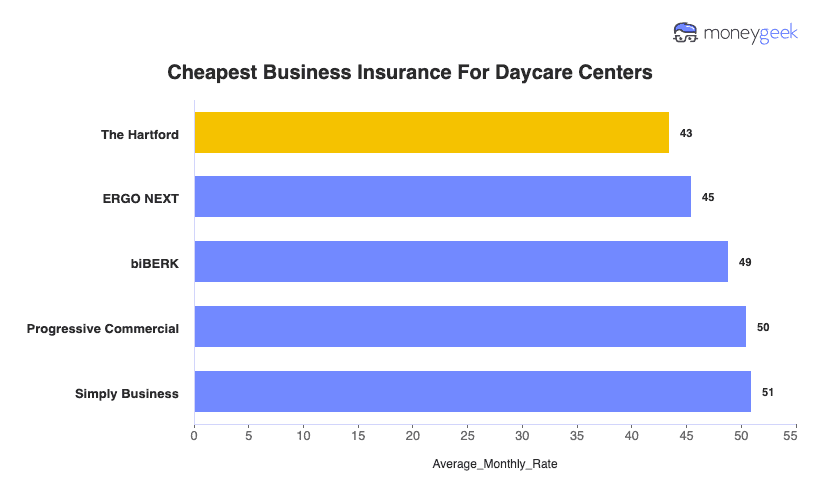

The Hartford secures our top spot for daycare center insurance with perfect scores across coverage options and affordability. Its coverage packages and cost-effective rates set them apart in the childcare insurance market.

You should also get quotes from our other recommended carriers, including ERGO NEXT, biBerk, Simply Business, and Progressive Commercial, before making your final decision.