ERGO NEXT leads Tennessee's best small business insurance with top-ranked customer service, strong coverage options and competitive rates at $98 monthly. The Hartford and Simply Business also offer solid protection for Volunteer State entrepreneurs.

Best Small Business Insurance in Tennessee

Tennessee's top business insurers are ERGO NEXT, The Hartford and Simply Business, with coverage starting at $70 annually for small businesses.

Get matched to the best Tennessee commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Tennessee's best small business insurance comes from ERGO NEXT, ranking first in customer service and second in coverage.

The Hartford offers the cheapest small business insurance in Tennessee at $82 monthly ($980 annually).

Choose the right small business insurance coverage by assessing risks, comparing quotes and claiming discounts.

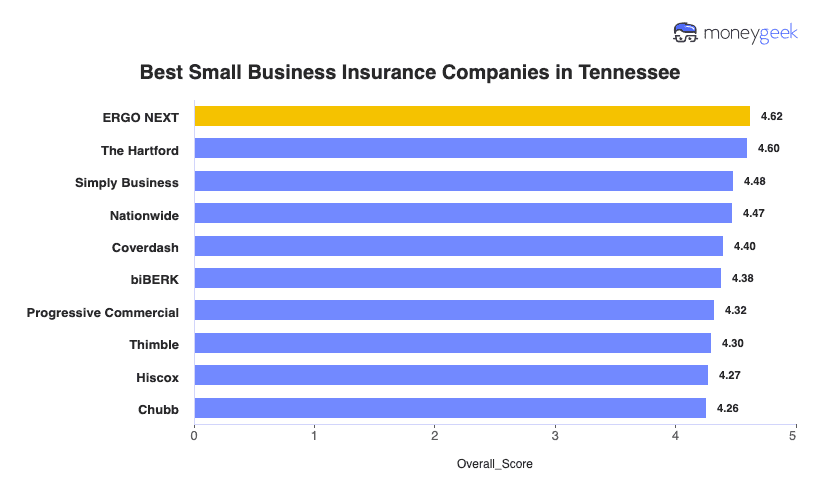

Best Small Business Insurance Companies in Tennessee

| ERGO NEXT | 4.62 | $98 | 1 | 2 |

| The Hartford | 4.60 | $82 | 2 | 3 |

| Simply Business | 4.48 | $94 | 5 | 1 |

| Nationwide | 4.47 | $99 | 2 | 4 |

| Coverdash | 4.40 | $99 | 6 | 2 |

| biBERK | 4.38 | $102 | 2 | 5 |

| Progressive Commercial | 4.32 | $97 | 7 | 5 |

| Thimble | 4.30 | $91 | 8 | 5 |

| Hiscox | 4.27 | $105 | 4 | 6 |

| Chubb | 4.26 | $115 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

The best or cheapest business insurer in Tennessee for your business depends changes, depending on what coverage type you need. Check out our resources to find the provider that matches your needs:

Best Tennessee Business Insurance

Average Monthly Cost of General Liability Insurance

$100This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$67This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first among the providers MoneyGeek researched

Provides excellent customer service

Provides quotes and coverage in under 10 minutes

A- AM Best rating

consHigher average cost than other providers

No physical offices

ERGO NEXT ranks first among Tennessee small business insurers, earning top scores for customer service and second for coverage breadth at $98 monthly. Founded in 2016 with an A- AM Best rating and 600,000+ customers nationwide, it's best for Tennessee businesses needing fast online quotes and same-day coverage.

ERGO NEXT averages $98 monthly ($1,173 annually), ranking fourth for affordability statewide. Tennessee contractors and professional services save most: workers' compensation costs just $67 monthly (cheapest statewide) and professional liability runs $71 monthly (second-cheapest). Business owner's policies cost $152 monthly, $8 above the $144 state average.

ERGO NEXT ranks first nationally for digital experience and policy management, with 18,000+ customer reviews praising instant certificates and 24/7 mobile app access. Claims processing ranks fourth, with some Trustpilot reviewers noting coverage challenges and difficulty reaching phone representatives. Tennessee business owners get excellent online tools but may experience delays with phone support.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers unlimited additional insureds on certificates at no extra cost—valuable for Tennessee contractors managing multiple client requirements. It covers 1,300+ business types with seven coverage options, including cyber liability and tools/equipment protection. Standard general liability limits range from $400,000 per claim to $1 million aggregate, though business owner's policies aren't available in all states.

Cheapest Tennessee Business Insurance

Average Monthly Cost of General Liability Insurance

$80This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$68This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks second among the providers MoneyGeek researched

Offers the lowest rates across all coverage types

Excellent claims process and customer satisfaction

A+ AM Best rating

More than 200 years of insurance industry experience

consRanks last for digital experience

Unavailable in Hawaii and Alaska

The Hartford ranks second overall among Tennessee small business insurers while offering the lowest rates at $82 monthly ($980 annually). Founded in 1810 with an A+ AM Best rating, it combines 200+ years of experience with top-ranked claims processing. It's best for Tennessee businesses prioritizing proven stability and cost savings over digital features.

The Hartford leads Tennessee in affordability across all coverage types, beating state averages substantially. General liability costs $80 monthly ($255 below the $1,212 annual state average), professional liability runs $69 monthly ($76 below average) and business owner's policies cost $110 monthly ($408 below the $1,724 state average). Workers' compensation ranks second-cheapest at $68 monthly.

The Hartford earns a 4.5 customer satisfaction score with top national rankings for claims processing and customer service. Customers praise efficient claim handling and knowledgeable representatives in MoneyGeek surveys. Digital experience ranks tenth among competitors, so Tennessee business owners get excellent phone support and claims help but may find the online platform less intuitive than newer insurers.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford ranks third for coverage breadth, covering 60+ industries with employment practices liability that automatically includes wage and hour defense costs. It offers multinational coverage spanning 220+ countries for Tennessee businesses expanding internationally. General liability limits range from $300,000 to $2 million, though Michigan businesses can't get business owner's policies.

Best Commercial Coverage Options in Tennessee

Average Monthly Cost of General Liability Insurance

$93This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$69This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

Above-average digital experience rating

consLower customer service ranking than other carriers

Ranks third to last in claims processing

Simply Business ranks third overall among Tennessee small business insurers and first for coverage breadth at $94 monthly. This Travelers-owned broker connects you with 20+ carriers in under 10 minutes through its digital marketplace, eliminating agent meetings. It's best for Tennessee businesses needing fast quotes and access to specialized coverage unavailable from single insurers.

Simply Business averages $94 monthly ($1,133 annually), ranking fourth for affordability statewide. General liability costs $93 monthly (second-cheapest, $91 below the $1,212 state average) and business owner's policies run $140 monthly ($42 below the $1,724 average). Professional liability costs $75 monthly and workers' compensation runs $69 monthly, both near state averages.

Simply Business ranks third nationally for digital experience with 4.6 Trustpilot stars from 1,400+ reviews praising its fast quote process. Customer service ranks sixth and claims processing ranks eighth because your actual carrier handles support, not Simply Business. Tennessee business owners get excellent online quote tools but service quality varies by which carrier underwrites your policy.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business ranks first for coverage breadth by connecting you with 20+ top-rated carriers including Travelers, Hiscox and CNA. Amazon chose Simply Business for its Insurance Accelerator Program, offering online sellers product liability policies formatted for Amazon's requirements. Tennessee contractors, e-commerce businesses and niche industries access specialized coverage single insurers can't match.

Get Matched to the Best Small Business Insurance Providers in Tennessee

Select your industry and state to get a customized quote for your Tennessee business.

How to Get the Best Cheap Small Business Insurance in Tennessee

Tennessee small business owners face tornado-prone counties across Middle Tennessee, a fifth-employee trigger for workers' comp that catches many off guard, and contractor rules requiring insurance proof before bidding jobs over $25,000. Getting business insurance that covers these risks means more than finding the lowest price.

- 1

Separate what Tennessee law requires from what protects your business

Tennessee requires workers' compensation when you hire your fifth employee (construction needs it from employee one) and commercial auto with $25,000/$50,000/$25,000 minimums for business vehicles. General liability insurance is mandatory only for licensed contractors, but clients and landlords often demand it, and Tennessee tornadoes prove you need commercial property coverage even when law doesn't require it.

- 2

Cover risks your Tennessee business actually faces

Construction and trade businesses (Tennessee has 75,877 construction firms) need tools and equipment insurance when items get stolen from job sites. Restaurants and event venues need coverage beyond the basics. With Tennessee averaging 7.8 major disaster events yearly since 2020, business interruption coverage pays lost income when tornadoes shut down your Davidson, Sumner, or Maury County operation for days.

- 3

Get quotes from top carriers and Tennessee programs

Compare rates from ERGO NEXT, The Hartford, and Simply Business (our highest-ranked small business insurers). Most Tennessee businesses find coverage easily since about 350 carriers operate here, but if standard insurers turn you down, the NCCI runs Tennessee's assigned risk program for workers' comp at higher rates. Shop standard carriers first before using assigned risk.

- 4

Look beyond the cheapest monthly premium

Low premiums backfire when May storms hit and your cheap policy excludes coverage Tennessee businesses need, or your insurer takes weeks answering questions after tornado damage. ERGO NEXT scores highest for customer service, while The Hartford offers stronger financial ratings. Ask how fast the company responds after Tennessee weather events and check its AM Best rating of A- or better.

- 5

Cut costs through bundling and payment timing

Combine general liability with commercial property in a business owner's policy to cut premiums 20% to 30%. Pay annually instead of monthly to avoid $200 to $400 in fees. Ask about Tennessee's Drug-Free Workplace Program for workers' comp discounts. These strategies lower the cost of your coverage without sacrificing protection.

- 6

Review coverage when your business changes

Your fifth employee triggers workers' comp in Tennessee (that's stricter than some nearby states). Opening a second location in Knoxville when you started in Nashville means different rates by region. Bidding construction contracts over $25,000 requires a contractor license with general liability proof. Update your policies annually and whenever you hire, add vehicles, or expand locations.

Best Business Liability Insurance Tennessee: Bottom Line

ERGO NEXT and The Hartford lead Tennessee small business insurance. ERGO NEXT excels in customer service while The Hartford offers the lowest rates at $82 monthly. Compare quotes from both providers, assess your business risks and claim discounts to find coverage matching your budget and needs.

Business Insurance Tennessee: FAQ

Small business owners in Tennessee often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need to run my small business in Tennessee?

Tennessee requires workers' compensation when you hire your fifth employee (construction needs it from employee one) and commercial auto for business vehicles. General liability is mandatory only for licensed contractors, but clients and landlords often demand it before contracts or leases.

What's required in Tennessee vs what my landlord or clients will ask for?

Tennessee law requires workers' comp at five employees and commercial auto for vehicles. Landlords want general liability naming them as additional insured. Clients often demand cyber liability for data protection and professional liability for errors before awarding contracts.

About how much does small business insurance cost per month in Tennessee, and what makes it go up or down?

Small business insurance costs in Tennessee depend on your industry, but these are the monthly and annual averages by coverage type:

- General liability insurance: $101 monthly or $1,212 annually

- Workers' compensation insurance: $72 monthly or $861 annually

- Professional liability (E&O) insurance: $76 monthly or $909 annually

- Business owner's policy (BOP): $144 monthly or $1,724 annually

Your industry, claims history, coverage limits and employee count affect rates.

How fast can I get a COI (proof of insurance), and what do you need from me?

ERGO NEXT and Simply Business issue instant certificates once coverage starts, while The Hartford processes them within 24 hours. You'll need the certificate holder's name, address and contract requirements like additional insured status or coverage minimums.

Do I need workers' comp in Tennessee if I have one employee or use 1099 help?

Construction and mining businesses need workers' comp from employee one. Other Tennessee businesses need it at five employees. Independent contractors (1099s) don't count toward your total, but misclassifying actual employees as contractors triggers penalties through Tennessee's Employee Misclassification Enforcement Fund.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- NOAA National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters: Tennessee." Accessed February 8, 2026.

- Tennessee Department of Commerce and Insurance. "Contractor Insurance Information." Accessed February 8, 2026.

- Tennessee Department of Labor and Workforce Development. "Who Must Carry Insurance." Accessed February 8, 2026.