Simply Business earns our top recommendation for spa business insurance with a MoneyGeek score of 4.70 out of 5. Whether you run a day spa, med spa or wellness center, it offers competitive rates and comprehensive coverage options that provide spa establishment financial protection without straining your budget. ERGO NEXT and The Hartford also offer coverage tailored to spa owners' unique needs.

Best Spa/Wellness Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for spa/wellness companies with rates starting at $46 monthly.

Discover the best business insurance provider for spa owners.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Spa owners need different types of coverage, like general liability for client injuries, workers' comp for staff, professional liability for treatments and commercial property for equipment.

Simply Business earns the best business insurance rating for spas, with a MoneyGeek score of 4.70, affordable rates and access to quotes from over 20 carriers in one place.

Simply Business provides the cheapest business insurance at $44 monthly, with workers' comp as low as $17 monthly to cover your massage therapists and estheticians.

Best Business Insurance for Spas and Wellness Centers

| Simply Business | 4.70 | $44 |

| ERGO NEXT | 4.59 | $84 |

| The Hartford | 4.58 | $80 |

| Coverdash | 4.50 | $79 |

| Progressive Commercial | 4.30 | $99 |

| Nationwide | 4.30 | $140 |

| Chubb | 4.30 | $121 |

| Hiscox | 4.20 | $107 |

| Thimble | 4.20 | $107 |

| biBERK | 4.20 | $137 |

Note: We based all scores on a spa and wellness business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Spa and Wellness Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for day and medical spas, check out the following resources:

1. Simply Business: Best and Cheapest Overall for Spas and Wellness Centers

Lowest rates for spa general liability and BOP coverage

Access to multiple top carriers through one digital platform

Excellent online tools for managing policies and certificates

Get personalized quotes in minutes without calling agents

Customer service can be slow with long phone waits

Professional liability costs more than some competitors offer

Claims quality varies depending on your selected carrier

Simply Business ranks first for spa business insurance with the lowest rates we studied: $238 annually for general liability and $354 for BOP coverage. As a broker, Simply Business connects spa owners to over 20 top-rated carriers, including Travelers, Hiscox and CNA.

Its digital platform lets you compare quotes in 10 minutes, bind coverage instantly and download certificates 24/7.

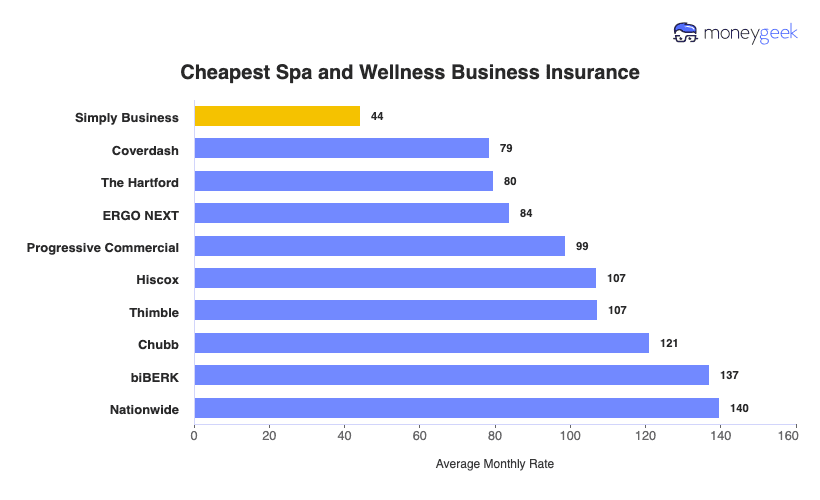

Cheapest Business Insurance for Spas and Wellness Centers

Simply Business offers the cheapest spa business insurance overall at $44 monthly ($532 annually), ranking first for general liability ($20 monthly) and BOP coverage ($30 monthly). ERGO NEXT leads for workers' comp at $16 monthly, while The Hartford offers the lowest professional liability rates at $98 monthly for med spas.

| Simply Business | $44 | $532 |

| Coverdash | $79 | $944 |

| The Hartford | $80 | $956 |

| ERGO NEXT | $84 | $1,008 |

| Progressive Commercial | $99 | $1,184 |

| Hiscox | $107 | $1,283 |

| Thimble | $107 | $1,287 |

| Chubb | $121 | $1,453 |

| biBERK | $137 | $1,643 |

| Nationwide | $140 | $1,676 |

Cheapest General Liability Insurance for Day and Medical Spas

Simply Business offers the cheapest general liability insurance for spa owners at $20 monthly ($238 annually). Med spas can cut general liability costs by 81% with Simply Business while maintaining comprehensive coverage for client injuries and property damage claims.

| Simply Business | $20 | $238 |

| Coverdash | $74 | $890 |

| The Hartford | $84 | $1,004 |

| ERGO NEXT | $84 | $1,008 |

| Progressive Commercial | $107 | $1,284 |

Cheapest Workers' Comp Insurance for Day and Medical Spas

ERGO NEXT provides the cheapest workers' comp insurance for spa businesses at $16 monthly ($195 annually). Wellness centers and day spas save $12 annually compared to the $209 industry average. The Hartford, Progressive Commercial and Thimble offer similarly competitive rates for spa owners protecting employees from workplace injuries.

| ERGO NEXT | $16 | $195 |

| The Hartford | $17 | $199 |

| Progressive Commercial | $17 | $201 |

| Thimble | $17 | $202 |

| Simply Business | $17 | $203 |

Cheapest Professional Liability Insurance for Day and Medical Spas

The Hartford leads professional liability coverage for spa businesses at $98 monthly ($1,171 annually), offering the cheapest professional liability insurance available. That saves med spas and wellness centers 11% compared to the $110 industry average. ERGO NEXT provides another budget-friendly option at $102 monthly for protection against treatment-related claims.

| The Hartford | $98 | $1,171 |

| ERGO NEXT | $102 | $1,230 |

| Progressive Commercial | $105 | $1,255 |

| Simply Business | $109 | $1,307 |

| Hiscox | $109 | $1,313 |

Cheapest BOP Insurance for Day and Medical Spas

Day spas and wellness centers bundling liability with property coverage pay just $30 monthly ($354 annually) with Simply Business for the cheapest business owners' policy available. That's $126 less per month than the $156 industry average, making it the most cost-effective way for spa owners to protect treatment rooms, equipment and client operations.

| Simply Business | $30 | $354 |

| Coverdash | $107 | $1,285 |

| The Hartford | $115 | $1,386 |

| ERGO NEXT | $128 | $1,533 |

| Progressive Commercial | $160 | $1,915 |

What Does Spa and Wellness Business Insurance Cost?

Spa business insurance costs vary by coverage type. Here's what spa owners pay for the four most common policies:

- General Liability: $107 on average per month, ranging from $88 to $125, depending on the state

- Workers' Comp: $17 on average per month, ranging from $15 to $20, depending on the state

- Professional Liability (E&O): $110 on average per month, ranging from $93 to $130, depending on the state

- BOP Insurance: $156 on average per month, ranging from $127 to $181, depending on the state

| Workers' Comp | $17 | $209 |

| General Liability | $107 | $1,281 |

| Professional Liability (E&O) | $110 | $1,322 |

| BOP | $156 | $1,874 |

What Type of Insurance Is Best for a Day and Medical Spa?

Most states require workers' compensation once you hire employees, and landlords won't lease you spa space without general liability coverage. Beyond these required coverage for day and medical spas, you'll want professional liability for treatment-related claims and property insurance to protect your equipment.

- Workers' Compensation Insurance: Your massage therapist throws out their back during a deep tissue session, your esthetician burns their hand on a wax warmer, or staff slips on wet tile near the hydrotherapy room. Workers' comp covers medical bills and lost wages for workplace injuries. Most states require this once you have employees, and skipping it means steep fines plus paying injury costs out of pocket. Limits follow state statutory requirements.

- General Liability Insurance: Covers client injuries like slipping out of your steam room, burns during hot stone massages or allergic reactions to massage oil. You'll need this to sign your lease and book corporate wellness contracts. Most spa owners carry $1 million per occurrence with $2 million aggregate.

- Professional Liability Insurance: Protects against treatment claims like chemical peels causing scarring, massages worsening back pain, or Botox complications. Med spas offering injectables, laser hair removal or fillers need $1 million per claim with $3 million aggregate. Day spas should carry at least $1 million per occurrence for massage therapy, facials and body treatments.

- Commercial Property Insurance: Your laser equipment costs $50,000 to $175,000, plus massage tables, facial steamers, product inventory and décor. This protects your assets from fire, theft or water damage, and covers lost income if you close temporarily. Match coverage limits to your total equipment and inventory replacement costs.

- Business Owner's Policy: Bundles general liability and property coverage at lower cost. Perfect for spas with multiple treatment rooms, reception areas and retail displays. Most spa owners choose $1 million per claim and $2 million total liability coverage, with property limits matching equipment and inventory value.

- Commercial Auto Insurance: Need this if you run mobile spa services for events, make supply runs or transport products. Personal policies exclude business use. Most spa owners carry $500,000 to $1 million per occurrence for medical expenses and property damage.

- Cyber Liability Insurance: Your spa stores client credit cards, contact info and appointment histories. Med spas also handle health records subject to HIPAA. A breach means client notifications, credit monitoring and potential fines. Most wellness centers carry $1 million in coverage.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Spa and Wellness Center

Finding affordable coverage for your day spa or wellness center starts with understanding how to get business insurance that matches your specific treatment offerings and risk profile.

- 1Decide on Coverage Needs Before Buying

Think about what keeps you up at night as a spa owner: clients slipping near your wet treatment rooms, burns from hot stones, allergic reactions to products or your expensive laser equipment breaking down.

- 2Research Costs

Know what you should pay before you start shopping. General liability for spas averages around $107 monthly, though rates vary based on your services and size.

- 3Look Into Company Reputations and Coverage Options

Check what other spa and wellness center owners say on Google reviews, Better Business Bureau and spa owner forums.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three companies using different approaches.

- 5Reassess Annually

Check your coverage every year to make sure it still fits what you're actually doing.

Best Insurance for Spa and Wellness Business: Bottom Line

Simply Business offers the best spa business insurance with competitive rates starting at $44 monthly and a MoneyGeek score of 4.70. Spa owners get multiple quotes from top carriers for general liability, workers' comp, professional liability and property coverage, among other coverage types. Compare options for your day spa or wellness center in one place.

Spa and Wellness Business Insurance: FAQ

We answer frequently asked questions about spa and wellness business insurance:

Who offers the best spa and wellness business insurance overall?

Simply Business delivers the best overall business insurance for spa and wellness firms, earning a MoneyGeek score of 4.7 out of 5. ERGO NEXT follows closely behind with a score of 4.59, offering excellent customer service and comprehensive coverage options.

Who has the cheapest business insurance for day and medical spas?

Here are the cheapest business insurance companies for day and medical spas by coverage type:

- Cheapest general liability insurance: Simply Business at $20 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $16 monthly

- Cheapest professional liability insurance: The Hartford at $98 monthly

- Cheapest BOP insurance: Simply Business at $30 monthly

What business insurance is required for spas and wellness centers?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated for spa/wellness businesses. General liability coverage remains essential for client contracts and leases.

How much does spa and wellness business insurance cost?

Spa/Wellness business insurance costs by coverage type are as follows:

- General Liability: $107/mo

- Workers' Comp: $17/mo

- Professional Liability: $110/mo

- BOP Insurance: $156/mo

How We Chose the Best Business Insurance for Spas and Wellness Centers

We selected the best business insurer for day and medical spas based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.