Nationwide ranks as the best business insurance provider for auto repair shops and mechanics with a MoneyGeek score of 4.80 out of 5. You'll pay just $113 monthly ($1,357 annually), the lowest rates in our study, while getting strong financial stability. ERGO NEXT and The Hartford rank second and third and offer excellent coverage options for car repair shops and automotive service centers.

Best Auto Repair Shop Business Insurance

Nationwide, The Hartford and ERGO NEXT offer the best cheap business insurance for auto repair shops, with rates starting at $81 monthly.

Get personalized quotes from the best auto repair shop insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Auto repair shops need several types of business insurance, including workers' compensation, general liability, garagekeepers, commercial property and commercial auto coverage.

Nationwide is the best business insurance provider for mechanics and auto repair shops, with a MoneyGeek score of 4.8 out of 5.

Nationwide offers the cheapest business insurance for car repair shops at $113 monthly, with the lowest general liability rate at $81.

Best Business Insurance for Auto Repair Shops

| Nationwide | 4.80 | $113 |

| ERGO NEXT | 4.70 | $131 |

| The Hartford | 4.69 | $127 |

| Coverdash | 4.60 | $129 |

| Progressive Commercial | 4.60 | $154 |

| Simply Business | 4.50 | $150 |

| Chubb | 4.40 | $175 |

| Hiscox | 4.30 | $164 |

| Thimble | 4.30 | $162 |

| biBERK | 4.20 | $220 |

Note: We based all scores on an auto-repair business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Auto Repair Shop Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

Find the right coverage for your auto repair shop with these resources:

1. Nationwide: Best and Cheapest Overall for Auto Repair Shops

Lowest rates for auto repair shops at $113 monthly

AM Best A (Excellent) rating for financial stability

Ranked first in J.D. Power 2023 Small Commercial Insurance customer satisfaction

Garage operations coverage protects customer vehicles in your care

Team evaluates your bay setup, lift safety, and how you protect customers' cars

Ranks eighth for digital experience among business insurers

Must work with an agent to purchase policies

Online policy management lags behind competitors

Nationwide has the lowest rates and top scores across categories. The company ranks third nationally for customer service and second for policy management.

Nationwide provides specialized garage operations coverage that protects customer vehicles while in your care, covers test drive accidents and pays for repairs if your work causes unintended damage. Coverage includes faulty brake installations and customer vehicles damaged in your parking lot.

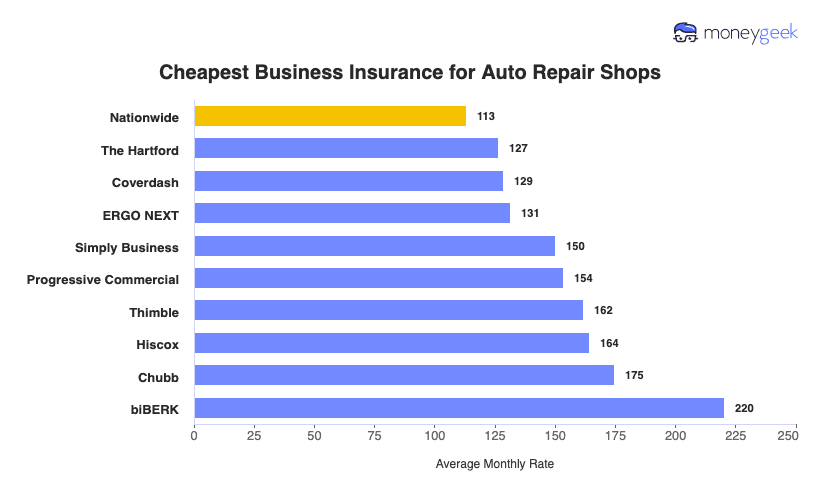

Cheapest Business Insurance for Auto Repair Shop Companies

Nationwide offers the cheapest business insurance for auto repair shops at $113 monthly ($1,357 annually). It also has the lowest rates for general liability insurance and business owner's policies. For workers' compensation, ERGO NEXT is a more affordable option, while The Hartford has the cheapest professional liability coverage rates for mechanics.

| Nationwide | $113 | $1,357 |

| The Hartford | $127 | $1,519 |

| Coverdash | $129 | $1,545 |

| ERGO NEXT | $131 | $1,576 |

| Simply Business | $150 | $1,804 |

| Progressive Commercial | $154 | $1,842 |

| Thimble | $162 | $1,943 |

| Hiscox | $164 | $1,971 |

| Chubb | $175 | $2,095 |

| biBERK | $220 | $2,644 |

What Does Auto Repair Shop Insurance Cost?

Auto repair shop insurance costs vary by coverage type. Here's what you can expect to pay for the four most common policies:

- General Liability: $153 on average per month, ranging from $132 to $184, depending on the state

- Workers Comp: $152 on average per month, ranging from $131 to $176, depending on the state

- Professional Liability (E&O): $82 on average per month, ranging from $71 to $96, depending on the state

- BOP Insurance: $223 on average per month, ranging from $190 to $263, depending on the state

| BOP | $223 | $2,675 |

| General Liability | $153 | $1,839 |

| Workers Comp | $152 | $1,828 |

| Professional Liability (E&O) | $82 | $989 |

What Type of Insurance Is Best for an Auto Repair Shop?

Auto repair shops and mechanics need workers' compensation (required by law in most states), general liability, and garagekeepers insurance as essential protections for daily operations. Depending on your shop's size and services, you should also consider commercial property, commercial auto, professional liability, business interruption, cyber liability, and pollution liability coverage.

- Workers' Compensation Insurance: Workers' comp is legally required in almost every state when you hire employees. Auto mechanics face constant injury risks from lifts, power tools and heavy machinery. This coverage pays medical expenses and lost wages when your technicians get hurt on the job, protecting you from costly lawsuits and out-of-pocket medical expenses. Most shops carry limits that match their total annual payroll.

- General Liability Insurance: General liability protects your shop when customers slip on oil, trip over equipment or get injured on your property. It covers medical bills, legal defense and settlements from customer injuries or property damage you cause. Landlords often require this before leasing space. Most car repair shops carry $1 million per occurrence and $2 million aggregate limits for adequate protection.

- Garagekeepers Insurance: Garagekeepers covers damage to customer vehicles while you're storing, servicing or test-driving them, whether parked in your lot or up on a lift. If a car gets stolen, vandalized or damaged by fire at your shop, this coverage pays for repairs. Most mechanics carry $50,000 to $300,000 limits with $500 to $1,000 deductibles per vehicle.

- Commercial Property Insurance: Commercial property covers your tools, lifts, diagnostic equipment and inventory when fire, storms, theft or vandalism damage your shop. A burst pipe can ruin thousands of dollars in specialized tools overnight, and this coverage helps you replace expensive equipment quickly so you can get back to business. Most auto repair shops carry $50,000 to $200,000 limits based on total equipment value.

- Commercial Auto Insurance: Commercial auto covers you when test-driving customer cars, delivering vehicles or using shop trucks for parts runs. Personal auto policies exclude business use and won't pay claims. This coverage protects you from liability if you damage another vehicle or injure someone while driving for work. Most shops carry $500,000 to $1 million per accident limits for solid protection.

- Professional Liability Insurance (E&O): Professional liability protects you when customers claim faulty repairs, incomplete work or missed deadlines caused financial harm. If a customer alleges your brake installation failed or repairs took longer than promised, it covers legal defense and settlements. Vehicle repair shops typically carry $500,000 to $1 million coverage to defend against allegations of negligence, errors or workmanship disputes.

- Business Interruption Insurance: Business interruption coverage, typically included in a Business Owner's Policy, replaces lost income when your shop closes temporarily due to fire, storm or covered property damage. It pays ongoing expenses like rent, utilities and payroll while you rebuild or repair. Most mechanics carry coverage equal to three to six months of operating expenses to stay financially stable during closures.

- Cyber Liability Insurance: Cyber liability protects your business when hackers breach your payment systems or steal customer data. If you process credit cards or store customer information digitally, this coverage pays for data breach notifications, credit monitoring services, legal fees and regulatory fines. Most auto repair shops carry $100,000 to $500,000 limits to cover costs from cyberattacks and data breaches.

- Pollution Liability Insurance: Pollution liability covers cleanup costs and damages when oil, fuel, solvents or other automotive fluids contaminate soil or water. If a storage tank leaks or chemicals spill, this pays for environmental cleanup and third-party claims. Auto repair shops handling hazardous materials typically carry $500,000 to $1 million limits to protect against expensive environmental liability claims.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Auto Repair Shop

Our guide show you how to get business insurance for your auto repair shop and find the best rates for mechanics.

- 1Decide on Coverage Needs Before Buying

Consider risks specific to auto repair shops: customer vehicles damaged on lifts, mechanics injured by equipment or customers slipping in your bay. Talk with other shop owners about claims experiences and consult agents specializing in garage coverage. Understanding coverage types helps you buy the right protection for your business.

- 2Research Costs

Find out what mechanics and auto repair businesses typically pay for insurance before requesting quotes. Research average costs for shops your size to understand normal pricing ranges. Knowing typical rates for general liability, garagekeepers and workers' comp helps you spot good deals and negotiate better prices with insurers.

- 3Look Into Company Reputations and Coverage Options

Read reviews from other auto repair shop owners about their claims experiences with each insurer. Check Google, Trustpilot and mechanic forums to see how companies handle vehicle damage claims and workplace injuries. Verify if each provider offers garage-specific coverage like garagekeepers insurance and pollution liability before getting quotes.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers using different methods to find the best rates for your car repair shop. Independent agents can find specialized garage coverage at lower prices than online tools. Call insurers directly to ask about mechanic-specific discounts like ASE certification or bundling savings.

- 5Reassess Annually

Your auto repair business changes as you add mechanics, upgrade equipment or expand services. Review your coverage every year to ensure limits still match your shop's value and you're getting competitive rates. Compare quotes annually to find better deals on general liability, property insurance and workers' compensation.

Best Insurance for Auto Repair Business: Bottom Line

Auto repair shops and mechanics need several types of business insurance, including workers' compensation, general liability, garagekeepers and commercial property coverage. Nationwide ranks as the best business insurance provider for the industry with a MoneyGeek score of 4.80 and offers the cheapest rates at $113 monthly.

Auto Repair Shop Insurance: FAQ

We answer frequently asked questions about auto repair business insurance:

Who offers the best auto repair business insurance overall?

Nationwide offers the best overall business insurance for auto repair firms, with a MoneyGeek score of 4.8 out of 5. ERGO NEXT comes second with a score of 4.7 out of 5.

Who has the cheapest business insurance for auto repair firms?

Here are the cheapest business insurance companies for Auto Repair businesses by coverage type:

- Cheapest general liability insurance: Nationwide at $81 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $143 monthly

- Cheapest professional liability insurance: The Hartford at $74 monthly

- Cheapest BOP insurance: Nationwide at $121 monthly

What business insurance is required for auto repair organizations?

Auto repair businesses must carry workers' compensation insurance if they have employees and commercial auto insurance for business vehicles, though requirements vary by state. General liability coverage is essential for client contracts and property leases.

How much does auto repair business insurance cost?

Auto Repair business insurance costs by coverage type are as follows:

- General Liability: $153/mo

- Workers Comp: $152/mo

- Professional Liability: $82/mo

- BOP Insurance: $223/mo

How We Chose the Best Auto Repair Business Insurance

We selected the best business insurer for auto-repair companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Affirms Credit Ratings of Nationwide Mutual Insurance Company and Its Key Operating Subsidiaries." Accessed October 30, 2025.

- J.D. Power. "Small Business Insurance Customer Satisfaction Defies Steadily Rising Rates to Reach All-Time High in J.D. Power Study." Accessed October 30, 2025.