ERGO NEXT earned the top spot in our best business insurance study for candle companies and candlemakers with a MoneyGeek score of 4.82. It leads in affordability, customer service and coverage options. We recommend comparing quotes from The Hartford, biBERK and Coverdash to find the right fit for your business.

Best Candle Business Insurance

ERGO NEXT, The Hartford and biBerk offer the best cheap business insurance for candle companies, with rates starting at $34 monthly.

Get matched with cheap candle business insurance below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Candle businesses need several types of business insurance, such as workers' compensation, general liability and product liability to cover risks like customer burns or defective wicks.

ERGO NEXT offers the best business insurance for candle businesses with a 4.82 MoneyGeek score, with top scores in affordability, customer service and coverage options for candle business owners.

ERGO NEXT provides the cheapest business insurance for candle companies at $41 monthly, including the industry's lowest general liability rate of $34 per month for fire and injury claims.

Best Business Insurance for Candle Makers

| ERGO NEXT | 4.82 | $41 |

| The Hartford | 4.74 | $44 |

| biBERK | 4.70 | $46 |

| Coverdash | 4.50 | $53 |

| Thimble | 4.50 | $49 |

| Nationwide | 4.50 | $60 |

| Hiscox | 4.40 | $57 |

| Chubb | 4.40 | $65 |

| Progressive Commercial | 4.40 | $54 |

| Simply Business | 4.30 | $81 |

Note: We based all scores on a candle business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Candle Making Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

Find the right coverage for your candle business with these resources:

1. ERGO NEXT: Best and Cheapest Overall for Candle Businesses

Ranked first in our analysis of 10 providers

Most affordable coverage for candlemakers nationwide

Get quotes, buy policies and access certificates online

A+ Superior AM Best rating with Munich Re backing

Digital-only application without agent assistance

Has only been in the insurance industry for nine years

ERGO NEXT offers candlemakers the best combination of affordability and customer service in our study. It ranks first nationally with a 4.45 customer satisfaction score and leads in digital experience.

Candle business owners consistently praise the straightforward process for startups. The A+ AM Best rating and Munich Re backing provide the financial strength and cover your candle-making business's needs.

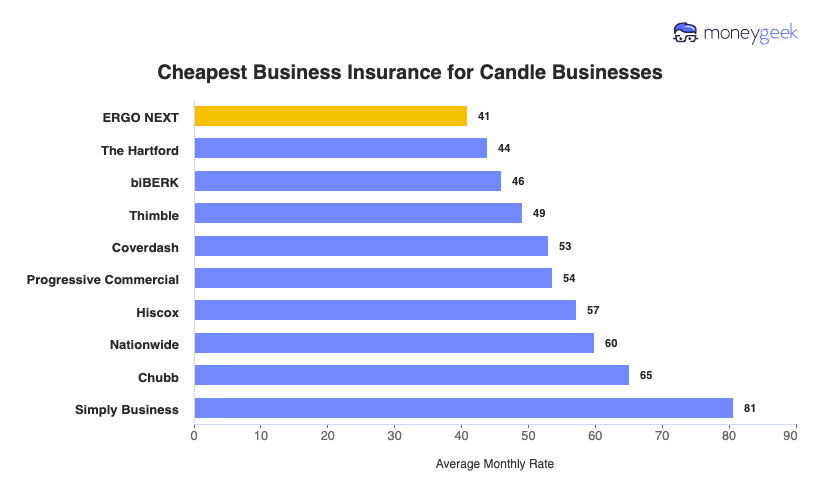

Cheapest Business Insurance for Candle Makers

ERGO NEXT offers the cheapest candle business insurance overall with a monthly rate of $41. It offers the lowest rates for general liability coverage, workers' compensation insurance and business owner's policies (BOP). Candlemakers get more affordable rates from The Hartford for professional liability insurance.

| ERGO NEXT | $41 | $491 |

| The Hartford | $44 | $527 |

| biBERK | $46 | $552 |

| Thimble | $49 | $590 |

| Coverdash | $53 | $636 |

| Progressive Commercial | $54 | $644 |

| Hiscox | $57 | $686 |

| Nationwide | $60 | $718 |

| Chubb | $65 | $782 |

| Simply Business | $81 | $967 |

What Does Candle Business Insurance Cost?

Candle business insurance costs are the following for the four most popular coverage types:

- General Liability: $55 on average per month, ranging from $48 to $64, depending on the state

- Workers' Comp: $40 on average per month, ranging from $35 to $47, depending on the state

- Professional Liability (E&O): $42 on average per month, ranging from $36 to $50, depending on the state

- BOP Insurance: $81 on average per month, ranging from $69 to $95, depending on the state

| BOP | $81 | $975 |

| General Liability | $55 | $661 |

| Professional Liability (E&O) | $42 | $502 |

| Workers' Comp | $40 | $482 |

What Type of Insurance Is Best for a Candle Business?

Different coverage types serve different purposes for your business. Most states require workers' compensation once you hire employees, and you need commercial auto insurance if you drive to craft fairs or make deliveries.

Beyond these, you also need general liability and product liability coverage to protect against fire damage claims and customer injury lawsuits.

-

Workers' Compensation Insurance: It covers medical bills and lost wages when employees get burned by melted wax or hot wax pots, are injured while pouring candles or lifting boxes of glass jars or develop respiratory issues from fragrance oil exposure. Most candlemakers need coverage limits of $100,000 per accident and $500,000 policy aggregate.

-

General Liability Insurance: It covers customers getting burned while sampling candles at craft fairs, slipping on spilled wax in your shop or experiencing house fires from defective wicks. Candlemakers carry $1 million per occurrence and $2 million aggregate limits for solid protection.

-

Product Liability Insurance: Product liability handles legal defense costs when someone sues over burns from improperly sized wicks, fires from container cracks or allergic reactions to fragrance oils or essential oils. Most candlemakers bundle product liability within their general liability policy at $1 million per occurrence limits.

-

Commercial Property Insurance: If a fire destroys your soy wax supplies, fragrance and essential oils, or wax melters or thieves steal your finished candles, glass containers and labeling equipment, commercial property insurance pays replacement costs. Candlemakers with retail locations or home-based operations should carry coverage equal to their total inventory and equipment value.

-

Business Owner's Policy (BOP): Your candle-making business gets protection for customer burns at vendor booths, stolen wax melters and pouring equipment, smoke damage to finished inventory and lost income when you can't fill orders during repairs. Candlemakers choose a BOP with $1 million liability limits and property coverage matching their asset values, saving 15% to 25% compared to separate policies.

-

Professional Liability Insurance (E&O): Professional liability covers claims arising from business mistakes, such as sending lavender candles instead of vanilla for a wedding order, missing deadlines for holiday custom candle deliveries or providing bad advice to other candlemakers about fragrance load percentages. Candle businesses offering custom services should carry $500,000 to $1 million limits.

-

Commercial Auto Insurance: Commercial auto insurance is legally required when you own vehicles for your business deliveries or vendor events. It covers accidents while transporting candles and supplies to farmers' markets and craft fairs, picking up wholesale wax and fragrance oil orders or delivering custom candle orders to event venues.

Candlemakers should carry at least $500,000 in liability coverage, plus comprehensive and collision coverage to protect their vehicles and inventory during transport.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Candle Making Company

Getting business insurance for your company costs less when you know where to look. Use these steps to find coverage that protects your business at rates you can afford.

- 1Decide on Coverage Needs Before Buying

Think through what could go wrong in your candle shop: employees burned while pouring melted soy wax, customers suing after house fires from your candles, shoppers slipping on wax spills at craft fairs or inventory stolen at weekend markets. Ask other candlemakers which claims they've filed to understand what coverage matters most.

- 2Research Costs

Know what candle businesses pay before shopping. General liability costs candlemakers $34 monthly, workers' comp runs $38 monthly, and BOPs cost $52 monthly based on our study. These benchmarks help you spot whether a $45 general liability quote is fair or overpriced for your candle making business.

- 3Look Into Company Reputations and Coverage Options

Read reviews from candlemakers who filed product liability claims for candle fires or allergic reactions to fragrance oils. Verify each insurer covers home-based candle production, sales at farmers markets and craft fairs, online storefronts and custom orders. Not all carriers insure every candle business model.

- 4Compare Multiple Quotes Through Different Means

Request quotes from three insurers for your candle business through websites, independent agents, and phone calls. Independent agents know which carriers offer discounts for safety measures like wax melter ventilation systems or fire extinguishers in your workspace. Each method reveals different pricing for identical coverage.

- 5Reassess Annually

Review coverage when you hire employees to pour candles, move from your home kitchen to commercial space, open a retail storefront or shift from weekend craft fairs to wholesale accounts.

These changes in your candle-making business create new risks and often qualify you for volume discounts or improved rates.

Candle Making Insurance: Bottom Line

Protecting your candle-making business starts with understanding which coverage types you need. Workers' compensation, general liability and product liability cover the unique risks candlemakers face, from employee burns to customer injury claims.

ERGO NEXT offers the best combination of affordability and service at $41 monthly, making comprehensive financial protection accessible for candle businesses of all sizes.

Candle Insurance: FAQ

We answer frequently asked questions about Candle business insurance:

Who offers the best candle business insurance overall?

ERGO NEXT delivers the best overall business insurance for candle companies, earning a MoneyGeek score of 4.82 out of 5. The Hartford follows closely behind with 4.74, offering excellent affordability and comprehensive coverage options.

Who has the cheapest business insurance for candle makers?

Here are the cheapest business insurance companies by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $34 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $38 monthly

- Cheapest professional liability insurance: The Hartford at $37 monthly

- Cheapest BOP insurance: ERGO NEXT at $52 monthly

What business insurance is required for candle businesses?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated for candle businesses, though requirements differ by state. General liability coverage becomes practically essential for securing commercial clients and property leases.

How much does candle business insurance cost?

Candle business monthly insurance costs by coverage type are as follows:

- General Liability: $55

- Workers' Comp: $40

- Professional Liability: $42

- BOP Insurance: $81

How We Chose the Best Candle Business Insurance

We selected the best business insurer for candle companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed October 17, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 17, 2025.

- Trustpilot. "Thimble." Accessed October 17, 2025.