The Hartford ranks first for jewelry store insurance with a MoneyGeek score of 4.76 out of 5. The company excels in coverage options, competitive rates and quality service for jewelry businesses of all sizes. We recommend comparing quotes from The Hartford, ERGO NEXT and Simply Business to find the best coverage for your jewelry shop.

Best Jewelry Business Insurance

The Hartford, ERGO NEXT and Simply Business offer the best cheap business insurance for jewelry stores, with rates starting at $17 monthly.

Discover the best business insurance provider for jewelers.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Jewelry companies need several types of business insurance including jewelers block, workers' comp, general liability and commercial property to protect inventory, employees and customers.

The Hartford offers the best business insurance for jewelers with a 4.76 MoneyGeek score for coverage options, rates and customer service.

Simply Business provides the cheapest business insurance at $33 monthly, with general liability starting at $17 monthly for jewelry retailers.

Best Business Insurance for Jewelry Stores

| The Hartford | 4.76 | $33 |

| ERGO NEXT | 4.73 | $35 |

| Simply Business | 4.70 | $33 |

| Nationwide | 4.50 | $39 |

| Thimble | 4.40 | $74 |

| Progressive Commercial | 4.40 | $39 |

| Chubb | 4.30 | $46 |

| Hiscox | 4.30 | $41 |

| Coverdash | 4.30 | $44 |

| biBERK | 4.20 | $46 |

Note: We based all scores on a jewelry business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Jewelry Shop Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for jewelry store owners, check out the following resources:

1. The Hartford: Best Business Insurance Provider for Jewelry Businesses

Tops national rankings for customer service and claims processing

Lowest professional liability rates

Competitive pricing across general liability, BOP and workers' comp

A+ financial rating ensures reliable claim payments

Specialized jewelers' block covers inventory on and off premises

Digital interface needs improvement

Phone support only available weekdays, no weekend customer service

Fewer coverage add-ons than competitors for complex jewelry operations

The Hartford covers your high-value inventory. The company offers the most affordable professional liability coverage at $55 monthly for appraisal errors and customer disputes.

You'll receive fast support when theft occurs or customers are injured. With data breach coverage protecting client information, The Hartford addresses the real risks jewelry businesses experience daily.

2. Simply Business: Cheapest Overall for Jewelry Businesses

Lowest general liability and BOP insurance rates

Third-best digital experience nationwide makes online quotes fast and easy

Owned by Travelers with access to 15+ A-rated insurance carriers

Compare multiple carriers in one place saves time shopping for coverage

Fast 10-minute quote process gets jewelry businesses covered quickly

Claims filed directly with carriers, not Simply Business broker

Customer service ranks eighth nationally

Professional liability higher than other carriers

Phone support only weekdays 8 a.m. to 8 p.m. ET, no weekend hours

Simply Business wins on affordability for jewelry stores. At $17 monthly for general liability and $26 monthly for BOP, you'll protect your showroom for less than your competitors charge.

As a broker owned by Travelers, Simply Business compares quotes from 15+ carriers in 10 minutes instead of you calling insurers while customers browse. The tradeoff: you file claims with your carrier, not the broker.

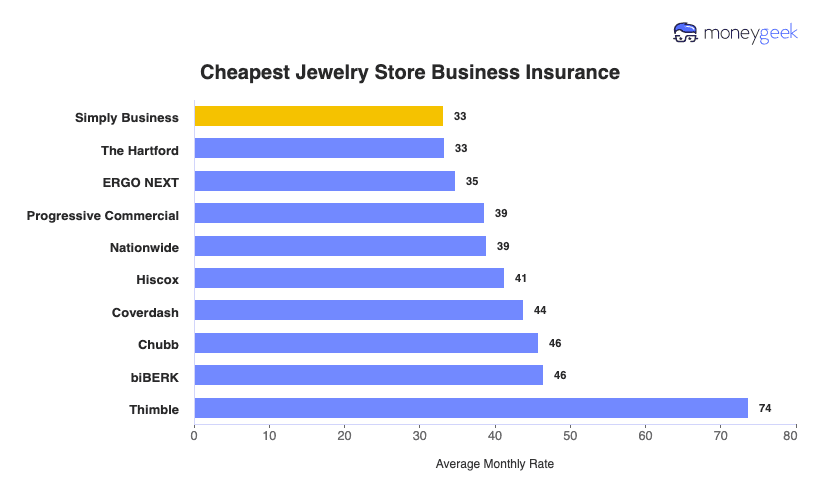

Cheapest Business Insurance for Jewelry Stores

Simply Business offers the most affordable coverage at $33 monthly, ranking among the top three providers for general liability and business owner's policies. For workers' compensation or professional liability, The Hartford and ERGO NEXT provide better rates on the specialized coverage types jewelers handling custom designs and repairs often require.

| Simply Business | $33 | $398 |

| The Hartford | $33 | $399 |

| ERGO NEXT | $35 | $418 |

| Progressive Commercial | $39 | $463 |

| Nationwide | $39 | $467 |

| Hiscox | $41 | $495 |

| Coverdash | $44 | $526 |

| Chubb | $46 | $549 |

| biBERK | $46 | $557 |

| Thimble | $74 | $884 |

Cheapest General Liability Insurance for Jewelry Businesses

Simply Business leads with the most affordable general liability insurance for jewelry stores at $17 monthly. That rate saves jewelers around $24 per month compared to the industry average of $41, cutting costs by nearly 60%.

| Simply Business | $17 | $206 |

| The Hartford | $21 | $250 |

| ERGO NEXT | $21 | $250 |

| Nationwide | $22 | $269 |

| Progressive Commercial | $27 | $320 |

Cheapest Workers' Comp Insurance for Jewelry Businesses

ERGO NEXT provides the cheapest workers' comp insurance for jewelry retailers at $28 monthly, beating the industry average of $30. While the savings appear modest at $2 monthly, it adds up for jewelry shop owners with employees handling repairs, custom designs and valuable inventory. The Hartford, Thimble, Progressive Commercial and Simply Business also offer competitive rates for jewelers needing workers' compensation coverage.

| ERGO NEXT | $28 | $340 |

| The Hartford | $28 | $342 |

| Thimble | $29 | $347 |

| Progressive Commercial | $29 | $348 |

| Simply Business | $29 | $350 |

Cheapest Professional Liability Insurance for Jewelry Businesses

The Hartford offers the cheapest professional liability insurance for jewelers at $55 monthly, saving you $6 compared to the $61 industry average. It protects jewelry designers and appraisers from claims related to professional mistakes, like incorrect gem valuations or flawed custom designs. ERGO NEXT follows closely at $58 monthly, giving jewelry business owners another affordable option.

| The Hartford | $55 | $657 |

| ERGO NEXT | $58 | $692 |

| Progressive Commercial | $58 | $695 |

| Thimble | $60 | $718 |

| Simply Business | $61 | $727 |

Cheapest BOP Insurance for Jewelry Businesses

Simply Business has the most affordable BOP insurance for jewelry stores at $26 monthly, saving jewelers $13 compared to the $39 industry average. For jewelry shop owners seeking comprehensive protection without paying for separate policies, this 33% savings makes financial sense.

| Simply Business | $26 | $307 |

| The Hartford | $29 | $344 |

| ERGO NEXT | $32 | $382 |

| Nationwide | $34 | $403 |

| Thimble | $38 | $459 |

What Does Jewelry Business Insurance Cost?

In general, jewelry business insurance costs are the following for the four most popular coverage types:

- General Liability: $41 on average per month, ranging from $35 to $54, depending on the state

- Workers' Comp: $30 on average per month, ranging from $26 to $35, depending on the state

- Professional Liability (E&O): $61 on average per month, ranging from $52 to $72, depending on the state

- BOP Insurance: $39 on average per month, ranging from $33 to $45, depending on the state

| Professional Liability (E&O) | $61 | $735 |

| General Liability | $41 | $490 |

| BOP | $39 | $467 |

| Workers' Comp | $30 | $362 |

What Type of Insurance Is Best for a Jewelry Shop?

Jewelry businesses experience unique risks managing high-value inventory, customer property and specialized operations like repairs and appraisals. Understanding your jewelry shop's insurance needs starts with mandated coverage, then adds specialized protection for your precious inventory before considering additional policies based on your specific operations.

- Workers' Compensation Insurance: Required in most states if you employ staff, this coverage handles medical costs and lost wages when your bench jeweler gets burned during soldering, your sales associate injures their back lifting inventory or employees experience trauma during robberies. Most jewelry shops need $500,000 to $1 million in coverage per occurrence.

- Jewelers Block Insurance: This specialized coverage protects your diamond rings, gold bracelets and gemstone inventory from theft, fire and mysterious disappearance both in your display cases and during transit to trade shows or bank deposits. It covers inventory in your vault, show windows and shipments, with most jewelers insuring 80% to 100% of replacement cost.

- General Liability Insurance: Protects your jewelry store when customers slip on your freshly polished showroom floor, you accidentally damage a client's heirloom during repairs or someone claims your marketing copied their designs. Jewelry retailers carry $1 million per occurrence and $2 million aggregate limits.

- Commercial Property Insurance: Covers your storefront, display cases, engraving machines and cleaning equipment when fire, storms or vandals strike your shop. Standard property policies exclude fine jewelry and precious metals, which is why you need jewelers block insurance as your primary inventory protection.

- Business Owner's Policy: Bundles general liability, commercial property and business income insurance at lower rates than buying separately. Most BOPs for jewelry stores cost $1,500 to $2,000 annually, though they cap jewelry coverage around $2,500, requiring jewelers block for your valuable inventory.

- Professional Liability Insurance: Guards against claims when you appraise an estate piece incorrectly, misgrade a diamond's clarity or make errors setting a customer's precious stone. Jewelers offering design, repair or appraisal services should carry at least $1 million in coverage.

- Commercial Crime Insurance: Protects against employee theft from your safe, counterfeit payment schemes and robbery beyond what jewelers block covers. Essential protection given that jewelry retailers experience significant internal theft risks alongside external crime threats.

- Cyber Liability Insurance: Covers costs from data breaches exposing your bridal clients' credit card information and addresses stored in your customer database. Critical for jewelry businesses accepting online orders, processing in-store card payments or maintaining client wish lists digitally.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Jewelry Store

Getting business insurance for your jewelry business involves comparing quotes from multiple providers and matching coverage limits to your inventory value and specific operations.

- 1Decide on Coverage Needs Before Buying

Think about what keeps you up at night: that $50,000 engagement ring display near the entrance, customers browsing without supervision, or transporting inventory to weekend shows.

- 2Research Costs

Know what jewelers with your inventory value actually pay for insurance so you can spot inflated quotes immediately. A store carrying $200,000 in inventory pays differently than one with $2 million in diamonds and gemstones.

- 3Look Into Company Reputations and Coverage Options

Ask other jewelers how insurers handled their claims after robberies or mysterious inventory disappearances.

- 4Compare Multiple Quotes Through Different Means

Get quotes from specialized jewelry insurers, not just standard business carriers who'll lowball initially then deny claims later. Use independent agents familiar with jewelers' block policies, compare online options and call insurers directly.

- 5Reassess Annually

Review coverage each year as your inventory value changes and your business evolves, ensuring your limits match current replacement costs and new revenue streams stay protected.

Best Insurance for Jewelry Business: Bottom Line

Protecting your jewelry business requires specialized coverage like jewelers block insurance for inventory, workers' compensation and general liability for customer incidents. The Hartford leads in comprehensive coverage and service quality, while Simply Business offers the most affordable rates at $33 monthly. Compare multiple quotes annually to match your evolving inventory value and operations.

Jewelry Business Insurance: FAQ

We answer frequently asked questions about jewelry business insurance:

Who offers the best jewelry business insurance overall?

The Hartford offers the best overall business insurance for jewelry firms, with a MoneyGeek score of 4.76 out of 5. ERGO NEXT ranks second with a score of 4.73, delivering excellent affordability and comprehensive coverage options.

Who has the cheapest business insurance for jewelry stores?

Here are the cheapest business insurance companies for jewelry shops by coverage type:

- Cheapest general liability insurance: Simply Business at $17 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $28 monthly

- Cheapest professional liability insurance: The Hartford at $55 monthly

- Cheapest BOP insurance: Simply Business at $26 monthly

What business insurance is required for jewelry shops?

Jewelry businesses must carry workers' compensation insurance with employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability insurance becomes practically mandatory for client contracts and property leases.

How much does jewelry business insurance cost?

Jewelry business insurance costs by coverage type are as follows:

- General Liability: $41/mo

- Workers' Comp: $30/mo

- Professional Liability: $61/mo

- BOP Insurance: $39/mo

How We Chose the Best Jewelry Business Insurance

We selected the best business insurer for jewelry stores based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.