ERGO NEXT leads MoneyGeek's study as the best small business insurance in Utah with top scores in customer service and coverage. The Hartford offers the lowest rates at $85 monthly, while Simply Business provides the broadest coverage options for Utah small business owners.

Best Small Business Insurance in Utah

Utah's top business insurers are ERGO NEXT, The Hartford and Simply Business, with annual rates starting at just $69 per year.

Get matched to the best Utah commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT ranks as the best small business insurance in Utah, leading in customer service and coverage.

The Hartford offers the cheapest small business insurance in Utah at $85 monthly ($1,021 annually).

Compare quotes and bundle small business insurance coverage to match your risks and save on premiums.

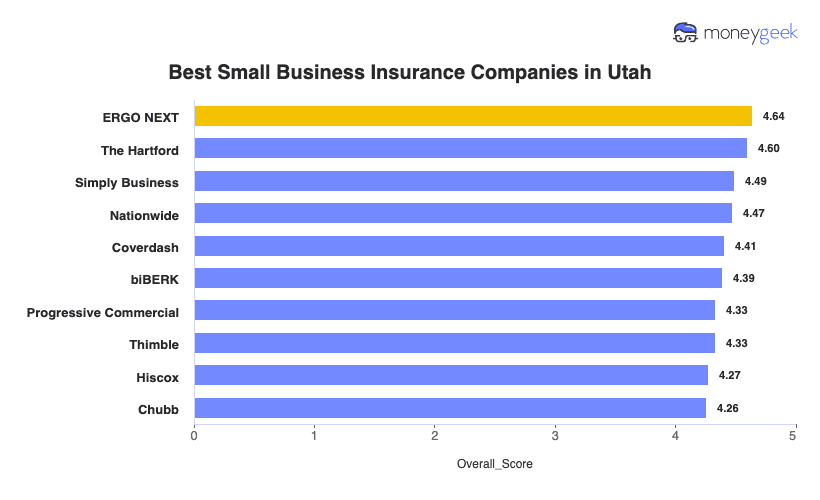

Best Small Business Insurance Companies in Utah

| ERGO NEXT | 4.64 | $86 | 1 | 2 |

| The Hartford | 4.60 | $85 | 2 | 3 |

| Simply Business | 4.49 | $93 | 5 | 1 |

| Nationwide | 4.47 | $97 | 2 | 4 |

| Coverdash | 4.41 | $96 | 6 | 2 |

| biBERK | 4.39 | $100 | 2 | 5 |

| Progressive Commercial | 4.33 | $94 | 7 | 5 |

| Thimble | 4.33 | $90 | 8 | 5 |

| Hiscox | 4.27 | $103 | 4 | 6 |

| Chubb | 4.26 | $112 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

ind the best and cheapest small business insurance providers in Utah for general liability, workers' comp, professional liability and more:

Best Utah Business Insurance

Average Monthly Cost of General Liability Insurance

$84This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first among the providers MoneyGeek researched

Provides excellent customer service

Provides quotes and coverage in under 10 minutes

A- AM Best rating

consHigher average cost than other providers

No physical offices

ERGO NEXT makes it easy for Utah contractors to get job-ready proof fast, ranking first in MoneyGeek's study for customer service and coverage at $86 monthly. Most policies issue instantly with same-day certificates of insurance for client contracts and job sites.

Utah contractors pay $86 monthly ($1,029 annually) for ERGO NEXT and save on the coverage they need most. General liability, professional liability and workers' comp all cost below state averages. Business owner's policies run $127 monthly, saving you $12 monthly compared to Utah's average.

ERGO NEXT ranks first nationally for digital experience and policy management, so you can get quotes and certificates fast online. Claims processing ranks fourth nationally, meaning longer waits when you file. The mobile platform excels for purchasing coverage but may frustrate you during claims.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT delivers same-day certificates of insurance, which is critical when Utah contractors need proof before starting jobs. You can add hired and non-owned auto coverage if employees drive personal vehicles for work, plus tools and equipment protection up to $50,000 for contractors and tradespeople.

Cheapest Utah Business Insurance

Average Monthly Cost of General Liability Insurance

$86This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks second among the providers MoneyGeek researched

Offers the lowest rates across all coverage types

Excellent claims process and customer satisfaction

A+ AM Best rating

More than 200 years of insurance industry experience

consRanks last for digital experience

Unavailable in Hawaii and Alaska

The Hartford offers the cheapest small business insurance in Utah at $85 monthly, ranking second in MoneyGeek's study for customer service and financial stability. It's best for Utah contractors and small businesses who want the lowest rates without sacrificing claims support when job-site accidents happen.

Utah small businesses pay $85 monthly ($1,021 annually) for The Hartford and save on coverage they need. General liability costs $86 monthly for contractor job-site protection, while workers' comp runs $66 monthly if you hire employees. Both cost below state averages.

The Hartford ranks first nationally for claims processing and customer service, meaning faster help when you file property damage or injury claims. The digital platform ranks 10th nationally, so getting online quotes and certificates of insurance takes longer than competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers equipment breakdown coverage to protect HVAC systems, refrigeration and machinery for Utah contractors and trades. You can add employment practices liability when you hire your first employee, plus cyber liability protection bundled in business owner's policies.

Best Commercial Coverage Options in Utah

Average Monthly Cost of General Liability Insurance

$92This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$68This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

Above-average digital experience rating

consLower customer service ranking than other carriers

Ranks third to last in claims processing

Simply Business offers the broadest coverage options in Utah at $93 monthly, ranking first for policy choices that match specialized business risks. It's best for Utah contractors who need pollution liability, hospitality businesses serving alcohol, or food retailers who need product liability beyond standard general liability.

Utah small businesses pay $93 monthly ($1,110 annually) for Simply Business. Business owner's policies cost $138 monthly and save you $16 compared to the state average, bundling general liability with property coverage contractors need for equipment and tools. Workers' comp costs $68 monthly if you hire employees.

Simply Business ranks third nationally for digital experience but doesn't offer same-day certificates of insurance like ERGO NEXT. Claims processing ranks eighth nationally, meaning longer waits when you file customer injury or property damage claims at job sites. The online platform works well for quotes but may frustrate you during claims.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business offers pollution liability for Utah contractors handling paint, solvents or hazardous materials at job sites. You can add liquor liability if you run bars, restaurants or catering businesses, plus product liability for food manufacturers and retailers selling products to customers.

Get Matched to the Best Small Business Insurance Providers in Utah

Select your industry and state to get a customized quote for your Utah business.

How to Get the Best Cheap Small Business Insurance in Utah

Utah small business owners, from Wasatch Front contractors to Salt Lake City restaurants to Provo tech startups, have risks like earthquakes and spring flooding from snowmelt. Getting business insurance that covers these hazards takes more than finding the cheapest premium.

- 1

Know Utah legal requirements and actual protection needs

Utah law requires workers' compensation from your first employee, commercial auto liability at $30,000/$65,000/$25,000 (increased January 1, 2025), and $3,000 minimum PIP coverage. Contractors need $100,000/$300,000 general liability to maintain DOPL licenses. Beyond legal mandates, landlords require commercial property coverage, and lenders mandate flood insurance for properties in the 186+ NFIP participating communities when you have a federally backed mortgage.

- 2

Match coverage to Utah industry and regional risks

Earthquake coverage protects restaurant equipment, retail inventory, and office technology from non-structural damage that standard policies exclude. Utah's Wasatch Front sits on major fault lines. Professional liability covers consultants and tech firms when clients claim your advice caused financial losses. Cyber liability protects businesses storing customer data, which matters more given Utah's competitive hiring market where data breaches hurt recruitment and retention.

- 3

Get quotes from top carriers and Utah programs

Since Utah doesn't maintain state workers' comp funds or assigned risk pools, compare private market carriers to find competitive rates. The difference between The Hartford and Chubb reaches $324 annually. Savings from getting better rates means more funds for other business needs.

- 4

Look beyond the cheapest monthly premium

The cheapest policy won't help when spring flooding hits and you discover it excludes earthquake damage Utah businesses need. Consider providers that offer specialized options (pollution liability for contractors, product liability for food retailers, liquor liability for restaurants), have excellent customer service and processes claims efficiently. Check AM Best ratings (A- or higher) and ask about response times for COI requests, which most Utah businesses need.

- 5

Stack bundling discounts with payment strategies for lower rates

Business insurance costs add up quickly when covering multiple risks. Bundle general liability with commercial property in a business owner's policy to cut combined premiums 20% to 30%, then add workers' comp and commercial auto for additional multi-policy discounts. Pay annually instead of monthly to avoid $200 to $400 in installment fees, and ask Utah insurers about claim-free discounts and safety program credits.

- 6

Update coverage as your Utah business evolves

Landing contracts above $1 million requires commercial umbrella coverage when your general liability limits won't cover large claims. Storing customer property in your warehouse requires bailee coverage, whether you're holding equipment for repairs or inventory awaiting distribution. Start manufacturing or selling products and you need product liability, from craft goods in Provo workshops to retail merchandise in Park City shops.

Best Business Liability Insurance Utah: Bottom Line

ERGO NEXT leads Utah in customer service and coverage. The Hartford offers the most affordable option at $85 monthly. Compare quotes from both carriers and bundle coverages for earthquake, flood and workers' comp protection to cut premiums 20% to 30%.

Business Insurance Utah: FAQ

Small business owners in Utah often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need to start a small business in Utah?

Utah requires workers' compensation from your first employee and commercial auto liability of $30,000/$65,000/$25,000 if you drive for business. Contractors need $100,000/$300,000 general liability for DOPL licenses. Add earthquake and flood coverage to protect against Utah-specific financial risks.

How much does small business insurance cost per month in Utah for my type of business?

Coverage costs for your Utah business depend on your industry, but here are the monthly and annual averages by coverage type:

- General liability insurance: $98 monthly or $1,179 annually

- Workers' compensation insurance: $70 monthly or $843 annually

- Professional liability (E&O) insurance: $74 monthly or $889 annually

- Business owner's policy (BOP): $139 monthly or $1,673 annually

What's required in Utah vs what my client, landlord or venue requires for a COI?

Utah requires workers' comp from one employee and commercial auto for business driving. Contractors need $100,000/$300,000 general liability for DOPL licenses. Clients, landlords and venues often require higher limits, additional insured status and commercial property coverage beyond state minimums.

How fast can I get proof of insurance (COI) and add my client as additional insured?

ERGO NEXT and The Hartford issue certificates of insurance within 24 hours after purchase. You'll add clients as additional insureds during the quote process or by contacting your agent afterward. Digital carriers like ERGO NEXT often provide instant COI downloads.

Will it cover common claims like customer injuries, property damage, employee injuries or business driving?

General liability covers customer injuries and property damage you cause. Workers' compensation covers employee injuries. Commercial auto covers business driving accidents. Bundle these coverages with commercial property in a business owner's policy for most common Utah claims.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Utah Division of Professional Licensing. "Specialty Contractor License Requirements." Accessed February 7, 2026.

- Utah Labor Commission. "Employers' Guide to Workers' Compensation." Accessed February 7, 2026.

- Utah Legislature. "H.B. 113 Motor Vehicle Insurance Revisions, Enrolled Copy." Accessed February 7, 2026.