The Hartford leads our rankings for cannabis dispensary insurance with a MoneyGeek score of 4.78 out of 5 and monthly costs starting at $79. It earned perfect scores across all categories, making it an outstanding choice for cannabis business owners seeking comprehensive coverage at competitive rates. We recommend comparing quotes from ERGO NEXT, biBerk and Simply Business.

Best Cannabis Business Insurance

The Hartford, ERGO NEXT and biBerk offer the best cheap business insurance for cannabis companies, with rates starting at $54 monthly.

Get matched with cheap cannabis business insurance below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Your cannabis dispensary needs several coverage types, including general liability, property insurance, crime protection and workers' compensation for your staff.

The Hartford provides the best business insurance for cannabis businesses with perfect scores in affordability, coverage options and customer service.

The Hartford offers the cheapest business insurance for cannabis companies at $79 monthly, and has the lowest rates for general liability and professional liability insurance.

Best Business Insurance for Cannabis Dispensary Companies

| The Hartford | 4.78 | $79 |

| ERGO NEXT | 4.75 | $82 |

| biBERK | 4.60 | $85 |

| Simply Business | 4.50 | $92 |

| Chubb | 4.30 | $108 |

| Progressive Commercial | 4.30 | $93 |

| Coverdash | 4.30 | $97 |

| Nationwide | 4.30 | $104 |

| Thimble | 4.20 | $97 |

| Hiscox | 4.20 | $98 |

Note: We based all scores on a cannabis business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Cannabis Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your cannabis business, explore these resources:

1. The Hartford: Best and Cheapest Overall for Cannabis Businesses

Lowest rates for cannabis dispensaries

Ranked first for claims process and customer service

A+ Superior financial strength rating from AM Best

Cheapest general liability and professional liability coverage options

Over 215 years of insurance experience

Digital experience ranks last among business insurers

Not available in Alaska or Hawaii for business insurance

Business owner's policies unavailable in Michigan

The Hartford provides cannabis dispensaries with comprehensive protection. Its A+ Superior AM Best rating gives your dispensary reliable financial backing in an industry where finding quality coverage proves challenging.

Your cannabis business receives certificates of insurance in five minutes to meet vendor compliance and licensing requirements. This insurer supports dispensary owners through security risks, cash-intensive operations and the complex regulations facing cannabis retailers today.

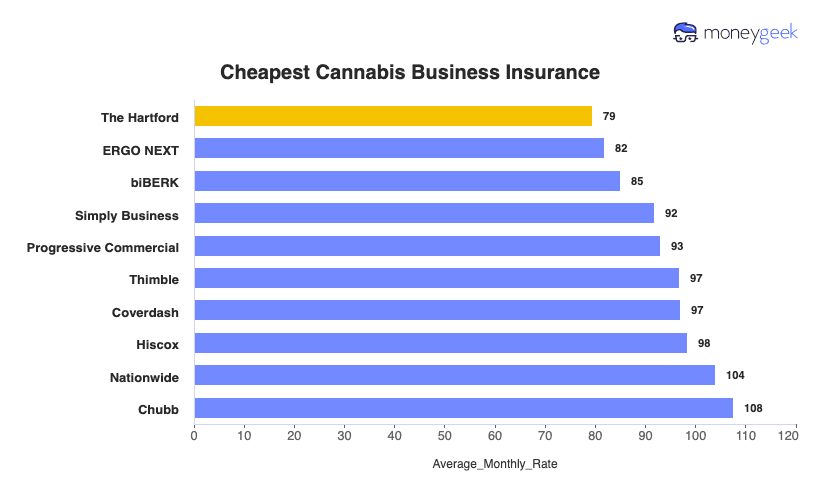

Cheapest Business Insurance for Cannabis Companies

The Hartford provides affordable cannabis business insurance at $79 monthly ($953 annually), offering the lowest rates for general liability at $54 monthly and professional liability at $110 monthly. For workers' compensation, ERGO NEXT leads at $79 monthly, while biBERK offers the cheapest BOP coverage at $73 monthly. Compare quotes from these three providers to find the best combination for your dispensary.

| The Hartford | $79 | $953 |

| ERGO NEXT | $82 | $982 |

| biBERK | $85 | $1,021 |

| Simply Business | $92 | $1,103 |

| Progressive Commercial | $93 | $1,115 |

| Thimble | $97 | $1,162 |

| Coverdash | $97 | $1,164 |

| Hiscox | $98 | $1,181 |

| Nationwide | $104 | $1,249 |

| Chubb | $108 | $1,291 |

What Does Cannabis Business Insurance Cost?

In general, cannabis business insurance costs are the following for the four most popular coverage types:

- General Liability Cost: $67 on average per month, ranging from $58 to $78 depending on the state

- Workers' Comp: $84 on average per month, ranging from $72 to $98 depending on the state

- Professional Liability (E&O): $122 on average per month, ranging from $104 to $143 depending on the state

- BOP Insurance: $99 on average per month, ranging from $84 to $117 depending on the state

| General Liability | $67 | $807 |

| Workers Comp | $84 | $1,006 |

| BOP | $99 | $1,191 |

| Professional Liability (E&O) | $122 | $1,468 |

What Type of Insurance Is Best for a Cannabis Dispensary Company?

Most states require workers' compensation as the required coverage for cannabis dispensaries that employ staff. Your cannabis business also needs general liability, property and crime insurance to address the theft, cash-heavy operations and liability claims common in the industry.

- Workers' Compensation Insurance: Most states require workers' comp if you employ staff. This coverage protects your budtenders, security personnel and cultivation workers from injuries related to heavy lifting, repetitive motions and robberies. Coverage limits must meet your state's requirements.

- General Liability Insurance: This coverage protects your cannabis business when customers slip and fall in your dispensary, claim your products caused illness or report property damage during deliveries. The policy covers legal defense costs and settlements. Most cannabis retailers carry $1 million per occurrence and $2 million aggregate limits.

- Professional Liability Insurance (Errors & Omissions): This policy covers claims when customers say your staff provided harmful advice about product selection, dosing or consumption methods. You need this protection when medical marijuana patients claim your recommendations worsened their condition. Cannabis dispensaries commonly carry $1 million to $2 million in coverage.

- Product Liability Insurance: Your dispensary needs this coverage when customers claim your cannabis products caused adverse reactions, contamination or unexpected side effects. This protection defends against lawsuits involving mold, pesticides or incorrect THC/CBD labeling. Small operations should start with $1 million per occurrence, while larger dispensaries need higher limits.

- Property Insurance: This coverage protects your dispensary's building, inventory, equipment and cash reserves from fire, theft, vandalism and natural disasters. Cannabis businesses handle significant cash due to banking restrictions, making this protection critical. Insure your inventory at replacement cost with limits that match your typical stock value.

- Commercial Auto Insurance: You need this coverage if your cannabis business uses vehicles for deliveries, bank runs or transporting inventory between locations. The policy covers accidents, theft and liability when employees drive for work. Cannabis retailers should carry higher liability limits because they transport valuable inventory.

- Cyber Liability Insurance: This policy protects your dispensary when hackers steal customer data, payment information or medical marijuana patient records. Cannabis businesses face higher cyber risks because of cash operations and customer databases. Start with $1 million in coverage for data breach response and legal costs.

- Crime Insurance: Cannabis dispensaries need this coverage because federal banking restrictions force them to hold large cash reserves. The policy covers employee theft, robbery, burglary and counterfeit money. Match your coverage limits to your typical cash on hand, usually $50,000 to $500,000.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Cannabis Company

Follow these steps for getting business insurance that provides your cannabis business financial protection without overpaying.

- 1Decide on Coverage Needs Before Buying

Consider risks specific to your cannabis dispensary: theft of inventory, cash handling and product liability claims. Talk with other dispensary owners about their experiences and consult agents who understand cannabis regulations. This upfront research helps you buy the right coverage without paying for protection you don't need.

- 2Research Costs

Check typical insurance costs for cannabis businesses your size before shopping. Federal restrictions make cannabis coverage more expensive than standard business insurance. Know the market rates so you recognize fair pricing when comparing quotes and can negotiate from an informed position.

- 3Look Into Company Reputations and Coverage Options

Read reviews from other cannabis business owners about their claims experiences, particularly theft and inventory loss claims. Many insurers exclude cannabis operations entirely, so verify each company covers dispensaries and offers the specific protection your cannabis business requires.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers that cover cannabis companies. Independent agents access specialized cannabis insurers that don't advertise publicly. Online tools provide quick comparisons, while direct calls may reveal discounts for security systems or surveillance equipment your dispensary already has.

- 5Reassess Annually

Your cannabis company faces changing regulations and inventory values throughout the year. Review your coverage annually to adjust for new locations, increased cash reserves or additional employees. Annual reviews help you maintain adequate protection as your dispensary grows and rates shift.

Best Cannabis Business Insurance: Bottom Line

The Hartford offers cannabis dispensaries the best combination of affordability and protection at $79 monthly, including the lowest rates for general liability and professional liability coverage.

Your cannabis company needs comprehensive insurance: property protection, crime coverage and workers' compensation for your staff. With perfect scores in affordability, coverage options and customer service, The Hartford stands as our top choice for cannabis operations.

Cannabis Insurance: FAQ

We answer frequently asked questions about Cannabis business insurance:

Who offers the best cannabis business insurance overall?

The Hartford leads cannabis business insurance with a MoneyGeek score of 4.78 out of 5. ERGO NEXT follows closely behind at 4.75, delivering excellent affordability, customer service and comprehensive coverage for cannabis businesses.

Who has the cheapest business insurance for cannabis firms?

Here are the cheapest business insurance companies for cannabis companies by coverage type:

- Cheapest general liability insurance: The Hartford at $54 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $79 monthly

- Cheapest professional liability insurance: The Hartford at $110 monthly

- Cheapest BOP insurance: biBerk at $73 monthly

What business insurance is required for cannabis organizations?

Cannabis businesses must carry workers' compensation insurance with employees and commercial auto insurance for business vehicles, though requirements differ by state.

How much does cannabis business insurance cost?

Cannabis monthly business insurance costs by coverage type are as follows:

- General Liability: $67/mo

- Workers Comp: $84/mo

- Professional Liability: $122/mo

- BOP Insurance: $99/mo

How We Chose the Best Cannabis Business Insurance

We selected the best business insurer for cannabis companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed October 17, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 17, 2025.

- Trustpilot. "Thimble." Accessed October 17, 2025.