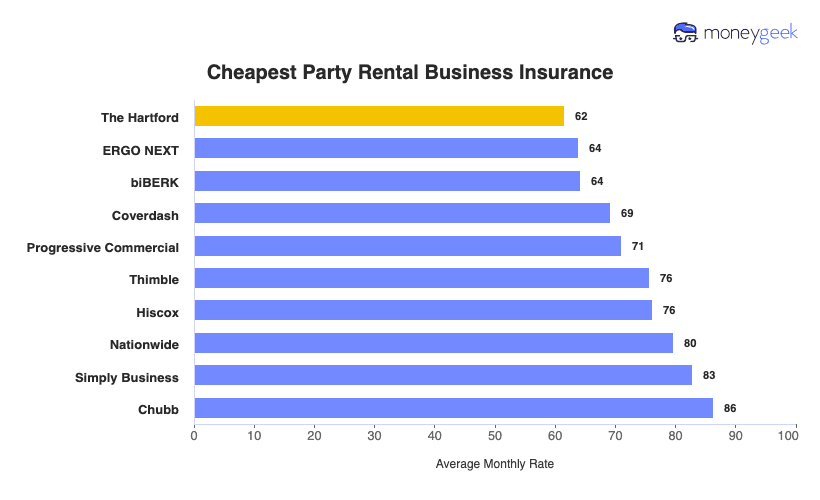

The Hartford leads our rankings for party rental business insurance with a MoneyGeek score of 4.78 out of 5. With top marks for competitive rates, quality customer service and comprehensive coverage options, it's helpful for party rental companies and event rental businesses looking for reliable financial protection.

We also recommend comparing quotes from ERGO NEXT and biBerk. Each provider offers unique advantages that might better suit your party equipment rental operation's specific needs and budget.