ERGO NEXT and The Hartford tie for Nevada's best small business insurance with top customer service and competitive rates at $102 monthly. Simply Business ranks third, offering strong coverage options through its multi-carrier marketplace for Nevada small business owners.

Best Small Business Insurance in Nevada

Nevada's top business insurance companies are ERGO NEXT, The Hartford and Simply Business, with coverage starting at $7 monthly.

Get matched to the best Nevada commercial insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT and The Hartford tie for best small business insurance in Nevada with 4.63 MoneyGeek scores, excelling in service and affordability.

The Hartford offers the cheapest small business insurance in Nevada at $102 monthly or $1,222 annually.

Compare quotes from multiple insurers for small business insurance coverage, assess your risks and stack available discounts.

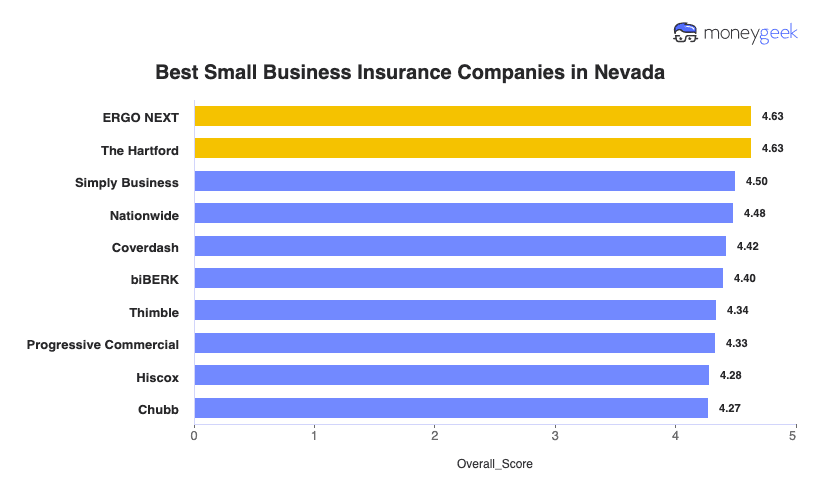

Best Small Business Insurance Companies in Nevada

| ERGO NEXT | 4.63 | $102 | 1 | 2 |

| The Hartford | 4.63 | $102 | 2 | 3 |

| Simply Business | 4.50 | $110 | 5 | 1 |

| Nationwide | 4.48 | $116 | 2 | 4 |

| Coverdash | 4.42 | $115 | 6 | 2 |

| biBERK | 4.40 | $119 | 2 | 5 |

| Thimble | 4.34 | $107 | 8 | 5 |

| Progressive Commercial | 4.33 | $113 | 7 | 5 |

| Hiscox | 4.28 | $122 | 4 | 6 |

| Chubb | 4.27 | $134 | 3 | 4 |

Note: These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Your actual rates vary based on your industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Find the best or cheapest small business insurer in Nevada for your coverage type in the resources below:

Best and Cheapest Nevada Business Insurance

Average Monthly Cost of General Liability Insurance

$103This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$79This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Claims Process

4.5/5 (1st)Our Survey: Agent Service

4.7/5 (1st)

- pros

Ranks first for affordability in Nevada ($102 monthly)

A+ AM Best rating for financial strength

Has a 4.8-star claims rating from more than 18,000 customers

Over 200 years of insurance experience

consRanks last for digital experience nationwide

Not available in Alaska or Hawaii

The Hartford saves Nevada small business owners money at $102 monthly. Its A+ financial rating means your claims get paid after wildfires or customer injuries. You'll get strong phone support and fast claims handling, but managing policies online proves harder than competitors offer.

The Hartford averages $102 monthly ($1,222 annually) across Nevada coverage types—the lowest among providers MoneyGeek analyzed. General liability costs $103 monthly, saving you $14 monthly compared to Nevada's average, while workers' comp costs $79, saving $5 monthly. You get low rates without sacrificing financial strength when claims happen.

The Hartford ranks second nationally for customer experience, meaning faster claims after customer injuries or equipment damage at Nevada job sites. You get knowledgeable phone support to guide you through claims and COI requests, but managing policies online proves harder than competitors. Expect to call for coverage changes and certificate requests instead of handling them yourself digitally.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford lets you add data breach and professional liability directly to business owner's policies, saving Nevada consultants and IT services the cost of separate coverage. Its Global Insurer Network spans 220+ countries if your business expands internationally or works with overseas clients. Employment practices liability automatically includes wage and hour defense, protecting Nevada hospitality and restaurant owners from common employee claims.

Best Nevada Customer Experience

Average Monthly Cost of General Liability Insurance

$100This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$78This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Survey: Digital Experience

4.8/5 (1st)Our Survey: Likely to be Recommended to Others

4.8/5 (1st)

- pros

Ties for first overall in Nevada (4.63 score)

A+ AM Best rating backed by Munich Re

Available in all 50 states and Washington D.C.

Unlimited instant certificates of insurance at no cost

consRanks sixth for financial stability

Phone support limited to weekday business hours only

ERGO NEXT ties for first overall in Nevada at $102 monthly, letting contractors generate certificates instantly when bidding casino and hotel jobs without waiting for agents. Custom endorsement language requires emailing support during weekday hours, which delays Friday afternoon bids needing weekend processing. You get same-day coverage and round-the-clock policy changes but sacrifice weekend phone access when emergencies happen.

ERGO NEXT saves Nevada contractors $17 monthly on general liability at $100 compared to the state's average, freeing budget for more casino and hotel bids. Professional liability costs $80 monthly and workers' compensation costs $78 monthly, the lowest statewide rates for consultants and hospitality businesses. Business owner's policies average $151 monthly, Nevada's third-cheapest option among providers.

ERGO NEXT generates certificates in minutes when Las Vegas casino properties demand proof before jobs start, avoiding costly bid delays for Nevada contractors. Upfront pricing helps you budget for seasonal tourism slowdowns, but watch for renewal increases that catch some owners off guard. Claims processing ranks fourth nationally, with difficult adjuster access after weekday hours, suiting Nevada businesses comfortable handling simple claims digitally over the phone.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT bundles liquor liability for Nevada restaurants and bars serving casino and hotel guests, starting at $25 monthly added to general liability and covering over-serving incidents required for state liquor licenses. Contractors add tools and equipment protection for $19 monthly, covering theft from job sites, in transit or in storage. ERGO NEXT generates unlimited certificates when Las Vegas properties demand proof before jobs start, avoiding bid delays at no extra cost.

Best Commercial Coverage Options in Nevada

Average Monthly Cost of General Liability Insurance

$109This rate is for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Average Monthly Cost of Workers' Comp Insurance

$81This rate is for small businesses with two employees across 79 major industries or business types and focus solely on workers' comp policies.Our Research: Digital Experience

4.5/5Our Survey: Service Quality

4.0/5

- pros

Ranks first for coverage options among Nevada providers

Owned by Travelers with A-rated carrier partnerships

Available in all 50 states and Washington D.C.

Amazon Insurance Accelerator Program partner for sellers

consRanks eighth nationally for claims processing

Fifth in Nevada for customer service

Simply Business's broker model gives Nevada contractors and online sellers access to specialized coverage traditional insurers don't offer, including Amazon seller policies and high-risk trade protection. Your claims experience and service quality depend entirely on which carrier underwrites your policy. Choose Simply Business if finding niche coverage for your Nevada business matters more than having consistent support when problems arise.

Nevada contractors save $96 yearly on general liability at $109 monthly, ranking third statewide, freeing budget for equipment costs. Simply Business averages $110 monthly across coverage types for hospitality and online sellers managing tight margins. Workers' compensation costs $81 monthly but ranks sixth, so casino and restaurant employers should compare other providers.

Simply Business's digital platform gets Nevada contractors and online sellers quotes from over 20 carriers within minutes, perfect when you need immediate coverage for casino job requirements. Claims processing ranks eighth nationally because you'll deal directly with whichever carrier underwrote your policy, creating inconsistent service. Choose Simply Business if you prioritize fast comparison shopping over dedicated support when filing claims.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business's tools and equipment coverage lets Nevada contractors replace stolen tools costing $15,000 to $25,000 when theft occurs on casino job sites. Nevada restaurants and online sellers can add cyber liability, covering investigation costs reaching $100,000 when payment systems are breached. Casino properties require waiver of subrogation and primary-noncontributory endorsements before contractors start work, available instantly online.

Get Matched to the Best Small Business Insurance Providers in Nevada

Select your industry and state to get a customized quote for your Nevada business.

How to Get the Best Cheap Small Business Insurance in Nevada

Nevada business owners face wildfire seasons forcing operational shutdowns, unexpected desert flooding, and contractor liability rules stricter than neighboring states. Learning how to get business insurance in Nevada means addressing coverage gaps that price shopping alone won't solve.

- 1

Know what Nevada law requires versus what contracts demand

Nevada requires 25/50/20 auto liability for company vehicles and workers' comp from your first hire. Meeting state minimums won't land contracts. Reno casinos demand $2 million in general liability before contractors start work. Las Vegas landlords require insurance certificates before signing commercial leases. Henderson tech companies need cyber liability for client data. Neither of these are legally required, but you'll need them to get business.

- 2

Address threats your Nevada small business actually encounters

Nevada's 108 wildfires in 2024 burned 69,258 acres, yet small businesses in Tahoe Basin and Elko County have difficulty obtaining wildfire coverage since some insurers stopped accepting applications in high-risk zones. Flood disasters show commercial property policies exclude Nevada's water risks. Tools and equipment insurance protects contractor gear from Las Vegas construction site theft, where losses average $15,000 to $25,000 per incident.

- 3

Compare top carriers and Nevada State Fund rates

We analyzed ERGO NEXT, The Hartford, and Simply Business for Nevada rankings. The Hartford offers the lowest rates at $83 monthly for general liability, which is important when 35% of Nevada owners adapt to inflation and 25% say funding access is their top challenge. Nevada State Fund provides workers' comp when private carriers reject high-risk businesses. Rural Nevada companies may find fewer carrier options than Las Vegas or Reno counterparts.

- 4

Don't sacrifice claim speed for monthly savings (58 words)

Saving $25 monthly matters when 47% of Nevada businesses struggle with finding customers and budgets are tight. But 2024's wildfires proved cheap coverage fails when carriers take weeks assigning adjusters while Sparks warehouses sit closed. Lost revenue from slow claims erases years of premium savings. Ask carriers about Nevada adjuster count and resolution timeframes before choosing the lowest rate.

- 5

Use bundling and discounts to offset Nevada insurance costs

Bundle liability and property into business owner's policies to cut business insurance costs by 20% to 30%. That's substantial savings for startups with funding challenges and established companies managing inflation pressure. Pay annually to eliminate monthly billing fees. Safety certifications, security systems and claim-free histories stack additional discounts. These savings help protect Nevada businesses in the state's tax-friendly environment without straining cash flow.

- 6

Update coverage when your Nevada operations expand

Thirty-one percent of Nevada businesses say managing growth is challenging. Growth creates coverage gaps: opening Reno locations after starting in Las Vegas, hiring your first employee requiring immediate workers' comp or landing contracts demanding higher liability limits. Adding vehicles, equipment or leased space all need policy updates before incidents expose vulnerabilities.

Best Business Liability Insurance Nevada: Bottom Line

ERGO NEXT and The Hartford both scored 4.63 in MoneyGeek's analysis of Nevada small business insurance. The Hartford offers the lowest rates at $102 monthly, making it best for budget-conscious owners. Compare quotes from ERGO NEXT and The Hartford, assess your wildfire and flood exposure, then bundle coverage to stack discounts. Choose The Hartford for affordability or ERGO NEXT for digital tools and faster online quotes.

Business Insurance Nevada: FAQ

Small business owners in Nevada often have questions about choosing the right business insurance. We answer the most common concerns below:

What insurance do I need for my small business in Nevada?

Nevada requires workers' compensation from your first employee and 25/50/20 commercial auto liability for work vehicles. Beyond legal minimums, you'll need general liability since Reno casinos and Las Vegas landlords won't sign contracts or leases without certificates. Compare options from ERGO NEXT, The Hartford or Simply Business to match your industry risks and budget.

How much does small business insurance cost per month in Nevada, and what factors affect the price most?

Your employee count, claims history and industry risk level affect rates most, but these are the monthly and annual averages by coverage type in Nevada:

- General liability insurance: $117 monthly or $1,405 annually

- Workers' compensation insurance: $84 monthly or $1,005 annually

- Professional liability (E&O) insurance: $88 monthly or $1,061 annually

- Business owner's policy (BOP): $167 monthly or $2,000 annually

Which companies are the best for small business insurance in Nevada (not just the cheapest)?

ERGO NEXT and The Hartford both earned 4.63 scores in MoneyGeek's Nevada analysis. ERGO NEXT provides same-day policies and instant certificates through mobile app, which is helpful when clients demand proof fast. The Hartford ranks first for claims satisfaction with 4.5 stars from 18,000+ reviews and offers Nevada's lowest rates. Choose based on your priorities.

Do I need workers' comp in Nevada if I only have 1 employee or I use 1099s?

Yes, Nevada requires workers' compensation from your first employee, even part-time or seasonal workers. True independent contractors (1099s) don't require coverage, but construction principal contractors remain liable for all job site workers. Misclassifying employees as 1099s triggers penalties up to three times owed premiums. Verify worker status with your insurance agent before hiring.

My client or landlord wants a COI. What limits do I need, and how fast can I get it?

Most Nevada contracts require $1 million general liability per occurrence with $2 million aggregate. Reno casinos and Las Vegas commercial properties often demand $2 million per occurrence. ERGO NEXT's mobile app provides instant certificates with unlimited additional insureds at no extra cost. The Hartford and Simply Business issue certificates within 24 hours.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Nevada Consumer's Guide to Auto Insurance Rates. "2024 Auto Guide." Accessed February 7, 2026.

- Nevada Division of Industrial Relations. "Employer Coverage Requirements." Accessed February 7, 2026.

- Nevada Division of Insurance. "Nevada Division of Insurance Holding Town Hall Meeting on the Impact of Wildfire Threat on Insurance." Accessed February 7, 2026.

- Nevada Division of Insurance. "Nevada Division of Insurance Announces Consumer Home Insurance Tool." Accessed February 7, 2026.

- Nevada Office of Emergency Management. "Historic Nevada Flood Booklet." Accessed February 7, 2026.

- Nevada Revised Statutes. "Chapter 616A - Workers' Compensation." Accessed February 7, 2026.

- University of Nevada, Reno. "NSBDC Small Business Challenges Survey 2025." Accessed February 7, 2026.

- University of Nevada, Reno. "SBDC Small Business Survey Results 2023." Accessed February 7, 2026.