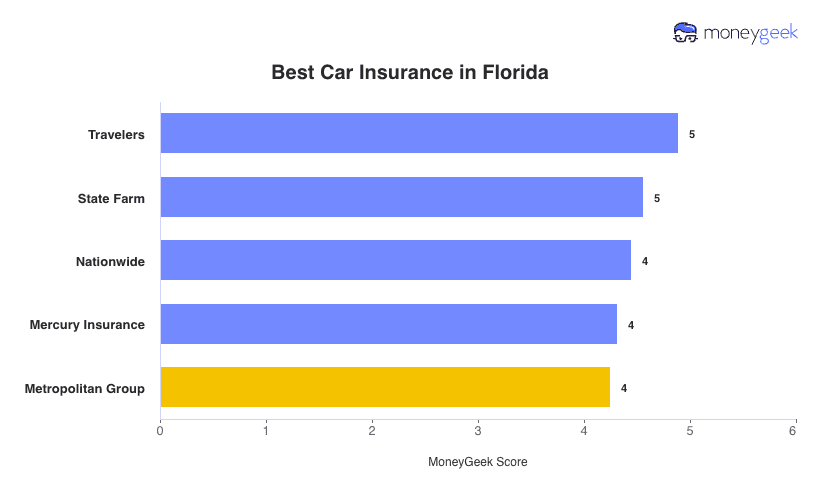

Travelers is the best car insurance company in Florida, with a 4.9 out of 5 MoneyGeek score. It excels in affordability, customer service and coverage options.

State Farm offers Florida's most affordable car insurance for drivers with DUIs. The company provides competitive rates for high-risk drivers while maintaining strong customer service through over 850 local offices statewide.

Our recommendations provide a starting point, but your age, driving record and coverage needs determine which provider offers the best value. Compare these top companies to find the insurer that best fits your profile.