The Hartford leads Oklahoma small business insurance with top rankings in affordability and financial strength. It offers the lowest rates statewide at $83 monthly while maintaining an A+ AM Best rating. ERGO NEXT and Simply Business also provide strong coverage options for Oklahoma business owners.

Best Small Business Insurance in Oklahoma

Get quotes from the best business insurance providers in Oklahoma including The Hartford, ERGO NEXT and Simply Business with rates starting at $6/mo.

Get matched to the best Oklahoma commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Oklahoma's best small business insurance comes from The Hartford, which ranks first in affordability and financial strength statewide.

The Hartford, Simply Business and Thimble have the cheapest small business insurance rates for small business owners in Oklahoma, starting at $83 monthly.

To choose the right small business insurance coverage, assess your risks, compare quotes from multiple providers and claim all discounts.

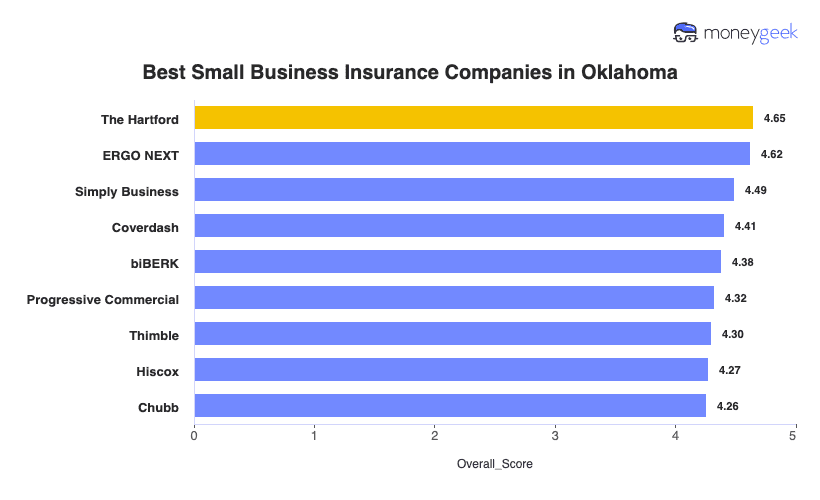

Best Small Business Insurance Companies in Oklahoma

| The Hartford | 4.65 | $83 | 2 | 3 |

| ERGO NEXT | 4.62 | $94 | 1 | 2 |

| Simply Business | 4.49 | $84 | 5 | 1 |

| Coverdash | 4.41 | $95 | 6 | 2 |

| biBERK | 4.38 | $98 | 2 | 5 |

| Progressive Commercial | 4.32 | $93 | 7 | 5 |

| Thimble | 4.30 | $89 | 8 | 5 |

| Hiscox | 4.27 | $102 | 4 | 6 |

| Chubb | 4.26 | $111 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

The best or cheapest business insurer in Oklahoma varies depending on what coverage type you need. Read our resources to find what matches your business:

Best and Cheapest Oklahoma Business Insurance

Average Monthly Cost of General Liability Insurance

$85This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$65This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks first among providers MoneyGeek researched

Offers the most affordable overall small business insurance

Excellent claims process and customer satisfaction

A+ AM Best rating

consRanks last for digital experience

Unavailable in Hawaii and Alaska

The Hartford ranks first among Oklahoma small business insurance providers at $83 monthly ($1,001 annually). Founded in 1810 with an A+ AM Best rating, it combines financial strength with top-ranked claims support. Best for Oklahoma businesses in construction, agriculture and oil and gas wanting low rates without sacrificing help when severe weather or workplace accidents occur.

The Hartford ranks first among Oklahoma small business insurance providers at $83 monthly ($1,001 annually). Founded in 1810 with an A+ AM Best rating, it combines financial strength with top-ranked claims support. Best for Oklahoma businesses in construction, agriculture and oil and gas wanting low rates without sacrificing help when severe weather or workplace accidents occur.

The Hartford ranks first nationally for claims processing and customer service—important when Oklahoma's tornados and hailstorms damage property or force closures. Customers rate claims handling at 4.5 out of 5. Digital experience ranks 10th nationally, so Oklahoma business owners get stronger phone support than online tools when filing claims or requesting certificates of insurance.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford covers over 60 industries in Oklahoma including oil and gas contractors, agricultural businesses, construction trades and hospitality. General liability limits range from $300,000 to $2 million. Employment practices liability automatically includes wage and hour defense costs—valuable when hiring your first Oklahoma employees or expanding your team beyond contractors.

Best Oklahoma Customer Experience

Average Monthly Cost of General Liability Insurance

$97This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$65This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to Be Recommended to Others

4.8/5 (1st)

- pros

Ranks first among providers for customer service

Provides quotes and coverage in under 10 minutes

Lowest workers' comp rates in Oklahoma

A- AM Best rating

consHigher average cost than other providers

No physical offices

ERGO NEXT ranks second among Oklahoma small business insurance providers at $94 monthly ($1,132 annually), earning top marks for customer service and digital experience. Founded in 2016 with an A- AM Best rating, it provides instant quotes and same-day coverage through its online platform. Best for Oklahoma contractors and mobile service businesses needing fast certificates over traditional agent support.

ERGO NEXT averages $94 monthly ($1,132 annually), ranking fourth among Oklahoma providers. Workers' comp costs $65 monthly. That the lowest in Oklahoma and valuable for construction and trades businesses managing first-employee requirements. Professional liability runs $69, below state averages. BOPs cost $146 monthly, about $8 above average, so compare quotes if bundling coverage.

ERGO NEXT ranks first nationally for customer service and digital experience, which is important when Oklahoma contractors need certificates fast for job sites or client contracts. Customers rate satisfaction at 4.4 out of 5, with instant COI generation through the mobile app. Claims processing ranks fourth, so expect stronger support for certificates than complex damage claims.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT covers over 1,300 Oklahoma business types including construction, oil and gas contractors, HVAC, plumbing and professional services. Coverage types include general liability, professional liability, workers' comp and commercial auto with $1 million aggregate limits. Unlimited additional insureds on certificates cost nothing, helpful when Oklahoma general contractors or landlords require proof before you start work.

Best Commercial Coverage Options in Oklahoma

Average Monthly Cost of General Liability Insurance

$80This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$66This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options

Lowest general liability rates in Oklahoma

Digital-first platform offers quotes in under 10 minutes

Specializes in Amazon seller insurance through Amazon Insurance Accelerator

consLower customer service ranking than other carriers

Ranks third to last in claims processing

Simply Business ranks third among Oklahoma small business insurance providers at $84 monthly ($1,011 annually), leading in coverage breadth through its multi-carrier marketplace. Since launching U.S. operations in 2017, it connects Oklahoma businesses from Tulsa retailers to Oklahoma City contractors with 20+ carriers in under 10 minutes. Best for Oklahoma e-commerce sellers and businesses wanting diverse options without agent meetings.

Simply Business offers competitive pricing at $84 monthly ($1,011 annually), ranking fourth among Oklahoma providers. General liability costs $80 monthly (lowest in Oklahoma and $18 below the state average) valuable for contractors bidding jobs. Workers' comp runs $66 and BOPs $119, both beating state averages. This multi-carrier approach helps Oklahoma businesses compare options across insurers.

Simply Business excels at digital experience, ranking third nationally with 4.6 stars on Trustpilot from over 1,400 reviews, which is helpful when Oklahoma contractors need quotes fast for project bids. Customer service ranks sixth and claims processing eighth because you're dealing with multiple carriers. Simply Business handles shopping while your actual carrier provides support and processes tornado or hail damage claims.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business provides access to policies from over 20 carriers including Travelers, Hiscox and CNA, earning its top-ranking coverage score in Oklahoma. It serves Oklahoma's diverse industries, such as construction, HVAC, plumbing, hospitality, retail and e-commerce, through its multi-carrier marketplace. Amazon chose it for its Insurance Accelerator Program, offering online sellers product liability and certificates formatted for Amazon's requirements.

Get Matched to the Best Small Business Insurance Providers in Oklahoma

Select your industry and state to get a customized quote for your Oklahoma business.

How to Get the Best Cheap Small Business Insurance in Oklahoma

Oklahoma requires workers' compensation from your first employee and commercial auto for work vehicles, but meeting legal minimums won't protect you when clients demand liability certificates or severe weather closes operations. Getting business insurance means covering gaps between state requirements and business reality.

- 1

Know Oklahoma legal requirements and coverage gaps

Oklahoma requires workers' compensation from your first employee (no exemptions unless you only employ family) and 25/50/20 commercial auto liability if employees drive for work. Meeting these won't help when clients refuse contracts without professional liability, landlords demand general liability certificates or you need customer injury coverage, since these protect your business even though state law doesn't mandate them.

- 2

Address hazards specific to your Oklahoma operation

Oklahoma's 152 tornadoes in 2024 threaten property-heavy businesses with closures. Contractors need inland marine covering tools stolen from job sites. Professional services need errors and omissions protection when advice causes client financial losses. Oklahoma City restaurants serving alcohol must carry liquor liability since ABLE certificates require coverage proof. Delivery businesses need hired and non-owned auto beyond basic commercial policies.

- 3

Get quotes from top carriers and Oklahoma's backup option

Oklahoma's top providers offer affordable rates and broad coverage for local businesses: The Hartford averages $83 monthly while ERGO NEXT costs $94 monthly, both maintaining A-rated financial strength. If standard carriers decline your application because of claims history or your industry, CompSource Mutual provides Oklahoma's workers' compensation backup coverage, ensuring you meet the state's mandatory requirement when private insurers refuse.

- 4

Balance affordability with service quality and coverage fit

Saving $20 monthly backfires when your cheapest policy excludes coverage clients require or takes three weeks to issue certificates while contractors need them within 48 hours for job starts. ERGO NEXT ranks first for customer service with instant certificate generation, while The Hartford's A+ financial rating means reliable claim payment when Oklahoma storms damage property. Ask providers about certificate turnaround times, coverage options for your industry and claims response speeds.

- 5

Stack bundling with Oklahoma safety program discounts

Bundle general liability with commercial property into a business owner's policy to cut combined premiums 20% to 30%. That's important savings since Oklahoma businesses face tornado, hail and earthquake property risks. Pay annually instead of monthly to avoid $200 to $400 in billing fees. Enroll in Oklahoma's Workers' Compensation Premium Reduction program for safety training discounts, reducing your cost of business insurance across policies.

- 6

Reassess coverage when your Oklahoma business grows

Opening a second location in Tulsa versus rural counties changes property insurance costs because tornado frequency varies by region. Oklahoma's 371,640 small businesses pay different rates based on geography. Landing larger contracts requiring $2 million general liability limits instead of $1 million means updating coverage before project work starts. Adding cyber liability when you start processing customer credit cards or hiring employees who drive company vehicles both demand coverage reassessment.

Best Business Liability Insurance Oklahoma: Bottom Line

The Hartford ranks first for Oklahoma small business insurance and has the lowest rates at $83 monthly. Simply Business and Thimble also offer competitive pricing. Compare quotes from these providers, assess your tornado and workers' comp risks for Oklahoma operations, and stack bundling discounts with safety program credits to cut costs.

Business Insurance Oklahoma: FAQ

Small business owners in Oklahoma often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need to start a small business in Oklahoma?

Oklahoma requires workers' compensation from your first employee and 25/50/20 commercial auto liability if employees drive for work. You'll also need general liability for landlord requirements and professional liability if clients demand it before signing contracts, even though state law doesn't mandate these coverages.

What does Oklahoma require vs what a landlord, client or venue will ask for?

Oklahoma law requires workers' comp from your first employee and commercial auto for work vehicles. Landlords demand general liability certificates before lease signing. Clients refuse contracts without professional liability coverage. Venues require liquor liability for events serving alcohol—none of which state law mandates for your business.

How much does small business insurance cost per month in Oklahoma?

Coverage costs for your Oklahoma business depend on your industry, but these are the monthly and annual averages by coverage type:

- General liability insurance: $98 monthly or $1,178 annually

- Workers' compensation insurance: $69 monthly or $823 annually

- Professional liability (E&O) insurance: $73 monthly or $877 annually

- Business owner's policy (BOP): $138 monthly or $1,656 annually

Can I get a COI fast for a job, lease or event, and what do I need to provide?

ERGO NEXT provides instant certificates through its mobile app 24/7 at no extra cost. You'll need your policy number, coverage limits, effective dates and the certificate holder's name and address. The Hartford and Simply Business issue certificates within one to three business days after you request them.

Do I need workers' comp if I hire my first employee (or use 1099s), and what if I drive my personal car for work?

Yes, Oklahoma requires workers' compensation from your first employee with no exemptions unless you only employ family members. Independent contractors don't trigger this requirement because they're not your employees. Driving your personal car for work needs hired and non-owned auto coverage beyond your personal policy.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Oklahoma ABLE Commission. "Frequently Asked Questions." Accessed February 7, 2026.

- Oklahoma Department of Emergency Management. "Tornadoes." Accessed February 7, 2026.

- Oklahoma Insurance Department. "FAQs." Accessed February 7, 2026.

- Oklahoma Workers' Compensation Court of Existing Claims. "Employers FAQ." Accessed February 7, 2026.

- U.S. Small Business Administration Office of Advocacy. "2023 Small Business Economic Profile - Oklahoma." Accessed February 7, 2026.