ERGO NEXT has the best business insurance for computer repair shops, earning a MoneyGeek score of 4.82 out of 5 with rates starting at $37 monthly. The Hartford ranks second, while Simply Business comes in third. Both are excellent alternatives for computer repair business insurance.

Best Computer Repair Shop Business Insurance

ERGO NEXT, The Hartford and Simply Business offer the best cheap business insurance for computer-repair companies, with rates starting at $23 monthly.

Get personalized quotes from the best computer repair business insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Computer repair shops need multiple coverage types including general liability, professional liability for data loss claims, workers' compensation and bailee's insurance for customer devices.

ERGO NEXT offers the best business insurance for computer repair shops, earning a MoneyGeek score of 4.82 out of 5 and top scores for affordability, customer service, coverage options.

ERGO NEXT provides the cheapest business insurance for computer repair companies and technicians at $37, offering rates as low as $24 monthly for workers' compensation.

Best Business Insurance for Computer Repair Shops

| ERGO NEXT | 4.82 | $37 |

| The Hartford | 4.64 | $43 |

| Simply Business | 4.50 | $51 |

| biBERK | 4.50 | $52 |

| Coverdash | 4.40 | $51 |

| Thimble | 4.40 | $46 |

| Hiscox | 4.40 | $50 |

| Chubb | 4.40 | $57 |

| Nationwide | 4.30 | $74 |

| Progressive Commercial | 4.30 | $52 |

Note: We based all scores on a computer-repair business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Computer Repair Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your computer repair business, check out the following resources:

1. ERGO NEXT: Best Overall for Cleaners

Lowest rates for computer repair shops at $37 monthly

Instant certificates of insurance for client contracts and venues

Tools and equipment coverage protects your diagnostic and repair gear

24/7 mobile app access for on-site repairs and service calls

Some customers report slow claims responses and adjuster accessibility

No phone support available during the quote process online

ERGO NEXT offers computer repair businesses the most affordable coverage, with general liability at $37 monthly and workers' compensation at $23 monthly. The company ranks first nationally for digital experience, earning a 4.8 customer score for its mobile app that lets computer technicians generate certificates of insurance instantly for client contracts.

Computer repair shops benefit from tools and equipment coverage protecting diagnostic devices and laptops during service calls. ERGO NEXT also offers professional liability at $58 monthly, covering claims from data loss or work errors that computer technicians face.

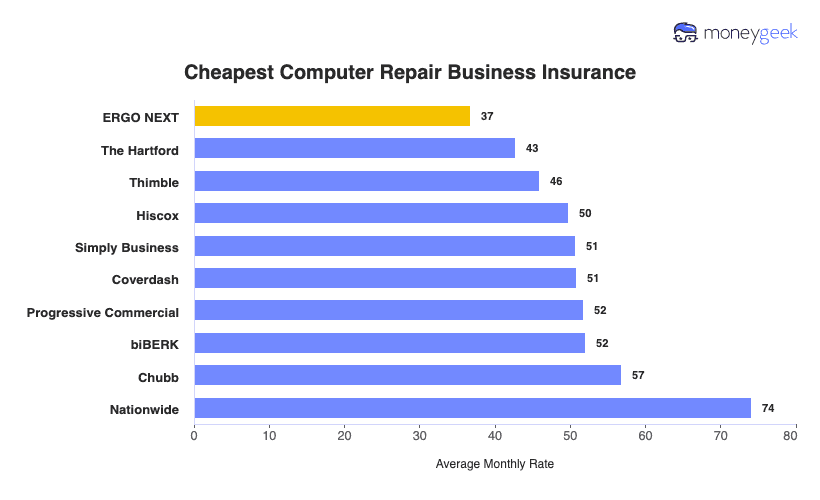

Cheapest Business Insurance for Computer Repair Shops

ERGO NEXT offers the cheapest business insurance for computer repair shops at $37 monthly ($441 annually), with the lowest rates for general liability, workers' compensation and business owner's policies (BOP). Computer repair technicians needing professional liability should explore The Hartford, which charges $56 monthly.

| ERGO NEXT | $37 | $441 |

| The Hartford | $43 | $513 |

| Thimble | $46 | $550 |

| Hiscox | $50 | $597 |

| Simply Business | $51 | $609 |

| Coverdash | $51 | $610 |

| Progressive Commercial | $52 | $620 |

| biBERK | $52 | $624 |

| Chubb | $57 | $681 |

| Nationwide | $74 | $889 |

How Much Does Computer Repair Shop Business Insurance Cost?

In general, computer repair shop business insurance costs are the following for the four most popular coverage types:

- General Liability: $48 on average per month ranging from $41 to $56 depending on state

- Workers Comp: $24 on average per month ranging from $21 to $28 depending on state

- Professional Liability (E&O): $63 on average per month ranging from $54 to $73 depending on state

- BOP Insurance: $67 on average per month ranging from $57 to $78 depending on state

| Workers Comp | $24 | $289 |

| General Liability | $48 | $572 |

| Professional Liability (E&O) | $63 | $752 |

| BOP | $67 | $806 |

What Type of Insurance Is Best for a Computer Repair Shop Business?

The coverage needs of computer repair shops start with workers' compensation if you have employees and commercial auto insurance if you own business vehicles. They’ll also need general liability and professional liability to provide financial protection from common risks like customer injuries and claims from work mistakes, while cyber insurance covers data breaches and tools coverage protects your diagnostic equipment.

- Workers' Compensation Insurance: Computer repair shops with employees must carry workers' comp to comply with state laws. It pays medical bills and lost wages when technicians suffer back injuries from lifting equipment or develop carpal tunnel from repetitive repairs. Requirements vary by state but typically mandate coverage once you hire your first employee.

- Commercial Auto Insurance: Computer technicians using company vehicles for on-site repairs or pickup and delivery services must carry commercial auto insurance. This covers accident damage, medical bills and liability when traveling to client locations. State minimum liability limits apply, though computer repair businesses often choose $500,000 to $1 million for better protection.

- General Liability Insurance: Computer repair businesses need general liability to protect against customer injuries and property damage claims. If a client trips over cables in your shop or a technician accidentally damages a customer's desk during an on-site repair, this coverage pays legal defense costs and settlements. Standard limits are $1 million per occurrence and $2 million aggregate.

- Professional Liability Insurance (Errors & Omissions): Computer technicians face lawsuits from work mistakes like failed repairs, missed deadlines or errors causing client data loss. Professional liability covers claims when your repair causes a client's business downtime or technical errors lead to lost files. Computer repair shops typically carry $1 million in coverage to protect against these professional negligence claims.

- Business Owner's Policy (BOP): Computer repair shops benefit from bundling general liability and commercial property insurance into a BOP at discounted rates. If a customer trips in your shop or a technician damages client property on-site, general liability covers legal costs. The property coverage protects your diagnostic equipment and inventory from fire or theft. Most shops need $50,000 to $100,000 in property coverage.

- Bailee's Coverage: Computer repair shops taking possession of customer devices need bailee's insurance to cover accidental damage to client property in your care. If customer laptops are stolen from your shop or damaged in a fire while awaiting repair, this coverage reimburses clients. Coverage limits typically range from $25,000 to $100,000.

- Cyber Liability Insurance: Computer repair businesses handling customer data need cyber insurance to cover data breach costs, ransomware attacks and client notification expenses. If hackers access client information through your systems or technicians accidentally expose customer passwords, this coverage pays for credit monitoring and legal fees. Coverage limits typically range from $500,000 to $1 million.

- Tools & Equipment Insurance: Computer repair technicians protect expensive diagnostic tools, laptops and specialized equipment with tools and equipment coverage. If your thermal imaging camera, oscilloscope or soldering station is stolen from your vehicle or damaged on a service call, this policy covers replacement costs. Computer repair shops typically need $10,000 to $25,000 in coverage, which costs $10 to $20 monthly as an add-on to general liability.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Computer Repair Shop

Our step-by-step guide for getting business insurance lets you find financial protection for your computer repair company without overpaying.

- 1Decide on Coverage Needs Before Buying

Think about what could go wrong: a laptop slips during a screen replacement, ransomware hits your network affecting client data or a customer trips over cables at your workbench. Talk with other shop owners about expensive claims they've faced and which coverages saved them money when disasters struck.

- 2Research Costs

Know what you should pay before getting quotes. General liability averages $48 monthly while professional liability runs $63 for computer repair shops. If quotes come back much higher, ask why. Your clean claims history and security certifications should work in your favor.

- 3Look Into Company Reputations and Coverage Options

Check reviews from other repair shop owners, not general business ratings. Look for feedback on data breach and equipment theft claims. Verify insurers cover customer devices in your custody, tools in your van, or errors causing data loss.

- 4Compare Multiple Quotes Through Different Means

Get at least three quotes and mention your specific setup, like whether you work from home, rent a storefront or make house calls. Independent agents familiar with tech businesses might bundle your tools coverage with general liability for less than buying separately.

- 5Reassess Annually

Your business changes when you hire your first technician, expand into data recovery services, or buy a service van. Review coverage when these shifts happen, not just at renewal time. Annual reviews prevent gaps and help you find better rates.

Best Busines Insurance for Computer Repair Shop: Bottom Line

Protecting your computer repair shop means covering the unique risks you face daily, from accidentally damaging client laptops during repairs to data breaches affecting customer information. ERGO NEXT earns top ranking with a MoneyGeek score of 4.82 out of 5 and keeps costs reasonable at $37 monthly. You get solid coverage at rates that won't hurt your bottom line.

Computer Repair Insurance: FAQ

We answer frequently asked questions about Computer Repair business insurance:

Who offers the best Computer Repair business insurance overall?

ERGO NEXT leads Computer Repair business insurance with an outstanding MoneyGeek score of 4.82 out of 5. The Hartford follows closely as runner-up with 4.64, delivering excellent value through competitive pricing and comprehensive protection.

Who has the cheapest business insurance for Computer Repair firms?

Here are the cheapest business insurance companies for Computer Repair businesses by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $37 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $23 monthly

- Cheapest professional liability insurance: The Hartford at $56 monthly

- Cheapest BOP insurance: ERGO NEXT at $28 monthly

What business insurance is required for Computer Repair organizations?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated for computer repair businesses, though requirements differ by state. General liability coverage remains essential for client contracts and leases.

How much does Computer Repair business insurance cost?

Computer Repair business insurance costs by coverage type are as follows:

- General Liability: $48/mo

- Workers Comp: $24/mo

- Professional Liability: $63/mo

- BOP Insurance: $67/mo

How We Chose the Best Computer Repair Business Insurance

We selected the best business insurer for computer-repair companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.