The Hartford scores perfectly in coverage and affordability for dog grooming business insurance. Pet grooming professionals get comprehensive protection at competitive prices.

Best Dog Grooming Business Insurance

ERGO NEXT, The Hartford and Thimble offer the best cheap business insurance for dog grooming companies with rates starting at $36 monthly.

Get personalized quotes from the best dog grooming business insurer for you.

Updated: February 2, 2026

Advertising & Editorial Disclosure

A dog grooming business needs general liability, professional liability and bailee insurance for the ideal commercial coverage.

The Hartford ranks as the best business insurance company for dog grooming firms with top scores for coverage and affordability.

Thimble provides the cheapest business insurance for dog grooming companies with monthly rates starting at $36 for general liability coverage.

Best Business Insurance for Dog Grooming Companies

| The Hartford | 4.67 | $57 |

| Thimble | 4.60 | $52 |

| ERGO NEXT | 4.60 | $62 |

| Coverdash | 4.40 | $67 |

| Simply Business | 4.30 | $77 |

| biBERK | 4.30 | $77 |

| Nationwide | 4.30 | $79 |

| Chubb | 4.30 | $83 |

| Progressive Commercial | 4.30 | $68 |

| Hiscox | 4.20 | $73 |

*We based all scores on a dog grooming business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Pet Groomer Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your dog grooming business, check out the following resources:

The Hartford: Best Overall for Dog Groomers

Great customer experience

Lowest pet groomer professional liability insurance

Tailored dog and pet grooming included coverages

Lowest rated digital experience

Not in Alaska and Hawaii for coverage

The Hartford offers coverage for pet grooming companies, including animal damage to buildings coverage that helps pay for repairs when pets in your care damage property, like chewing through fences or scratching walls.

This insurer is also the second cheapest overall in the industry. In our study, customers rated their claims experience and agent service the best, making them a provider you can trust in the event you need to use your coverage.

Thimble: Cheapest Rates for Dog Groomers

Best rates overall

Most flexible coverage offerings

Not as affordable for professional liability coverage

No customer service agents over the phone (email & app service)

While customer support is not as available as many other providers, Thimble offers a unique coverage experience that allows buying policies in as little as an hour. It is the most affordable for general liability or BOP policies.

3. ERGO NEXT: Best for Pet Grooming Workers' Comp

Best rates for workers comp insurance

Best digital experience

Tailored coverage recommendations

Not all products are offered directly

Higher rates for general liability and BOP policies

ERGO NEXT offers instant online quotes and the ability to purchase coverage in under 10 minutes. You'll also get much more detailed coverage recommendations than competitors. It also offers savings of up to 10% when bundling multiple policies and is the most recommended company by other businesses in our survey.

Cheapest Business Insurance for Dog Grooming Firms

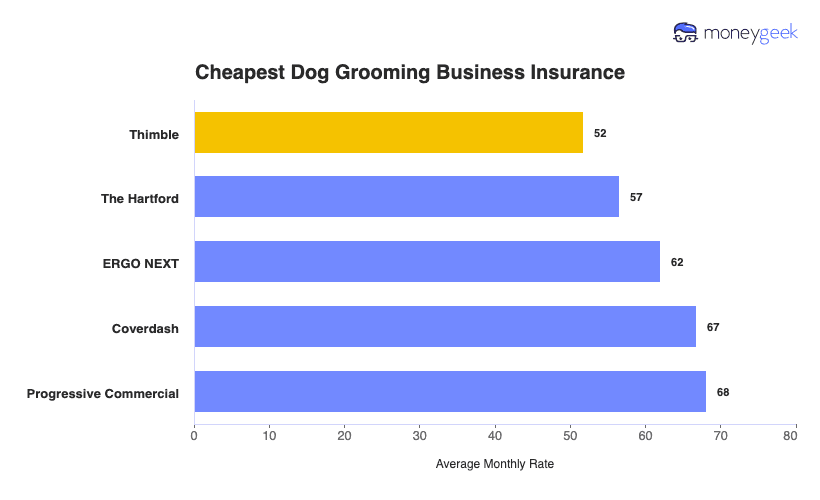

Thimble leads dog grooming insurance at $52 monthly, especially for general liability coverage. But if you need workers comp, professional liability or BOP insurance, The Hartford and ERGO NEXT offer more affordable rates for those specific coverage types.

| Thimble | $52 | $622 |

| The Hartford | $57 | $678 |

| ERGO NEXT | $62 | $744 |

| Coverdash | $67 | $802 |

| Progressive Commercial | $68 | $817 |

| Hiscox | $73 | $870 |

| Simply Business | $77 | $924 |

| biBERK | $77 | $929 |

| Nationwide | $79 | $951 |

| Chubb | $83 | $993 |

What Does Dog Grooming Business Insurance Cost?

In general, dog grooming business insurance costs are the following for the four most popular coverage types:

- General Liability: $64 on average per month, ranging from $55 to $74, depending on the state

- Workers' Comp: $65 on average per month, ranging from $56 to $75, depending on the state

- Professional Liability (E&O): $55 on average per month, ranging from $47 to $63, depending on the state

- BOP Insurance: $93 on average per month, ranging from $79 to $109, depending on the state

| BOP | $93 | $1,120 |

| General Liability | $64 | $763 |

| Professional Liability (E&O) | $55 | $658 |

| Workers' Comp | $65 | $780 |

What Type of Insurance Is Best for a Dog Grooming Company?

For most dog grooming operations, general liability and animal bailee insurance represent the most critical non-required coverages. State laws and client contracts frequently mandate workers' compensation, professional liability, commercial property, and commercial auto insurance (for mobile operations).

Here's why these coverages matter and what coverage amounts work best for the average dog grooming business:

- General liability insurance: Covers client slip-and-falls and damaged belongings, the most common claims grooming businesses file. Get $1 to $2 million per occurrence or $2 to $3 million aggregate coverage.

- Workers' compensation: Required by law once you hire employees. Pays medical bills and lost wages when workers get hurt, from chemical burns to back injuries from lifting large dogs.

- Professional liability insurance: Protects you from negligence claims and grooming error lawsuits. Get $500,000 to $1 million per claim or $1 million aggregate to meet client requirements and avoid financial ruin.

- Animal bailee insurance (care, custody and control): Covers pets that get injured, lost, stolen or die while you're caring for them. Start with $2,500 to $5,000 per occurrence and a $10,000 aggregate limit. Handle multiple pets at once? Consider $15,000 to $25,000 per occurrence.

- Commercial property insurance: Protects your grooming tables, tubs, clippers, dryers and specialized equipment from damage or theft. Coverage runs $10,000 to $50,000 depending on your equipment value and business size.

- Commercial auto (for mobile grooming operations): Mobile groomers who transport pets need this. Get $1 million combined single limit (CSL) liability with comprehensive and collision coverage to meet state laws and protect your mobile setup.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Dog Grooming Company

Here's how to buy business insurance for your dog grooming company:

- 1Decide on Coverage Needs Before Buying

Think through what could go wrong: a nervous dog bites during nail trimming, a client slips on your wet floor, a pet escapes from your mobile van. Talk with other grooming business owners about claims they've filed and which coverages saved them money. Insurance agents who specialize in pet businesses can guide you toward the right policies. Your specific risks (whether you handle aggressive breeds, run mobile services or board pets overnight) determine which coverages you need.

- 2Research Costs

Find out what groomers in your area pay for insurance. Check typical small business insurance costs for dog grooming companies your size since solo mobile groomers pay different premiums than salons. This research gives you negotiating leverage and helps you spot fair pricing.

- 3Look Into Company Reputations and Coverage Options

Read what other pet service business owners say about each insurer, especially groomers, dog walkers and pet sitters. Check Google, Better Business Bureau and pet industry forums for reviews about claims handling when groomers file for injured animals or damaged equipment. Confirm each company offers dog grooming coverage like animal bailee insurance, veterinary expense reimbursement and mobile grooming equipment protection.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three pet service insurers using different channels. An independent agent who knows grooming businesses might find discounts you won't see on company websites. National Dog Groomers Association member rates or bundle savings for pairing general liability with animal bailee coverage. Online tools give quick standard policy comparisons, but calling insurers directly can uncover savings for groomers with clean claims histories or documented safety protocols.

- 5Reassess Annually

Your grooming business changes. You add mobile services, hire staff, buy hydraulic grooming tables or handle more pets daily, all of which affect your coverage needs and rates. Review your policy yearly to confirm your animal bailee limits match how many pets you now handle and your equipment coverage reflects current tool values. Shop around annually for the best coverage at competitive prices, and ask about loyalty discounts after claim-free years.

Best Insurance for Dog Grooming Business: Bottom Line

The Hartford is the best insurer for dog grooming business insurance, while Thimble offers the cheapest option overall. We also recommend getting quotes from ERGO NEXT, Coverdash and Simply Business. For the best deal, consult agents and similar businesses, research costs and companies, and compare multiple quotes.

Dog Grooming Insurance: FAQ

We answer frequently asked questions about dog grooming business insurance:

Who offers the best dog grooming business insurance overall?

The Hartford leads dog grooming business insurance with a MoneyGeek score of 4.67 out of 5. Thimble follows closely as second-best, delivering excellent affordability alongside solid customer service and comprehensive coverage options.

Who has the cheapest business insurance for dog grooming firms?

Here are the cheapest business insurance companies for Dog Grooming businesses by coverage type:

- Cheapest general liability insurance: Thimble at $36 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $61 monthly

- Cheapest professional liability insurance: The Hartford at $49 monthly

- Cheapest BOP insurance: Thimble at $56 monthly

What business insurance is required for dog grooming organizations?

Workers' compensation (with employees) and commercial auto insurance (with business vehicles) are legally mandated for dog grooming businesses, though requirements differ by state. General liability insurance remains essential for most commercial leases and client contracts.

How much does dog grooming business insurance cost?

Dog Grooming business insurance costs by coverage type are as follows:

- General Liability: $64/mo

- Workers' Comp: $65/mo

- Professional Liability: $55/mo

- BOP Insurance: $93/mo

How We Chose the Best Dog Grooming Business Insurance

We selected the best business insurer for dog grooming companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.