ERGO NEXT and The Hartford tied for best roofing company insurance with MoneyGeek scores of 4.65 out of 5. Both insurers offer quality service, competitive rates and comprehensive coverage for roofing contractors handling high-risk work. Thimble and Simply Business are also solid choices, so get quotes from multiple providers to find the right financial protection for your roofing business.

Best Roofing Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for roofing companies, with rates starting at $87 monthly.

Discover the best business insurance provider for your roofing company.

Updated: February 2, 2026

Advertising & Editorial Disclosure

The coverage types roofing contractors need include workers' compensation for crew injuries, general liability for property damage claims, commercial auto for work vehicles and tools and equipment insurance.

ERGO NEXT and The Hartford offer the best business insurance for roofing companies, earning MoneyGeek scores of 4.65 for balancing affordable rates with responsive customer service and comprehensive coverage options.

Thimble provides the cheapest business insurance for roofers at $348 monthly, with professional liability coverage starting at just $96 per month for contractors offering design or consulting services.

Best Business Insurance for Roofing Companies

| ERGO NEXT | 4.65 | $399 |

| The Hartford | 4.65 | $433 |

| Thimble | 4.50 | $348 |

| Simply Business | 4.50 | $447 |

| Coverdash | 4.40 | $448 |

| Nationwide | 4.40 | $513 |

| Progressive Commercial | 4.30 | $456 |

| Hiscox | 4.30 | $481 |

| Chubb | 4.30 | $551 |

| biBERK | 4.20 | $581 |

Note: We based all scores on a roofing business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Roofing Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your roofing business, check out the following resources:

1. ERGO NEXT: Best Overall for Roofing Businesses

Ranks first for workers' compensation insurance for roofing businesses

Best digital platform nationwide for quotes and certificates

A+ AM Best rating backed by Munich Re

Top customer satisfaction scores from our customer surveys

Claims process scores lower most competitors

Limited phone support for contractors preferring direct agent contact

For roofing contractors, ERGO NEXT delivers the best balance of competitive pricing, quality service and digital tools. Roofers praise the instant certificate of insurance feature. You can download unlimited certificates and add additional insureds 24/7 through the app, saving time when homeowners or general contractors request proof of coverage before the job starts.

ERGO NEXT bundles general liability with contractor E&O coverage, protecting your roofing business if a client claims faulty workmanship caused property damage.

2. Thimble: Cheapest Overall for Roofing Businesses

Cheapest general liability and BOP rates for roofing contractors

Strong digital platform ranks second nationally for user experience

Pay-as-you-go coverage by job, month or year available

Backed by financially strong A-rated carriers like Markel Insurance

Claims processing ranks seventh, slower than top-rated competitors

Customer service ranks eighth with no phone support option

For roofing contractors, the pay-as-you-go model of Thimble works well for roofing businesses handling seasonal work or bidding multiple residential projects. You can activate coverage only when you need it instead of paying year-round.

You can generate instant certificates of insurance through the app when homeowners or general contractors require proof before you start a job. Policies are underwritten by Markel Insurance and other A-rated carriers from AM Best.

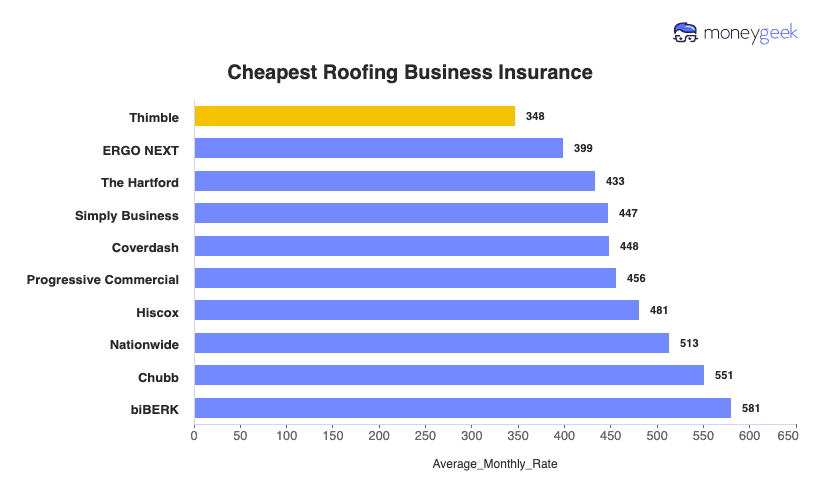

Cheapest Business Insurance for Roofing Companies

Thimble offers the cheapest roofing company insurance at $348 monthly ($4,170 annually) across the four common coverage types. It ranks first for general liability ($207 monthly) and BOP ($320 monthly), but the Hartford beats Thimble on professional liability at $87 monthly. ERGO NEXT also delivers competitive pricing, ranking first for workers' comp ($784 monthly).

| Thimble | $348 | $4,170 |

| ERGO NEXT | $399 | $4,791 |

| The Hartford | $433 | $5,202 |

| Simply Business | $447 | $5,370 |

| Coverdash | $448 | $5,379 |

| Progressive Commercial | $456 | $5,469 |

| Hiscox | $481 | $5,774 |

| Nationwide | $513 | $6,161 |

| Chubb | $551 | $6,613 |

| biBERK | $581 | $6,969 |

What Does Roofing Business Insurance Cost?

In general, business insurance costs for roofing companies are the following for the four most popular coverage types:

- General Liability Cost: $389 on average per month, ranging from $207 to $608, depending on the state

- Workers' Comp: $836 on average per month, ranging from $784 to $966, depending on the state

- Professional Liability (E&O): $97 on average per month, ranging from $87 to $113, depending on the state

- BOP Insurance: $567 on average per month, ranging from $320 to $785, depending on the state

| Workers' Comp | $836 | $10,037 |

| BOP | $567 | $6,806 |

| General Liability | $389 | $4,672 |

| Professional Liability (E&O) | $97 | $1,170 |

What Type of Coverage Do You Need for a Roofing Business?

Required coverage for roofers varies by state, but most roofing companies need workers' compensation and general liability at minimum to operate legally and win contracts. Beyond these, commercial auto insurance protects your fleet, while tools and equipment coverage and professional liability insurance safeguard against the specific risks roofing contractors face daily.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Roofing Company

Getting business insurance doesn't have to be complicated when you follow our step-by-step method to find the best and most affordable coverage for your roofing business.

- 1Decide on Coverage Needs Before Buying

Think about real scenarios: a worker slipping on a wet roof, your trailer full of tools stolen overnight or a homeowner suing over alleged water damage. Talk to other roofers about their costliest claims. Understanding these risks helps you buy adequate protection without wasting money on coverage your roofing operation doesn't need.

- 2Research Costs

Know what roofing contractors with similar crew sizes and revenue pay before requesting quotes. Research shows roofers often pay more than other contractors due to fall risks and weather exposure. Knowing industry-standard rates helps you spot fair pricing and gives you leverage when negotiating with insurers who understand roofing work.

- 3Look Into Company Reputations and Coverage Options

Read what other roofing business owners say about claims processing speed on Trustpilot or contractor forums. When your crew can't work because a truck accident left you without transportation, you need an insurer who pays quickly. Look for policies that grow with you as you add bucket trucks, expand territories or start offering storm-chasing services.

- 4Compare Multiple Quotes Through Different Means

Request quotes from at least three insurers using independent agents, direct calls and online platforms. An agent specializing in contractor insurance might find you better rates on high-limit policies or coverage for hot tar work that standard quotes exclude. Calling insurers directly sometimes reveals discounts for safety training or clean claims records.

- 5Reassess Annually

Your roofing company evolves as you hire seasonal workers, invest in new equipment or shift from residential to commercial projects. Review coverage yearly to increase limits for expensive roof systems, add newly purchased vehicles or drop redundant policies. Your rates often decrease as you build a safer work record and claims-free history.

Best Insurance for Roofing Business: Bottom Line

Roofing company insurance protects your business from the financial hit of crew injuries, property damage lawsuits and stolen tools. ERGO NEXT and The Hartford deliver the best coverage for roofing contractors, combining reasonable rates with reliable service when you need to file a claim. Thimble offers the most budget-friendly option at $348 monthly, making solid protection accessible for roofers just starting out or running lean operations.

Roofing Business Insurance: FAQ

Common questions about roofing business insurance:

Who offers the best roofing business insurance overall?

ERGO NEXT and The Hartford tie for the best roofing business insurance, each earning a MoneyGeek score of 4.65 out of 5. Thimble and Simply Business follow closely behind with scores of 4.50, offering competitive coverage options.

Who has the cheapest business insurance for roofing firms?

Here are the cheapest business insurance companies for roofing businesses by coverage type:

- Cheapest general liability insurance: Thimble at $207 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $784 monthly

- Cheapest professional liability insurance: The Hartford at $87 monthly

- Cheapest BOP insurance: Thimble at $320 monthly

What business insurance is required for roofing organizations?

Workers' compensation (for employees) and commercial auto insurance (for business vehicles) are legally mandated for roofing companies, though requirements differ by state. General liability coverage is practically essential for client contracts.

How much does roofing business insurance cost?

Roofing business insurance costs by coverage type are as follows:

- General Liability: $389/mo

- Workers' Comp: $836/mo

- Professional Liability: $97/mo

- BOP Insurance: $567/mo

How We Chose the Best Roofing Business Insurance

We selected the best business insurer for roofing companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Removes From Under Review With Positive Implications and Upgrades Credit Ratings of Next Insurance US Company." Accessed October 13, 2025.