of 4.82 out of 5. It offers competitive rates and quality service that wedding planning businesses need. We also recommend comparing quotes from The Hartford and Simply Business to find the best coverage for your wedding coordination business.

Best Wedding Planner Business Insurance

ERGO NEXT, The Hartford and Simply Business offer the best cheap business insurance for wedding planning services, with rates starting at $12 monthly.

Discover the best business insurance provider for wedding planners.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Wedding planners need several types of business insurance including general liability, professional liability, workers' compensation and cyber liability for comprehensive protection.

ERGO NEXT offers the best business insurance for wedding planning businesses with a 4.82 MoneyGeek score, offering competitive rates and quality customer service.

ERGO NEXT is the cheapest business insurance for wedding coordinators with rates starting at $32 monthly, while general liability costs as low as $12 monthly.

Best Business Insurance for Wedding Planning Services

| ERGO NEXT | 4.82 | $32 |

| The Hartford | 4.74 | $34 |

| Simply Business | 4.60 | $35 |

| Nationwide | 4.50 | $41 |

| biBERK | 4.40 | $42 |

| Progressive Commercial | 4.40 | $38 |

| Chubb | 4.30 | $47 |

| Hiscox | 4.30 | $41 |

| Thimble | 4.30 | $57 |

| Coverdash | 4.20 | $49 |

Note: We based all scores on a wedding planning businesses with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Wedding Planning Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your wedding planning business, check out the following resources:

1. ERGO NEXT: Best and Cheapest Insurance Provider for Wedding Planning Businesses

Lowest rates for general liability, BOP and workers' comp

Best digital experience with instant quotes and 24/7 access

Highest customer satisfaction and recommendation ratings

Strong A+ financial strength rating backed by Munich Re

Claims process rated lower than customer service overall

No phone support available while getting quotes online

Workers' comp limited to 20 employees or less

ERGO NEXT ranked first for digital experience and customer service with a 4.8 out of 5 rating.

Wedding coordinators can generate unlimited certificates of insurance instantly when venues require proof of coverage before events.

You can add venues or vendors as additional insureds at no charge through your account, which saves time when managing multiple weddings.

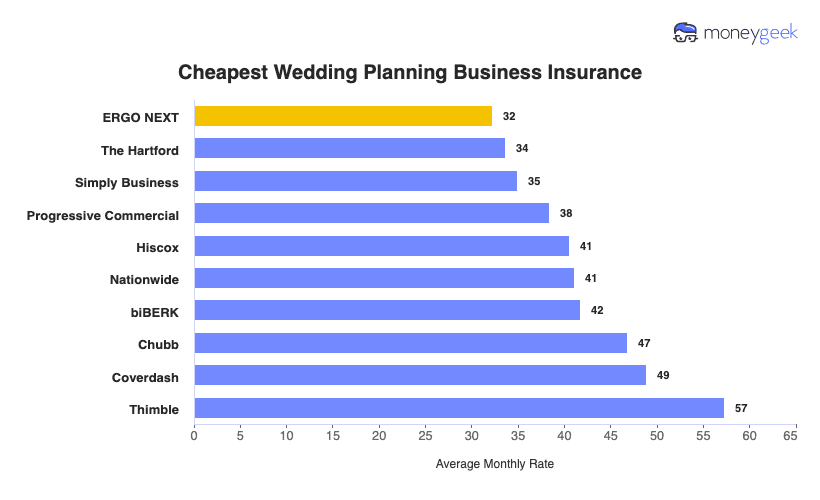

Cheapest Business Insurance for Wedding Planning Businesses

ERGO NEXT offers the cheapest wedding planner business insurance at $32 monthly or $386 annually, with the lowest rates for general liability ($143 annually), workers' comp ($321 annually) and BOP coverage ($219 annually). For professional liability insurance, The Hartford provides more affordable rates at $818 per year, with ERGO NEXT ranking second at $858 annually for wedding planning businesses.

| ERGO NEXT | $32 | $386 |

| The Hartford | $34 | $403 |

| Simply Business | $35 | $419 |

| Progressive Commercial | $38 | $460 |

| Hiscox | $41 | $487 |

| Nationwide | $41 | $492 |

| biBERK | $42 | $500 |

| Chubb | $47 | $561 |

| Coverdash | $49 | $586 |

| Thimble | $57 | $688 |

Cheapest General Liability Insurance for Wedding Planners

ERGO NEXT offers the cheapest general liability insurance for wedding planners at $12 monthly or $143 annually. This saves wedding planning businesses $16 per month compared to the $28 industry average, cutting costs by 57%. Wedding coordinators who work with multiple venues particularly benefit from these lower rates while meeting venue insurance requirements.

| ERGO NEXT | $12 | $143 |

| Simply Business | $14 | $171 |

| The Hartford | $16 | $194 |

| Nationwide | $20 | $241 |

| Progressive Commercial | $21 | $249 |

Cheapest Workers' Comp Insurance for Wedding Planners

Wedding planning businesses with employees can get the cheapest workers' comp insurance from ERGO NEXT at $27 monthly or $321 annually. That's $2 less per month than the $29 industry average. The Hartford, Thimble and Simply Business also offer competitive rates for wedding coordinators managing event-day staff.

| ERGO NEXT | $27 | $321 |

| The Hartford | $27 | $324 |

| Thimble | $27 | $327 |

| Simply Business | $28 | $331 |

| Progressive Commercial | $28 | $332 |

Cheapest Professional Liability Insurance for Wedding Planners

The Hartford provides the cheapest professional liability insurance for wedding planners at $68 monthly or $818 annually, saving $9 per month compared to the $77 industry average. ERGO NEXT ranks second at $72 monthly for wedding planning businesses.

| The Hartford | $68 | $818 |

| ERGO NEXT | $72 | $858 |

| Progressive Commercial | $73 | $878 |

| Thimble | $75 | $904 |

| Simply Business | $76 | $912 |

Cheapest BOP Insurance for Wedding Planners

For wedding coordinators seeking bundled coverage, ERGO NEXT offers the most affordable BOP insurance at $18 monthly or $219 annually. That's $14 less per month than the $32 industry average. Simply Business ($21 monthly) and The Hartford ($22 monthly) are the next most affordable options for wedding planning businesses.

| ERGO NEXT | $18 | $219 |

| Simply Business | $21 | $255 |

| The Hartford | $22 | $270 |

| Nationwide | $30 | $360 |

| Progressive Commercial | $31 | $373 |

What Does Wedding Planning Business Insurance Cost?

In general, wedding planning business insurance costs are the following for the four most popular coverage types:

- General Liability: $28 on average per month, ranging from $24 to $34, depending on the state

- Workers' Comp: $29 on average per month, ranging from $25 to $33, depending on the state

- Professional Liability (E&O): $77 on average per month, ranging from $65 to $90, depending on the state

- BOP Insurance: $32 on average per month, ranging from $28 to $37, depending on the state

| Professional Liability (E&O) | $77 | $921 |

| BOP | $32 | $382 |

| Workers' Comp | $29 | $342 |

| General Liability | $28 | $336 |

What Type of Insurance Is Best for a Wedding Planning Business?

Required coverage for wedding planners varies by situation, but most wedding coordinators need general liability and professional liability to meet venue requirements and protect against client lawsuits. Additional coverage types depend on your business model, client data handling and whether you own vehicles or maintain physical office space.

- Workers' Compensation Insurance: Most states require workers' comp if you have employees or assistants helping with event-day coordination. It covers medical bills and lost wages when your coordinator sprains an ankle while setting up ceremony chairs or your assistant injures their back lifting decorative arches. Standard coverage limits start at your state's minimum requirements.

- General Liability Insurance: Wedding venues require proof of general liability before allowing you on-site, with $1 million per occurrence and $2 million aggregate limits. This protects you when a guest trips over your lighting cables during the reception or you accidentally knock over a venue's expensive chandelier while hanging decorations.

- Professional Liability Insurance (Errors & Omissions): Professional liability protects your wedding planning business from costly lawsuits when clients claim you booked the wrong venue date, hired a caterer who couldn't accommodate food allergies or let the event run late causing extra venue fees. Most wedding coordinators carry $1 million per occurrence limits to cover legal defense costs and settlements.

- Cyber Liability Insurance: Cyber liability protects wedding planners who store client credit card numbers, guest lists and vendor contact information from data breach costs. This coverage pays for breach notifications, credit monitoring services for affected clients and ransomware attacks that lock your planning software. Average cyber incident claims cost $169,000, making this essential protection for digitally-focused wedding coordinators.

- Business Owner's Policy (BOP): A BOP bundles general liability and commercial property coverage, protecting your office equipment, sample centerpieces, client contracts and planning materials. This works well for wedding planners with physical offices or inventory, offering comprehensive protection at lower rates than purchasing policies separately.

- Commercial Auto Insurance: Required by most states for business-owned vehicles, commercial auto covers accidents when you're transporting wedding decor to venues, picking up last-minute supplies or driving between vendor meetings. It pays for repairs when you back into a venue's porch while unloading ceremony supplies.

- Hired and Non-Owned Auto Insurance (HNOA): HNOA provides liability coverage when you or employees drive personal vehicles for wedding-related errands or use rental cars to transport decorations. Personal auto policies exclude business use, leaving you exposed when picking up emergency supplies or meeting clients at venues in your own car.

- Commercial Umbrella Insurance: Umbrella coverage adds extra liability protection beyond your general liability, commercial auto and workers' comp limits. Wedding planners purchase this when high-end venues require $2 million to $5 million in coverage or when managing large weddings where one serious accident could exceed standard policy limits.

- Inland Marine Insurance: Inland marine protects your business property while transporting decorations, centerpieces and equipment between your office and wedding venues. This covers theft when someone breaks into your van overnight and steals $10,000 worth of ceremony decor, or damage when your trailer gets rear-ended while carrying floral arrangements.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Wedding Planning Business

Getting the best business insurance for your wedding planning business involves a gathering quotes from multiple providers to comparing coverage options and rates.

- 1Decide on Coverage Needs Before Buying

Talk with other wedding coordinators about their actual claims experiences to identify which coverage types matter most for your business.

- 2Research Costs

Research insurance costs for wedding planners in your area before shopping. A solo coordinator handling 15 weddings annually pays differently than a team managing 50 events.

- 3Look Into Company Reputations and Coverage Options

Read reviews from wedding coordinators about claims experiences, especially how insurers handled situations like venue cancellations, vendor failures or client lawsuits over timeline mistakes.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers using different channels. Independent agents often find specialized event planner rates unavailable online, while comparison tools offer quick results.

- 5Reassess Annually

Review coverage annually before peak season to ensure limits match your current revenue and venue requirements without overpaying for outdated protection.

Best Insurance for Wedding Planning Services: Bottom Line

Wedding planners need comprehensive business insurance to protect their operations. ERGO NEXT stands out as both the best and cheapest option for wedding planning businesses, earning a 4.82 MoneyGeek score for its competitive rates and quality service. General liability, professional liability, workers' compensation and cyber liability coverage safeguard your business from financial risks.

Wedding Planning Business Insurance: FAQ

We answer frequently asked questions about wedding planning business insurance:

Who offers the best wedding planning business insurance overall?

ERGO NEXT leads Wedding Planning business insurance with an outstanding MoneyGeek score of 4.82 out of 5. The Hartford follows closely as second place, earning a solid 4.74 score through excellent affordability, customer service and comprehensive coverage options.

Who has the cheapest business insurance for wedding planning services?

Here are the cheapest business insurance companies for wedding planners by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $12 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $27 monthly

- Cheapest professional liability insurance: The Hartford at $68 monthly

- Cheapest BOP insurance: ERGO NEXT at $18 monthly

What business insurance is required for wedding planners?

Wedding planning businesses must carry workers' compensation insurance when employing staff and commercial auto insurance for company vehicles, with specific requirements differing by state. General liability coverage becomes practically mandatory for client contracts and venue agreements.

How much does wedding planning business insurance cost?

Wedding Planning business insurance costs by coverage type are as follows:

- General Liability: $28/mo

- Workers' Comp: $29/mo

- Professional Liability: $77/mo

- BOP Insurance: $32/mo

How We Chose the Best Wedding Planning Business Insurance

We selected the best business insurer for wedding planning businesses based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.