ERGO NEXT ranks first for florist business insurance with a MoneyGeek score of 4.62 out of 5, thanks to its competitive rates and quality service. If you own a flower shop, compare quotes from ERGO NEXT and Coverdash to find coverage that fits your budget and protects your floral business.

Best Florist Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for florists and flower shops, with rates starting at $30 monthly.

Discover the best business insurance provider for flower shops.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Florists need several types of business insurance, including general liability, property and workers' compensation coverage to protect against customer injuries and inventory loss.

ERGO NEXT offers the best business insurance for flower shops with a MoneyGeek score of 4.62, providing comprehensive coverage options and competitive rates.

Simply Business provides the most affordable small business insurance at $43 monthly, with general liability coverage starting at just $30 per month.

Best Business Insurance for Florists

| ERGO NEXT | 4.62 | $45 |

| The Hartford | 4.61 | $45 |

| Thimble | 4.60 | $45 |

| Simply Business | 4.60 | $43 |

| Nationwide | 4.50 | $49 |

| Coverdash | 4.40 | $50 |

| biBERK | 4.30 | $53 |

| Chubb | 4.30 | $59 |

| Progressive Commercial | 4.20 | $53 |

| Hiscox | 4.10 | $60 |

Note: We based all scores on a flower shop with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Florist Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your flower shop business, check out the following resources:

1. ERGO NEXT: Best Business Insurance for Florists

Cheapest rates for workers' comp insurance

Generate venue certificates instantly from your phone

Get coverage in 10 minutes

Ranks first for service and recommendations

Claims take longer than other providers

Limited phone hours

Digital-only approach without face-to-face consultations

For florists and flower shop owners, ERGO NEXT offers the best balance of affordable rates and quality service. Their workers' comp costs just $57 monthly (ranking first), while general liability and professional liability both average $35 monthly (ranking second). Customers scored ERGO NEXT first for

digital experience.

ERGO NEXT understands floral business challenges like refrigeration failures during Valentine's Day and Mother's Day rushes.

2. Simply Business: Cheapest Overall Flower Shop Insurance

Cheapest general liability rates for florists

Ranks third nationally for its online platform

Compare multiple insurers instantly

Extensive policy customization for flower shop needs

Customer service placed eighth among national competitors

Some florists report difficulty reaching support

Acts as broker rather than direct insurer

For florists and flower shop owners, Simply Business offers the most affordable general liability insurance at $30 per month and the second-best business owner's policy rates at $45 per month. Its marketplace connects you with multiple insurers to compare coverage in minutes, ranking third nationally for digital experience.

Simply Business understands florist needs like seasonal coverage for Valentine's Day rushes and spoilage protection for refrigerated inventory.

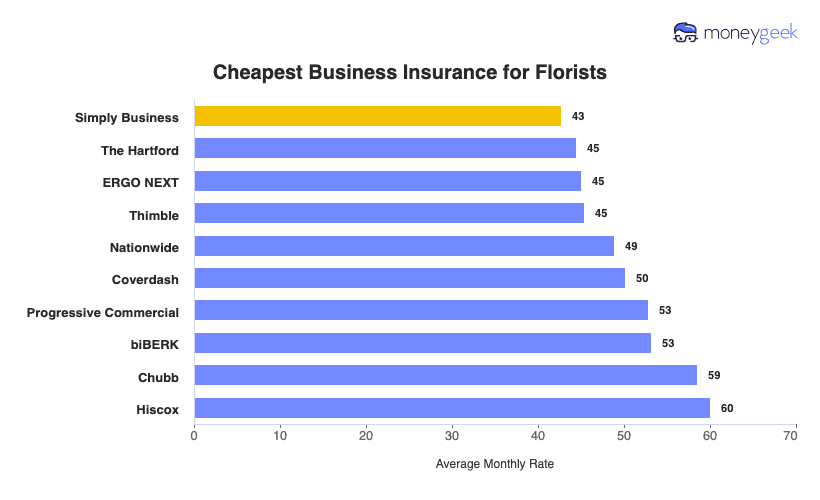

Cheapest Business Insurance for Florists

Simply Business leads florist business insurance at $43 monthly or $513 annually, offering the cheapest general liability coverage for flower shops at $30 monthly. For workers' compensation, ERGO NEXT and The Hartford offer better rates. Thimble provides the most affordable business owner's policy at $38 monthly, while The Hartford leads professional liability at $34 monthly.

| Simply Business | $43 | $513 |

| The Hartford | $45 | $534 |

| ERGO NEXT | $45 | $541 |

| Thimble | $45 | $545 |

| Nationwide | $49 | $587 |

| Coverdash | $50 | $603 |

| Progressive Commercial | $53 | $634 |

| biBERK | $53 | $638 |

| Chubb | $59 | $703 |

| Hiscox | $60 | $720 |

What Does Florist Business Insurance Cost?

In general, business insurance costs for flower shops are the following for the four most popular coverage types:

- General Liability: $43 on average per month, ranging from $37 to $50, depending on the state

- Workers' Comp: $61 on average per month, ranging from $52 to $71, depending on the state

- Professional Liability (E&O): $38 on average per month, ranging from $32 to $44, depending on the state

- BOP Insurance: $59 on average per month, ranging from $51 to $70, depending on the state

| Workers' Comp | $61 | $734 |

| BOP | $59 | $713 |

| General Liability | $43 | $517 |

| Professional Liability (E&O) | $38 | $453 |

What Type of Insurance Is Best for a Florist?

Most states require workers' compensation if you employ delivery drivers or designers, while commercial auto coverage is mandatory for business-owned vehicles.

Beyond these insurance needs of flower shops, general liability and property protection are highly recommended to protect your floral business from slip-and-fall accidents and spoiled inventory during peak seasons.

- Workers' Compensation Insurance: Your designer cuts their hand while trimming rose thorns or your delivery driver throws out their back loading a 50-pound wedding arch. Workers' comp covers their medical bills and lost wages while they recover. Required in most states if you have employees, even part-time seasonal help, during Mother's Day.

- Commercial Auto Insurance: Your van slides on black ice during a Valentine's Day delivery, damaging both your vehicle and a client's fence. Commercial auto covers these accidents, unlike your personal policy. Required by most states for business vehicles, protecting you from liability when transporting arrangements to weddings, funerals and corporate events.

- General Liability Insurance: A bride trips over your equipment during ceremony setup and breaks her ankle, or your centerpiece stains a venue's $10,000 custom drapes. General liability covers medical bills, legal fees and property damage. Start with $1 million coverage since wedding venues and event spaces require proof before you can deliver.

- Commercial Property Insurance: Your cooler breaks down the week before Valentine's Day, destroying $5,000 worth of roses and tulips. Or a burst pipe floods your shop overnight, ruining your entire Easter inventory. Property insurance covers refrigeration failures, fire, theft and weather damage. Carry $50,000 to $150,000 based on your inventory value and equipment.

- Professional Liability Insurance (E&O): You accidentally use lilies in a wedding bouquet after the bride specifically said she's allergic, sending her to the ER. Or your delivery arrives three hours late, ruining the ceremony timeline. Professional liability covers lawsuits from mistakes, missed deadlines and wrong flower selections. Wedding and event florists need $1 million minimum.

- Business Owner's Policy (BOP): Combines general liability and property coverage at a lower cost than buying separately, plus adds business interruption protection. When a kitchen fire forces you to close for two months, BOP replaces your lost income and covers ongoing expenses like rent and utilities while you rebuild your flower shop.

- Cyber Liability Insurance: A hacker steals credit card numbers from your online ordering system, or ransomware locks you out during prom season. Cyber insurance covers data breach notifications, credit monitoring for affected customers and ransom payments. Essential for florists who accept online orders or store customer payment information in your point-of-sale system.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Flower Shop

Our step-by-step guide to getting business insurance helps you find coverage tailored to your flower shop's business needs.

- 1Decide on Coverage Needs Before Buying

Your cooler dies overnight, destroying $8,000 in wedding flowers. A bride trips over your ladder at the venue. Your delivery driver rear-ends someone rushing to a funeral.

- 2Research Costs

You're quoted $200 monthly but other flower shops pay $80. Know the real numbers: general liability costs $30 monthly, workers' comp runs $57 and BOPs average $45.

- 3Look Into Company Reputations and Coverage Options

Search "Simply Business florist claim review" or "ERGO NEXT wedding florist payout." Find florists who actually filed claims for spoiled roses or broken coolers.

- 4Compare Multiple Quotes Through Different Means

Call ERGO NEXT directly, use Simply Business's online marketplace, then talk to an independent agent who knows florists. Look at several quotes.

- 5Reassess Annually

Review your policy every January before Valentine's orders arrive, not after disaster strikes during your busiest week.

Best Insurance for Flower Shop: Bottom Line

Protecting your flower shop starts with the right coverage. ERGO NEXT earned the highest MoneyGeek score of 4.62 for comprehensive financial protection, while Simply Business offers affordable rates starting at $30 monthly for general liability. Whether you run a boutique floral studio or event-focused operation, securing general liability, property and workers' compensation coverage protects your business from unexpected costs.

Florist Business Insurance: FAQ

We answer frequently asked questions about florist business insurance:

Who offers the best flower shop business insurance overall?

ERGO NEXT has the best florist business insurance with a MoneyGeek score of 4.62 out of 5. The Hartford follows closely at 4.61, delivering excellent affordability, customer service and comprehensive coverage options.

Who has the cheapest business insurance for florists?

Here are the cheapest business insurance companies for flower shops by coverage type:

- Cheapest general liability insurance: Simply Business at $30 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $57 monthly

- Cheapest professional liability insurance: The Hartford at $34 monthly

- Cheapest BOP insurance: Thimble at $38 monthly

What business insurance is required for a flower shop?

Flower shops must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements vary by state. General liability insurance is also essential for client contracts and property leases.

How much does florist business insurance cost?

Florist business insurance costs by coverage type are as follows:

- General Liability: $43/mo

- Workers' Comp: $61/mo

- Professional Liability: $38/mo

- BOP Insurance: $59/mo

How We Chose the Best Florist Business Insurance

We selected the best business insurer for flower shops based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.