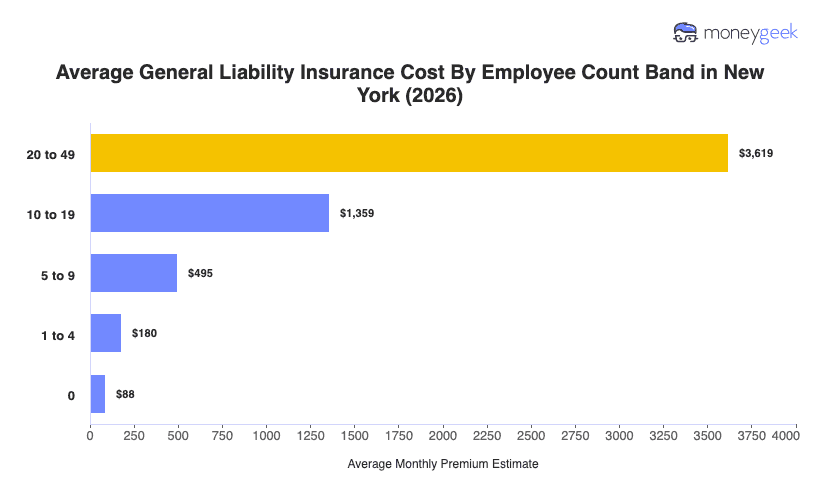

The cost of general liability insurance for New York businesses with one to four employees is an average of $180 per month ($2,157 annually), based on MoneyGeek's analysis of premium estimates across over 400 business types statewide. New York’s premium falls $57 below the national average, making it the second-most expensive nationally.

Within the Northeast, pricing varies by over $50 monthly. Pennsylvania anchors the low end at $129 per month, while New Jersey and Connecticut sit closer to New York at $160 and $159 respectively. New York's position at the higher end of this regional range reflects differences in market conditions and regulatory environments across neighboring states.

These state averages provide market orientation but don't determine your individual quote. Use New York’s average to gauge where your business sits relative to the broader market, then examine which operational factors beyond geography account for your specific cost.