The Hartford earned our top ranking for funeral home business insurance providers with a MoneyGeek score of 4.78 out of 5. It offers funeral directors competitive rates, quality customer service and comprehensive coverage options. ERGO NEXT and Progressive Commercial also provide strong insurance solutions for funeral service providers.

Best Funeral Home Business Insurance

The Hartford, ERGO NEXT and Progressive Commercial offer the best cheap business insurance for funeral homes, with rates starting at $25 monthly.

Get matched to the best business insurance provider for funeral service providers.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Funeral directors need several types of coverage, like workers' compensation for employee injuries, commercial auto for hearses, general liability for visitor accidents and professional liability for negligence claims.

The Hartford offers the best business insurance for funeral homes with a 4.78 MoneyGeek score, providing competitive rates, quality service and comprehensive coverage options.

The Hartford provides the cheapest business insurance for funeral home businesses at $53 monthly or $635 annually, with workers' compensation coverage starting at $26 monthly for funeral directors.

Best Funeral Home Business Insurance

| The Hartford | 4.78 | $53 |

| ERGO NEXT | 4.77 | $53 |

| Progressive Commercial | 4.50 | $63 |

| Simply Business | 4.50 | $63 |

| Coverdash | 4.50 | $66 |

| Hiscox | 4.40 | $68 |

| Thimble | 4.40 | $68 |

| biBERK | 4.40 | $75 |

| Nationwide | 4.40 | $63 |

| Chubb | 4.30 | $78 |

Note: We based all scores on a funeral home business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Funeral Home Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your funeral home business, check out the following resources:

1. The Hartford: Best and Cheapest for Funeral Homes

Lowest BOP and professional liability rates for funeral homes

Highest customer service and claims satisfaction scores nationally

Comprehensive coverage for funeral directors and cremation services

A+ financial stability rating from AM Best

Digital experience ranks 10th among national business insurers

Funeral home owners need agents for online purchases

For funeral home operators, The Hartford offers the most affordable coverage. With over 200 years of insurance experience, it provides funeral-specific coverage protecting against risks like mishandling remains or equipment damage. Its workers' compensation gives funeral directors access to over one million healthcare providers, ensuring quality care after workplace injuries.

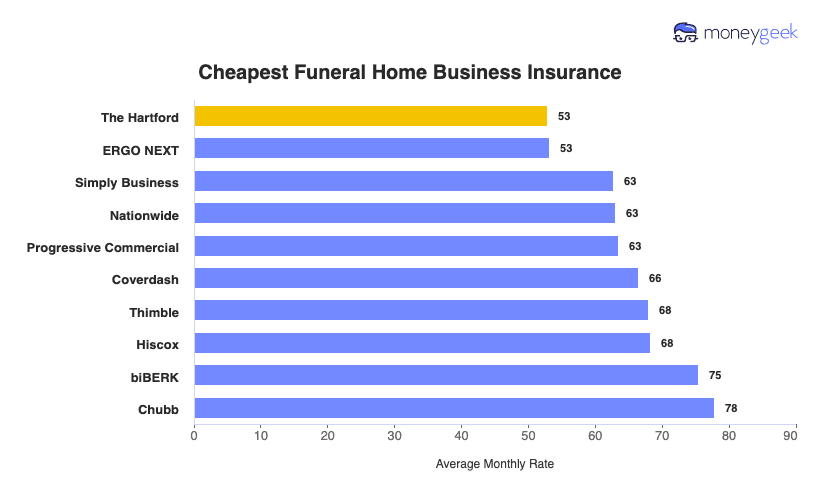

Cheapest Business Insurance for Funeral Homes

The Hartford offers funeral directors the most affordable overall coverage at $53 monthly or $635 annually. The company ranks first for BOP ($64 monthly) and professional liability ($73 monthly), with second-lowest rates for general liability and workers' compensation. ERGO NEXT offers the lowest rates for workers' compensation ($25 monthly) and general liability ($44 monthly) for funeral home businesses.

| The Hartford | $53 | $635 |

| ERGO NEXT | $53 | $638 |

| Simply Business | $63 | $753 |

| Nationwide | $63 | $756 |

| Progressive Commercial | $63 | $761 |

| Coverdash | $66 | $797 |

| Thimble | $68 | $815 |

| Hiscox | $68 | $819 |

| biBERK | $75 | $905 |

| Chubb | $78 | $933 |

What Does Funeral Home Business Insurance Cost?

In general, business insurance costs for funeral homes cost the following for the four most popular coverage types:

- General Liability: $61 on average per month, ranging from $44 to $81, depending on the state

- Workers' Comp: $27 on average per month, ranging from $25 to $31, depending on the state

- Professional Liability (E&O): $81 on average per month, ranging from $73 to $94, depending on the state

- BOP Insurance: $89 on average per month, ranging from $64 to $109, depending on the state

| BOP | $89 | $1,067 |

| Professional Liability (E&O) | $81 | $968 |

| General Liability | $61 | $728 |

| Workers' Comp | $27 | $322 |

What Type of Coverage Do You Need for a Funeral Home Business?

The required coverage for a funeral director includes workers' compensation and commercial auto insurance if you have employees or operate hearses. Beyond legal requirements, funeral homes need general liability and professional liability coverage to protect against visitor injuries and claims of mishandling remains.

- Workers' Compensation Insurance: Required in nearly all states if you have employees. Covers funeral home attendants injured while lifting caskets, morticians exposed to embalming chemicals or drivers hurt during body transfers. Funeral directors typically carry $500,000 to $1 million in coverage for medical expenses and wage replacement.

- Commercial Auto Insurance: Mandatory in every state where you operate hearses or limousines. Protects your funeral home when hearses are rear-ended during processions or transport vans are involved in accidents while moving remains. Funeral service providers need $500,000 to $1 million in liability limits for specialized funeral vehicles.

- General Liability Insurance: Protects your funeral home when mourners slip on icy walkways before viewings or elderly visitors fall on chapel steps during services. Covers medical bills and legal fees if families sue over injuries at your mortuary. Most funeral directors carry $1 million per occurrence limits.

- Professional Liability Insurance (E&O): Essential when families claim you cremated the wrong body, ordered incorrect caskets or mishandled remains during preparation. One lawsuit alleging professional negligence could bankrupt your funeral service business. Funeral home operators typically need $1 million to $2 million in coverage.

- Commercial Property Insurance: Protects your funeral home building, prep room equipment, casket showroom inventory and embalming machinery from fire or storm damage. Critical if you own your facility, as replacing cremation equipment and refrigeration units costs hundreds of thousands without coverage.

- Business Owner's Policy (BOP): Bundles general liability and property coverage at lower rates for funeral homes. Covers visitor injuries, building damage and lost income when burst pipes flood your chapel, forcing you to cancel services. Saves funeral directors money while maintaining comprehensive protection.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Funeral Home Business

Finding the best and cheapest business insurance for your funeral home requires comparing quotes and understanding how to get business insurance that fits your specific needs as a funeral director.

- 1Decide on Coverage Needs Before Buying

Assess risks funeral directors face daily: attendants injuring backs while moving caskets, families suing over wrong urn deliveries or mourners falling during graveside services. Consult other funeral home operators about their costliest claims to understand what coverage protects mortuaries best.

- 2Research Costs

Compare what similar funeral homes pay for coverage. If you operate two hearses and employ five embalmers, research rates for businesses your size to identify which insurers offer funeral directors the most affordable professional liability and workers' compensation premiums.

- 3Look Into Company Reputations and Coverage Options

Read reviews from other funeral service providers about claim experiences, especially for sensitive incidents like refrigeration failures destroying remains or chapel fires canceling multiple services. Funeral home owners need insurers experienced with death care industry claims who respond compassionately during crises.

- 4Compare Multiple Quotes Through Different Means

Request quotes specifically mentioning your prep room operations, crematorium equipment and fleet of funeral vehicles. Funeral directors find drastically different rates between insurers familiar with mortuary risks versus those who rarely cover death care businesses.

- 5Reassess Annually

Reevaluate coverage when you expand cremation capacity, acquire additional chapel locations or purchase new embalming equipment. Your funeral home's growing casket inventory, increased service volume and additional staff create new liability exposures requiring higher coverage limits each year.

Best Insurance for Funeral Home Business: Bottom Line

The Hartford offers funeral directors the best combination of affordability and service, with comprehensive coverage starting at $53 monthly and a 4.78 MoneyGeek score. Funeral home businesses need workers' compensation for employee injuries, commercial auto for hearses, general liability for visitor accidents and professional liability to protect against negligence claims from grieving families.

Funeral Home Business Insurance: FAQ

We answer frequently asked questions about Funeral Home business insurance:

Who offers the best funeral home business insurance overall?

The Hartford leads funeral home business insurance with a MoneyGeek score of 4.78 out of 5. ERGO NEXT follows closely at 4.77, delivering excellent affordability, customer service and comprehensive coverage for funeral directors.

Who has the cheapest business insurance for funeral home firms?

Here are the cheapest business insurance companies for funeral home businesses by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $44 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $25 monthly

- Cheapest professional liability insurance: The Hartford at $73 monthly

- Cheapest BOP insurance: The Hartford at $64 monthly

What business insurance is required for funeral home organizations?

Funeral homes must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements differ by state. General liability coverage and professional bonds are also essential for client contracts.

How much does funeral home business insurance cost?

Funeral home business insurance costs by coverage type are as follows:

- General Liability: $61/mo

- Workers' Comp: $27/mo

- Professional Liability: $81/mo

- BOP Insurance: $89/mo

How We Chose the Best Funeral Home Business Insurance

We selected the best business insurer for funeral-home companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.