The Hartford earned our top spot for pressure washing business insurance with a perfect MoneyGeek score of 4.61 out of 5, excelling in affordability, customer service and coverage options. Compare quotes from our other top picks, Thimble, Simply Business and Nationwide, to find the right balance of coverage and cost for your power washer service.

Best Pressure Washing Business Insurance

The Hartford, Thimble and Simply Business offer the best cheap business insurance for pressure washing, with rates starting at $51 monthly.

Discover affordable business insurance for pressure washing companies below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Pressure washing businesses need general liability, workers' compensation, and commercial auto, among other coverage types for damage claims and theft protection.

The Hartford ranks as the best business insurance provider for power washing companies, scoring 4.61 in our study, providing quality service for affordable rates.

Thimble offers the cheapest business insurance for pressure washer contractors at $312 monthly, with professional liability coverage available for $57 per month.

Best Business Insurance for Pressure Washing Companies

| The Hartford | 4.61 | $561 |

| Thimble | 4.50 | $312 |

| Simply Business | 4.50 | $489 |

| Nationwide | 4.40 | $660 |

| ERGO NEXT | 4.37 | $773 |

| Progressive Commercial | 4.30 | $602 |

| Coverdash | 4.30 | $628 |

| biBERK | 4.30 | $709 |

| Chubb | 4.30 | $741 |

| Hiscox | 4.20 | $657 |

Note: All scores were based on a pressure-washing business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Pressure Washing Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your pressure washing business, check out the following resources:

1. The Hartford: Best Overall for Pressure Washing Businesses

Ranks first nationally for customer service and claims processing

Cheapest professional liability coverage at $51 monthly for pressure washers

Fast claims processing with some resolved in five days

Over 200 years serving small businesses like pressure washing companies

Digital experience ranks last

Not available in Alaska, Hawaii or Michigan for BOPs

Higher costs for general liability and BOP coverage options

The Hartford's customer service and claims processing matters when you're dealing with property damage disputes or incomplete work claims.

Budget-focused pressure washing contractors handling residential work may find better rates elsewhere, but commercial pressure washing services needing reliable E&O coverage and strong financial backing benefit from The Hartford's A+ AM Best rating.

2. Thimble: Cheapest Overall for Pressure Washing Companies

Cheapest general liability and BOP coverage

Outstanding digital experience ranks second nationally

Flexible coverage by job, day, month or year perfect for seasonal work

Instant certificate of insurance generation through mobile app

Claims processing and customer service place seventh and eighth among competitors

Professional liability costs $57 monthly, more expensive than other carriers

Thimble's flexible by-the-job coverage solves a unique challenge for seasonal pressure washing operations, allowing you to activate insurance for specific projects, then pause between them without paying for unused coverage.

Thimble includes customer property protection coverage, addressing a critical gap most insurers exclude for pressure washing services. It covers restoration costs if you accidentally damage siding, windows or lawn decor while cleaning.

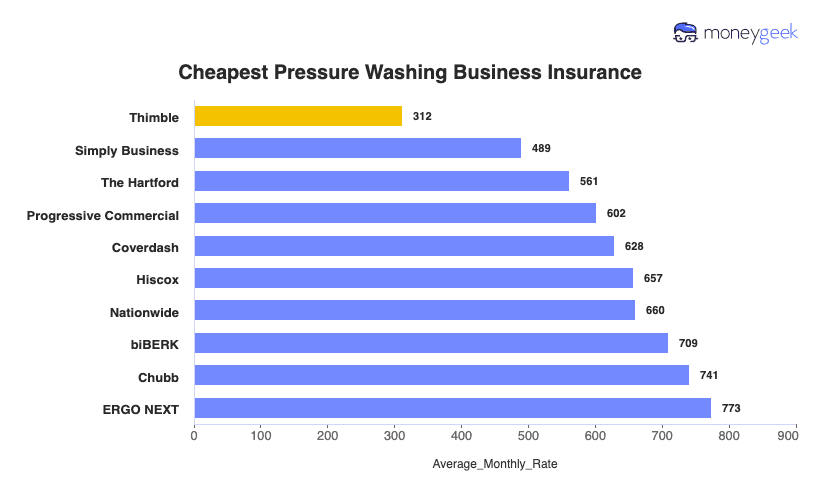

Cheapest Business Insurance for Pressure Washing Companies

Thimble offers the cheapest pressure washing business insurance at $312 monthly ($3,747 annually), ranking first for general liability and BOP. For workers' compensation, ERGO NEXT and The Hartford offer better rates at $39 monthly and The Hartford leads professional liability at $51 monthly. Compare the most affordable providers by coverage type below.

| Thimble | $312 | $3,747 |

| Simply Business | $489 | $5,873 |

| The Hartford | $561 | $6,737 |

| Progressive Commercial | $602 | $7,228 |

| Coverdash | $628 | $7,536 |

| Hiscox | $657 | $7,889 |

| Nationwide | $660 | $7,920 |

| biBERK | $709 | $8,506 |

| Chubb | $741 | $8,891 |

| ERGO NEXT | $773 | $9,281 |

What Does Pressure Washing Business Insurance Cost?

In general, business insurance costs for pressure washing businesses are the following for the four most popular coverage types:

- General Liability Cost: $918 on average per month, ranging from $429 to $1,152, depending on the state

- Workers' Comp: $84 on average per month, ranging from $79 to $97, depending on the state

- Professional Liability (E&O): $57 on average per month, ranging from $51 to $612, depending on the state

- BOP Insurance: $1,346 on average per month, ranging from $665 to $1,754, depending on the state

| Professional Liability (E&O) | $57 | $689 |

| Workers' Comp | $84 | $1,007 |

| General Liability | $918 | $11,022 |

| BOP | $1,346 | $16,158 |

What Type of Coverage Do You Need for a Pressure Washing Business?

The required coverage for pressure washing service providers includes workers' compensation if you have employees, while general liability and commercial auto insurance protect against the property damage and accidents. Beyond these essentials, professional liability, commercial property insurance, and specialized equipment coverage become important depending on your business size, client requirements and equipment value.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Pressure Washing Company

Getting business insurance the best and cheapest business insurance for your pressure washing business means comparing quotes, understanding what coverage you actually need and choosing providers who specialize in contractors.

- 1Decide on Coverage Needs Before Buying

Think about what actually goes wrong in pressure washing: you accidentally blast through a client's window, your $8,000 pressure washer gets stolen from your trailer or a homeowner slips on their wet driveway. Talk to other pressure washing contractors about claims they've filed to understand what coverage protects your business versus what agents oversell.

- 2Research Costs

Research what other pressure washing businesses pay for similar coverage in your state. It prevents you from accepting the first quote or choosing bargain coverage that denies claims when your equipment damages a client's property.

- 3Look Into Company Reputations and Coverage Options

Check reviews from contractors who've filed claims for damaged property or stolen equipment. You need insurers who understand pressure washing work and pay claims promptly when you crack a client's siding or total your truck. Look for flexible coverage that adapts as you add crews or upgrade to commercial-grade equipment.

- 4Compare Multiple Quotes Through Different Means

Get quotes from independent agents who specialize in contractor insurance, direct from insurer websites and through business insurance comparison sites. A pressure washing business in Florida pays different rates than one in Michigan, and coverage limits that work for residential jobs may fall short for commercial contracts. Comparing three quotes shows which insurers offer the best value for your operation.

- 5Reassess Annually

Your business evolves: you buy a second truck and trailer setup, hire two employees or start landing commercial contracts requiring higher liability limits. Review your coverage before renewal to confirm your policy covers your current equipment value and employee count. Last year's $10,000 equipment limit won't replace this year's $25,000 investment in pressure washers and surface cleaners.

Best Insurance for Pressure Washing Business: Bottom Line

Pressure washing businesses need three core policies: general liability for property damage, workers' compensation for employee injuries and commercial auto for vehicle accidents. The Hartford leads our rankings with a 4.61 score, offering solid coverage at competitive rates. Thimble works well for businesses on tighter budgets, with comprehensive protection starting at $312 monthly and professional liability available for $57 per month.

Pressure Washing Business Insurance: FAQ

Common questions about pressure washing business insurance:

Who offers the best pressure washing business insurance overall?

The Hartford delivers the best overall business insurance for pressure washing companies, earning a MoneyGeek score of 4.61 out of 5. Thimble and Simply Business tie for second place, both achieving solid 4.50 scores with competitive pricing and comprehensive coverage options.

Who has the cheapest business insurance for pressure washing firms?

Here are the cheapest business insurance companies for pressure washing businesses by coverage type:

- Cheapest general liability insurance: Thimble at $429 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $79 monthly

- Cheapest professional liability insurance: The Hartford at $51 monthly

- Cheapest BOP insurance: Thimble at $665 monthly

What business insurance is required for pressure washing organizations?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated, though requirements differ by state.

How much does pressure washing business insurance cost?

Pressure washing business insurance costs by coverage type are as follows:

- General Liability: $918/mo

- Workers' Comp: $84/mo

- Professional Liability: $57/mo

- BOP Insurance: $1,346/mo

How We Chose the Best Pressure Washing Business Insurance

We selected the best business insurer for pressure-washing companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 13, 2025.